August Jobs Report 2022: What Investors Need to Know

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 7th September 2022, 02:27 am

Key Takeaways:

- The U.S. economy added 315,000 jobs in August, down from 528,000 in July

- The August jobs report indicates we're seeing a recovery of the labor market as more people are looking to take advantage of remote working opportunities

- U.S. stock indexes reacted favorably to the jobs report, although this could be short-lived

Investors have been paying close attention to the recent jobs report for August 2022, which looks at the economy and whether or not we’re adding jobs at a sustainable rate. Recent job reports showed the economy slowing down, with interest rate hikes and record-high inflation taking effect. However, job growth was strong in July and investors will be looking to see what the job growth numbers are for August.

This article will dive into the August jobs report, what it means for investors, and how you can start saving more money and open a self-directed IRA to reach your retirement goals.

Table of Contents

The Preface: July 2022 Jobs Report

July had a so-called frenzied month and outpaced previous months, so experts predicted a report for August that didn’t meet the July results.

Economists predicted about 318,000 jobs to be added over the month, and they were nearly correct as the jobs report indicated that 315,000 jobs were added. However, this is down from a strong July when 528,000 jobs were added.

Even though we had a strong July and the numbers aren't as strong for this month, this is still a major step in the right direction for our economy, which has lost a big chunk of its value over the past two years and has dipped into recession territory.

The August 2022 Jobs Report: An Overview

Even with modest gains in consumer spending, the August jobs report is a promising sign for the sputtering US economy. Rising interest rates and low inventory continue to hurt the housing market, but job growth and low unemployment of 3.7 percent point toward signs of recovery.

Another important contributor to the strong jobs report is that the labor force is recovering, as more people are looking for jobs and want to return to work. This is why a favorable labor market seems to be in the future for the US economy.

The jobs report also found that monthly and yearly average hourly earnings increased modestly in both regards, showing that workers are being compensated better for their work as inflation continues to rise.

However, Jerome Powell pointed out that the demand for workers far exceeds the current supply. The Federal Reserve Chair said that the labor market is out of balance, but there may be some softening of labor conditions that help to bring down inflation numbers.

How Markets Responded

As we recently noted, inflation and the stock market are inextricably tied. So too is the stock market and labor statistics. US stock indexes responded favorably to the jobs report, as the latest update showed the S&P 500 up 0.7% and the Dow Jones Industrials up about 0.5%. The NASDAQ also saw gains of 0.6% when this article was written.

Sectors with a particularly good August include retail, business services, and consulting firms. The retail sector added roughly 44,000 jobs, equating to an increase of over 50 percent from July. The retail sector saw continued hiring despite Walmart announcing they'll be laying off part of their workforce due to inflation concerns and current economic conditions.

Business consultants and professional service providers also led the way in job growth, totaling roughly 68,000 jobs added in August. Technology consulting, management, architecture, and scientific research services all had the best reports and month-over-month growth than other sectors.

Unemployment Rates: Hope on the Horizon?

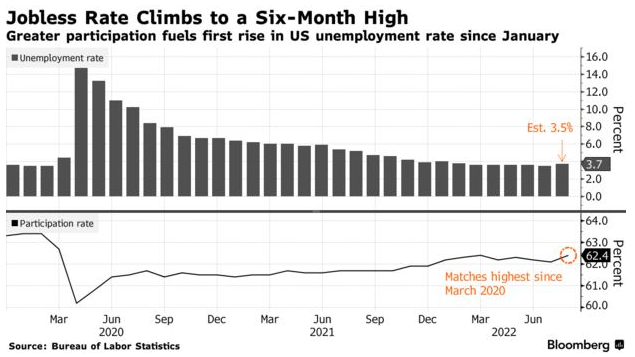

Source: Bloomberg

While we mentioned that low unemployment numbers point toward economic recovery, we'd like to dive deeper into what these numbers mean for everyday consumers.

The increase in participation among workers shows that inflation pressures are starting to slow and we may see a cooling period in monthly wage growth. This comes at a critical time as the Federal Reserve contemplates its next move with rate hikes and shifts its focus towards consumer spending and price data.

The labor force participation also saw increases, meaning that more people are shifting to getting back to work or starting to look for work after taking time off due to COVID. Labor force participation increased to 62.4% and matched the highest we had seen since March 2020.

Data also showed the younger demographic starting to participate in the workforce– up to 82% of workers aged 25-54 were active in the job market. The jobs report also showed that teenagers and students in college are entering the workforce in hopes of making a dent in their student loan debt.

Young adults just getting started in their working lives may not realize the importance of saving for retirement immediately once they start working after college. The money you invest now could be worth much more in the future with compound interest. That’s why a self-directed IRA is a great choice for young professionals who want to get their investing careers started early.

How COVID-19 Has Changed The Way We Work

The August jobs report is an indicator of the economy's strength compared with the previous month. However, those numbers only tell part of the story. Since early 2020, many workers have realized that they don't need to be in an office to do their jobs effectively. Workers found they could save time and money by working from home and eliminating their busy work commute.

This has opened the door for many companies to take the initiative and hire for remote-only positions with full-time health and retirement benefits, encouraging a new workforce to apply for jobs they can do in the comfort of their home.

In fact, the Pew Research Center found the following statistics among adults who started to work from home since the Coronavirus outbreak came to the US:

- About 87 percent of respondents said having the technology and equipment they need to do their job was very easy while working from home.

- Roughly 80 percent of respondents found that meeting deadlines and completing projects on time was easy for them to do consistently when working from home.

- About 77 percent of respondents said that having an adequate workspace was very easy for them when working from home.

- Nearly 70 percent of people surveyed said it was easy to finish their work without interruptions while at home.

What the August Jobs Report Means for Real Estate

The real estate market continues to be plagued by low inventory and record-high property values. Some borrowers who lost their jobs due to COVID in 2020 were forced into “forbearance,” meaning they paused their mortgage payment for a period of six months or longer.

Millions of Americans in forbearance today still haven't made their mortgage payments in months or even years. These borrowers often find they've accumulated a massive amount of debt due to late fees, back rent, or unpaid taxes and insurance.

However, the August jobs report is a promising sign that more people are looking for work– whether it's remote work or a traditional job. We should start seeing more borrowers come off of forbearance as the labor market recovers and more people return to work in 2022 and beyond.

What the August Jobs Report Means for Small Businesses

Small businesses have arguably been affected the hardest among all companies across the country. Local businesses and general stores were forced to close in early 2020 in the government's attempt to contain the COVID-19 outbreak.

While government intervention and regulations regarding mask-wearing and social distancing did little to stop the spread of the virus, small business owners found themselves shut down with no way to make their rent payments. This forced family businesses that have been open for generations to close down permanently.

On the bright side, small businesses that survived the dark days of early 2020 and are still open today often find that business is better than ever. The rise in food delivery services and ecommerce makes small local businesses global brands that can serve customers around the world.

Final Thoughts

The August jobs report is a positive sign for an economy that continues to struggle and has dipped into recession territory as we enter the fall season of 2022. We're seeing the labor market rebound with many teens and young adults entering the workforce and the possibility of remote work becoming a reality for many workers who prefer not to commute to work each day.

As investors continue to navigate troubled economic waters in 2022 and beyond, the best way to build a resilient portfolio continues to be a self-directed IRA. Find out why a self-directed IRA is the best choice for savvy investors who want to diversify their assets and achieve a comfortable retirement by reading our free online handbook.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,328.02

Gold: $3,328.02

Silver: $37.77

Silver: $37.77

Platinum: $1,404.65

Platinum: $1,404.65

Palladium: $1,226.98

Palladium: $1,226.98

Bitcoin: $117,368.41

Bitcoin: $117,368.41

Ethereum: $3,090.52

Ethereum: $3,090.52