- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

As Critical British Elections Hang in the Balance, Arab Row Breaks Out and American Growth Is Downgraded

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 7th June 2017, 04:09 pm

This past week saw a number of geopolitically destabilizing events transpire around the world. In the U.K., the June 8th British Parliamentary elections have swung from what was projected to be a massive landslide victory for Theresa May's ruling Conservative Party over to a now too close to comfortably call result in some of the more recent polls. The London terrorist attack has not helped matters. In the unlikely event that a hung parliament results, analysts are forecasting the British pound could plunge as much as seven percent.

Over in the Middle East, a huge diplomatic and economic battle erupted over Qatar's continued financing and supporting of terrorists. Saudi Arabia and its main three Gulf State allies have cut all ties with the oil rich principality and are even imminent to start economically blocking air and land traffic to the tiny nation. Practically every major regional Islamic nation has taken one side or the other on the issue already.

Meanwhile in the United States, the OECD issued its updated growth forecast reports showing that U.S. economic growth is slowing for both 2017 and 2018. This comes as most of the rest of the world is still on track for slightly improving growth and somewhat better international trade. The OECD blames the slowdowns in the estimates for America on the delays to President Trump's economic infrastructure stimulus and tax-cutting reform agendas.

The geopolitical headlines are a constant reminder anymore that your retirement assets are at risk of black swan events erupting throughout the world at any moment without warning. Your most reliable and proven defense is to invest in gold. Gold makes sense in an IRA and can protect your retirement accounts. It might be a good idea to think about a Gold IRA rollover now.

British Election Forecast Swings from Conservative Landslide Victory to Too Close to Call

When British Prime Minister Theresa May called for unexpected snap elections, all the pollsters showed her with an enviable and commanding lead going into the election campaign. Since then, her main rival opposition Labour Party group led by Jeremy Corbyn has managed to eat into the perceived polling lead to the point that it has dropped from upwards of 25 percentage points to as little as from one to 11 percentage points (depending on which polls you believe).

This could all cause substantial impacts on financial markets and especially the value of the British pound sterling. As of now, the markets foresee a Conservative Party victory, if not an enormous one than at least a Parliamentary majority result. If the markets become shocked Friday morning with one of several other scenarios, this could quickly lead to yet another meltdown in the British currency against its major global rivals.

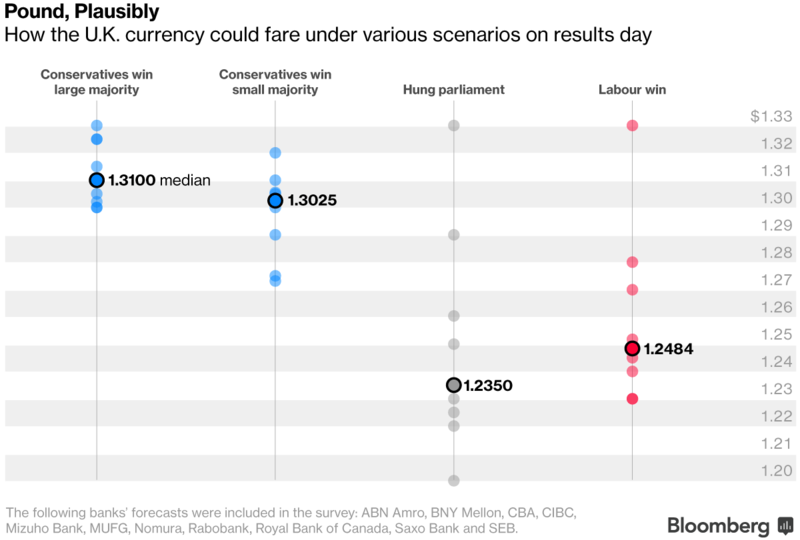

Analysts polled by Bloomberg expect the pound will suffer the most in the event that a hung parliament or indecisive election results. They have projected that the pound could plunge to even as low as $1.20 against the dollar on Friday, a drop of seven percent, if this unlikely scenario were to unfold.

On the other side of the spectrum, if Theresa May's ruling Conservatives emerge with a larger majority or even a supermajority, then the pound is seen rallying to as high as from $1.31 to $1.33 versus the dollar. If instead Labour were to pull off an upset victory, then the pound is anticipated to drop to around $1.24 before recovering on hopes for a “softer” Brexit.

The short-term to long-term effects might also vary with the different potential results. The immediate effects of the Conservatives retaining power or strengthening their lead to a commanding one would reduce current uncertainty and boost the currency somewhat, yet raise the chances of a harder or hardest-possible Brexit hurting the pound going forward. Head of RBC Global Foreign Exchange Strategy Adam Cole in London stated:

“In the markets there is a very simple rule of thumb: the larger the Conservative majority becomes, the more positive it is for sterling.”

If the Conservatives merely maintain a similar majority to what they have now, then the markets will likely hold where they are and wait to see how the Brexit negotiations will go. The results of this election and its effects on markets matter hugely as London is still one of the world's two main financial centers and remains hands down the largest one in Europe.

Saudis and Other Arab States Isolate Terrorist-Funding Qatar

In a dramatic diplomatic standoff, Saudi Arabia and three other neighbors Egypt, Bahrain, and the United Arab Emirates cut nearly all their economic and diplomatic connections with Qatar on Monday. These four Arabian peninsular heavyweights were attempting to punish the Qataris for their long-standing connection to Iran as well as their historical financial and other material support for radical Islamist groups such as the Muslim Brotherhood.

The Saudis and their allies have long viewed Qatar as the region's second greatest destabilizing element behind Iran. Qatar may be tiny, but it is rich and flexes its muscles by deploying its vast resources in support of various terrorist groups. It also stymies the other Gulf Cooperation Council members from their efforts at isolating trouble-making neighbor Iran.

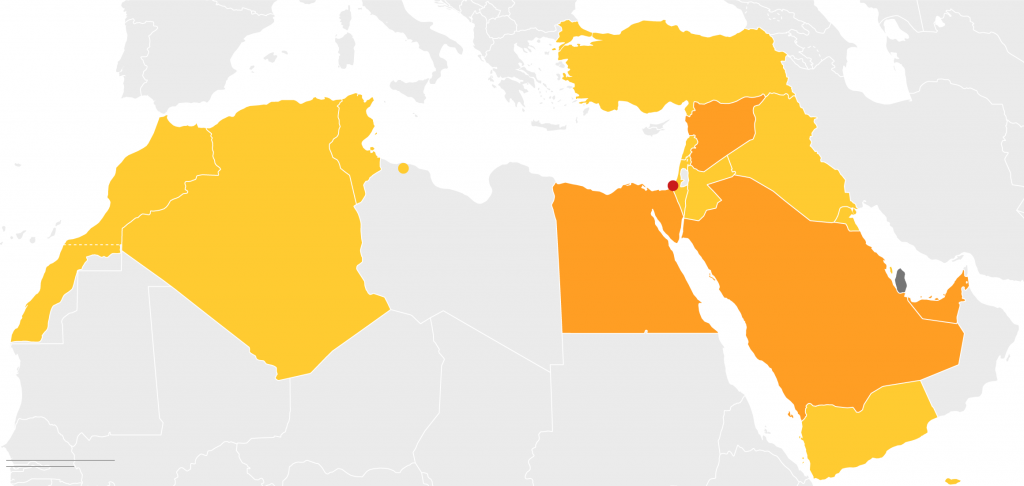

This is not a new problem. Every time there are rising tensions in the region, it is the Qatari backing of the Muslim Brotherhood related groups that crops up consistently. For almost a hundred years, the Muslim Brotherhood has been impacting the philosophies and ideologies from literally dozens of descendent or related groups spanning from Kuwait to Morocco, as this map below demonstrates:

OECD Downgrades U.S. Projected 2017 -2018 Economic Growth Rates

While the Organization for Economic Co-operation and Development increased its world growth forecasts for 2017, it simultaneously reduced all estimates for the U.S. economic growth this past week. They did this even with a weakening dollar increasing American exports while tax cuts are slated to improve the level of business and consumer investment going forward. The OECD lowered its U.S. economic growth rate predictions from the prior 2.4 percent to 2.1 percent for the year 2017. For the year 2018, they reduced the U.S. growth rates from 2.8 percent down to 2.4 percent.

The Chief Economist Catherine Mann of OECD blamed this resulting decrease in estimates for American economic growth on the increasing delays to the President Trump agenda of increasing spending on infrastructure while cutting taxes.

Even though they were rosier on the rest of the world's economic outlook, the OECD did warn in the report that there are real financial risks that could impede the positive international projections, with:

“Geopolitical shocks and trade protectionism could catalyze snap-backs in asset prices and realize downside risks through a variety of channels.”

The Paris-based OECD anticipates that the world economy growth rate will increase to 3.5 percent for 2017 and 3.6 percent for 2018. Their arguments for this lie in the increasing business and consumer confidence around the world along with a rise in international trade and investment levels. Their report declared:

“International trade growth revived in the last year, although it still remains less robust than in pre-crisis decades. Technology-driven and deeper trade integration through global value chains creates new markets and raises productivity.”

This is not to say that the global economy growth is so much better than the still flagging U.S. growth rates, as Secretary General Angel Gurria of the OECD opined, with:

“Everything is relative. What I would not like us to do is celebrate the fact that we're moving from very bad to mediocre.” The world has to continue to strive to do better.

It all reminds you why gold is the best possible historically proven hedge for your retirement portfolio. Now is the time to re-discover the Top 5 gold coins for investors and to review the IRA-approved gold.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68