August 2021 Newsletter: The U.S. Dollar on the Decline While Gold and Crypto Are Set for a Breakout Autumn

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 27th August 2021, 06:27 pm

Inflation is coming.

A recent survey of the nation’s top economists found that inflation is here to stay, and that it’ll reach levels unseen since the early 1990s. Rising prices and fewer jobs are going to not only take its toll on the strength of the U.S. dollar, but will also likely wreak havoc on consumer confidence and the stability of the stock market.

Due to rising inflation, the average U.S. household has less real disposible income compared to prepandemic levels. The consequences of inflation are many. Household budgets will be squeezed, business planning will be stalled, and the cost of borrowing will skyrocket.

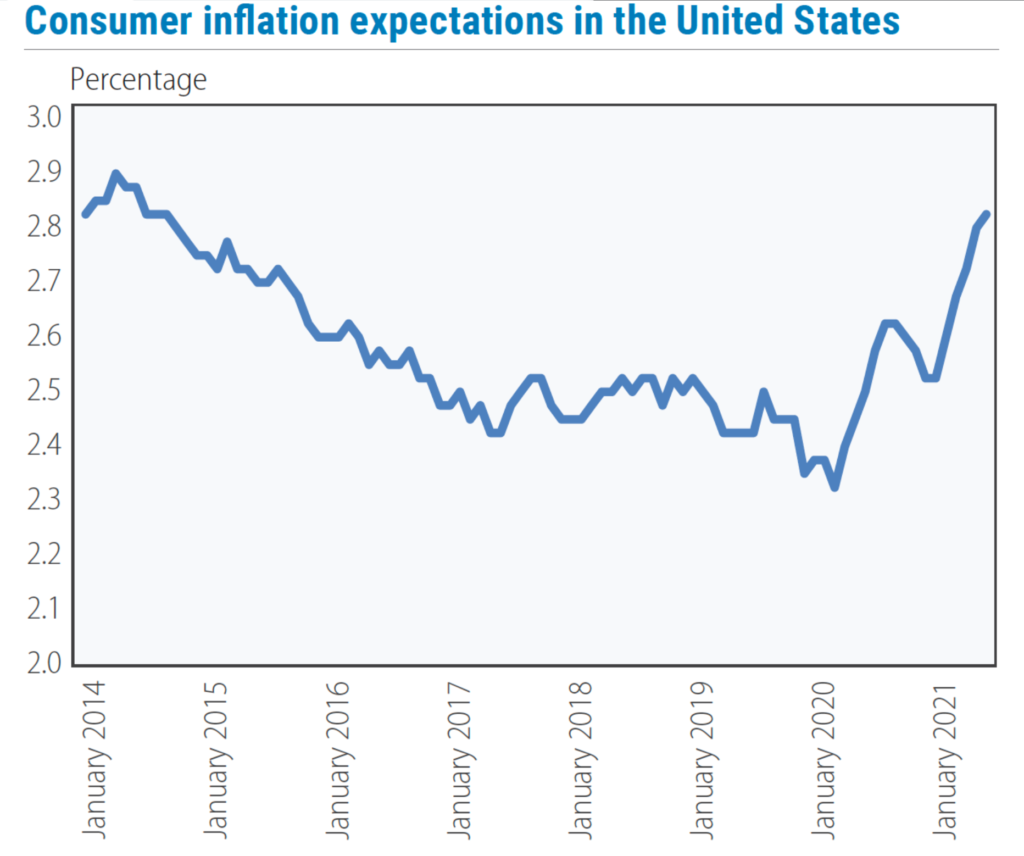

The chart below (Fig. 1) represents the monthly median expected change in prices in the United States over the next 5 to 10 years. The most recent data, from January 2021, is the highest it has been since early 2014.

Fig. 1. Source: UN Department of Economic and Social Affairs

Earlier this summer, the Fed announced that they expect to hike interest rates multiple times by 2023. When the Fed’s easy money monetary policies finally grind to a halt, and we have to foot the bill for years of deficit spending, the dollar won’t be the only asset taking a hit.

High interest rates will send shockwaves through the housing market and the stock market, since both are propped up by cheap borrowing. In other words, we’re likely headed for a reckoning when it comes to home prices and stocks.

And this says nothing about the recent surge in infections. If America continues to let Covid get away from its control, and states impose more lockdown restrictions, the federal government might decide to turn the money printers back on. At which point, all hell will break loose on the strength of the U.S. dollar.

The virus also appears to have global supply chains, once again, in its crosshairs. One of Japan’s leading automakers has halted all vehicle production in Thailand after a breakout in Delta variant cases. Much of Vietnam is now back under curfew.

Worse yet, tens of thousands of commercial ships are stuck unable to port in Asian harbors. If Asian supply chains shut back down, we could see massive ripple effects in the U.S. domestic economy.

Diversify Now to Hedge Against Tomorrow

No matter how the virus plays out in the months ahead, the federal government isn’t about to stop its runaway spending. In July, a bipartisan group of Senators authorized a $1.2 trillion spending bill to reinvest in American infrastructure. The Biden Administration hopes to follow up this bill with another partisan reconciliation bill to the tune of $3.5 trillion.

Clearly, there’s no brakes on the money printer. Thanks to unprecedented levels of government spending and a virus that’s still wreaking havoc on the global economy, the U.S. dollar has never been in a more precarious position.

Luckily, there are alternative stores of value that can help you weather the storm. While the stock market and the housing market are under threat, alternative assets such as gold and silver provide vital stability and reassurance.

To get started, check out our list of IRA-approved gold products so you can diversify with recession-resistant precious metals. For added portfolio insurance, consider opening a Bitcoin IRA this month as well—while cryptocurrency prices are still affordable!

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.85

Gold: $3,355.85

Silver: $38.41

Silver: $38.41

Platinum: $1,434.24

Platinum: $1,434.24

Palladium: $1,243.37

Palladium: $1,243.37

Bitcoin: $117,749.21

Bitcoin: $117,749.21

Ethereum: $2,952.91

Ethereum: $2,952.91