- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Bank of England Governor Threatens Dollar’s Reserve Currency Status

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 30th August 2019, 03:56 pm

This past week saw a scathing attack on the U.S. dollar from America's closest ally. Bank of England Governor Mark Carney became the latest key policy making figure to suggest putting a system into place that cuts the dollar out of its key role in the world financial system. The dollar's status as central reserve currency of the world has been threatened for some time now. It is no secret that America's enemies have worked towards this for years. Now its friends are as well.

Bank of England Governor Mark Carney Takes Aim at the Dollar

At the conclusion of the annual Jackson Hole meeting, Mark Carney, the Bank of England governor, boldly challenged the dollar's long standing status as global reserve currency. He argued that potentially two different currency alternatives could be used to replace it. One of these was the Chinese yuan and the other a Facebook digital currency initiative called Libra.

Carney has argued that such a replacement is necessary to reverse a glut in dollar savings that has caused 10 years of ultra low interest rates and low inflation. The Bank of England governor compared such a transition to when British pound sterling lost its dominance of global money markets around a century ago. According to the report in the Guardian, Carney claimed that the dominance of the dollar has created a barrier that has interfered with a sustainable recovery.

Carney refers to the habit of governments around the world. They stockpile up on U.S. dollars as an insurance against significant swings within the American economy. As these have grown worse in recent years, it has created a substantial increase in the cost to borrow in many nations following this practice. The Bank of England governor boldly stated that:

“The dollar's influence on global financial conditions could similarly decline if a financial architecture developed around the new [digital currency] and it displaced the dollar's dominance in credit markets. By reducing the influence of the U.S. on the global financial cycle, this would help reduce the volatility of capital flows to emerging market economies.”

Mark Carney argued that the rise of a new digital currency which a significant number of countries backed would result in dollar funds that governments are hoarding (as their insurance policy) becoming released. Such a digital currency “could dampen the domineering influence of the U.S. dollar on global trade,” Carney stated at the annual meeting of central bankers in Wyoming. According to the Bank of England governor:

“If the share of trade invoiced in [a digital currency] were to rise, shocks in the U.S. would have less potent spillovers through exchange rates, and trade would become less synchronized across countries.”

This is the most pointed verbal attack so far on the U.S. dollar by a major ally of Washington.

Carney Mentions Chinese Yuan as Potential Replacement to Dollar

Another interesting takeaway from Mark Carney's speech was his reference to the Chinese yuan. Carney reminded listeners that China's currency has also been mentioned as a possible alternative to the American dollar. He did follow this up with a statement that neither the Chinese yuan nor Facebook's Libra digital currency were yet positioned to assume the dollar's role.

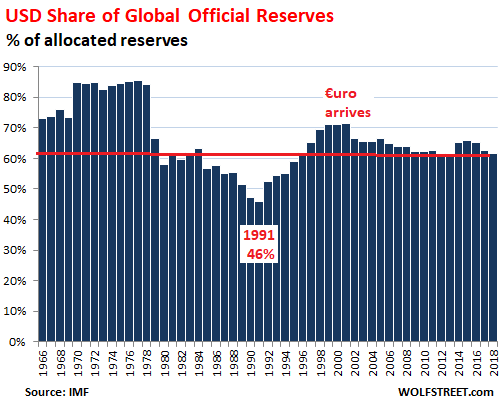

Yet Carney sees emerging technologies that might make it possible for an international digital currency to mount a successful challenge to the dollar. The chart below shows that the dollar has been on a gradual decline in its share of global central banking reserves:

The Bank of England governor is only the latest individual to join the tide of complaints from policymakers and countries who are frustrated by the dollar's “domineering influence.” American foreign policy that weaponizes the dollar has only made such frustrations worse. Such nations have complained that they are being bullied by threats to use the dollar against them.

U.S. Control Over Reserve Currency Gives It Great International Influence

The U.S. control over the global reserve currency allows it to have massive leverage on nations around the world. One of these instruments is the SWIFT payment system. It gives the U.S. a platform to push foreign policy goals and to project influence.

This SWIFT refers to the Society for Worldwide Interbank Financial Telecommunication. The financial system permits banks and other financial organizations to send out and receive information on financial transactions securely in a standardized format. SWIFT utilizes the dollar as the world's reserve currency. This is how it supports the global dollar system.

There have been various occasions when the U.S. deployed the SWIFT system as a stick. In both 2014 and 2015, Russian banks were excluded from the system as relations between the United States and Russia declined. During the fall of 2018, the U.S. administration threatened China with being restricted from the dollar system if they would not cooperate with United Nations sanctions against the rogue regime in North Korea. The high profile use of this form of economic bullying has galvanized the victim nations to take action.

Russia and China Are Already Trading Using Their Own Currencies

In has not taken long for Russia and China to retaliate by moving away from trading using dollars. China, Russia, and several other nations (like Iran) have been reducing their dollar exposure over the last few years. Recently China and Russia signed an agreement to boost their trade in each other's own currencies.

Now the level of trade between China and Russia in yuan and rubles is limited to around 10 percent. As the new arrangement is implemented, this will rise to approximately 50 percent. It is the latest action in a number of attempts to decrease reliance on the American dollar.

Russia and China have taken other steps as well. Moscow has created its own rival payment system to the dollar-centered SWIFT platform. Besides this, Russia is reputedly contemplating creating their own cryptocurrency backed by gold to help it decrease dollar usage still further. In 2018, China started up its highly anticipated oil futures contract denominated in yuan. This was also a direct challenge to oil traded in dollars around the globe.

America's Friends Are Plotting Against the Dollar's Dominance Now Too

What threatens the dollar's place in the international system even more is that not only enemies of the country are plotting against the U.S. today. Long-time allies are now seeking out alternatives to the dollar led regime. It has only been months since the Europe Union announced that it nearing completion on another alternative system of payments to SWIFT.

German Foreign Minister Heiko Maas made this announcement in June. This will permit EU nations to go around the American sanctions on Iran. Countries around the world are also adding significant amounts of gold to their central bank reserves in an effort to diversify away from the dollar.

The news of these latest comments from the Bank of England governor shows that the international movement to limit the dollar's place and power as reserve currency is gaining traction. It is no longer only enemies of the U.S. who are increasingly on board with the agenda. With the dollar's value ultimately under threat, it is another reason why gold makes sense in an IRA. It is not difficult to do a gold IRA rollover. This starts with learning more about IRA-approved precious metals and top gold IRA companies and bullion dealers.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68