5 Best Gold Investment Companies 2021

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 14th December 2021, 06:43 am

Gold is an asset most investors understand will help defend their portfolio from stock market turmoil. The precious metal also has the capability of withstanding the unfavorable effects of inflation. In the search for diversification, and therefore a less risky portfolio, gold makes all the sense.

Before we get into the list of the 5 best gold investment companies let’s have a closer look at gold investment and the ways we can achieve exposure to the shiny yellow metal.

Table of Contents

How to Invest in Gold

There are various ways of holding gold as an asset in your investment portfolio. The traditional way, as it’s the oldest, is buying gold bullion and keeping it in a safe place. You can also purchase gold coins and store them in a bank vault. You also have the option of holding physical gold bullion in an IRA.

Another way is to invest in a gold fund. These funds benefit from economies of scale, as they tend to have under management large amounts of cash. They also have the know-how and the expertise to look after your gold.

A third option, although a bit riskier, is buying stocks of a gold fund that invests in futures. As we shall see later on, these funds don’t hold any underlying assets. They instead buy gold futures to obtain exposure to the price movements of the yellow commodity.

Is it better to buy gold or gold stocks?

The first option mentioned above may be time-consuming and kind of complicated for some. Once you have found your physical gold seller you then need to establish a place to hold your physical gold. The gold will be held in a safe vault. Usually, the seller works with several locations, although they might not be close by.

You can make life simpler for yourself by investing in publicly traded stocks. To avoid the hassle of buying your own gold, or setting up a gold IRA, you can go to your brokerage house or bank and buy gold through an ETF.

Holding physical gold as opposed to stocks has its advantages. Firstly you have an asset that unlike a security will never fail. Gold stocks or funds have corporate risk as well as market risk. Bad governance or fraud could see a company fold. With gold, you avoid those risks altogether.

Investing in gold companies, however, allows you to gain access to the returns of holding gold with the liquidity gained from holding a publicly-traded security. Buying and selling physical gold can be time-consuming, whereas investing in gold companies allows you to buy and sell gold in a matter of minutes.

Another factor is the price you will pay when buying physical gold. Unless you are investing millions at a time, your gold purchase will be considered as retail. For physical gold sellers to create revenue they need to markup their prices. This means you will pay a considerable amount over the current spot price.

Thanks to the size of investments a gold fund can make when buying gold they can command the spot price of gold. This feature gives you access to gold at wholesale prices rather than retail prices.

5 Best Gold Companies

If you are looking at gold investing through a company and you want to maintain the liquidity found from publicly traded stocks your best option is an ETF.

We have ranked the best 5 gold ETFs according to the following criteria:

- Best Overall

- Largest Fund

- Most Traded Fund

- Best Performance 3 Years

- Best Expense Ratio

Aberdeen Standard Life Gold Trust (SGOL) – Best Overall

- Etfdb.com rating A+

- AUM $2.39 Billion

- Performance 3 Years 44.70%

- Expense Ratio 0.17%

- Daily Average Shares Traded 1,002,420

The fund was set up as a grantor trust in September 2009. The status of grantor trust for U.S. tax purposes means the company is not subject to U.S. federal income tax. Taxation will only occur once income flows through to the shareholders.

SGOL has the highest rating available at etfdb.com, the site awards them an A+ rating. The fund has a very competitive expense ratio of 0.17%. It only invests in gold bullion which it keeps in secure vaults with Swiss custodians.

The gold holdings are inspected twice a year by an independent metals assayer, one of these inspections is held at random. The serial numbers for all bars held are also published daily on their website. Their custodians are also required to report daily movements in gold holdings to the trust.

SGOL has a secure holding for its gold, which is inspected and reported on regularly. The gold standard for all holdings conforms to LBMA (London Bullion Market Association) standards. The trust has a competitive expense ratio and a high level of security.

The daily trading turnover average is just over 1 million shares, providing enough liquidity to promptly enter or exit your gold investments. The ETF is quoted on NYSE Arca and should be available at your regular brokerage house.

SPDR Gold Shares (GLD) – Largest Fund

- Etfdb.com rating A-

- AUM $59.26 Billion

- Performance 3 Years 43.80%

- Expense Ratio 0.40%

- Daily Average Shares Traded 7,293,242

This is the most popular and the largest gold fund among ETFs, with a total of $59.26 billion of net assets. The fund was created in November 2004 and is managed by BNY Mellon Asset Servicing. GLD is marketed by State Street Corporation through one of its affiliates.

The fund has so much appeal to investors that it is also traded on various exchanges across the globe. It is listed on the following international exchanges, Singapore Stock Exchange, Tokyo Stock Exchange, The Stock Exchange of Hong Kong, and The Mexican Stock Exchange.

The gold bars are held in a secure vault in London under the care of the fund’s custodian, HSBC Bank plc. The bank has an international presence and is a market maker, clearer and approved weigher as determined by the LBMA.

GLD offers a large asset base with the security of top-tier institutions in all processes of the fund’s activities. It also offers a high level of liquidity with over 7 million shares traded daily on average. The fund is quoted on NYSE Arca.

iShares Gold Trust (IAU) – Most Traded Fund

- Etfdb.com rating A

- AUM $28.2 Billion

- Performance 3 Years 44.5%

- Expense Ratio 0.25%

- Daily Average Shares Traded 11,118,471

iShares Gold Trust is sponsored by Blackrock, the world’s largest asset manager, and is quoted on NYSE Arca. The fund was created in January 2005, and holds $28.2 billion in assets. That amount is equal to nearly 16 million ounces of gold.

This fund is operated by Bank of New York Mellon, the trustee. The fund's custodian is JP Morgan Chase Bank N.A. London branch. Together with the sponsor, they make a formidable combination of know-how, expertise, and reliability.

The fund’s objective is to achieve the same exposure as holding physical gold for its shareholders. The securitization under the trust means that investors can access physical gold for their portfolios in a convenient and cost-effective way.

This ETF trades on average over 10 million shares a day, giving you that extra level of tradability. The high liquidity allows you to be almost certain of being able to add or decrease your gold investments in a timely manner.

ProShares Ultra Gold (UGL) – Best Performance

- Etfdb.com rating A

- AUM $95.5 million

- Performance 3 Years 66.3%

- Expense Ratio 0.95%

- Daily Average Shares Traded 114,023

ProShares Ultra Gold fund is a leveraged fund, intending to achieve twice the return of holding gold bullion. This explains the large difference in returns between this fund and the others, whose returns differ only slightly.

The leverage is obtained by investing in futures, swaps, and other derivatives. Leverage means you will see positive returns amplified. However, when the price of gold falls you will also see negative returns amplified.

Although the fund’s objective is to duplicate returns for gold, returns are net of the costs of trading derivatives and fees. Still, the 3-year return of 66.3% is considerably higher than the average return of funds in the group.

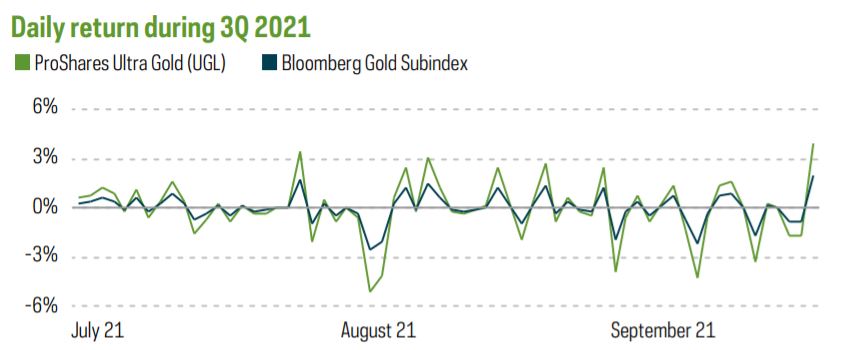

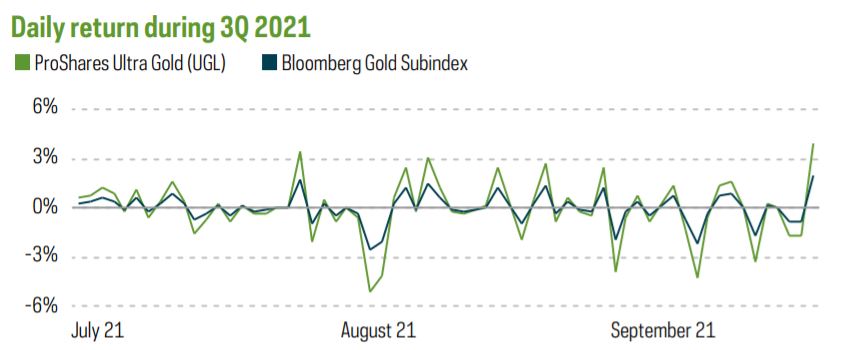

The chart below shows the daily returns for 3Q 2021, where you can see the fluctuation in returns of the fund compared to that of gold.

Source ProShares Ultra Gold

As you can appreciate, the daily returns for this fund are considerably larger than those for the gold index. This fund is for those who have a high enough risk appetite to add this security to their portfolio.

The leverage applied by the fund not only increases return volatility, but also allows you to gain a higher amount of exposure, or overweighting, to gold using less cash. Using derivatives to gain twice the exposure to gold returns also carries higher commissions reflected in the high expense ratio, 0.95%.

The sponsor is registered as a Commodity Pool Operator (CPO) and as a Commodity Trading Advisor (CTA) with the CFTC and is a member of the NFA. These requirements for trading derivatives guarantee a high level of accountability, transparency, and trust.

iShares Gold Trust Micro (IAUM) – Best Expense Ratio

- Etfdb.com rating N/A

- AUM $810 million

- Performance 3 Years N/A

- Expense Ratio 0.15%

- Daily Average Shares Traded 37,033

iShares Gold Trust Micro is a newcomer to the gold ETF investment space. The fund was set up in June 2021. It does, however, have the lowest fees in the market at 0.15%. IAUM is sponsored, like its big sister, by Blackrock.

As all gold ETFs hold the same asset they should perform in a similar way. The biggest factor that can change your compounded returns over the years is the expense ratio. This fund has the cheapest fees which over time can translate into a significant improvement in performance.

The fund has just over 48.8 million shares outstanding, and a relatively small daily traded volume average of 37,000. However, it is sponsored, operated, and has the same custodian as the IAU fund.

The micro version of the iShares Gold Trust allows you to redeem your shares in the ETF for physical gold in smaller amounts of capital. Shares in the fund are redeemable only in baskets. The IAUM fund has a smaller basket size, approximately half that of the IAU fund.

Wrapping Up

These funds are created with the objective of supplying a cost effective convenient form of investing in gold. Buying gold through a fund eliminates the barriers to holding physical gold. Such as, secure storage, transportation, and insurance.

Holding shares in a Gold ETF will give you very similar returns to those of holding physical gold. The funds have all their cash invested in gold bullion, therefore the funds’ performances will match very closely that of holding an investment in gold bullion.

The properties of gold make this commodity a useful tool to diversify and protect your portfolio. Gold has the capability to resist the negative effects inflation has on stocks. It also tends to have little correlation to stocks in times of markets crises and recessions.

These factors can help your portfolio suffer less in times of adverse market events. At the same time, gold has had a history of positive returns in the long run. If you prefer to hold physical gold bullion you could also invest in a gold IRA.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24