42 Percent of Lost Jobs Will Never Return in Lasting Structural Change

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 22nd May 2020, 12:23 pm

This past week the news emerged from the highly respected University of Chicago economics research department that massive permanent losses of jobs will be the base case for any future U.S. economic recovery. They now estimate that an incredible 42 percent of all recently unemployed people will not get their old jobs back, thanks to the “profound” shocks that have resulted from the manmade response to the coronavirus in the form of the economic shutdowns and several months’ long consumer lockdowns.

Economic Devastation of Shutdowns Is Severely Damaging and Will Be Long Lasting

The largest economy in the globe has suffered devastating effects from the results of the global pandemic. More than 38 million individuals so far have been ejected from their jobs in just the past two months. Even though states have started to relax the lockdown rules in an attempt to reopen businesses, economists have concurred that many of these employers will not rehire their furloughed or outright laid off workers.

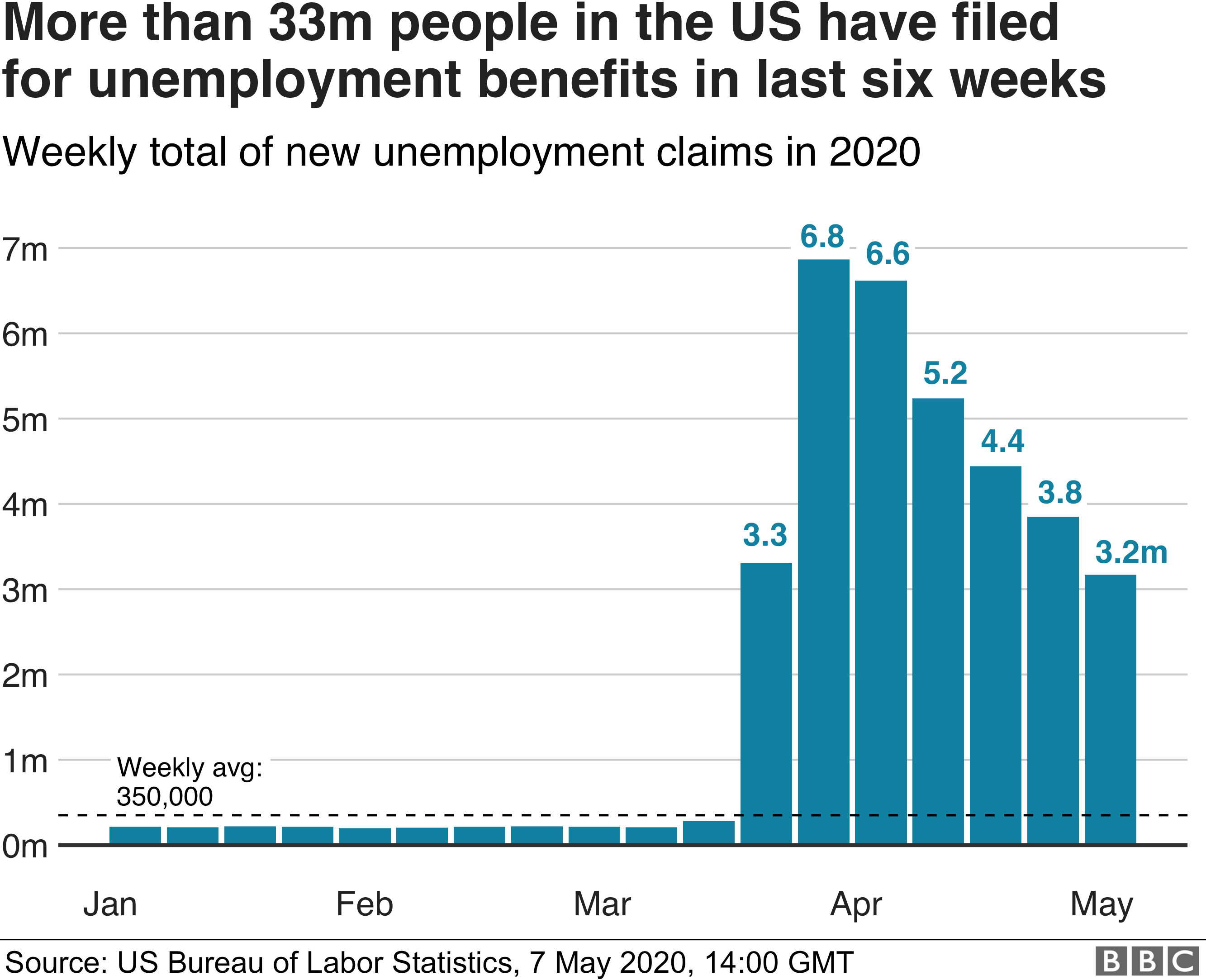

The University of Chicago researchers are not alone in their negative assessment for job prospects going forward. The University of California's Becker Institute for Economics has similarly painted a bleak portrait for the labor market and its likelihood of restoring lost jobs. They referred to the ongoing crisis as a “major reallocation shock” over all significant sectors of the economy. The study authors revealed that only three new jobs were created to offset the disappearance of every 10 coronavirus lost jobs. This chart reveals just how bad the job losses have been so far:

A few employers hired aggressively to handle their short term spikes in demand. This included the likes of Amazon, Target, and Walmart. Yet the Chicago-run study argues that these jobs which appeared in the midst of the coronavirus pandemic and crisis will not even begin to offset the bloodbath in the labor markets across the United States.

Thanks to the government created lockdowns, practically all economic activity has crashed and burned across an economy that depends for 70 percent of its economic activity on consumer spending these days. The entire job creation gain of the last ten years is now gone. Study authors Nick Bloom, Jose Maria Barrero, and Steven Davis wrote that:

“Even if medical advances or natural forces bring an early resolution to the crisis, many pandemic induced shifts in consumer demand and business practices will persist.”

They warned that a whole host of reasons “will impeded reallocation responses to the COVID-19 shock.” These include regulatory factors, policies that have motivated firms to hold on to their employees on the company payrolls, and unusually generous unemployment benefits whose income proved to be greater than the loss of job earnings. The result is that:

“Much of the near-term reallocative impact of the pandemic will also persist, as indicated by our forward-looking reallocation measures. Forty-two percent of recent layoffs will result in permanent job loss.”

The news could hardly be more discouraging for those people who have only temporarily lost their jobs (so far).

Jobless Recovery to Be Hallmark of Bounce Back

This study paints a grim picture of a likely jobless recovery akin to the one that followed the after 2001-era recession from the dot-com crash. Policymakers then were unable to jump start the job market either. Economist Michael Feroli of JPMorgan Chase cautioned that “the specter of permanent job loss looms as a factor that could contribute to a painfully slow recovery.”

The researchers at the University of California similarly opined with:

“If the pandemic and partial economic shutdown linger for many months, or if pandemics with serious health consequences and high mortality rates become a recurring phenomenon, there will be profound, long-term consequences for the reallocation of jobs, workers, and capital across firms and locations.”

Even the eternally optimistic economists of Wall Street have become increasingly more pessimistic on the recovery's shape and length. Wells Fargo wrote to its clients in a research note this past week that employment should rebound, but:

“It is likely [that it] will take a number of years for the labor market to recover from its pandemic-induced meltdown.”

100,000 Restaurants and A Third of Smaller Businesses Will Never Re-open Doors

It does not much matter whether you call the pandemic a one-off event or not. The upcoming changes to the economy will be massive and devastating for millions. Mass bankruptcies are expected as a result of the longer- term changes to consumer behavior. The University of Chicago authors wrote that:

“The restaurant industry provides a salient example of industry reallocation in the current crisis. Much of this immediate reallocative impact will likely persist.”

Gathering data from the National Restaurant Association on recently closed down restaurants, researchers have conjectured that more than 100,00o individual restaurants will be permanently closed down over the near-term. This is despite the ability most of them had to offer delivery and takeout options, both of which subsequently boomed. For small to medium sized business enterprises in general, a survey shows that fully one-third of them will never reopen their doors after the initial crisis has ended. This is devastating for any meaningful recovery prospects in the country.

Restaurant, retail, leisure, and travel jobs are the main victims of the present economic calamity. But even a rising number of the white collared jobs have been shifted remotely so that there will be a lasting impact across various other economic sectors. For example, employers will move resources around to other jobs, causing a great number of laid off employees to need to seek out new careers or positions.

Major Structural Changes Are Coming Soon to An Economy Near You

The Former Treasury Secretary Larry Summers (under President Clinton) warns that the economy which Americans must return to will be substantially changed from the one they knew previously. He told Yahoo Finance that the all-time record collapse in only a two month timeframe is going to have lasting consequences for the economy regardless of how fast a vaccine becomes available.

“I think [the pandemic] is going to mark a fairly profound structural change. We're going to have very substantial increases in inequality, and a very substantial reduction in any sense of solidarity in our society, unless the government steps up and meets this challenge.”

The latest U.S. economic data is certainly not encouraging so far. Retail sales plunged an all-time historic amount of 16 percent for the month of April even as the national GDP collapsed by 4.8 percent for Q1 of 2020.

Economic Pain and Hardship Set to Continue for Long Time to Come

Summers argued that still more financial hardship is to follow, particularly in the labor market. He warned that:

“In general, unemployment goes up the escalator and goes down the staircase. My guess is that we still have not hit bottom, that there will be a range of knock on effects from the disruptions that have taken place that are likely to be significant relative to the effects of people coming back. I'm pretty concerned about the economic outlook, not just for the next few months, bur for the next few years. I think we need to inject much more money into the economy, and we need to find ways of injecting it that reward working, rather than reward not working. I do worry about social insurance measures that provide people an incentive not to work. I think that is a legitimate concern. But I worry much more about not providing enough funding and not providing enough demand in the economy, which I think is potentially a more serious problem.”

The House of Representatives recently passed another more than $3 trillion dollar stimulus package, but it was quickly shot down in the Senate. Now rising concerns have emerged that party politics will stall the much-needed assistance for those who desperately require it now. Unemployment benefits will soon expire in July.

The economic news this week continues to be incredibly discouraging. This reminds why gold makes sense in an IRA. For thousands of years now through countless economic and financial crises, IRA-approved gold has provided the ultimate safe haven economically. You can learn more by reading about Top Gold IRA Companies and the Top Five Gold Coins for Investors today.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,727.53

Gold: $2,727.53

Silver: $33.49

Silver: $33.49

Platinum: $1,014.28

Platinum: $1,014.28

Palladium: $1,136.33

Palladium: $1,136.33

Bitcoin: $67,743.12

Bitcoin: $67,743.12

Ethereum: $2,495.34

Ethereum: $2,495.34