Best Copper Stocks: Which Are the Top Picks in 2022?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 25th August 2022, 08:44 am

Let’s take a look at the best copper stocks, and which ones might outperform the broader stock market. Copper has gained the interest of a lot of investors looking to diversify their portfolios. The semi-precious metal has wide industrial use as well as being the main component of most wiring systems.

The reason investors started looking at copper comes from the stellar performance of this raw material in 2021 and the beginning of 2022. In February of 2022 copper futures on the COMEX exchange reached their all-time high at $5.0395 per pound.

The rest of 2022 saw copper spot price fizzle. However, prices are now down 27.5% from their all-time high. It’s always hard to time a market but this looks like an opportunity to make a long-term investment.

Copper stocks like silver stocks, gold stocks, and lithium stocks can be an effective way to diversify the returns of a stock portfolio. However, to diversify the returns of a portfolio overall and reduce the overall risk you would need to add assets that are not correlated to the stock market.

For this purpose, adding physical gold and silver can reduce the risk to your portfolio and add some protection. The intrinsic features of precious metals make them act like a kind of insurance against stock market crises.

Source: TradingView

Table of Contents

Best Copper Stocks

Let's go through the best copper stocks we found with promising growth potential. The list below is in order of market capitalization.

BHP Group Limited: (NYSE: BHP)

- Market Capitalization: $207.6 billion

- Average Volume: 3.3 million shares

- Forward Annual Dividend Yield: 12.38%

- Profit Trend: 2 years of increasing gross profit

BHP Group is based in Australia and is one of the largest copper producers globally. The company operates mines in Australia and Chile. And in 2021 alone produced 1.6 million metric tons of copper. The miner is nevertheless expanding copper production to meet increasing demand.

In 2020, BHP finalized the expansion of the Spence copper mine in the Chilean desert. The expansion will extend the mine’s life for 50 years and add 185 thousand metric tons of production annually. BHP has also partnered with Rio Tinto (RIO) to develop a copper project in Arizona.

The Resolution Copper Project could produce 25% of the United States copper demand. The project is still in the permitting phase. However, once finalized it should take 10 years to construct and give the mine a life of 40 years. BHP owns 45% of the project.

This copper miner would seem to have its future covered and at the same time is guaranteeing production capacity to match increased future demand. We also like that it pays a healthy dividend of 12.38% and we can see that with all the developments on the go, it should be able to keep that dividend in the future.

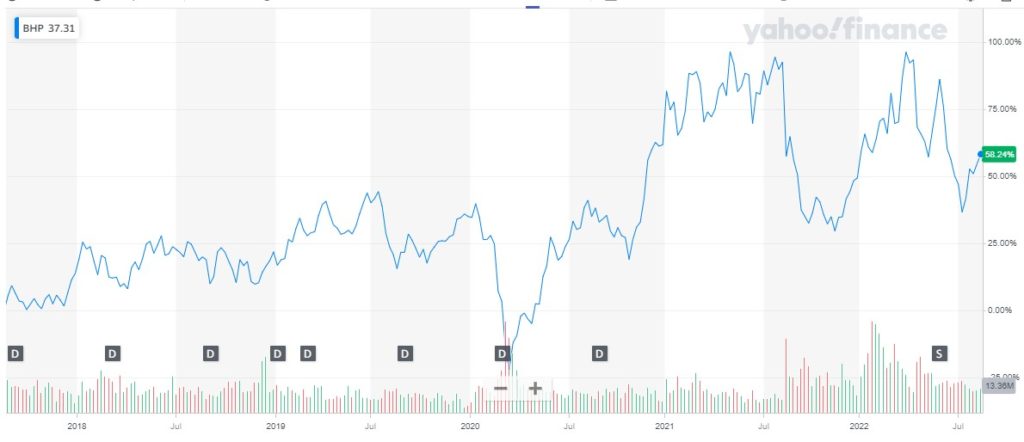

BHP’s stock performance has produced a return of 58.24% over the last 5 years. That’s considerably lower than the S&P 500 which returned 74.3%. However, this copper stock has outperformed the S&P 500 YTD, BHP has shown an increase in the price of 6.12% YTD, while the S&P 500 has dropped 10.12%.

Source: YahooFinance

Source: YahooFinance

Rio Tinto Group: (NYSE: RIO)

- Market Capitalization: $97.9 billion

- Average Volume: 3.5 million shares

- Forward Annual Dividend Yield: 11.46%

- Profit Trend: 4 straight years of increasing gross profit

Rio Tinto is a mining conglomerate that also produces lithium, borates, salt, and titanium dioxide. The company is based in the UK and also produces aluminum, diamonds, and gold as well as copper.

Rio Tinto's copper production comes from two large-scale mines. Through its subsidiary, Turquoise Hill Resources (TRQ) the company has access to one of the largest copper and gold mines in the world, Oyu Tolgoi, in Mongolia. The miner also operates the Kennecott mine in Utah, which also produces silver and gold.

As mentioned above Rio Tinto also has a 55% stake in the Resolution Copper project and is also developing another project in Australia. Rio Tinto also has a 30% stake in BHP’s mine in Chile. The current production and growth of various projects should mean the company will continue paying its healthy dividend of 11.46% for years to come.

We can see from the chart below that the company has returned 35.3% over the last 5 years. The performance YTD is negative and in line with the broad stock market. The stock’s price peaked in May 2021, at $93.35. Considering the future of its operations there seems to be room for recovery, once the stock market gets back to bullish sentiment.

Source: YahooFinance

Source: YahooFinance

Freeport-McMoRan Inc.: (NYSE: FCX)

- Market Capitalization: $44.5 billion

- Average Volume: 4.6 million shares

- Forward Annual Dividend Yield: 1.97%

- Profit Trend: 3 years of increasing gross profit

Arizona-based Freeport-McMoRan has operations in North America, South America, and Indonesia. The miner also produces gold and molybdenum, used in steel alloys. Its flagship copper project is the Grasberg mine in Indonesia.

The miner operates 7 open-pit copper mines in the US, 5 in Arizona, and 2 in New Mexico. FCX also has 2 large mines in South America. All together these operations allowed Freeport to produce 3.8 billion pounds of copper in 2020, a 20% increase from the previous year.

This copper miner is well positioned to meet the increasing demand for copper in the future. And therefore, continue to show growth. The company has a relatively low dividend yield, but you may offset that with a better stock price performance.

FCX stock price performance has given a positive return of 123.48% over the past 5 years. Compared to the S&P 500 that equals an outperformance of 46.87%. Of the best copper stocks we looked at, this miner was the first of two outperformers of the S&P 500 over the 5-year period.

On a sour note, this stock is down 25.16% YTD compared to a loss of 10.33% over the same period for the S&P 500. Having said that, it is also true that this stock's price peaked in March 2022, at $51.99, which is making its performance YTD weaker than other peers.

Source: YahooFinance

Source: YahooFinance

Southern Copper Corporation: (NYSE: SCCO)

- Market Capitalization: $38.1 billion

- Average Volume: 1.4 million shares

- Forward Annual Dividend Yield: 8.11%

- Profit Trend: 4 straight years of increasing gross profit

Southern Copper was founded in 1952 in Delaware. Its main operation is mineral extractions which include copper, molybdenum, silver, and zinc. The company conducts operations in South America and owns two subsidiaries. Southern Peru Copper Corp. and Minera Mexico S.A.

SCCO is indirectly owned by Grupo Mexico, a metallurgic and mining conglomerate. Southern Copper strives to remain profitable throughout the price cycle by focusing on cost control, production, and maintaining a prudent capital structure.

This miner has the largest copper reserves in the world, giving it a long future for long-term investors. This factor allowed the company to issue $1.5 billion in bonds to finance new development and production projects.

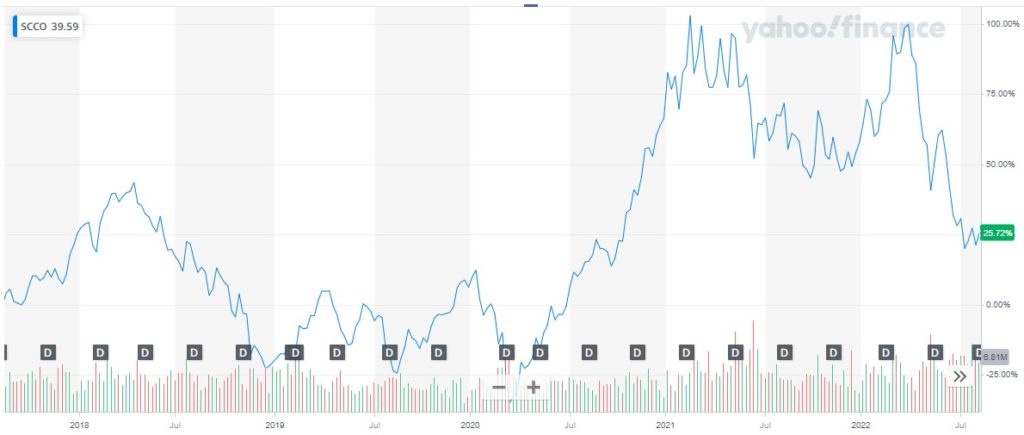

Southern Copper's stock price has had a bumpy ride since it peaked in February 2021. The company’s share price hit a high of $79.49. After that peak, the stock's price tumbled to then touch a new top for 2022 of $78.18 in March. However, by July 2022 SCCO shares had fallen to a recent low of$44.70. Over the 5-year period the stock has still managed to hold on to some gains and is up 26.33%.

Source: YahooFinance

Source: YahooFinance

First Quantum Minerals Ltd.: (TSX: FM)

- Market Capitalization: $16.6 billion

- Average Volume: 2.9 million shares

- Forward Annual Dividend Yield: 0.7%

- Profit Trend: 4 straight years of increasing gross profit

First Quantum was incorporated in 1983 and has its headquarters in Toronto, Canada. The company’s main activity is the exploration, development, and extraction of raw minerals. TSX explores for copper, nickel, pyrite, gold, silver, and zinc. The company also produces acid.

Currently First Quantum has operating mines in the following countries:

- Australia

- Spain

- Finland

- Panama

- Turkey

- Mauritania

They are also developing mining projects in the Taca Taca copper, gold, and molybdenum project in Argentina. As well as developing a copper mine in the Haquira deposit in Peru and a nickel mine in Zambia.

This company has a very low dividend yield of 0.7%. However, the performance of the stock price may make up for it in the long run.

This is one of the few copper miners that has managed to produce increasing gross profits for 4 consecutive years. In fact, the stock performance of this miner has managed to outperform the S&P 500 by 13.9%.

We can see how TSX stock price peaked at its all-time high in March 2022 at $44.48. It then went on to lose 62% when it bottomed in July of 2022. The copper stock’s price action is similar to the others on the list and ultimately similar to the performance of the broad stock market.

Source: YahooFinance

Source: YahooFinance

Best Copper Stocks: Conclusion

As we have seen from the charts above, all the best copper stocks have experienced a decline YTD along with the broad stock market. The chart below shows the copper miners ETF COPX and copper futures compared to the Dow Jones Index over the past 5 years.

We can see both assets follow the broad stock market very closely. In our opinion, the diversification benefits from holding copper stocks are only relevant to diversification among stock sectors. As returns for copper stocks have a high correlation to the broad stock market.

Source: YahooFinance

Physical copper also moves in line with the broad stock market and that would be due to the fact that copper demand is mostly industrial. Therefore, economic activity will tend to drive this commodity’s price.

If you are looking to diversify the returns of your portfolio and lower the overall risk, then adding other alternative assets would be more effective. Physical precious metals, in particular gold, are known to have several characteristics that make them great portfolio protectors.

Bottom Line

You can invest in copper stocks or precious metals as well as other alternative assets through a self-directed IRA. This type of retirement account allows you to watch your investments grow in a tax-free environment.

However, In our opinion, there is no better asset than gold to protect your portfolio and wealth against the adverse effects of a stock market crisis, inflation, or government money grab.

Many companies offer their services to help you set up and administer a gold IRA. We have gone through many of the best ones and created a short list of the top companies. You can read our reviews on them here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,335.81

Gold: $3,335.81

Silver: $36.93

Silver: $36.93

Platinum: $1,394.91

Platinum: $1,394.91

Palladium: $1,141.81

Palladium: $1,141.81

Bitcoin: $108,236.09

Bitcoin: $108,236.09

Ethereum: $2,517.33

Ethereum: $2,517.33