- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

China increases official gold reserves by 60%

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Following nearly 6 years of radio silence, Chinese officials finally ended years of rampant speculation within the gold community by announcing the country’s official gold reserves increased by nearly 60% to 1,658 metric tons. With their recent announcement, China has become the fifth largest holder of gold in the World, just marginally ousting Russia from the “Top 5” list. The increase in China’s gold reserves has had a fairly lacklustre impact on the price action of precious metals, with many analysts and traders within the gold market underwhelmed at the size of the increase. Some of the more bullish forecasts had been calling for an increase of up to 3,000 metric tons of bullion by the PBoC – the actual data fell well short of this forecast, triggering a mild bout of disappointment in some quarters of the bullion market. Indeed, gold analysts have had relatively few reasons to be cheerful in recent weeks, with gold falling to 5 year lows on the back of a broad based collapse across the commodity sector due to ongoing concerns about the possible deflationary forces beginning to appear from, ironically, China.

Chinese stock market volatility triggers investor caution

Extreme volatility in China’s stock markets are an increasing cause of concern amongst investors, who have been witness to increasingly desperate measures from the Chinese authorities to try and quell the market carnage. Authorities have already implemented a vast array of policy measures including lower interest rates and reserve requirements, outright suspension of specific securities, a relaxation of margin rules, a short selling ban, and in some case, an outright ban on selling altogether. Despite such intervention, the Shanghai composite has retraced nearly 30% from its all time high during the last two months alone, and the overall Chinese market is now officially in a bear market territory year to date. Investors worldwide are watching the Chinese situation unfold with a great deal of trepidation, with many fearing China’s centrally planned economy could be heading for its first skirmish with free market uncertainty.

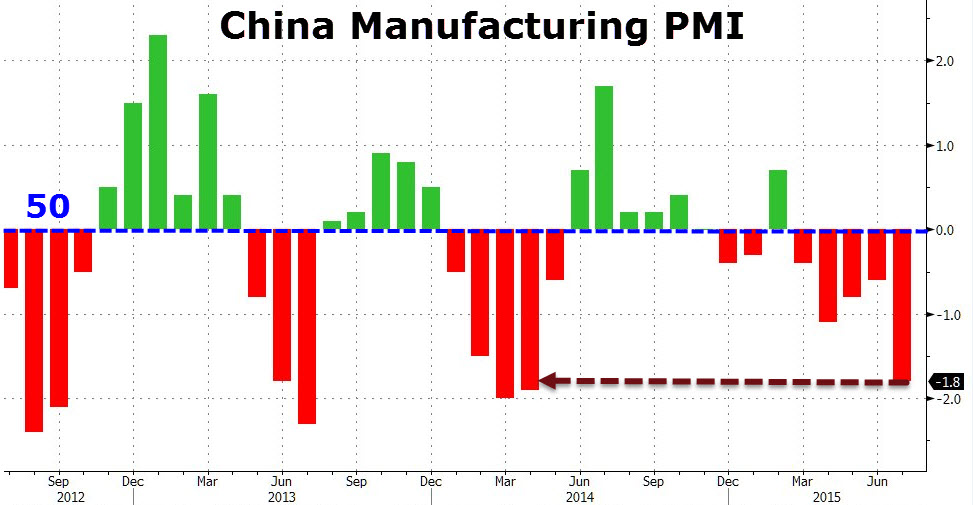

Compounding the weakness in Chinese equity markets is a deteriorating macroeconomic picture, with nearly all gauges of China’s manufacturing showing signs of weakness in recent weeks. This weakness in the macroeconomic data emphasises that there is real structural weakness in the Chinese economy, and this structural weakness more than the recent stock market volatility will have ramifications globally.

Recent manufacturing PMIs have slumped to a 15 month low and the large level of overinvestment and inventory build which has been occurring within the past 12 months, could stoke deflationary pressures throughout the world economy in the near future.

Contagion from China is spreading worldwide

We are already seeing signs of broad based weakness in world markets as a result of the the ongoing turmoil in China. Commodity markets have been the most affected, but there are increasing signs of commodity related currencies being dragged into the fray. The Canadian and Australian dollars have succumbed to severe selling pressure in recent weeks, prompting the Canadian central bank to cut interest rates in a bid to shore up confidence in the nation’s financial system. Australian equities and the currency markets have been rattled, with the Aussie dollar falling to levels unseen since the Lehman crash. With financial and mining related activities making up a large percentage of GDP, Australia looks to be in an increasingly dangerous position. House prices in the country are at astronomical levels fueled by a circular interplay between the mining sector and the nation’s mortgage lenders. Australia is not alone. Emerging markets across the world are beginning to enter precarious positions of their own. China is an integral part of many of these nation’s economies. With falling demand, particularly for commodities, these countries are facing severe budget pressures in the months ahead. Given that emerging markets have played a crucial role in the global recovery, any slowdown in their economies will ultimately impact the developed world.

Where does this leave us? Should commodity markets continue their precipitous fall, it seems increasingly likely that there will be unprecedented intervention by monetary authorities worldwide. This ultimately means more money printing, and a continuation of the very same policies which have led to this position in the first place.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81