- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Can Struggling ECB Manage to Stave Off European Pullback?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 11th March 2019, 04:24 pm

Recently released data revealed that the economy of the euro zone has experienced its slowest rate of growth in the last four years for the last three months in 2018. More recently than this, manufacturing data (for Germany and the block as a whole) uncovered a worsening slowdown. The discouraging economic updates come as worries grow surrounding emerging market weakness, trade tariffs with China and the U.S., and fears over generally slowing global growth.

Europe's latest troubles and the world as a whole's remind you why gold makes sense in an IRA. Today is the day to hedge your investment and retirement portfolios with IRA-approved gold. Now is the time to consider Gold IRA asset allocation strategies while you still have some time left.

European Growth Rates Collapse into 2019

The European Central Bank has been the bearer of unusually bad news lately. They had to slash their area wide forecasts for growth for this year 2019 down from 1.7 percent (back in December) to a mere 1.1 percent now. Just last week, ECB's President Mario Draghi found himself forced to admit that a:

“sizable moderation in economic expansion will extend into the current year… The persistence of uncertainties related to geopolitical factors, the threat of protectionism, and vulnerabilities in emerging markets appears to be leaving marks on economic sentiment. The impact of these factors is turning out to be somewhat longer lasting, which suggests that the near term growth outlook will be weaker than previously anticipated… We are aware that our decisions certainly increase the resilience of the euro zone economy, but actually can they address these factors that are weighing on the euro zone economy in the rest of the world? They cannot.”

Mario Draghi followed this unusually candid admission up with a pledge that interest rates will stay at all-time lows through December of 2019 at the least. Even as he was busily slashing euro zone growth rates for the year, Draghi announced new cheap loans to be offered to euro zone area banks.

There is considerable debate among economists and observers as to whether or not this will make much of a difference though. One analyst said that their best efforts will not be enough to salvage the flagging economy and take on the largest risks. ING's Chief Economist Carsten Brzeski wrote in a research note:

“The ECB's announcements have some flavor of panic as the ECB's base case scenario still foresees a gradual recovery and the 2020 and 2021 forecasts were hardly revised downwards. The measures as such are not such a big surprise but the timing of the announcement is. The announcements are also a bit of a gamble as they will do very little to tackle the biggest risks for the euro zone economy, which according to the ECB stem from external sources.”

That is as much an admission that the ECB is powerless to make a real difference in the euro zone's ongoing economic woes as you will get.

European Economy Facing Challenges From All Sides

The 19 nation member economic block has suffered one setback after another from developments within Europe. Italy fell into a recession in the last quarter of 2018 and has politically resisted the interference of the EU institutions in its budget and decision making policies since the summer. The United Kingdom is still finalizing an agonizingly drawn out exit from the EU at the 11th hour in March.

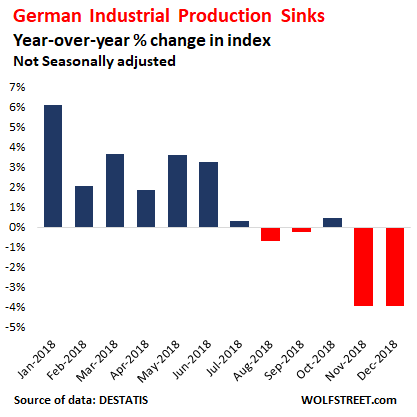

But these are not all of the continent's economic and political woes. Germany's long-powerful economic engine has been sputtering out, according to recent weaker manufacturing data. Its manufacturing index fell for 11 out of 12 months in 2018. This chart below tells the grim tale:

Germany has long been the traditional economic growth driver of the entire euro zone. Worries about upcoming economic slowdowns in China's economy have also overshadowed the future stability of European exports to the Middle Kingdom.

Worsening Economic Conditions Force ECB to Act

The ECB felt like it had no choice but to act in light of the deteriorating economic conditions in the block. They also had to reduce their forecasts on inflation for 2019 along with the economic slowdown. They see inflation for 2019 at 1.2 percent for the year. This is revised down from a target of 1.6 percent back in December's forecasts. Draghi and company remain confident that their new set of easing measures will raise inflation back up to their long standing target of “close but below two percent.”

Besides keeping the all-time low interest rates through end of 2019, the ECB will also initiate a new round of loans. Euro area banks will be able to access funds (almost for free) in an effort to improve the real European economy.

This follows up the end of the quantitative easing program of the European Central Bank that tapered off in December. They had ceased their enormous bond buying program at the end of 2018. Yet now they are rolling out brand new stimulus as growth weakens internally and external risks rise at the same time. None of this is a vote of confidence in the euro zone block's economy.

Whatever the ECB Does, Recovery Hinging on China?

Some economists are warning that the ECB's actions will be mostly irrelevant (or at best neutral) in their helpfulness to the area's economy. The EMEA Chief Market Strategist Karen Ward of J. P. Morgan Asset Management stated that the ECB had pivoted in its policy significantly in line with the recent moves by the U.S. Federal Reserve and its about face on fiscal policy, with:

“Whilst such an announcement was expected at some point in the coming years the market is welcoming this proactivity. The euro exchange rate is down alongside European government bond yields. This should help stabilize sentiment and activity in the euro zone. But for a meaningful turn around in Europe, we look further afield to what is happening in Beijing. In our view, a notable rebound in activity in China is required to see a significant re-acceleration in Europe over the course of the year.”

In other words, the economic salvation of Europe lies with China's economic success, not the best efforts of the policies of the European Central Bank. Another economist sadly commented on how long the European economy has been on life support, and pontificated on how much longer this state of affairs will continue. Executive Director Christoph Schon of Axioma queried meaningfully:

“I wonder if the ECB will ever increase rates in this economic cycle” given the long standing moribund state of the European area's economy?

Gold is the Refuge to Turn to When the Wheels Are Coming Off the Developed World Economies

The ongoing economic agony of the leading European economies reminds you that you need to take proactive measures to safeguard your investment and retirement portfolios today. This is why it is sensible to study the list of the Top 5 Gold Coins for Investors and the Top 5 Silver Coins for Investors now. When you are ready to buy, remember to contemplate the Top Gold IRA Companies and Bullion Dealers trading on the market today.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68