- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Asset Price Inflation Warns that Easy Money Policies Have Caused A Significant Impact

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 11th July 2019, 09:21 pm

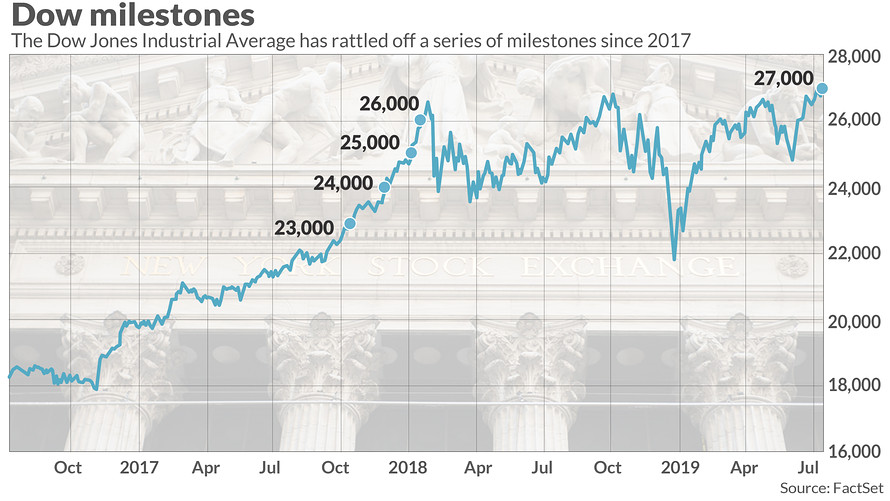

As the Dow Jones broke through the 27,000 level this week for the first time ever, it has raised the question once again regarding sustainability. Many economists warned that easy money policies would bring significant inflation that would bring down the economic expansion. Over the last decade you have seen liquidity injections, interest rates that were historically low, and several rounds of quantitative easing. By some miracle, inflation officially remains tame. Or does it?

In fact inflation has appeared substantially in the prices of assets. This is called asset price inflation, or in layman's terms bubbles. The problem with these bubbles is the historical record. They always pop, crushing markets and asset prices in the process. You do not have to think that far back to 2007-2008 to remember what happened last time in the Great Recession and Global Financial Crisis. Now is the time to take thought for your portfolio and its stability in the next crisis.

Dangerous Inflation Has Appeared In Real Estate Despite Tame Official Estimates

Even though the CPI shows inflation to be a tame number, there is another dangerous kind of inflation that has been consistently impacting prices. This is asset inflation that has so pushed prices higher that some analysts refer to today's scenario in markets as the “everything bubble.”

Wolf Richter the founder of the Wolf Street Report states that there really is huge inflation. He calls this asset price increase a case of pernicious and dangerous inflation, explaining it as:

“Assets – stocks, bonds, commercial real estate, residential real estate and so on – are highly leveraged. When their prices rise, they are used as collateral for more debt. This means banks and bondholders are on the hook when prices turn the other way. This can lead to a banking crisis and then a financial crisis. We saw this scenario play out when the housing market crashed in 2006-2007 precipitating the financial crisis.”

In other words, bubbles inflate as a result of the easy money policies of the Federal Reserve and policy makers. You can think of this inflation in assets in terms of a house. If you purchase a home for $200,000 one year and sell it for $300,000 the next, has the house grown significantly in any way to warrant the massive price increase? Richter puts this idea in perspective:

“It doesn't mean that the house grew 50 percent in size or got 50 percent more opulent… The house stayed kind of the same, except it got a little older. But what it means is that the dollar with regards to this house lost much of its purchasing power. This just means that it takes a heck of a lot more dollars than six years ago to buy the very same house. No magic here.”

Home price inflation in the United States from January of 2013 to December of 2018 came out to 42 percent across the country. Many metro areas saw the prices rise substantially higher than this even. This is one key area where the elusive seeming inflation from the Fed's easy money policies has appeared.

Stocks Are Also In A Huge Bubble

What about stocks though? It is more difficult to determine how much inflation has taken place in these assets. Yet as the chart below shows, the market has been pushing one record milestone after another over the last two years:

Houses are different than American corporations which expand as revenues rise and earnings increase. You can use the P/E Ratio (price to earnings) to get a clearer understanding of stocks and their asset price inflation. Price to earnings reveals the numbers of dollars you have to spend to purchase a certain amount of earnings.

Consider that back in July of 2012, the combined P/E ratio on companies in the S&P 500 amounted to slightly less than 15. This means that you needed to spend $15 in order to purchase one dollar in earnings. Today, this same P/E ratio on the S&P equals approximately 23.

You would need to spend $23 now in order to purchase that identical one dollar of earnings per share. Comparing apples to apples, you have seen a significant 55 percent gain in the S&P 500's asset price inflation (about eight percent per year). Meanwhile, over this identical time frame, gains in the S&P 500 were roughly 120 percent. This tells you that around half of all gains in these stock prices resulted from just the asset price inflation. It is a worrying revelation that you should take seriously.

A Big Danger Is That Higher Prices Kill Demand

As Richter explains, asset inflation has a pernicious effect. This is because it reduces the rewards of individuals' labor. When prices for houses grow by around 50 percent because of inflation in prices, and wages grow by a mere 10 percent, it means that you need substantially more work to purchase the identical house.

Finally the bubble bursts shockingly because the over heated home prices kill demand. Houses are extremely leveraged. This leads to a pricing crash hurting the mortgage holders (banks) severely. You witnessed this in the 2006 period, and it led to the devastating Great Recession.

Spillover from Stock Market Bubble Bursting Will Impact Banks Again

What makes a bubble burst impact in stocks so dangerous is that they are also extremely leveraged. This popping of the stock price bubble causes major problems for banks. It also forces yields to decline. Investors receive less income as a result and feel they have no choice but to take on more risk to try to increase their income. This can quickly create a vicious cycle as Richter warns:

“Inflated asset prices support larger debts, but when asset prices deflate and the borrower defaults, their collateral is no longer enough to cover the debt and these lenders take big losses. Asset price inflation feels good because it translates into seemingly free and easy wealth for asset holders. But when it deflates, it tends to pull the rug out from under the banks and the broader financial system, and it causes all kinds of other mayhem. Asset price inflation is not benign. It's not a free lunch. It loads up the financial system with systemic risks and future losses.”

Before long you come return to the catch phrase of “too big to fail,” relating to important banks that hold up the U.S. financial system. This is why the currently spotlighted asset price inflation in the stock market represents just as big of a problem for your portfolio and the economy as the more traditional measure of consumer price inflation.

Gold Represents A Proven Safe Haven and Hedge for Your Retirement Portfolio

Inflation is a monster that you can not easily make go away once it has escaped. It may appear that the economy in the United States has managed to avoid it despite all of the cheap and easy money floating around, but this is actually not the case. Instead the inflation has blown up incredibly dangerous bubbles that will burst one day. This is why gold makes sense in an IRA.

There is no reason for your retirement portfolio to be unprotected. You purchase insurance on everything else in your life. IRA-approved gold has a proven track record dating back around 3,000 years. You can even buy gold in monthly installments these days. Converting from a traditional IRA to a self directed one involves certain Gold IRA rules and regulations. It is also helpful to consider some Gold IRA allocation strategies when you are investigating top gold IRA companies and bullion dealers.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,385.11

Gold: $2,385.11

Silver: $27.83

Silver: $27.83

Platinum: $938.54

Platinum: $938.54

Palladium: $884.45

Palladium: $884.45

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81