- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

ATMs In Times Of Crisis: 3 Major Crises Where People Couldn’t Get Their Cash From the Bank

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 13th December 2019, 09:37 pm

For anyone who has watched the Christmas classic, It’s a Wonderful Life, you’ll remember the famous scene – Jimmie Stewart’s beleaguered character “George Bailey” attempting to calm a growing crowd that has descended upon the bank demanding their money. He attempts to explain to the furious mob that, in actuality, the bank doesn’t have any physical money because it’s all tied up in investments. These sorts of situations aren’t merely the product of the dream factory that is Hollywood. Throughout history, there have been numerous economic crises around the globe when citizens were impeded from accessing their money. Here are 3 major crises where people couldn’t get their money from the bank.

Table of Contents

What Is A Banking Crisis?

Banks are vulnerable to a variety of risks. These can include liquidity risk (when too many withdrawals occur that exceed the funds that are available), interest rate risk (the danger that bond values will decrease due to increasing interest rates), and credit risk (loans and other assets cease to perform as expected). The World Bank defines a banking crisis as thus:

“Banking problems can often be traced to a decrease in the value of banks’ assets. An deterioration in asset values can occur, for example, due to a collapse in real estate prices or from an increased number of bankruptcies in the nonfinancial sector. Or, if a government stops paying its obligations, this can trigger a sharp decline in value of bonds held by banks in their portfolios. When asset values decrease substantially, a bank can end up with liabilities that are bigger than its assets (meaning that the bank has negative capital, or is “insolvent”). Or, the bank can still have some capital, but less than a minimum required by regulations (this is sometimes called “technical insolvency”).

Bank problems can also be triggered or deepened if a bank faces too many liabilities coming due and does not have enough cash (or other assets that can be easily turned into cash) to satisfy those liabilities. This can happen, for example, if many depositors want to withdraw deposits at the same time (depositor run on the bank). It can also happen also if the bank’s borrowers want their money bank and the bank does not have enough cash on hand. The bank can become illiquid. It is important to note that illiquidity and insolvency are two different things. For example, a bank can be solvent but illiquid (that is, it can have enough capital but not enough liquidity on its hands). However, many times, insolvency and illiquidity come hand in hand. When there is a major decline in asset values, depositors and other banks borrowers often start feeling uneasy and demand their money bank, deepening the bank’s troubles.”

Moreover, there is the “systemic banking crisis”, which is the far more deleterious financial crisis when a nation’s corporate and financial sectors are essentially wiped out. In its 2008 report, Systemic Banking Crisis: A New Database, the International Monetary Fund (IMF) explained a systemic banking crisis as:

“Under our definition, in a systemic banking crisis, a country’s corporate and financial sectors experience a large number of defaults and financial institutions and corporations face great difficulties repaying contracts on time. As a result, non-performing loans increase sharply and all or most of the aggregate banking system capital is exhausted. This situation may be accompanied by depressed asset prices (such as equity and real estate prices) on the heels of run-ups before the crisis, sharp increases in real interest rates, and a slowdown or reversal in capital flows. In some cases, the crisis is triggered by depositor runs on banks, though in most cases it is a general realization that systemically important financial institutions are in distress.”

To mitigate the effects of a systemic banking crisis, the IMF outlined various techniques that could be utilized.

“Banks suffering severe losses tend not only to see rising costs but also to experience liability rationing, either because they must contract deposits to satisfy their regulatory equity capital requirement, or because depositors at risk of loss prefer to place funds in more stable intermediaries. Banks, in turn, will transmit those difficulties to their borrowers in the form of a contraction of credit supply. Credit will become more costly and financial distress of borrowers and banks more likely.

The appropriate policy response will depend on whether the trigger for the crisis is a loss of depositor confidence (triggering a deposit run), regulatory recognition of bank insolvency, or the knock-on effects of financial asset market disturbances outside the banking system, including exchange rate and wider macroeconomic pressures.

Deposit withdrawals can be addressed by emergency liquidity loans, usually from the central bank when market sources are insufficient, by an extension of government guarantees of depositors and other bank creditors, or by a temporary suspension of depositor rights in what is often called a “bank holiday”. Each of these techniques is designed to buy time, and in the case of the first two, that depositor confidence can soon be restored. The success of each technique will crucially depend on the credibility and creditworthiness of the government,” outlined the IMF report.

The Great Depression

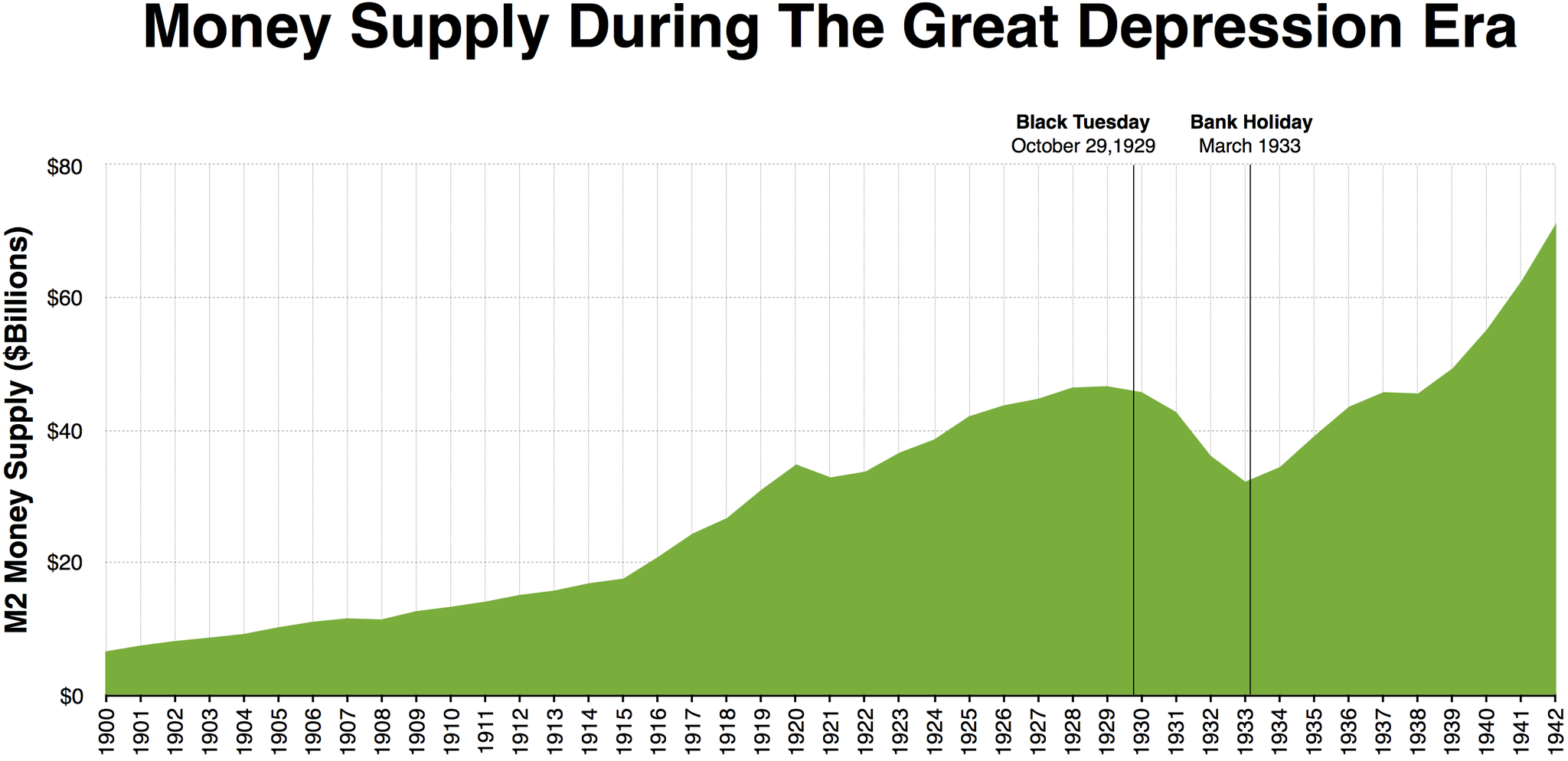

The worst economic crisis in US history was the Great Depression. According to renowned economist and quondam Chair of the Federal Reserve, Ben Bernanke, bank runs and a flawed Federal Reserve System directly caused it.

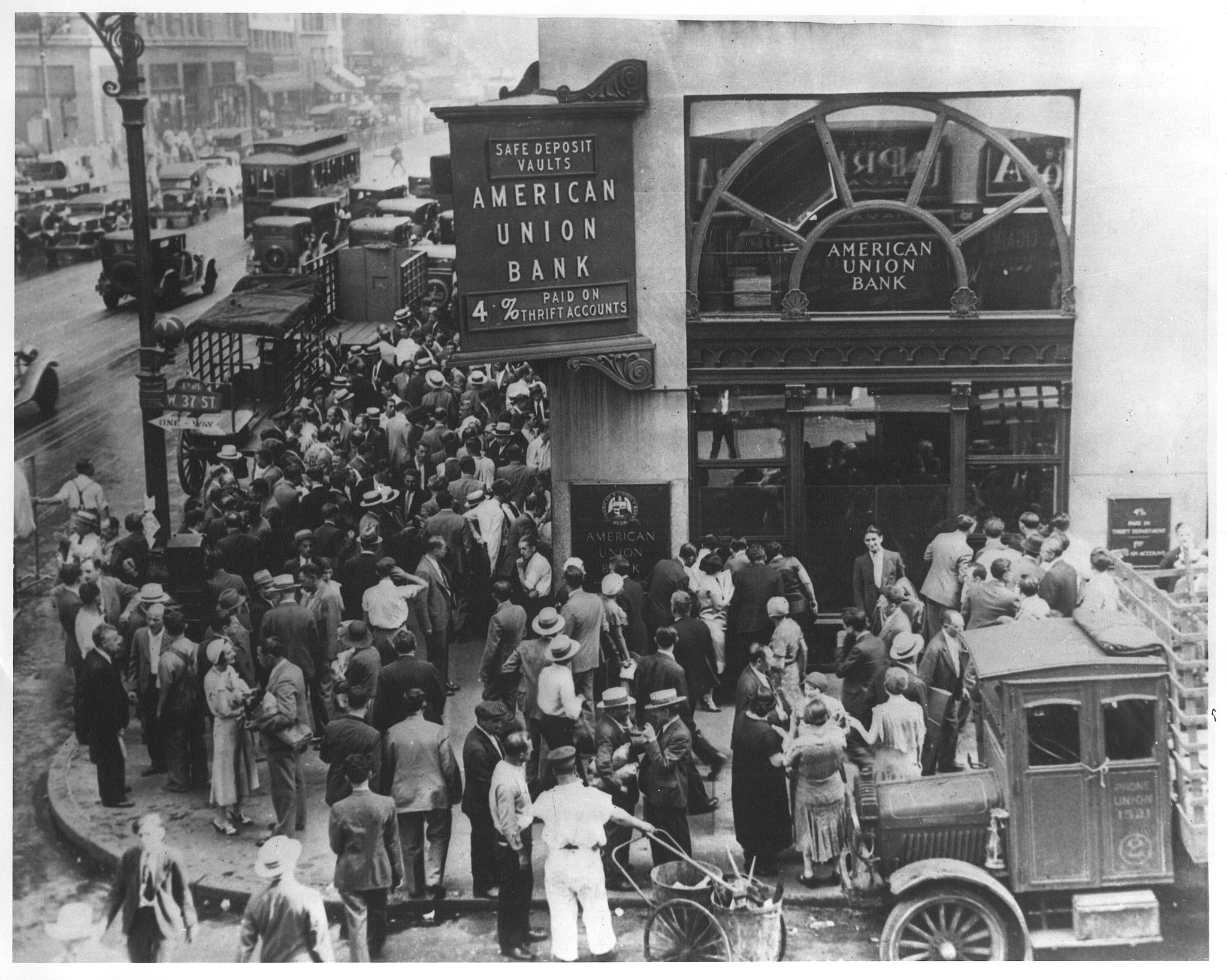

Referred to as “bank panic” or “banking panic”, this financial crisis occurs when a large number of people withdraw their funds from banks, because they believe said institution will become insolvent. When numerous clients attempt to withdraw money from a single banking institution, this is known as a bank run.

Between 1929 and 1933, America experienced numerous banking panics, which consisted of bank runs. During the late 20s, many states across the country had laws only permitting a single branch. In certain regions dependent on a single industry such as farming, these financial institutions struggled to accept deposits and provide loans to farmers. As the Depression hunkered down, fewer farmers had money to spend. Thus, bank failures increased at a troubling rate.

Between the stock market crash in October 1929 and the Spring of 1933, the monetary supply declined alarmingly in America. In 1933 alone, it’s estimated that 4,000 banks failed. By the time Franklin D. Roosevelt took office in March 1933, the economic situation had become incredibly dire. By this juncture, financial institutions in all 48 states had either placed restrictions on the amount of money that could be withdrawn, or had either closed outright. In fact, as his first act as president, Roosevelt declared a three-day national bank holiday, when all financial institutions were closed.

The Sovereign-Debt Crisis of Greece

A sovereign-debt crisis transpires when the government of a sovereign nation is either unable, or refuses to pay back its debt in full – commonly referred to as “sovereign default”. In recent history, perhaps the most famous example of this is the sovereign-debt crisis in Greece.

A direct aftermath of the global financial crisis in 2008, the Greece crisis commenced a year later. Thereafter, the country’s economy was on a death-spiral downward trajectory. In fact, the Greek economy has endured the longest recession of any first-world economy in history, superseding the Great Depression in the US.

On June 30, 2015, Greece had the unfortunate distinction of being the first industrialized nation to miss an IMF debt payment. As a result, Greek citizens began emptying their bank accounts. The crisis spiraled further, when more than a third of ATMs in Greece ran out of money. Eventually, the government shut down ATMs entirely for a while.

In March of this year, the country experienced a milestone on its road to economic recovery, after selling 2.5 billion euros ($2.8 billion US) for the first time in nine years.

The Financial Crisis in Iceland

In the latter portion of 2008, all three of Iceland’s major privately-owned banks defaulted on loans. Previously, all three aforementioned financial institutions had experienced difficulties in refinancing their short-term debt. Consequently, these banks experienced bank runs in both Great Britain and the Netherlands.

As a result of the Icelandic systemic bank crisis, the Nordic country endured an acute depression from 2008 to 2010, coupled with substantial political unrest. Among other things, Iceland’s currency, the króna, depreciated in value and the market cap of the country’s stock exchange declined by more than 90%. Relative to the size of Iceland’s economy, this systemic bank collapse was the largest in global economic history.

However, by 2011, Iceland was on the road to economic recovery. By 2015, the International Monetary Fund had released its Iceland: Selected Issues.

“Iceland’s robust economic growth will push economic activity past its pre-crisis peak this year. The economy grew by 2¼ percent on average in the past 3 years—a turnaround from negative growth in 2009–10—exceeding growth among the euro area crisis economies and the OECD average. Economic activity is expected to surpass pre-crisis levels this year. Inflation has fallen in range with the CBI target, helped by an appreciating króna, after peaking at 18½ percent at end-2008 and early 2009. Iceland remains a wealthy country with low unemployment,” the report explained.

The IMF report highlighted Iceland’s economic recovery. In addition, the nation is considered a financial and economic recovery success story in Europe.

There are many economic crises around the globe where people are impeded from accessing their money from banks. This is yet another reason why gold makes sense in an IRA. One strategy to help you diversify your portfolio is by buying gold in monthly installments. For those investors who are interested, learn more about Gold IRA rules and regulations and information about the Top Gold IRA companies to understand your options in the space.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,385.11

Gold: $2,385.11

Silver: $27.83

Silver: $27.83

Platinum: $938.54

Platinum: $938.54

Palladium: $884.45

Palladium: $884.45

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81