April 2022 Newsletter: Crypto Market Rallies Once Again (+27.5%); Silver Slides, and Russia Installs New Price Floor for Gold Amid Buying Campaign

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 21st April 2022, 03:05 pm

The ongoing conflict in Ukraine has disrupted global markets, and gold has once again found itself at the center of the story.

In response to Western sanctions, the Central Bank of the Russian Federation has effectively created a price floor for gold at about $1,846 per troy ounce. Until June 30, the Russian central bank will pay a fixed price of 5,000 rubles (or $59.35) per gram.

Contrary to what some onlookers have suggested, this does not mean that the rouble is “gold-backed”, but it could signal the return of a gold-backed rouble sometime in the future. What it does mean, however, is that gold can now be exchanged for rubles at a predictable set rate over the next months.

In other words, it's likely impossible that the price of gold will fall from its current spot price of $1,937 to below $1,846 before July. This is because Russian state actors have guaranteed that they will buy gold at that price.

There's little doubt that this is a buy signal for gold, as it signals the strategic importance of gold in international commerce and particularly for maintaining the economic longevity of Russia. In doing so, Russia's move will mitigate much of the risk for gold investors.

A Spring Rally for the Crypto Market?

Beyond gold, the utility of cryptocurrency once again made a case for itself in March.

Amid his Ukraine being thrust into violent turmoil, Ukrainian President Volodymyr Zelenskyy has formally legalized cryptocurrency in his country as of March 17. Before then, Bitcoin and other cryptocurrencies operated on a strictly informal basis. This comes on the heels of Ukraine receiving over $100 million in donations via cryptocurrency since the start of the invasion.

Kraken, one of the world's biggest crypto exchange platforms, went further by gifting every Ukrainian user $1,000 worth of Bitcoin. At a time when traditional financial platforms have been disrupted in Ukraine, Bitcoin and other digital assets have proven that they can serve as a reliable store of value—even during times of war and crisis.

The European Union even went as far as taking any proposed ban on Bitcoin off the table. While legislative initiatives were previously being discussed by the EU Parliament regarding Bitcoin banning, this has now been completely shelved.

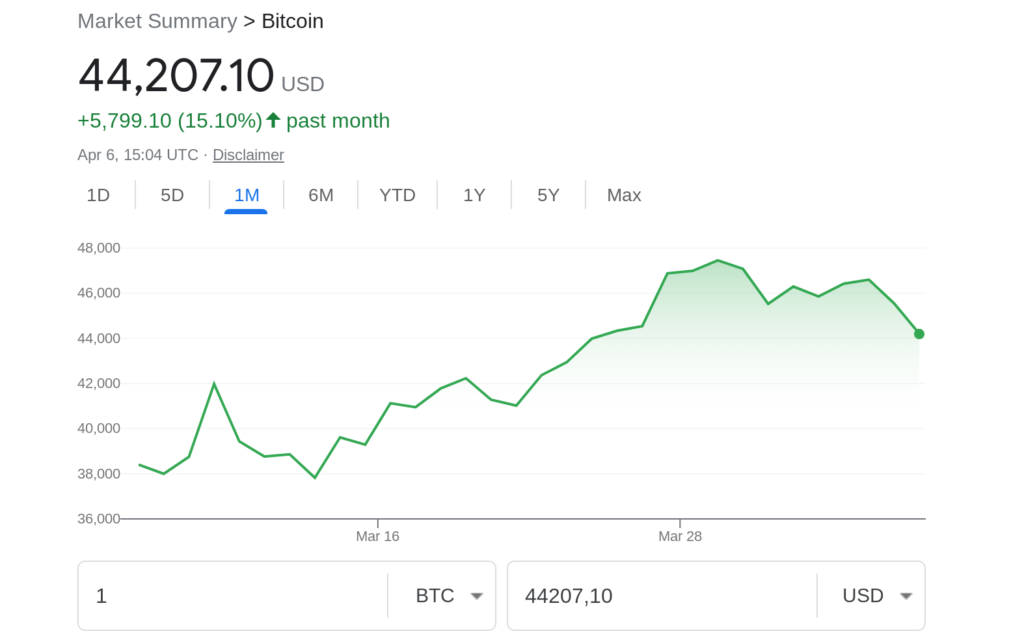

The crypto markets responded positively to the news. At the time of writing, BTC is traded at $44,207 USD, which amounts to a +15.1% rise over the past 30-day period. Even more impressive is Ethereum, with one ETH trading at $3,250 and sitting at +27.5% gains on the month.

Source: Google Market Summary

In short, the crypto market is back on a bull run while gold and silver have cooled off following post-invasion highs. However, gold is, for perhaps the first time in our lifetimes, experiencing a unique artificial price floor due to the gold-buying initiative of the Russian central bank.

But the highs won’t last forever.

The World Bank, on Tuesday, noted that three major economic shocks are going to leave their mark this year. First, is the war in Ukraine. Second, a massive economic slowdown, or perhaps even a recession, in China. Third, interest rate hikes from the U.S. Federal Reserve.

We've seen the first of them, although the next two are yet to come. At this point, it's likely only a question of when and not if.

To prepare your portfolio for the times ahead, consider diversifying with assets that aren't strongly correlated with the stock market or the U.S. dollar. For instance, real estate, cryptocurrencies, annuities, and precious metals can help your savings weather the storm if an economic downturn is around the corner.

Consider getting started today. The longer you wait, the more you risk losing out if traditional markets take a turn for the worse. When you're ready to make the first move, check out our exclusive list of IRA-approved metals that you can add to your retirement accounts today.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.86

Gold: $3,355.86

Silver: $38.42

Silver: $38.42

Platinum: $1,468.02

Platinum: $1,468.02

Palladium: $1,243.37

Palladium: $1,243.37

Bitcoin: $117,714.11

Bitcoin: $117,714.11

Ethereum: $2,956.39

Ethereum: $2,956.39