Best Gold Stocks: Which Are the Best Gold Stocks for 2022?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 18th August 2022, 03:38 pm

Let’s dive into the three best gold stocks of 2022. They are listed by market capitalization in ascending order. Gold stocks offer the opportunity to gain exposure to the returns of gold through mining operations of the precious metal.

However, we also pick up returns from the value of other precious metals these companies may mine. We picked four gold stocks that are actively traded, have a reasonable market value, and have strong growth potential.

Table of Contents

Best Gold Stocks

Sibanye Stillwater Ltd (NYSE: SBSW)

- Market Capitalization: $6.9 billion

- Average Volume: 2.87 million shares

- Forward Annual Dividend Yield: 13.65%

- Profit Trend: 4 Years of increasing gross profits

Source: TradingView

Sibanye Stillwater is the smallest gold mining company on the list, but don't be fooled by its size. The company was founded in 2013 and is headquartered in South Africa. So, it has come a long way already.

We believe this stock has a lot of growth potential. The company has mining operations in South Africa, the United States, Zimbabwe, Canada, and Argentina.

Together with its subsidiaries, it mines gold and platinum metals, which include palladium, platinum, and rhodium. They also produce by-products such as nickel, copper, and chrome.

Something that caught our attention was the 30% stake SBSW has in a lithium project in Finland. In case you haven’t heard, the price of lithium has exploded over the past year and is up 379%. Lithium seems scarce and it is in high demand for various green energy products. In particular, demand is coming from battery production for electric vehicles.

This company has a fairly high dividend yield although payment dates and amounts tend to change from year to year. The company has shown a strong growth record increasing gross profit from $2.3 million in 2018 to $59.8 million in 2021.

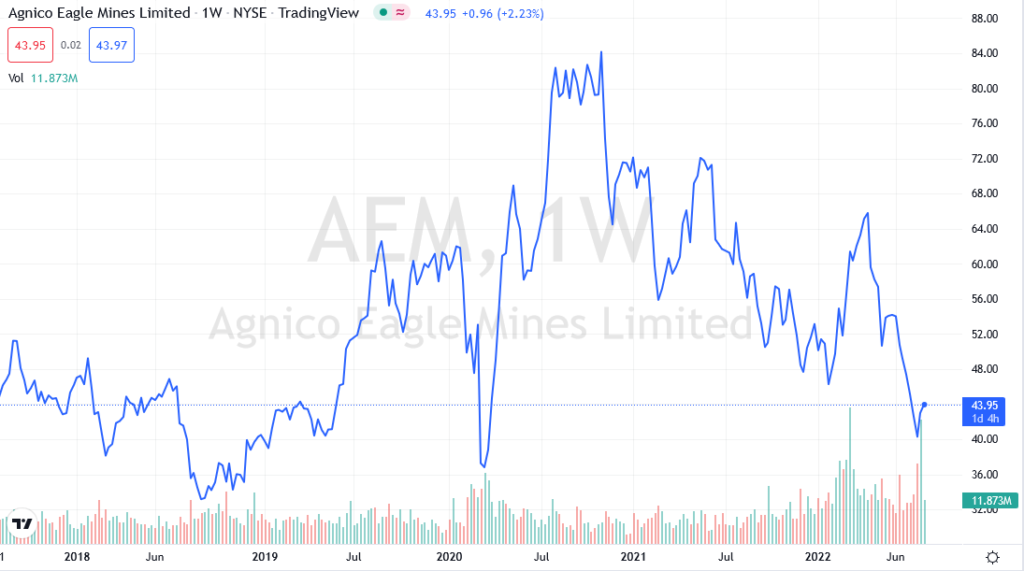

Agnico Eagle Mines Ltd. (NYSE: AEM)

- Market Capitalization: $19.4 billion

- Average Volume: 5.7 million shares

- Forward Annual Dividend Yield: 3.7%

- Profit Trend: 4 Years of increasing gross profits

Source: TradingView

Source: TradingView

This is a well-known mining company in the institutional investor space. In fact, VanEck Gold Miners ETF owns a considerable number of shares in this stock. The last report available the ETF has 4.31% of its funds invested in this gold miner.

This company started operations in 1953 and is based in Toronto, Canada. The company is very active in exploration and has acquired a multitude of exploration sites around the world. Its flagship mine is in Abitibi, Québec, Canada. Which as of December 2021, has 3.8 million ounces of gold in proven and probable reserves.

Before its merger with Kirkland Gold, AEM had 25.7 million ounces of gold in proven and probable gold reserves. Now we can add to that Kirkland’s proven and probable gold reserves of 18.9 million ounces.

The company has a relatively low dividend yield compared to SBSW. However, AEM has a much larger capital base and far greater reserves of gold. AEM has also had four years of consecutive gross profit growth.

Barrick Gold Corporation (NTSE: GOLD)

- Market Capitalization: $28 billion

- Average Volume: 24.51 million shares

- Forward Annual Dividend Yield: 2.54%

- Profit Trend: 3 Years of increasing gross profits up to 2020

Source: TradingView

Source: TradingView

Barrick Gold is one of the largest gold miners in the world. Even though it does not have the largest market capitalization, it does have a huge trading volume with an average of 24.51 million shares. In coherence with its size, net earnings for 2021 were $2.022 billion.

The company was founded in 1983 and is based in Toronto, Canada. And has gold and copper mining activities on various continents across the world. Countries, where Barrick produces gold and copper, include:

- United States

- Canada

- Argentina

- Republic of Congo

- Dominican Republic

- Mali

- Tanzania

- Cote d’Ivoire

- Chile

- Saudi Arabia

- Zambia

The VanEck Gold Miners ETF also has holdings of Barrick Gold. The fund has 11.23% of its investments in this miner, which ranks second amongst its holdings. The company extracted 4.4 million ounces in 2021 and expects to produce between 4.2 and 4.6 million in 2022.

The company has a large runway with a forecast of 18 years of production with current mines. Barrick also expects to reduce its all-in-sustaining costs (AISC) over the coming years by concentrating on cost reduction.

The AISC for 2021 was $1,000 and the miner expects to cut that figure to $900 by 2026. That kind of savings would give Barrick Gold a greater margin at remaining profitable if the price of gold were to decline slightly.

The dividend yield for this gold miner is considerably lower than others on the list. However, we feel that despite the low-income stream, this miner has one of the largest operations in the world and reserves for many years to come. And therefore qualifies as one of the best gold stocks.

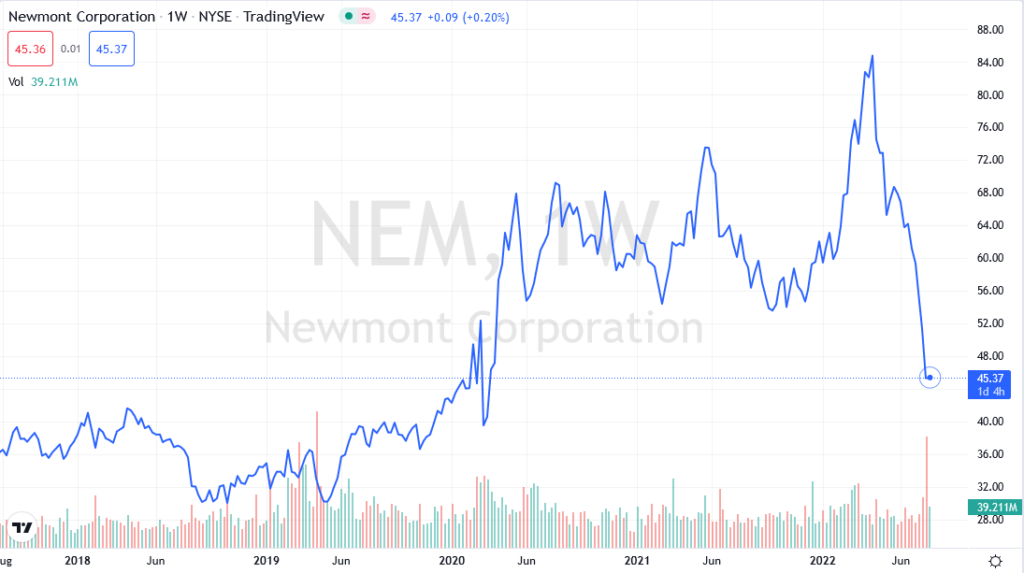

Newmont Corporation (NYSE: NEM)

- Market Capitalization: $36 billion

- Average Volume: 16.7 million shares

- Forward Annual Dividend Yield: 4.91%

- Profit Trend: 4 Years of increasing gross profits

Source: TradingView

This gold miner was founded in 1919 and is headquartered in Denver, Colorado. Newmont Corporation mines for gold and other metals, such as copper, zinc, lead, and silver. The company has mining prospects in the following countries:

- United States

- Canada

- Mexico

- Dominican Republic

- Peru

- Suriname

- Argentina

- Chile

- Australia

- Ghana

As of December 2021, Newmont Corporation has proven and probable reserves of 92.8 million ounces of gold. And that’s just for starters. The company also has 15 billion pounds of proven and probable copper reserves and nearly 600 million ounces of silver reserves.

Like Agnico Eagle Mines Ltd, Newmont Corporation is also on the list of gold miners held by the VanEck Gold Miners ETF. For the fund, Newmont Corporation is its biggest holding and represents 15.50% of all assets.

That to us seems to be an indication that this gold miner has a lot of growth potential. Things to consider are the length of experience in the industry, and the size of precious metals reserves that will keep it making money for years to come. Plus a fairly healthy forward dividend rate close to 5%.

Are Gold Stocks a Better Play Than Physical Gold?

Well, the question, to begin with, is off track. Owning gold stocks as a play to gain returns from the price of gold is simply not a complete assumption. The reason is that many factors come into play when you own gold stocks.

Gold stocks have various inherent risk factors that physical gold does not. The first is corporate risk. That is the risk that is derived from bad management, negligence, or simply fraud. Second, gold stocks are a sector of the broader stock market.

So, as they are part of the broad stock market gold stocks tend to move in line with the price movements of the S&P 500. Basically, buying gold stocks does not diversify your portfolio from stock risk.

However, it can diversify your stock portfolio, by spreading your returns across another sector, and different companies within that sector. But you are still exposed to the risk of a stock market crisis. Put simply, you are diversifying your stock risk but not your overall portfolio risk.

To reduce your portfolio risk, you need to hold assets that are not correlated with each other. Or at least, have a very low correlation to each other.

Stock Market Correlation to Physical Gold & Gold Stocks

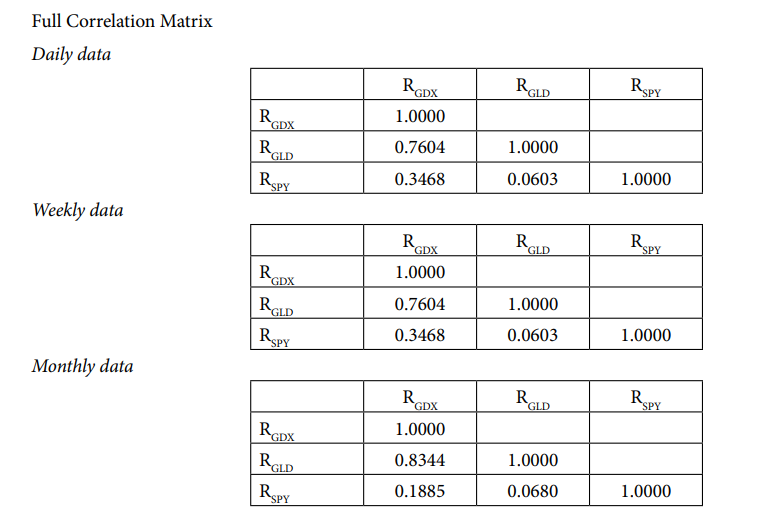

Let’s have a look at how these three assets, broad stock market, gold, and gold stocks are correlated. Research by the CAIA Association and by many others has shown that gold has very little, or almost no correlation to the broad stock market. And a lower correlation than 1 to gold stocks.

The table below shows the correlation matrix for the returns from gold (GLD), the VanEck Gold Miners ETF (GLX), and the S&P 500 (SPY). We can see that gold returns have nearly no correlation to the S&P 500 returns, with 0.0603 correlation.

While gold miners have a much higher correlation of 0.3468. It is still much lower than full-correlation which is 1. However, you are not getting the full benefits of diversification when holding gold miners as you would by holding physical gold.

Source: CAIA

That sounds surprising, right? You would expect that if the price of gold goes up, miners would automatically benefit. In theory, they do, but there are things like production and extraction costs that can rise and reduce the company’s profit margin.

While holding gold bullion is a pure play on the price of gold. You are not exposed to any other risks than the risk associated with the price of gold itself.

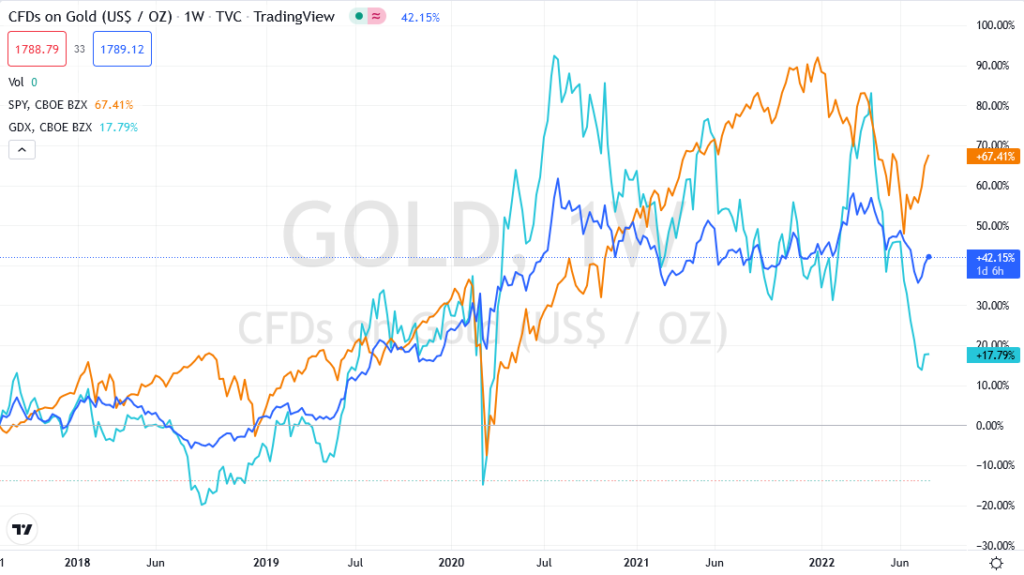

Performance comparison

Now let’s have a look at the recent performance of the three assets mentioned above. Comparing the performance over the past 5 years we see that the S&P 500 comes out a clear winner with a return of 67.44%. Which is only a good thing.

Gold takes second place with a return of 47.23%, while gold stocks have only managed a return of 18.15%.

Source: TradingView

Source: TradingView

Looking at the behavior of the three assets over the last mini-COVID-related crisis we see from the above chart how stocks tumbled way lower than gold. And gold stocks followed the broad stock market reaching lower levels than the S&P 500.

If we go a bit further back and look at the financial crisis of 2008 that rocked the global stock market. We can see in the chart below how the S&P 500 and gold stocks lost 45% and 57% of their values respectively before correcting course.

While the price of gold was not lower than 20% at any time and made a recovery before the S&P 500 and gold stocks.

Source: TradingView

Source: TradingView

Conclusion

We are not making any statement against or in favor of holding any particular asset. To be clear, we think that a well-diversified stock portfolio should hold stocks from all industries and the mining industry certainly qualifies. And that holding gold bullion allows an investor to diversify their portfolio and greatly reduce overall risk.

With gold and other precious metals, you are also buying into other features that give gold value. Talking of gold as an investment, it holds the capacity to act as an inflation hedge. Meaning it will typically rise in high periods of inflation.

It also seems to fare well in market crises protecting the downside of your portfolio. Gold acts like an insurance policy, as it limits the losses your portfolio can take. At the same time it's an intrinsic store of value. If all else fails gold will always have value. However, always speak to your financial planner before taking a final decision on where to invest your money.

Bottom Line

People have been investing in gold for thousands of years and the value of this asset is not about to change. Since Nixon let the value of gold float the price of one ounce of gold has continued to rise. Sure, gold has a fair amount of volatility but so do stocks, for example.

Many financial advisors recommend gold for various reasons, and we've gone through some of them. If you are thinking of buying gold, you can do so through a self-directed IRA to take advantage of a tax-enhanced environment. You can choose between traditional IRAs and Roth IRAs. In the first type, you contribute tax-free dollars to your plan and pay taxes at the end.

While in the Roth IRA you contribute after-tax dollars and pay no tax when you take distributions. In both cases, you can watch your investments grow tax-free. Many companies can help you set up a self-directed gold IRA.

These companies have the knowledge and specialization to do a great job and the trustworthiness of their customers. We have gone through a multitude of companies to filter out the best. You can read our reviews on the top gold IRA companies here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,325.82

Gold: $3,325.82

Silver: $36.46

Silver: $36.46

Platinum: $1,365.19

Platinum: $1,365.19

Palladium: $1,139.37

Palladium: $1,139.37

Bitcoin: $111,339.83

Bitcoin: $111,339.83

Ethereum: $2,773.71

Ethereum: $2,773.71