- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Chinese Empire Strikes Back As Trade War with U.S. Begins in Earnest

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 18th June 2018, 11:45 am

For months the threats of a full-scale trade war between the U.S. and China have been thrown around, and last week they actually finally materialized. President Trump and his administration at last made good on their threats by applying 25 percent tariffs on $34 billion in Chinese imports (with a threat of another $16 billion worth of imported goods' tariffs to come in the next few weeks). Chinese President Xi Jinping declared that his country will similarly match the “scale and intensity” of the tariff rates and import amounts in lockstep in retaliation. They have also rescinded all commitments for fairer trade pledged in the last few weeks of negotiating.

These new tariffs come into effect as of July 6th. President Trump promised another imminent round of import goods' tariff announcements against China if and when they retaliated (which they have). It is next move Trump in the increasingly hostile war of trade barriers that are rapidly threatening to upend the entire global economic recovery.

Today you need more than mere words and good intentions to safeguard your retirement portfolio from the stock market chaos which could easily result. Gold makes sense in an IRA exactly because it embodies this ultimate, historically proven financial insurance. Consider the most ideal Gold IRA allocation strategies now while you still can.

Beijing Prepares for A Lengthy War of Attrition

It could be any day and time when the Trump administration announces the next salvos in this escalating trade war. Just Friday President Trump promised more duties would be forthcoming when China chose to retaliate (as it already has now). Some of the punishment from the American side will include restrictions on Chinese investments flowing into the country. The U.S. Trade Representative Robert Lighthizer stated that these will be announced over the coming two weeks. It's green light for the trade war after months of talking about it.

The Chinese side has been free in admitting its pre-planned strategy for this war. They are planning and preparing for a long and drawn-out trade war of attrition. China is staunchly refusing to walk away from its core industrial policy of dominating the AI and robotics technologies of tomorrow. Co-Founder Andrew Polk of research company Trivium China (based in Beijing) warned that:

“The Chinese view this as an exercise in self-flagellation, meaning that the country that wins a trade war is the country that can endure the most pain. China thinks it can outlast the U.S. They don't have to worry about an election in November, let alone two years from now.

China Has Many Retaliatory Choices in Its Toolbox

The popular Fox News Sunday program hosted ranking Senate Armed Services Committee Democrat Jack Reed to on program this weekend. There he strongly warned that:

“We could be dangerously approaching such a trade war.”

China is not merely limited to erecting new tariffs on U.S.-made products and exports. They have a formidable toolbox of punishing responses they can unleash at any time. There is over $200 billion in American corporate investment in China for them to target.

They might apply a partial or total consumer boycott of U.S. goods sold in the booming Chinese retail market. They could even cut off the rush of tourists to the States and their hard currency they spend freely in the U.S. State media Xinhua commented over the weekend that:

“China does not want the trade war, but facing a capricious Washington, China has no choice but to fight back vigorously in defense of its national interests, the trend of globalization, and the world's multilateral trading system.”

Those are definitely fighting words from the Chinese side.

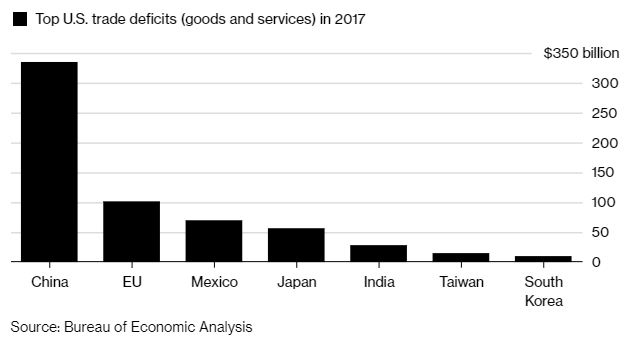

The Trade Gap Infuriates President Trump's Administration

The U.S. President commonly refers to the unacceptable “massive” trade deficit the country shows (with China) as a serious problem. This chart below shows how much larger such a deficit is between the two countries as opposed to with other significant American trading partners around the globe:

Even those at odds with the President's solutions agree that the issue of Chinese trade represents a problem for the U.S. Former National Security Adviser (to President Obama) Susan Rice opined Sunday on the “Fareed Zakaria GPS” program on CNN that:

“We have very legitimate reasons to be concerned about China's trade practices. But the way to resolve this is not at the expense of American workers and manufacturers and farmers, by getting into a trade war that has potential, real global ramifications.”

Yet with Obama's people long gone from office, there is nothing that they can do to prevent the trade war that has begun with a powerful American salvo and a counter Chinese return fire since just Friday.

Chinese Have Used Economic Warfare Successfully In the Past

The ability of China to inflict economic pain on its enemies and rivals should never be underestimated. The Middle Kingdom has a long and storied history of effectively wielding economic weapons to further its foreign policy objectives in the region.

When South Korea allowed the United States to base technologically advanced missile defense systems in its territory, China punished Seoul with trade tactics that bled billions of dollars out of South Korea. The dragon has also deployed such economic warfare weapons successfully in the recent past against both Japan and the Philippines (for contesting the ownership and maritime claims of distant islands with China).

China also holds a unique, key bargaining chip in the ongoing diplomatic overtures with North Korea. They play a crucial role in the Trump administration's overarching goal of the nuclear disarmament of the Korean Peninsula. Without this Chinese support and cooperation, the sanctions against Pyongyang will ultimately fail. This would remove a key pressure that brought North Korean strongman dictator Kim Jong Un to the negotiating table with the U.S. in the first place.

The Chinese have longer-term, more devastating trade weapons they could unleash if the situation does not become resolved sooner rather than later. They could simply curtail their ongoing purchase of U.S. Treasuries, or in a more nightmare scenario start selling them off on already dollar-bond glutted global markets. This would cripple the financing means of the American federal government in short order.

The Chinese might also choose to devalue their currency the yuan, a decision that would ultimately unleash terrible economic forces around world markets and economies. Asian Director Michael Hirson of the Eurasia Group based in New York City warned ominously that:

“The next several weeks will be critical for determining how bad the tit for tat gets, which will rest crucially on the relationship between the two leaders, and how they perceive their advantages. Xi is not looking to escalate the trade dispute, but is not afraid to climb the escalation ladder with Trump.”

Hirson further hinted that the Chinese will increase their considerable threats to retaliate against American business interests in the country. This could start with delays on approvals to operate in China. Next would come disruptive regulation -based actions in response to President Trump actually making good on Friday's threats to begin a second tariffs round with China.

A Major American Goal in the War Is to Head Off the Chinese Advance Up Technology Ladder

Some analysts believe the trade war is really not so much about trade imbalances as it is for the future of the important manufacturing sectors of tomorrow, AI and robotics. The Chief Asia-Pacific Economist Alicia Herrero of Natixis SA's regional office in Hong Kong believes that this is all a smokescreen for attempting to stop China from advancing along the high-technology ladder.

While the “America First” policy may be directed towards all rival nations in the world at once, it is specifically laser focused on a high-tech arms and manufacturing race against China. The Chinese will simply adapt to develop trade with other countries and purchase high-technology from the likes of Britain, Germany, France, Russia, and whoever else they can, according to Herrero.

As the state-operated China Daily warned early Monday morning, “China's stance has been consistent: It welcomes dialogue but is not afraid of a trade war.” You must prepare your investment and retirement portfolios with IRA-approved precious metals and especially IRA-approved gold now. This is easier than ever, thanks to your newfound ability to buy gold in monthly installments and then secure it in top overseas storage locations for IRA gold.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81