Breaking Down The Growth of the “Gold IRA” Industry Over the Last 10 Years

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 17th April 2024, 10:21 pm

When we launched this blog in 2012, the term “Gold IRA” was relatively unknown. After all, where does this term come from? There is no such thing as a “Gold IRA”. It's a catchy term that gold companies started using in the last decade to sell the idea of investing in gold through a self-directed IRA (SDIRA).

Although gold IRA accounts were officially born in 1997, when the IRS passed the Taxpayer Relief Act, this investment vehicle only started gaining steam ten years later during the Great Economic Crisis of 2008.

Investors, desperate to protect their savings from a historical crash in paper assets that saw 401k accounts lose about 40% of their value, were increasingly looking into gold as a way to hedge their savings.

Now, let's look at some key facts and statistics about the gold IRA industry's growth in the last decade…

Table of Contents

The Gold IRA Industry in 2014

- Gold Price: $1,266.06

- Less than 10 gold IRA companies were actively marketing this type of investment, as per our own research and review staff.

- Most companies had a minimum order size ranging between $10,000 and $20,000 for Gold IRA investments.

- The companies we interviewed for our reviews section had an average order size of $20,000 to $25,000 for Gold IRA accounts.

- No notable political figures, high-profile investors, or celebrities were involved in the industry.

The Gold IRA Industry in 2024

- Gold Price: $2,361.09 (at time of press)

- Over 100 companies are actively promoting Gold IRA accounts, a staggering increase in ten years. We have reviewed 116 gold IRA companies on our website.

- Most companies we reviewed have reported between $35,000 and $100,000 as their average order size in 2023 and early 2024.

- While most companies still enforce a minimum order of $20,000 for Gold IRA accounts, some companies, like Augusta Precious Metals started requiring a larger minimum investment size of $100,000.

- Many high-profile political figures and celebrities have gotten involved in this industry as either co-owners, partners, or ambassadors of gold IRA companies. Some examples include:

- Joe Montana and Mark Levin with Augusta Precious Metals

- Ben Shapiro and Ron Paul with Birch Gold Group

- Chuck Norris and Sean Hannity with GoldCo

- Glen Beck with Lear Capital

- Bill O'Reilly with American Hartford Gold Group

- Charlie Kirk with Noble Gold Investments

- Mike Huckabee with Gold Alliance

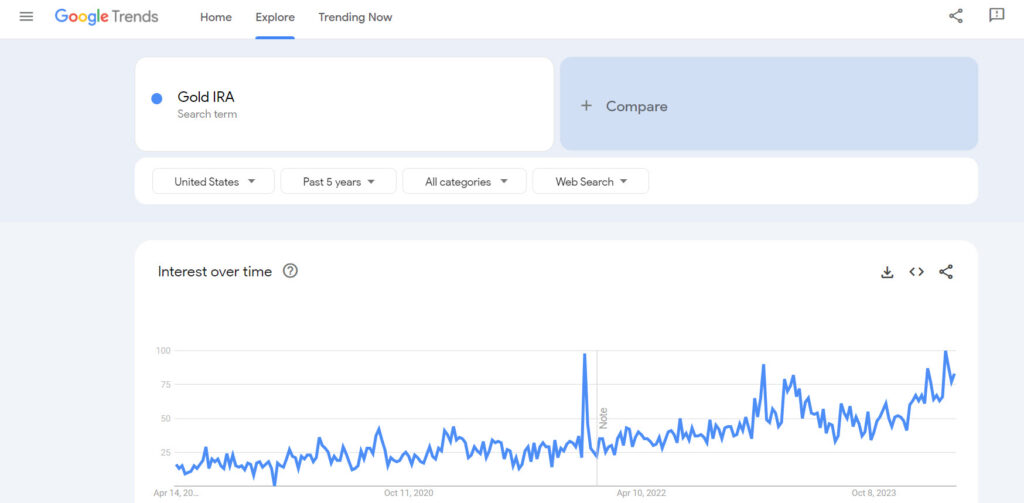

The Appetite for Gold IRA Accounts is Increasing

Again, the staggering increase in the number of active gold IRA companies in the last ten years alone is a clear indicator of this industry's growth.

Over 10,000 Americans retire every day, and these companies want to capitalize on the baby boomers' love for gold. The unstable geopolitical landscape and high inflation are driving more and more retirees to look at gold as a way to hedge and protect their wealth.

12% of Americans own gold, according to a study we published in 2019. Today, one can argue that the percentage would be substantially higher. We are planning an updated study later this year.

Gold IRA accounts, while being a relatively newer way to invest in physical gold, are growing in popularity due to being an easy way to own gold in a tax-advantaged manager. In fact, Gold Roth IRA accounts offer tax-deferred growth, which is highly attractive to investors that don't want to worry about paying taxes until later down the line.

It's not just retiremees that are hoarding gold. Central Banks' appetite for gold is also increasing year over year, according to a recent article from Bloomberg, with countries like China and Turkey leading the charge. The unstable economic and geopolitical landscapes caused by the wars in the Middle East and Ukraine are making the shiny yellow metal more attractive than ever.

As always, this content isn't financial advice. Speak to your financial advisor before making any investment decision. All assets carry a certain level of risk, including precious metals. Also, past results aren't always indicative of future returns. Do your due diligence and invest wisely.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,307.17

Gold: $3,307.17

Silver: $36.09

Silver: $36.09

Platinum: $1,351.02

Platinum: $1,351.02

Palladium: $1,110.25

Palladium: $1,110.25

Bitcoin: $107,626.91

Bitcoin: $107,626.91

Ethereum: $2,483.54

Ethereum: $2,483.54