4 Silver Stocks To Consider In Your Portfolio

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

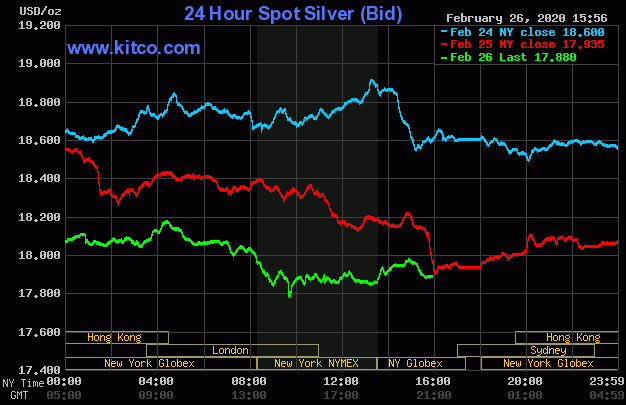

Amid concerns over the spread of the COVID-19 Coronavirus and its effects on the global economy, markets have been on a downward trajectory. Yet, while global stock markets are in turmoil, precious metals like gold and silver have seen significant highs as savvy investors hedge against the economic uncertainties. Moreover, gold stocks and silver stocks have sustained growth, especially since the coronavirus has now reached near-pandemic levels. Here are 4 silver stocks to consider in your portfolio.

MAG Silver Corp

MAG Silver Corp (NYSEAmerican:MAG,TSE:MAG) is a headquartered in Vancouver, Canada, and is one of the top producers of silver in the world. It has both development and exploration programs.

At present, MAG Silver is developing what will become one of the largest silver mines on Earth. The Juanicipio property located in Mexico will support a 4,000 tonnes per day mining operation. The company has a 44% stake in the project, partnering with top precious metals producer Fresnillo, which is the project operator. Commercial production at the mine is expected to commence by June 2020, ahead of schedule. MAG Silver announced that the project is now expected to reach 85% nominal capacity by the fourth-quarter of 2021 (with previous governance at 65%), and 90% to 95% by 2022. The company has reported additional silver discoveries through its exploration program at the property.

Fortuna Silver Mines

Fortuna Silver Mines (NYSE:FSM, TSE:FVI) is a Vancouver, Canada-based silver producer with mining operations in Mexico and Peru. The San Jose Mine in Mexico produces silver and gold, while the Caylloma Mine in Peru mines silver, lead, and zinc. The company also has a third mine under development in Argentina, with production expected by mid-2020. In 2019, Fortuna mined a total of roughly 18 million oz. of silver equivalent.

Akin to many other silver producers, Fortuna has diversified into other precious metals, principally gold. The mine in Argentina, known as the Lindero Project, has an initial mine life of 13 years and will add 90,000 oz. of gold production this year.

The company has maintained a strong balance sheet, and as of Q3, it has $77.2 million US in cash and $150 million US credit facility.

Franco-Nevada Corporation

Franco-Nevada Corporation (FNV) is a streaming and royalties company, with stakes in precious metals like silver and gold, in addition to oil, and gas. However, the company’s primary focus is precious metals, with 80% of its revenue coming from gold, silver, and platinum group metals (PGMs).

Franco-Nevada is the largest steaming company in the world, with a market cap of $25.76 billion. It has been extremely profitable, and has increased dividends eleven consecutive years since its IPO over a decade ago. In addition, the company maintained its dividend growth and outperformed the gold price after it plunged. In 2019, the company saw gains of 40%.

Franco-Nevada provides the capital in return for a royalty on whatever a mining operation produces. Additionally, it holds the rights to a stream of precious metal or oil supply of a producer. Franco-Nevada, itself, neither owns mines nor conducts exploration or develops projects, meaning that it never has the capital expenditure of those components. Because of its large, and diversified portfolio, Franco-Nevada has little of the downside risk potential that producers are faced with when there is a decrease in the price.

Silvercorp Metals Inc

Silvercorp Metals Inc (NYSE American:SVM, TSXSVM) is based in Vancouver with mining operations focused in China. Silvercorp Metals is the largest producer of silver in the Asian nation. Additionally, it also has mining operations extracting lead, zinc, and gold. By the fiscal year ending March 31, 2019, Silvercorp reported the production of 6.4 million ounces of silver, 64.8 million pounds of lead, 22.7 million pounds of zinc, and 3,500 ounces of gold.

The company operates four mines in the Ying Mining District in Henan, China: the SGX mine, HPG mine, TLP mine and LM mine. The SGX mine is considered Silvercorp’s flagship operation and produces silver, lead, and zinc. It is the company’s largest mine.

For the third quarter ended December 31, 2019, Silvercorp reported a net income of $6.3 million, $0.04 per share. It sold 1.7 million ounces of silver, 18.8 million pounds of lead, and 8.4 million pounds of zinc. The company increased revenue 5% to approximately $44.5 million, compared to the previous year quarter. Silvercorp also has a strong balance sheet with $155.1 million in cash and cash equivalents and short-term investments, up 15% from the second quarter.

Because of the increasing fears surrounding the coronavirus outbreak, global markets have been in turmoil. For the fifth straight day, the markets were rattled amid concerns of the repercussions the virus will have on the global economy. However, amid this unrelenting chaos, precious metals like gold and silver are enjoying substantial highs. Many analysts are speculating that the bear market in silver is coming to an end. As a hedge against market volatility and a method of wealth protection, investing in gold and silver is an excellent diversification strategy. A good way is investing in precious metals through your IRA, but it is essential to understand the Precious Metals IRA rules and regulations enforced by the IRS. Before making any investment decisions, always consult a financial professional and do your due diligence.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,447.76

Gold: $3,447.76

Silver: $39.73

Silver: $39.73

Platinum: $1,366.64

Platinum: $1,366.64

Palladium: $1,117.75

Palladium: $1,117.75

Bitcoin: $108,459.67

Bitcoin: $108,459.67

Ethereum: $4,480.21

Ethereum: $4,480.21