- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

China Flexes Muscles as Portugal Reaches Out to Chinese Markets

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

This past week, Portugal has taken a huge leap and become the first country in the euro zone to issue bonds denominated in China's own currency the yuan. The “Panda” bonds (what economists call yuan denominated debt for foreign governments) sale will happen Wednesday and Thursday. The small southern European nation has announced its goal to sell two billion in yuan (or $289 million) in three year maturity bonds. Poland has issued similar bonds back in 2016 and Hungary in 2018, but these are far less influential and important European nations which lie outside of the euro zone system.

Other European Union nations are understandably cautious (and even nervous) about the development. It is yet another sign of the balance of power shift moving to the East and away from the Western world. Such economic developments will have major impacts on the future of your investment and retirement portfolios. This is yet another reason why gold makes sense in an IRA. Now is the day to check out Gold IRA rules and regulations for IRA-approved gold while you still can.

Portugal Boasts Unusually High Level of Chinese Investment

The Portuguese consider this foreign yuan bond sale a Godsend. Their Finance Minister Mario Centeno claimed that:

The issue is a “positive step in managing Portugal's external debt in the medium term.” It will permit Portugal to grow its investor base.

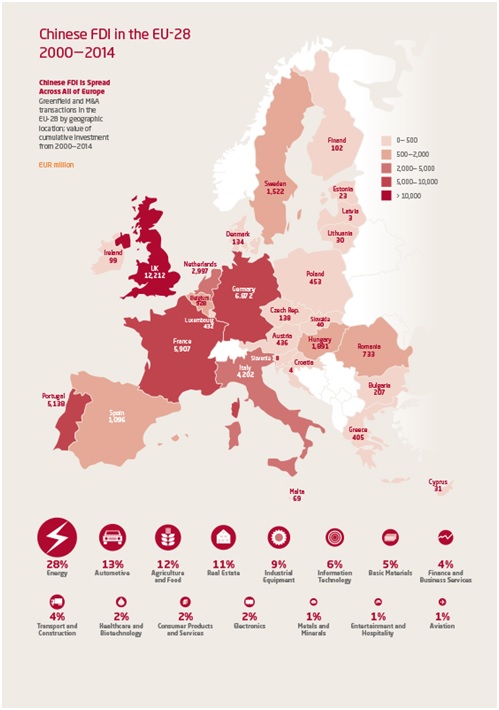

Portugal was already among the European nations possessing the largest amounts of Chinese investment as this graphic to the right demonstrates. This stems in part from their significant international bailout that (saved them from the brink of collapse) dated from 2011 through 2014 in the peak of the euro zone's Sovereign Debt Crisis.

In the ensuing years, Portugal's economy has enjoyed rebounding and encouraging amounts of growth. Credit ratings agencies have similarly taken note on the progress the nation has made. In only the last week, ratings agency Fitch ratings issued an update on the outlook for Portugal. They raised it from the past level of stable to positive, and opened the path for an upgrade to the ratings later on in the year. No doubt, the Chinese have played their part in the little nation's surprisingly fast recovery. Certainly it has bought them influence in Lisbon and thus the European Union.

Chinese Issue Dire Threat Only Used Twice Before When War Broke Out

It is not only in the world of international finance that China has been flexing its increasingly growing muscles though. Their state agency newspapers have suddenly turned militant on the subject of the trade war with the United States. The largest of these Chinese newspapers issued a dire warning to the U.S. last Wednesday, stating that Beijing will cut off all rare earth metals supplies as a counter strike in this escalating trade war. They even employed a historical expression that has only been utilized twice in advance of outright military conflicts in the past.

“We advise the U.S. side not to underestimate the Chinese side's ability to safeguard its development rights and interests. Don't say we didn't war you!” from the commentary entitled “United States, don't underestimate China's ability to strike back.”

This is all the more significant as this paper is actually the official Communist Party newspaper for China. The last two times China relied on this phrase “Don't say we didn't warn you!” was before the the China-Vietnam War back in 1979 and the 1962 border war with India.

Rare Earth Metals Could Become the Next Battleground in Trade War with China

The paper made no weak or veiled threats on the critically necessary rare earth metals. They were blunt and explicit, with:

“Will rare earths become a counter weapon for China to hit back against the pressure the United States has put on for no reason at all? The answer is no mystery.”

It appears that the trade war between the two mightiest economies on earth may be rapidly spiraling out of control. Only last month, the two sides hit each other with billions of dollars in tariffs on one another's exports. China reserved its threats on rare earth metals exports until American President Donald Trump chose to blacklist the giant Chinese telecommunications firm Huawei. This of course caused numerous internet firms and chip makers to sever all ties to the Chinese company.

Analysts were watching closely to determine what China's retaliation to the Huawei move would be. Guesses about rare earth metals as a bargaining chip in the conflict first emerged when China's President Xi Jinping went to visit the rare earth mining and processing centers in Jiangxi two weeks ago on a domestic tour. It was only then that one Chinese official issued a warning that such products made from the Chinese sourced materials should not be employed as a weapon against the development of China. This was more than a veiled threat against the United States' technological industries, which are entirely dependent on the elusive minerals.

These rare earth metals are found almost entirely and exclusively in China. They are absolutely necessary for producing iPhones, advanced system weapons, and electric vehicles. The dollar amount involved in the scheme of the two countries' trade is a tiny portion of the $420 billion in the American goods trade deficit with Beijing for 2018.

But it is no doubt an area where China enjoys major and powerful leverage, as there is no known substitute for these aptly named materials anywhere else in the world. China's other state controlled major publication Global Times also issued a similar warning last week that China has the “rare earths card” to play, and more ominously still that it is “seriously considering” engaging in such a move.

China's Expanded Influence and the Trade War Causing Financial Market Pain

The U.S. stock markets have taken massive hits in the midst of this back and forth war of attrition between the United States and China. Stocks have now suffered their first negative month for 2019. The S&P 500 alone plunged around six percent for just the month of May. That makes it the worst end of spring month in years.

It appears quite clear that the impacts from the trade war and newfound flexing of Chinese muscles on the international stage can get a whole lot worse before they start to improve at all. You should not let your investment and retirement portfolios be taken hostage by Beijing's increasingly belligerent actions. One way to reduce your exposure to U.S. investments and dollar denominated assets is through buying gold in monthly installments. The IRS allows you not only to do this now, but also now to store your retirement treasure hoard in top offshore locations for Gold IRAs.

Do not be too shy in taking full advantage of this fantastic opportunity to diversify away from the U.S. dollar, like countless other central banks are doing into gold (including Russia, China, Turkey, Kazakhstan, and even Serbia). Just make sure when you do that you go with top Gold IRA companies and bullion dealers so that you do not find yourself taken advantage of in the actual purchases. You can still buy gold bullion at highly competitive prices compared to the stock and bond market valuations these days.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68