- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

China Increases Gold Reserves Again As Diversification from Dollar Continues

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 10th September 2019, 02:55 pm

This week saw the announcement that China has increased its gold reserves by 5.91 more tons for the month of August. The new figures mean that their aggregate official gold buys for year 2019 are up to nearly 100 tons, per data out of the People's Bank of China this past weekend. It marked the ninth consecutive month that China has bought gold in the country's continuing endeavors to diversify its massive reserves away from American dollars. The news is all the more significant as China is not even the largest central bank purchaser of gold for the year.

Trade War and Sanctions Encouraging China and Russia to Diversify Out of Dollars

China and Russia have been vying for the top spot of largest central bank gold buyer this year. A National Australia Bank economist revealed to Bloomberg that he anticipates the two nations will keep purchasing gold going forward. He argued that trade war restrictions against China and sanctions (on countries like Russia and Iran) are providing:

“an incentive for these central banks to diversify. Also, with increasing political and economic uncertainty prevailing, gold provides an ideal hedge, and will, therefore, be sought after by central banks globally.”

As much gold as China has already purchased this year, Russia has bought up still more of the yellow metal. Through the month of July, the Central Bank of Russia had bought 106 tons of gold for 2019. Data from the World Gold Council showed that Russia purchased 12.2 tons in gold for the month of July as well. Russia's acquisition raised global central bank net purchases to 13.9 tons for the month (with gross purchases reaching 36.4 tons for July).

China Is Using Gold To Back Its Rise To Superpower Status

China (as well as gold buying nations like Russia) is using its gold purchases for a specific set of larger geopolitical end goals. These nations are seeking to reduce the dollar's international hegemony and ability for the U.S. to weaponize the dollar in foreign policy. Analyst Brett Arends in MarketWatch explained that:

“Some of America's biggest geopolitical rivals were stockpiling gold. Especially China and Russia… And there's an obvious reason for China to buy gold. It wants to break up the global hegemony of the U.S. dollar – the hegemony that former French President Charles de Gaulle called America's ‘exorbitant privilege.' It wants to make its own currency, the renminbi, a world player… Buying gold bullion is a natural move. Gold reserves should add to world confidence in the Chinese currency.”

It was only back in December of 2018 that the People's Bank of China revealed its first new gold reserves purchases dating back to 2016. China has a history of waiting longer periods of time to announce additions of gold to its holdings, then without warning announcing a significant addition to its reserves. Back in 2009, the country discontinued gold holdings reports for more than five years. In June of 2015, they suddenly shocked the world by revealing that their gold assets had increased by 57 percent. The country added another 185 tons in the 16 months following before they stopped updating totals once again.

In its previous gold buying bonanza, China worked tirelessly to get its currency included in the benchmark currency basket of the International Monetary Fund. Yet a number of analysts believe that China inventories a much greater amount of the yellow metal than they officially declare even today. One analyst Jim Rickards discussed the rampant speculation that China holds up to several thousand tons more in gold “off the books” in another government entity called SAFE — the State Administration for Foreign Exchange.

Other Central Banks Also Purchasing Gold

China and Russia are not alone in purchasing gold these days. The global central banks acquired an incredible 651.5 tons of gold in 2018 alone. This trend has only continued for 2019 so far.

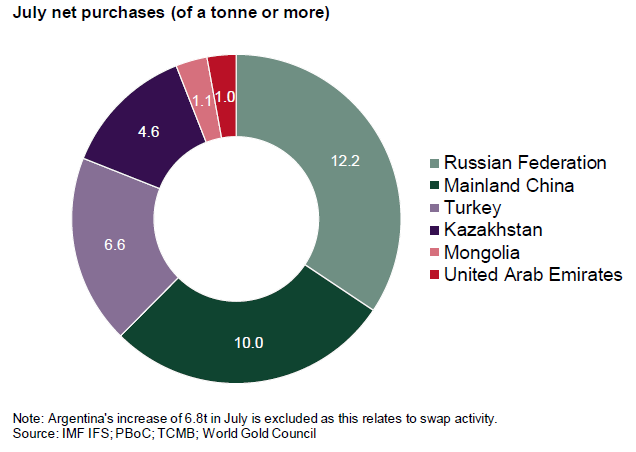

The World Gold Council has remarked that the year 2018 proved to be the greatest amount of net annual central bank gold acquisitions going back to the fateful 1971 suspension of dollar convertibility to gold under President Nixon. Last year's total was also the second largest annual gold total ever recorded. Per the World Gold Council, 12 central banks have boosted their net gold reserve totals by minimally one ton in this year's first seven months. This graphic from the WGC shows the countries that significantly boosted their gold holdings in July:

ETF Gold Holdings Also Approaching All-Time Highs

It is not only the central banks that are adding significant quantities of gold to reserves lately. For the month of August, the gold-backed ETFs increased their holdings by 122 tons around the world. These aggregate holdings are now approaching their highest records of all time. The total of ETF gold holdings equaled 2,733 tons in August. This figure was only 52 tons off of the previously recorded high set back in 2012 (at a price when gold was nine percent higher) per the World Gold Council data release. In the past three months, the worldwide ETFs have boosted their total gold holdings by a significant 13 percent. For the year, global gold backed funds have added a total of 292 tons so far.

It is significant that all regions of the world saw gains in August gold holdings. North American funds increased their holdings by 78 tons as the leading region for the month. This area has now passed the European region for the largest gold holding increase of the year. The European-based funds added another 33 tons in gold for August.

Unsurprisingly, British funds led the continent in purchases, thanks to the ongoing uncertainty surrounding Brexit and the weakening pound. At the same time, Germany held its first auction with a 30 year negative yielding bond. The World Gold Council states that this shows the effects of low interest rates on gold purchases. Euro-based gold prices were at their historic highs for the month. In fact, gold is priced in record highs now in all of the G10 currencies besides the U.S. dollar and the Swiss franc (and almost at the record high recorded in Chinese yuan).

Asian funds also added nine tons in gold for August. China's funds were the leading buyers in Asia. The WGC showed that the Shanghai Futures Exchange saw its average daily gold trading volume rise to more than $20 billion for August. That figure compares to a year to date $8 billion average and a 2018 average of just $3 billion.

Gold ETFs and Central Banks Helping Push Total Demand Substantially Higher

These gold ETF inflows (along with central bank purchases) have caused a major impact on total demand for gold around the world. In the first half of 2019 alone, total gold demand increased by eight percent. Between fears of the ongoing trade war and worries about recession in the U.S. and around the world, gold purchases from central banks and ETF's are the two main factors pushing safe haven demand higher.

The news of continued diversification away from the dollar by other countries and their central banks is not good. It does show why gold makes sense in an IRA. The IRS has made it easier for retirement accounts to legally store gold abroad in top offshore storage locations and to gradually buy gold in monthly installments. You can get information on top gold IRA companies and bullion dealers to learn more.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81