- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

China Prepared To Fight A Long and Lasting Trade War With the U.S.

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 7th August 2018, 09:58 pm

This past week you saw an ominous development in the trade war as it settled into a potentially long-term geopolitical dispute. U.S. President Trump continued to spread the message that America possesses the advantage in the deepening economic, diplomatic, and geopolitical rift. China responded through their official state media that they are prepared to suffer through the economic consequences for a “protracted war” if necessary.

It means that you had better prepare your retirement portfolios for the economic and trade conflict to stretch into the longer-term. China claimed that it will unflinchingly sacrifice whatever shorter-term economic interests that they must, per the nationalist Global Times editorial from Sunday night. You had better start contemplating the top five gold coins for investors while the prices for IRA-approved gold are still reasonable.

China Hits Back Against the U.S.

The Global Times revealed very graphically the official Chinese position on the worsening trade dispute, with:

“Considering the unreasonable U.S. demands, a trade war is an act that aims to crush China's economic sovereignty, trying to force China to be a U.S. economic vassal.”

While the U.S. and China were engaged in trading verbal jabs over whose fault the trade war actually was, the wheels in Beijing continue turning. They rolled out their own list of tariffs in an effort to retaliate for the American threat to erect $200 billion in new duties on Chinese imports. Emotions are running high on both sides, even as China's economy starts to show signs of strain. The Chinese juggernaut has slowed, their stocks have crashed, and the yuan currency is in significant decline.

Even as the U.S. President was claiming that the country was holding the better hand in the early rounds of the trade war against China, the Chinese gritted their teeth and refused to surrender. Yet Trump was not conceding an inch either.

He argued that goods needed to be either made in the United States or taxed for being imported. The President raised another interesting point. He intimated that the tariffs would permit the country to retire “large amounts of the $21 trillion in debt that has been accumulated” at the same time as American taxes go down. Trump expounded on this policy with:

“Every country on earth wants to take wealth out of the U.S., always to our detriment. I say, as they come, tax them.”

The Chinese currency experienced a rally after the country's central bank took steps to increase the costs of siding against the yuan. The government was attempting to cushion yuan moves after it had suffered from a record number of weekly declines that saw the Chinese yuan nearing 7 yuan per dollar.

Chinese Duties' List Is Comprehensive

China threw down their gauntlet with a significant and comprehensive list of duties. These will range from five percent on up to 25 percent on fully 5,207 different imports from the United States. This assumes that Washington makes good on its promise to levy tariffs on $200 billion in Chinese exports, according to the Ministry of Finance.

When these are combined with the tariffs the Chinese already have in effect, the list includes nearly 6,000 different goods. Among these are soybeans, liquid natural gas, and other American products. The list encompasses over two-thirds of China's total imports from America. Still excluded from the list are larger ticket items like airplanes and higher technology goods like computer chips. China has trouble domestically producing these, so it has little choice.

The Shots Fired So Far In the U.S. – China Trade War

The size and scope of this trade dispute is only worsening according to both threatened and actually erected trade tariffs. Head of China Economics Larry Hu of Macquarie Securities Limited based in Hong Kong explained the situation with:

“Chinese buyers don't have any bargaining power on these products. Even if the trade war escalates, China would rather lift the 25 percent tariffs to 50 percent, instead of imposing any tariffs on integrated circuits or big airplanes. What's the point of imposing tariffs? Chinese companies would have to pay all the additional costs.”

The China Daily editorial took a more nationalistic view of the situation with:

“In the face of the bullying of the Donald Trump administration, Beijing must remain sober-minded and never let emotion override reason when deciding how to respond. Given China's huge market, its systemic advantage of being able to concentrate resources on big projects, it's people's tenacity in enduring hardships, and its steadiness in implementing reform and opening up policies, the country can survive a trade war.”

In other words, the Chinese will not blink first in the face of economic hardship from the ongoing trade tensions.

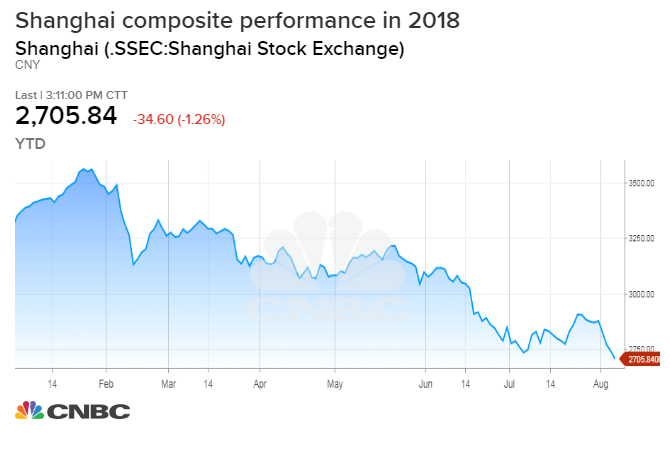

China's Stock Market Tanks From Escalating Trade War

The Chinese have two major stock indices. Both of them have dropped by around 25 percent from their peak last year as the trade war intensified. Just yesterday (on Monday), the Shanghai composite fell by 1.3 percent. It amounted to four in a row negative trading sessions. This chart below tells the full ugly story:

At the same time, the U.S. stock market is only three weeks away from notching the impressive record of longest lasting bull market in its distinguished history. For the moment, U.S. President Donald Trump appears to have the significant advantage in the unfolding trade dispute. Rest assured, if the American equities' market had suffered a 25 percent drop, then President Trump would be under intense pressure to yield.

Meanwhile Chinese Strongman President Xi Can Bide His time

China is a different story altogether. Analysts there are simply informing their Chinese clients that they need to get ready for a lengthy and “bumpy” trip as the conflict only expands. The huge advantage that China's President Xi Jinping has is that political pressure on him is practically non-existent. He enjoys the knowledge that the parliament of China recently amended the country's constitution so that presidential term limits are eliminated.

Chief Investment Officer John Rugledge of Safanas explained that the Chinese President Xi Jinping enjoys an ideal political position. He is not under threat from political pressure of the citizens. This is thanks to the constitutional amendment from earlier in the year. It ended term limits on the Chinese president. This means that President Xi can remain the head of the country until he dies or chooses to retire. He explained that:

“Xi doesn't give a hoot about the poor people in China. Why do you think they attacked soybeans? Not just because of our farmers, but because he doesn't care about the pressure from his own people.”

Bank of America concurs. They have forecast that the trade war will require a significant amount of time to be concluded successfully. Meanwhile J.P. Morgan argues that the vast differences in national requirements for the trading relationship will lead to a lengthier and more drawn out series of negotiations. China Equity Strategist Haibin Zhu of J.P. Morgan stated the case that:

“The gap between U.S.'s demand list and China's offer list is very large, and the back and forth of the negotiations in recent months suggests that neither side would make major concessions. Given the huge gap between the two sides, the outlook remains extremely unclear. Negotiations, even if resumed, will likely involve a bumpy and lengthy process.”

This is a serious warning that you simply can not take for granted or dismiss. Gold makes sense in an IRA because it has the distinguished historical track record of thousands of years to back up its claims to be the world's ultimate safe-haven asset. The good news is that you can now store your physical IRA-approved precious metals in top offshore storage locations with the blessings of the IRS. Time to seriously consider gold IRA rules and regulations while you still can.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81