- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

3 Factors That Could Kill The American Recovery Before It Even Begins

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 28th December 2020, 11:48 pm

After years of a brutal recession, things are finally turning around in America. Unemployment’s down to pre-recession levels, the stock and housing markets are bouncing back, and American workers are even getting pay raises.

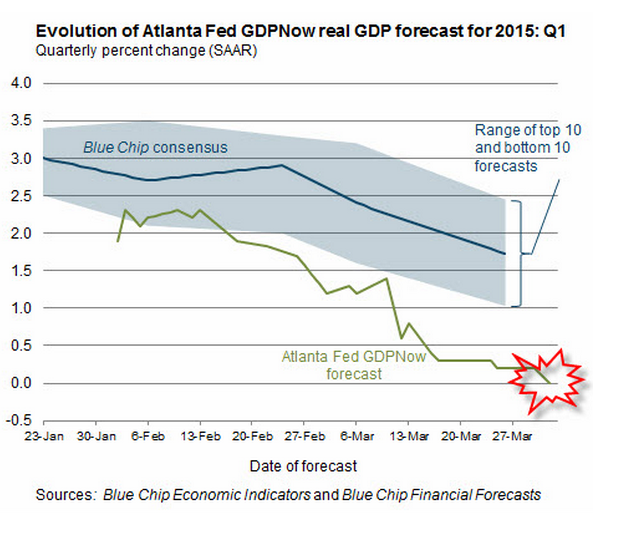

Don’t get too comfortable though because there are various signs hinting that the recovery might already be falling apart. The Atlanta Fed has just downgraded its GDP growth forecasts for the first quarter from a 2.3% down to 0.0%, pushing us to the edge of recession territory.

The Fed is playing this off as a blip but this seems like too sharp a drop to not be worried. This decline is likely the result of three serious problems which could kill the American recovery before it even begins.

Problem 1 – A strong dollar is crushing American exports

Over the past year, the dollar has soared against other major currencies, especially the Euro. While the American economy isn’t doing amazing, it’s still in much better shape than the Eurozone and Japan while developing economies are also slowing down. At the same time, other central banks are taking action to depreciate their currencies. For example, the ECB recently launched a new round of QE programs to lower the value of the Euro.

This is starting to take a toll on American companies. Multinational firms like IBM, McDonalds, and Walmart all expect to have lower earnings because of the stronger dollar. On average, firms expect that for every percentage point the dollar appreciates against a basket of other major currencies, their earnings will fall by 2%. This is troubling considering the dollar has gained well over 20% against the Euro over the past few months.

It seems like the rest of the World is exporting their economic troubles to America and we simply aren’t in a strong enough position to handle them. That’s why our recovery is already slowing down.

Problem 2 – Fed tightening could derail the stock market

While the stock market continues to set records, no one should feel confident that this will last. It’s very likely that the current bull market is only being supported by extremely loose Fed monetary policies, a problem we’ve covered in detail here.

Basically, the Fed has kept interest rates around 0% for years. This had made it extremely easy for firms to borrow money. As a result, companies that would normally have gone under have been able to survive and profit thanks to the never ending flow of “free” money.

As soon as the Fed raises interest rates, which it should do later this year, many of these firms will be unable to manage their borrowing costs and could go under. This could create a domino effect that will take down the entire stock market.

Problem 3 – California is running out of water

This is scariest and potentially most serious problem facing the country: California is running out of water. The state is going through the worst drought ever in the history of the United States and it doesn’t look like weather patterns are going to improve. Governor Brown has just announced unprecedented water usage restrictions to address the problem but these restrictions likely aren’t enough. By some estimates, California could be out of water in a year. This would not only be a disaster for California, but for the entire World.

First, if California were its own separate country, it would be the 8th largest economy in the World so a recession here would be felt across the globe. Property values are starting to fall in drought-affected areas while the Californian agricultural sector is bracing itself for a brutal year.

What’s even more concerning is that California is so important for the World’s food supply. The vast majority of America’s fruits and vegetables come from California, especially in the winter. Food prices are already up 6.3% since 2011 with chicken and beef prices up close to 20%. Things could get a lot worse especially as the World is starting to struggle with food shortages. High food prices will put a damper on consumer spending and hurt the economy, but if things keep spiraling out of control this could be the least of our worries.

Impact for investors

Any one of these factors would be scary. When you consider all three, it’s hard to see how America can maintain its recovery. Remember, our current bull market has been going on for six years while the average bull market only lasts four. Our current economic expansion has been going on for 70 months while the average expansion only lasts 57 months. We’re overdue for crash.

Investors should take action to protect their portfolio by moving out of the stock market and locking in their gains while they still can. Now would be a good time to buy gold and other safe assets in anticipation of another crash. If the World really unravels, gold and other precious metals might be the only assets that can hold their value.

Americans have suffered enough and in a fair World, we’d still have years of recovery ahead of us. Unfortunately, that’s not the World we live in. Thanks to these three serious problems, investors should anticipate that America’s recovery won’t last much longer.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68