- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

“Bond King” Joins Respected Voices Warning on Market Pullback

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 28th December 2020, 11:01 pm

This past week, the “Bond King” of Wall Street CEO Jeffrey Gundlach of DoubleLine Capital joined a growing cast of respected voices warning that a stock market pullback is long overdue. Gundlach stated that the “massive buying frenzy” evident in retail investors for 2020 is a worrying sign for the equities markets in general. Highly respected former Fed Chairman Alan Greenspan and legendary billionaire investor Stanley Druckenmiller also shared their thoughts on the troubling signs surrounding the U.S. stock markets now.

Retail Investor Activity A Frenzied Cause for Concern

Jeffrey Gundlach addressed the issues of a booming retail trading in U.S. stock markets by explaining what has been happening. He explained that the federal government's historical levels of stimulus were to blame. While many Americans who were struggling were helped by the funds the government extended in the forms of additional unemployment benefits and direct payments, others found a way to plough their stimulus funds into the stock markets. The “bond king” compared this level of novice investor to a child taking candy out of the hands of a stranger, with:

“Of course retail investor activity is downright terrifying. We just see how much trading is going on in retail. It looks like people are kind of re-gifting the candy the con has given them… they are throwing that candy into this retail investment fervor. This is a terrible sign for the condition of the market for anybody who has experienced a significant number of cycles, which I've definitely experienced.”

Gundlach was referring to a daily average trade surge as well as the sudden rise in trade per accounts at online brokers in his data sets.

Where Did All the New Retail Investor Accounts Come From Specifically?

The stock market plunge encouraged a large number of new retail stock traders to seek out online brokerage accounts. These so-called amateur traders and investors wanted to participate in their share of the market gains they saw taking place on a huge scale as markets rebounded sharply. Online brokers including TD Ameritrade, Charles Schwab, Interactive Brokers, and Etrade each benefited from this huge jump in account opening activity. Another firm that the millennials prefer called Robinhood experienced an all time record of fully three million individual new account openings in only January through end of April in 2020.

Meanwhile a large number of observers on Wall Street warned about what the surge in speculative trading meant with the retail investors plunging head first into the most risky parts of the markets in their hunt for returns. There was a time when several of the bankrupt company stocks and penny stocks experienced share price doubling in a single session at the same point as shares that had been most crushed during the pandemic downturn rallied dramatically. This crowd stampede into equities extended into even the more savvy markets for options.

Revered Federal Reserve Chairman Alan Greenspan Expresses Fears Over Budget Deficit and Inflation

The famous former Federal Reserve Chairman Alan Greenspan also gave his first televised interview of the U.S. coronavirus pandemic this past week. Greenspan warned that his greatest economic worries for the United States are the enormous budget deficit and potential high inflation. The “Maestro” shared his interview with the CNBC “Squawk on the Street” program last Thursday, with:

“My overall view is that the inflation outlook is unfortunately negative and that's essentially the result of entitlements crowding out private investment and productivity growth.”

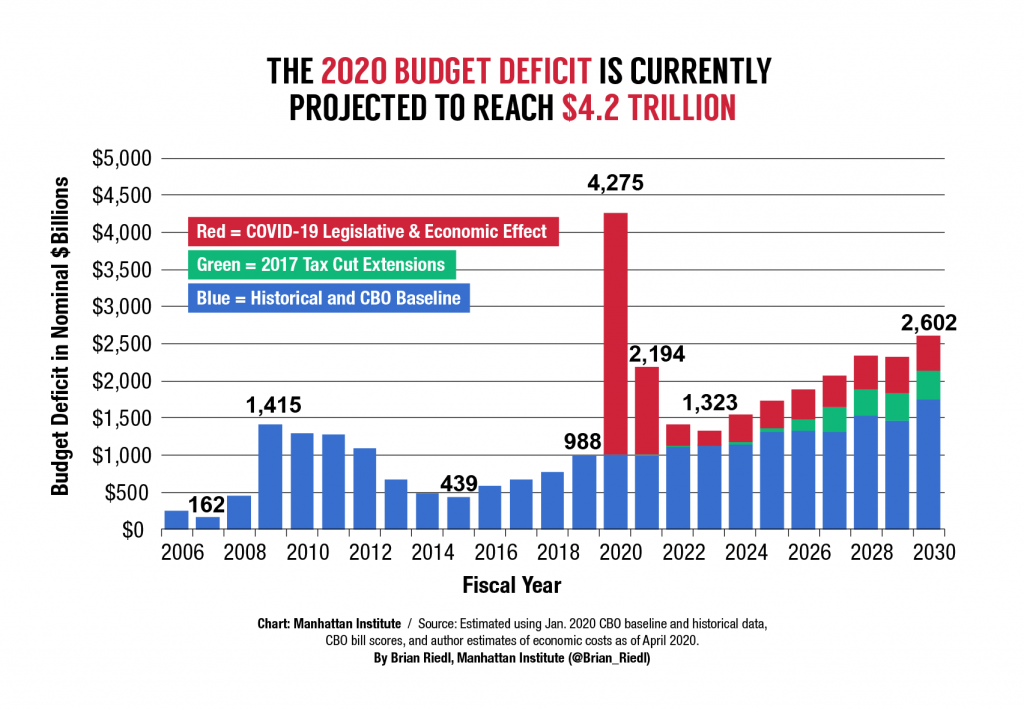

Concerning the budget deficit, Greenspan stated categorically that the spending imbalance pursued by the U.S. federal government is “getting out of hand.” Up to end of July, the 2020 fiscal shortfall amounted to $2.45 trillion. It represented concentrated efforts by the American national government to keep the economy afloat during the country's economic shutdown brought on by the pandemic. The chart below shows the Manhattan Institute's projections for how high the U.S. budget deficit might reach this year:

Alan Greenspan long has been a key voice sounding the alarm about major shortfalls in funding for critical entitlement spending programs such as Medicare, Social Security, and Medicaid. He shared that:

“We do have a great deal of knowledge on the extraordinary increase in the size of the retirement area. We are if anything underestimating the size of the budget deficits that are down the road.”

Meanwhile the Federal Reserve has maintained low interest rates all the while America has reeled from the fiscal problems. Besides this, the U.S. central bank pledged to raise inflation to the two percent goal. The Fed declared that it will not increase the nearly zero percent interest rates even should inflation exceed their desired goal for some time with unemployment hitting levels usually consistent with increasing cost pressure.

Billionaire Investor Stanley Druckenmiller Warns of Absolute Mania in Stock Markets

This past week another leading investor voice Stanley Druckenmiller also shared his growing concerns about what he called the Federal Reserve-fueled mania. Druckenmiller went so far as to predict that over the coming months to years things will end badly for the markets and overall economy. Druckenmiller dramatically explained his position on a Squawk Box interview with:

“Everybody loves a party… but, inevitably, after a big party there's a hangover. Right now, we're in an absolute raging mania. We've got commentators encouraging companies to do stock splits. Companies then go up 50 percent, 30 percent, 40 percent on stock splits. That brings no value, but the stocks go up.”

Druckenmiller also attributes the huge run up in the market (at least in a significant way) to the Federal Reserve's response since the pandemic began affecting the U.S. According to the legendary billionaire investor, the American central bank's March great job of slashing rates and forging historically unequaled stimulus programs to boost the flagging economy since then has become “excessive.” Druckenmiller is also woried for the first time in a number of years about a roaring higher of inflation levels that could equal to 10 percent in coming years. He cautioned investors that:

“The merging of the Fed and the Treasury, which is effectively what's happening during Covid, sets a precedent that we've never seen since the Fed got its independence. It's obviously creating a massive, massive mania in financial assets. I have no clue where the market is going to go in the near term. I don't know whether it's going to go up 10 percent. I don't know whether it's going to go down 10 percent. But I would say the next three to five years are going to be very, very challenging.”

Unfortunately for everyone, the news from this past week on major voices warning about impending future trouble for U.S. stock markets is not good. A growing chorus of voices agree that there is a danger of a difficult period of from several months to even several years in U.S. stock market prices. This is the latest reason for why gold makes sense in an IRA. One way that you can diversify your investment and retirement portfolios is by considering IRA-approved precious metals. By reading about some of the Top Gold IRA Companies along with the various Gold IRA Rules and Regulations you can learn more on the subject.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81