- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Chinese Premier’s Admission of Downward Economic Pressure Threatens Global Growth

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 18th March 2019, 09:05 am

The Chinese Premier Li Keqiang made a rare and somewhat startling admission this past week. He admitted that the Chinese government will have to support the economy as new pressures to national growth emerge. Translation: All is far from well with China economically. In this opening of the Chinese congress last week, Li painted a deteriorating picture of the country's economy. He reiterated the necessity of preparing to endure a “tough struggle” while setting lowered growth targets ranging from 6 to 6.5 percent in total annual growth.

This is your latest reason to keep an eye on your investment and retirement portfolios. China has now been the entire world's growth engine for the past two decades. With other economies already noticeably slowing down, the U.S. and the rest of the world can not afford for China's to decelerate too. This is why gold makes sense in an IRA. Now is the time to consider what IRA-approved gold you can buy in monthly installments.

Premier of China Admits to Decelerating Economy

For most countries, an annual growth rate of 6.6 percent would seem like an impossible dream. For China, this total growth for 2018 represented its slowest growth dating back to 1990. Chinese Premier Li mourned the whole discouraging affair, with:

“It is true that China's economy has encountered new, downward pressure… We are not going for monetary easing but trying to provide effective support to the real economy.” Our slowdown in economic growth transpired as worldwide growth was also feeling the pressure.

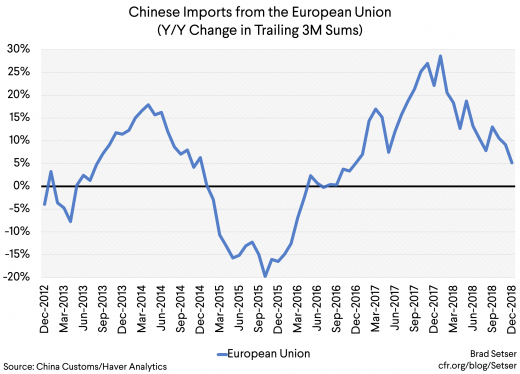

Li shared all of this with reporters on hand after the National People's Congress annual ceremony closed. The National People's Congress was occurring against a backdrop of the U.S. and China trade dispute and ongoing negotiations coming to a crucial point. This chart below shows how the Chinese imports from Europe have been precipitously declining along with their slowdown in growth:

Chinese Dissemble on Commercial and Trade Secrets

Li was not forthcoming on the current status and atmosphere of the trade talks with the Americans. He did declare his confidence in the two sides continuing the dialogue until they are able to sufficiently dispel the tensions. One question hit near the mark of international criticism against Beijing when a reporter wondered if China officially makes its tech companies spy on other nations. This has been a major sticking point in the argument of the U.S. and the West against utilizing Huawei technology hardware. Li argued once again that China would never enforce this kind of behavior, with:

“Let me tell you explicitly that this is not consistent with Chinese law. This is not how China behaves. We did not do that and will not do that in the future.”

One thing giving weight to his argument was a new foreign investment law. The Chinese delegates approved the new law that included language for protecting foreign companies and their trade and commercial secrets, per the U.S.-China Business Council.

Meanwhile China Continues Anti-Dollar Push, Increasing Gold Reserves Again

Yet even as China's economic growth and prospects continue to slide and wither, the country has been taking some dramatic economic warfare steps of its own lately. Beijing increased its officially held gold reserves for the third consecutive month for February. This was the latest effort in their endeavors to reduce exposure to U.S. dollars.

In February, the People's Bank of China increased its fabled gold holdings by another 10 tons for the month. This was on top of another 32 tons of gold it had already obtained since 2019 began. The Financial Times argues that at this pace, China will soon pass both Kazakhstan and Russia as the world's foremost central bank gold buyers.

It was only in December of 2018 that the Chinese made their first gold update announcement since year 2016. China claims that it officially has 1,874 tons of gold now. At the same time, Beijing has been aggressively selling off its once enormous pile of U.S. Treasuries it amassed over decades. In the last year, China has net sold over $50 billion worth of its American Treasury debt paper.

Per analysis of the Global Times in China, these transactions are “due to the U.S. diving credibility as a result of the hegemonic like behavior that's on the rise in the U.S.” According to Director Zhou Yu of the Research Center of International Finance of the Shanghai Academy of Social Sciences, China is seeking to minimize its total exposure to the American dollar:

“Since the start of the China-U.S. trade dispute, China has realized that there are risks in holding the U.S. dollar, and it is taking action to increase holdings of other financial assets such as gold to replace its U.S. dollar denominated assets to guard against those risks.”

Director Dong Dengxin of the Finance and Securities Institute of Wuhan University shared with Global Times about the growing concerns over the creditworthiness of America:

“A common view has formed across the world that the decline in U.S. creditworthiness, resulting from the America First policy, the transition in U.S. trade policy, and flip flopping of the U.S president, is hurting the global economy and destabilizing the global financial system. Therefore, many countries feel unsafe, and they are choosing to reduce dollar asset allocation to protect themselves from potential risks.”

No One Really Knows How Much Gold The Chinese Actually Have

China's crucial real position in gold is difficult to figure for several reasons. They have demonstrated their tendency to allow significant periods of time to pass without updating their gold reserves holdings and then announcing a huge boost to their gold reserves. For example, back in 2009, the People's Bank of China ceased updating on its gold reserves. Suddenly in June of 2015, China's central bank out of the blue revealed its gold holdings had increased by 57 percent.

Then the PBOC central bank gave routine updates for just over a year as it added to the gold holdings. In the following 16 months, China added still another 185 tons of gold to their total national hoard before they went dark once more. It was at this time that the Chinese were working towards getting their currency the yuan included in the benchmark currency basket of the International Monetary Fund. The efforts in boosting their central bank gold holdings can only have helped this endeavor to be ultimately

successful.

Still many other analysts concur that China actually possesses a great deal more gold than it officially shares. Many analysts opine that Beijing is hiding a few thousand tons of gold in an off the books arrangement under an entity they call the State Administration for Foreign Exchange, or SAFE. It remains unlikely that the Chinese have not continued adding to their gold reserves since 2016.

You should take a serious lesson from the Chinese. They do not allow the collective fortunes of their future finances to be held hostage by any ambivalent government or financially destructive international policies. Now is the time to consider Gold IRA rules and regulations. Thanks to the IRA approval, you can now store your IRA gold in top offshore storage locations. Be sure to consider the Top Gold IRA Companies and Bullion Dealers before buying.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68

It seems that gold is breaking its inverse correlation to growing real yields on US government bonds and the Chinese yuan. Yuan and gold have recently moved together, weakened after the start of the trade war between the United States and China. The close correlation between gold and the yuan in recent months has confused the market.