Are Diamonds a Good Investment? A Full Guide to Investing in Diamonds

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 15th August 2022, 02:15 pm

You may have heard the phrase, “a diamond is forever.” This was recognized as the most prominent slogan of the 20th century, and its marketing can largely be accredited with proliferating diamonds into the hearts and minds of modern society.

If diamonds are forever then the significance of gifting them implies that your love lasts forever, but if you're purchasing diamonds as an investment, then diamonds really only last long enough for you to see a profit. So, the question, are diamonds a good investment, really depends on whether they appreciate in value or not.

Table of Contents

Do Diamonds Appreciate in Value?

Simply put, only the rarest ones do. These rarities are in such high demand relative to their supply that the price tags can scale anywhere from $25,000 to upwards of $1 million. However, for the investor willing to land such a prospect, the investment may be lucrative.

The International Gem Society, a leader in global and online-based schooling for gemology, describes the value—and by inference the rarity—of diamonds as being determined by the “Four C’s”:

- Color: Color grades the diamonds hue from D-Z, D being colorless and the rarest. However, there are extremely rare colored diamonds for which this scale doesn't apply.

- Clarity: Clarity grade is based on the diamond’s transparency. Generally, clearer diamonds are more valuable.

- Carat: Carat is the measurement of weight. Diamonds are priced per carat, so naturally the bigger the diamond the more valuable it is.

- Cut: The cut is how the shape is crafted and can affect its carat. The oval shape is the most valuable.

Anything that is rare is likely to appreciate over time because the demand invariably outstrips the supply. Conversely, anything that is purchased which isn't rare is likely to depreciate in value as supply increases in greater proportion to demand.

The International Gem Society postulates that diamonds are not rare, but may be amongst the most abundant gems in nature. Moreover, diamonds are synthesized in labs and sold as jewelry. Due to being the hardest material on earth, they are also sold for industrial application.

It becomes easy to see why the resale value of diamond jewelry drops significantly after you purchase them from retailers. It's not only because retailers have an extremely high markup, but it is also because diamonds are everywhere. Only the very rare ones are truly investment grade.

Diamond Stocks and ETFs

Just like the best gold stocks, there are well-diversified diamond ETFs and stocks to help you gain exposure to the global diamond market without purchasing physical diamonds. Some of the world’s largest “paper diamond” assets (i.e., stocks and ETFs) include the following:

- LVMH Moet Hennessy Louis Vuitton (OTC:LVMUY)

- Rio Tinto (NYSE:RIO)

- Anglo American (OTC:NGLOY)

- Signet Jewelers (NYSE:SIG)

Diamond Appreciation in History

International trading jeweler Dalby Diamonds states that colored diamonds have appreciated by 112% in the last decade, with some having an annual appreciation of 12%. However, it's important to understand the implication of such stats.

According to dealer and manufacturer Naturally Colored by Peled Diamonds, the sale of a 3 carat blue diamond goes for $1 million per carat in auction. One reason why diamonds are sold per carat is because they are cut by manufacturers after being purchased to proliferate profits.

The demand for these diamonds may then depend on the potential that they have in being cut for profit, so whether a diamond appreciates in value largely depends on its size. So, that 1 carat diamond, although rare, may literally not make the cut.

The question, are diamonds a good investment, relies upon two things: firstly, establishing what to look for by understanding what makes a diamond rare using the 4 C’s, and secondly, screening for trusted suppliers who can offer rarities that are certified by a gemological authority such as the GIA (Gemological Institute of America).

Gold Versus Diamonds: The Difference in Investments

Each diamond is unique; whereas gold is a commodity that can actually be standardized. When investing in diamonds you're essentially investing in one diamond, but when investing in gold you're investing in the gold market, and therein is the significant difference.

For example, gold ETFs can track the price of gold directly, whereas diamonds differ in that any available ETFs for them can only track the companies that mine diamonds and not the diamonds themselves.

When the question of gold versus diamonds becomes a matter of investing, it's important to understand that commodities with the ability to be standardized, such as gold, will always have a track record which establishes some level of assurance for them.

What’s Worth More, Diamonds or Gold?

Gold is rarer than diamonds by an order of magnitude. In fact, research at the Massachusetts Institute of Technology (MIT) suggests that the gold found on earth is the result of neutron stars colliding.

Compare that with our ability to compress solid carbon at searing temperatures to synthesize perfect diamonds, I would say that—much to the dismay of alchemy— gold will not get any less rare. This is especially true if 80% of gold reserves have already been mined, as is suggested by the British Broadcasting Corporation (BBC).

Yet, a simple trip to the jeweler will show that diamonds are worth more than gold. This worth has nothing to do with rarity; rather, it is largely attributed to how diamonds have been ingrained into culture as reflecting a standard of beauty worth paying large amounts for.

To put gold versus diamonds on the same plane is to assume they function similarly. Diamonds are marketed to wear, whereas gold is an investment market. While diamonds may be worth more on their price tag, gold gets its worth by operating more practically as an investment and store of value.

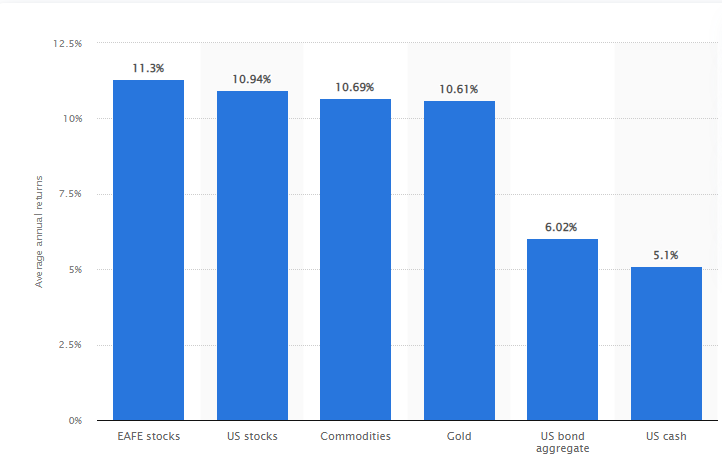

The following is the average annual return of gold worldwide from 1971 to 2019.

Source: Statista

A rare diamond may offer 12% appreciation per year. Conversely, gold can provide more or less the same percentage in returns, but the dynamic of the markets in which they operate differs drastically. The question, what’s worth more diamonds or gold, is really a matter of which market you choose to operate in.

Investing in Diamonds and Gold

At this point. you may be wondering where you can hold your diamond investments. The unique nature of diamonds establishes them as a collectible rather than an investment, so unlike gold they are prohibited from being held in a self-directed IRA.

It is in this regard that the term “diamond investing” becomes a misnomer. You can invest in art, but you still can't hold it in your IRA. However, an insured safe deposit box is a viable way of holding a rare diamond as it appreciates.

To better equip yourself with an understanding of the types of investments you can hold in an IRA, I suggest you read our exclusive guide to simple IRAs. If you also want to learn more about how a self-directed IRA can be used for your gold investments, I also recommend you read our exclusive guide to investing in gold with a self-directed IRA.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.83

Gold: $3,355.83

Silver: $38.43

Silver: $38.43

Platinum: $1,468.02

Platinum: $1,468.02

Palladium: $1,286.05

Palladium: $1,286.05

Bitcoin: $117,574.14

Bitcoin: $117,574.14

Ethereum: $2,959.38

Ethereum: $2,959.38