- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Booming Bubble Economy Again Threatens Financial Mass Destruction

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 9th November 2018, 09:00 pm

The month of October that just ended last week was the worst one for global stock markets in over six years. Around the world, global equities' markets plunged 7.5 percent. This dismal performance represented the worst October going back to May of 2012. There may have been a late month rally in U.S. stocks, yet the NASDAQ still experienced its largest single month drop since 2008.

This is a prescient reminder for why you need IRA-approved gold and IRA-approved silver in your investment and retirement portfolios. The markets are slowly adjusting to the realities of the deflation in the “everything bubble.” This is why the world's ultimate safe haven gold makes sense in an IRA. Now is the time to familiarize yourself with Gold IRA storage options.

Was October A Correction or the Overdue End of the Longest Lasting Bull Market?

The volatile market action in October and the steep declines for the month in the U.S. and around the world beg the question: was this merely a correction of sorts or was it actually the significantly overdue end to the longest running bull market in U.S. history? Analyst Peter Schiff from Euro Pacific Capital, Inc. has a strong opinion on this:

“The fact that there is no fear, to me, shows that it's more likely that this is not the end of the correction, but the beginning of the bear market and that this rally is a correction… What is more likely? That the longest bull market in history just had a correction or that it is finally come to its long overdue end?”

What is interesting is that not only global equities suffered a severe beating for the month of October. The junk bond market experienced its biggest losing month dating back to 2008. This stems from rising fears of corporate defaults on debt. Schiff again raised an interesting point on this phenomenon with:

“If the economy is booming, why would people think that the risk of a company defaulting is going up? Because when the economy is really good, that is when companies do not default. It is when the economy is bad, that is when companies might default.”

Though this argument makes sense, it is not exactly the majority opinion among economists and stock market analysts these days.

Housing Market Barometer Sounding Warning Bells

Unfortunately it is not only the American and worldwide stock markets that are sounding warning bells these days. The Real Estate market is starting to show signs that the fiction of a roaring economy is at last cracking. California has recently reported its lowest housing sales figure for 10 years. This is with interest rates at a mere two percent and mortgage rates for home buying only recently regaining the still-reasonable levels of five percent.

It is important to keep in mind that normal interest rates have not yet even returned yet. Historically normal interest rates for the U.S. are closer to five percent versus today's two percent. Yet despite this, housing is already suffering. Most sobering of all is the fact that this housing data turns out to be an important leading indicator of the effects from higher interest rates.

Government Debt Is Also A Worsening Problem

Federal debt is also a growing problem for the American economy. The recent leapfrog past $21 trillion total federal debt should worry everyone in the nation, investors and consumers alike. If the economy is truly booming, then then the enormous deficits of the last few years should not exist.

For this last quarter in 2018, the U.S. Treasury will borrow fully $425 billion more for just the quarter. It will bring 2018's total deficit up to $1.34 trillion. To objective observers, this is the level of borrowing more typical in the middle of a painful and lasting recession than in a booming economy.

The Corporate Bond/Debt Bubble Presents Even More Serious Trouble

What is ironic and tragic is the fact that the very corporate debt spree that has created the last decade stock market boom will also be the bitter undoing of the equities markets' run. The under the radar perilous bubble that formed quietly away from the eye of the investing public is the corporate bond market.

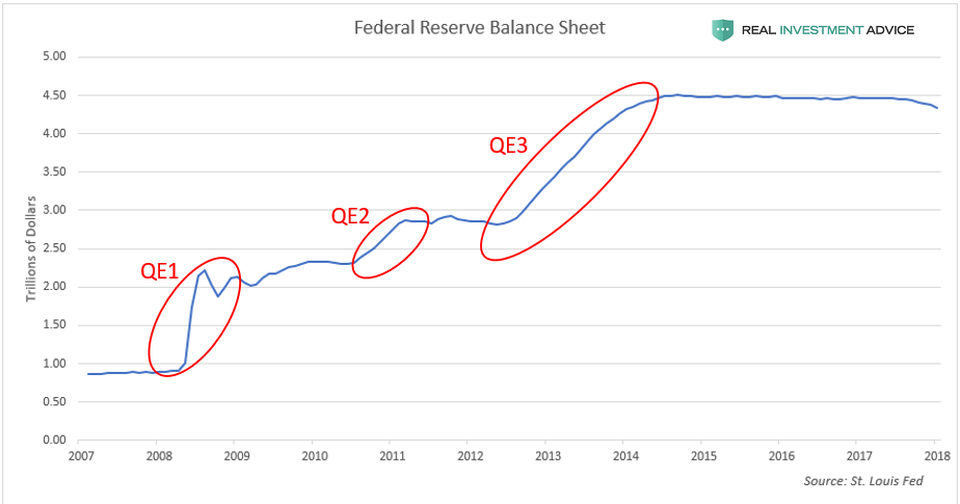

You need to understand a little background to comprehend how the stock market bubble resulted from the unprecedentedly low interest rates and the impact this had on the American corporate bond markets. Following the Great Recession and Global Financial Crisis of 2008 to 2009, global central banks (and especially the U.S. Federal Reserve) struggled to restore their crushed economies by desperately slashing interest rates to all-time lows. Meanwhile, they also flushed literally trillions in dollars, euros, yen, pounds sterling, and Swiss francs through the stricken markets and worldwide financial system in the form of several rounds of Quantitative Easing.

Unfortunately, a dangerous side effect of this practice was to create a phenomenon now called yield chasing. This widespread practice caused the prices of bonds to roar higher while their yields crashed inversely to the price movement. Meanwhile the Fed conjured up new money from nothing digitally and utilized this to purchase both MBS mortgage backed securities and government Treasury bonds. Such actions successfully lifted the fortunes of the general bond market alongside the MBS and Treasuries.

This chart below demonstrates how dramatically the balance sheet of the Federal Reserve has exploded from the Global Financial Crisis:

The Federal Reserve literally conjured up more than $3.5 trillion in magic new money. With every new Quantitative Easing episode, both bonds and stocks would surge higher. Meanwhile the bond yields were so incredibly cheap that publicly traded corporations could not resist the temptation to borrow massive amounts of capital from bond markets.

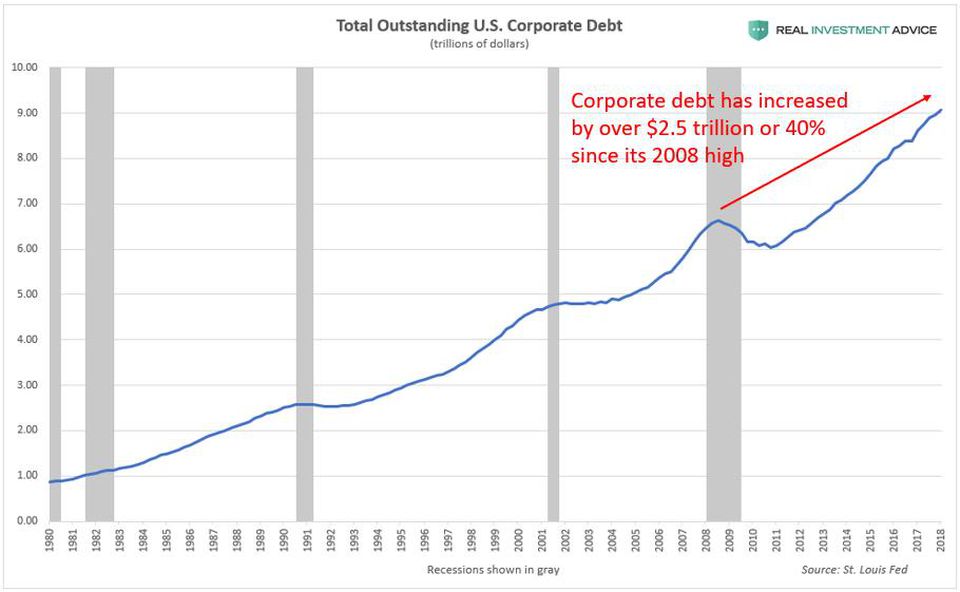

This chart below shows how the non-financial company debt in America has skyrocketed by more than $2.5 trillion. It translates to 40 percent corporate debt growth from the highs of 2008. Keep in mind this was a level that was already perilously elevated too:

What does it mean in the bigger picture? American corporate debt has now risen dramatically to a historical high point of more than 45 percent of the entire annual GDP. This amounts to a higher level than those experienced in both the American housing/credit bubble and the notorious dot-com bubble.

If the money had been wisely invested in productivity, expansion, or capital improvements, it might have been reasonably done and well spent. Instead though, the companies generally utilized the proceeds from the corporate borrowing to pursue stock buybacks in an effort to increase their share prices, for mergers and acquisitions, and to pay out higher dividends. It was a radical departure from the uses of borrowed capital in the past, more disciplined corporate days that made the country great. For 2018, these buybacks amounted to in excess of $1 trillion.

The net result has been that the S&P 500 rose more than 80 percent from the 2007 peak and an incredible more than 300 percent from the lows in the Global Financial Crisis. This reached a point in recent months that the CAPE ratio touched overvalued levels last seen in the 1990's dot-com bubble and approached the 1929 valuations just before the Great Depression struck. Consider yourself fairly warned.

The Ultimate Safe Haven of History Is Your First, Best, Last, and Only Real Line of Portfolio Defense

There are now a range of bubbles that could burst, including housing prices, government debt, and especially corporate debt as the Federal Reserve once again self inflicts its own wounds by raising interest rates. The end of the cheap and easy money era spells disaster for the raging corporate debt bubble. Crashing corporate bond prices alongside rising corporate bond yields mean that the stock buybacks' days are numbered. Soon they will be over completely. The stock market bubble likely will be the next casualty after this.

Welcome back to the central banks' meddling-induced meltdowns of the past two decades. For some reason, they never learn the lesson. Fortunately, you can buy gold for your retirement accounts and then keep it in top offshore storage locations for your gold IRA.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68