- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

American Consumer Debt Reaches New All-Time High in September

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 18th January 2024, 01:36 pm

One consistent trend over the last few years is the dangerous rise of American consumer debt. This past week the news revealed that the U.S. consumer has again pushed this category of debt to another all-time high in September. The September new record amounts to $4.15 trillion worth of consumer held debt.

It is in large part the ongoing surge of student loan debt that continues to fuel the record increases. This is unsustainable for several reasons. When the increasingly in default student loan bill comes due, it will be you the taxpayer who is on the hook for it.

Student Loans Reach Record High, Pushing Consumer Debt to New All-Time Highs in September

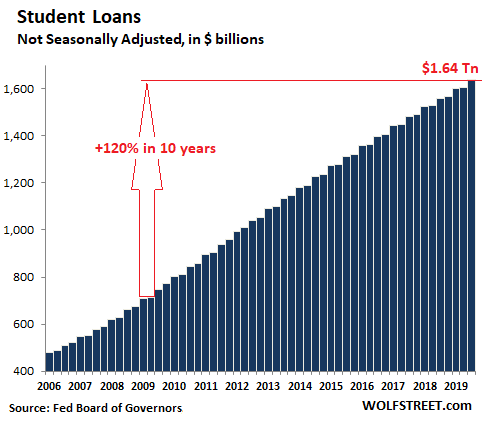

American student loan balances roared $32.9 billion higher for the third quarter of 2019. It brought the aggregate outstanding student loans to an all-time high of $1.64 trillion. For the year on year time frame, these student loan balances have increased by 5.1 percent.

Looking at the last decade the picture is far more alarming. Student loan debts have increased by an astonishing 120 percent in the past ten years, as this chart below reveals:

Today's student loan balances amount to an incredible 7.6 percent of American national GDP. This is also significantly up from the 5.1 percent GDP share back in 2009.

Yet Most Americans Do Not Attend College or University

Despite the alarmingly rising student debt levels now saddling the last generation's graduates, the truth is that a smaller number of students are going to college or university now. From the years 2010 to 2017, enrollment at the centers of higher learning decreased by seven percent, per the National Center for Education Statistics. Enrollment for the foreseeable future will remain stagnant. It means that a significantly smaller pool of students are having to borrow larger amounts of cash in order to pay for their higher educations.

Economist Peter Schiff of Euro Pacific Capital Management has discussed this ongoing student loan crisis earlier this fall. He demonstrated the way in which the federal government is actually to blame for this student loan crisis. Schiff explained that:

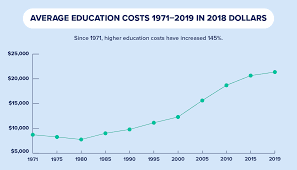

“Before the government got involved, college wasn't all that expensive. It was government policy that made it unaffordable. And not only did it manage to dramatically drive up the cost of a college education, but it also succeeded in destroying the value of that degree.”

Schiff went on to argue that in the years before the government attacked the college education problem, there was not a real problem. Studies back up Peter's claims too. They reveal that the inflow of student loan money into the college system (which the government guaranteed) directly impacted the rising cost of college education. The chart below reveals how the average cost of college education in consistent 2018 dollars has increased by 145 percent since 1971:

Many Interests Benefit from College Peripheral Business

The growing cost of the college experience has created a lucrative industry for many interested third parties. Thanks to the government funded money flooding into the higher education system, everyone rushed to stake a claim to their share of the business opportunities. WolfStreet put it like this: students turned into a lucrative conduit from American taxpayers to a host of enterprises.

These included universities seeking to expand their student empires, publishers of textbooks with their legal monopolies, corporations like Apple selling laptops and other technology to students, and landlords looking to get stronger yields on their apartment investments (with Wall Street making money securitizing it all the while). Even grocery stores, ticket sellers, car dealers, restaurants, bars, airlines, and other companies have cashed in on the government funded pool of money.

The worrying problem is that someone is on the hook to repay all of this money, and the historical statistics bear out that it will be the government picking up the tab as students are hopelessly in over their heads. In Great Britain, they have already acknowledged this reality on the ground by adjusting government debt reporting to assume all student loan debt, which they have astutely recognized will never be paid back by overburdened university graduates.

Federal Government on the Hook for Student Loans That Can Not Be Repaid

The statistics show how much of a struggle indebted students and recent graduates are undergoing in an effort to pay their loans back. For the first quarter in 2019, around 5.2 million federal student loan borrowers were in default. Another 3.4 million student loans back by the federal government were in deferment. A troubling 2.7 million more stood in forbearance.

Ultimately it is you the American taxpayer who will have to cover the overwhelming majority of these student loans. Education Secretary Besty DeVos admitted as much with how substantial the student debt levels have become in a speech she gave towards the end of 2018. DeVos worried about the “significant risk” this debt entails with:

“At 1.5 trillion dollars, FSA's loan portfolio is now one-third of the Federal government's balance sheet. Last year, uncollateralized student loans- which are all of them, by the way- accounted for over 30 percent of all federal assets. One-third of the balance sheet. Only through government accounting is this student loan portfolio counted as anything but an asset embedded with significant risk. In the commercial world, no bank regulator would allow this portfolio to be valued at full face value. Federal Student Aid has a consumer loan portfolio larger than any private bank. Behemoths like Bank of America or J.P. Morgan pale in comparison. FSA also is the largest direct loan portfolio in the whole Federal government- by far- surpassing all other federal direct loans combined by 1.1 trillion dollars.”

It is a recipe for financial disaster, which DeVos herslef admitted when she argued that this surging amount of student debt has “very real implications for our economy and future,” with:

“The student loan program is not only burying students in debt, it is also burying taxpayers and it's stealing from future generations.”

This is yet the latest bubble blown up courtesy of your well-meaning federal government. Like every bubble in history, it will spectacularly pop one day, creating economic carnage when it does.

No Wonder Gold Is Now the Third Most Consistently Bought Investment in the World

Another piece of news released last week should not come as a great surprise in the light of the worsening student loan crisis. The World Gold Council just released its latest consumer research report, which found out just how strong the worldwide gold market actually is. The report reveals that gold is now officially the third most consistently purchased investment on the planet. The market is backed by a strong potential for future continued growth. The report concluded that:

“Globally, there are clear perceptions of gold as a safe, durable, traditional store of value. As an investment, it plays to these strengths- retail investors buy it to protect wealth and create long term returns. Jewelry buyers treasure it for sentimental reasons and as a reward for success.”

This week's disturbing news on the state of student loans and astronomically rising consumer debt is troubling. It is yet another reason why gold makes sense in an IRA. One way that you can diversify your U.S. dollar exposed investments (which are all of them) and assets is through buying gold in monthly installments. The IRS will even let you store it in top offshore storage locations for IRA gold these days, allowing you to eliminate the risk of U.S. government seizure if the cards come crashing down. Read on to learn more about the Top Gold IRA companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81