Amid Political Standoff, Markets Stabilize and Precious Metals Hold Steady

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 6th June 2023, 04:02 pm

Market Snapshot: June 1, 2023

- Inflation Rate: 4.9%

- Fed Rate: 5.00% to 5.25%

- Gold Price: US$1,982/oz.

- Silver Price: $23.91/oz.

- Bitcoin Price: US$26,913

- Ethereum Price: US$1,865

May was a slow and steady month for precious metals investors, who briefly benefited from the uncertainty surrounding the congressional debt ceiling crisis. While the Republican-controlled House and the Democrat-controlled White House squared off over the federal government’s borrowing limits, a resolution in principle was finally reached by the end of May, cooling off investors’ worries and reinjecting a modicum of certainty back into the market.

Gold came within razor-thin distance of its all-time high price, briefly hitting $2,050 per ounce on May 4th before stabilizing back to in the mid-high $1,900s. Gold’s price rise was supported, at least in part, by a less hawkish tone from Federal Reserve Chair Jerome Powell, who hiked the federal funds rate to 16-year-highs before declaring that the U.S. banking sector is “sound and resilient”—soothing the concerns of many who questioned the system’s integrity after several mid-sized banks failed in March.

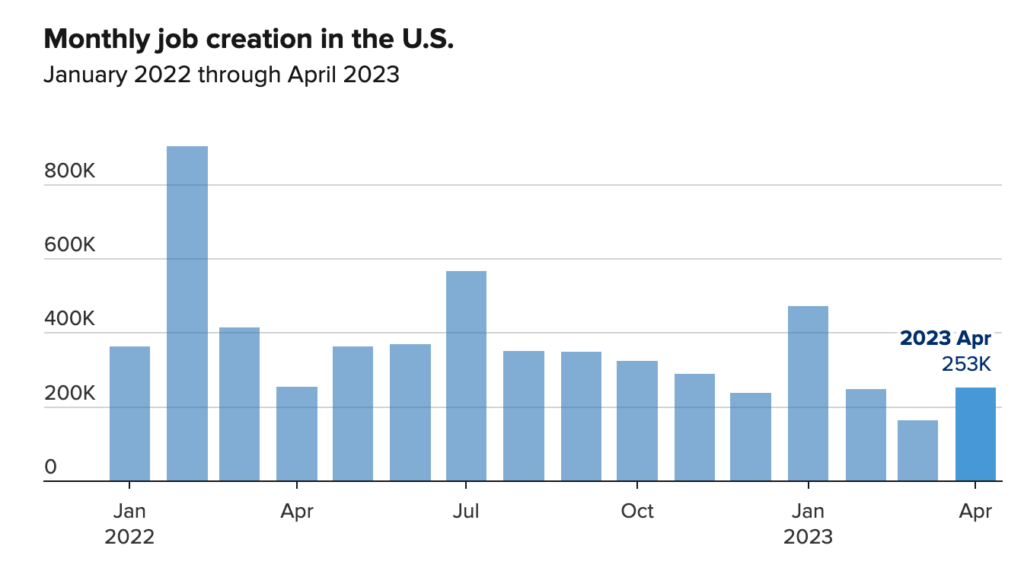

Although interest rates are at generational highs, markets appear to be stabilizing faster than expected, and macroeconomic fundamentals appear to be strong. The U.S. jobs report for April—sourcing the most recent data available—found that 253,000 jobs were created versus the 180,000 expected by analysts, with unemployment dropping to 3.4%, lower than the anticipated 3.6%.

Source: CNBC

Zooming in, however, we see a far bleaker picture in the United States. On a micro level, about 90 million Americans (38.5% of the population) are still struggling to make ends meet, with many claiming to be racking up credit card debt to cover expenses. And although inflation is currently decelerating, it may be too little too late as a strong job market hasn’t offset the rising costs of living for average families.

We have, therefore, two different perspectives on the U.S. economy playing out in parallel. On one hand, there are strong macroeconomic indicators of growth (e.g., decelerating inflation and strong jobs growth), while a large percentage of Americans are becoming increasingly poor and indebted—conditions that may lead to recessionary activity further down the road.

Those who want to protect their investment portfolio from the possibility of a later recession may want to consider diversifying with gold or silver assets. When added to an IRA or 401(k), gold and other precious metals can help manage risk and reduce one’s unipolar exposure to stock market volatility, inflationary risks, and counterparty risks.

Speak to your financial advisor today about opening a self-directed IRA containing physical gold bullion—one of the historic top performers during recessions and economic downswings.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.86

Gold: $3,355.86

Silver: $38.42

Silver: $38.42

Platinum: $1,468.02

Platinum: $1,468.02

Palladium: $1,243.37

Palladium: $1,243.37

Bitcoin: $117,714.11

Bitcoin: $117,714.11

Ethereum: $2,956.39

Ethereum: $2,956.39