- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

3 Charts that will show you how UNDERVALUED Gold is right now…

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 26th January 2015, 04:50 pm

Marc Faber is one of the more noteworthy ‘gold bugs’, sharing a seat at the front of the gold bus with the likes of Peter Schiff. The Swiss investor correctly predicted the huge spikes in oil prices and emerging markets funds in the 2000s, and he called the rise in precious in the beginning of this decade. Faber has long-since lost faith in the dollar, and he's not the only one.

He’s now sounding the gold alarm again, claiming that government assets are dramatically overvalued and that gold is proportionately undervalued.

By ‘government assets’, Faber means the bond bubble, which thus far has been saved by long-running, near-record-low interest rates. His point is well taken: there has never been so much debt (consumer and government) in the history of the world, and it has also never been so expensive. The laws of economics suggest something has to give, which is one major reason why gold beats government bonds as a hedge in your retirement portfolio.

It’s not as though bond yields have been setting the world on fire lately, either. Even if you use the almost-deliriously understated Consumer Price Index figures, government bonds are still producing at a below-inflation level, meaning that you are on net becoming poorer each year that you hold on to bonds.

Measuring How Undervalued Gold Is

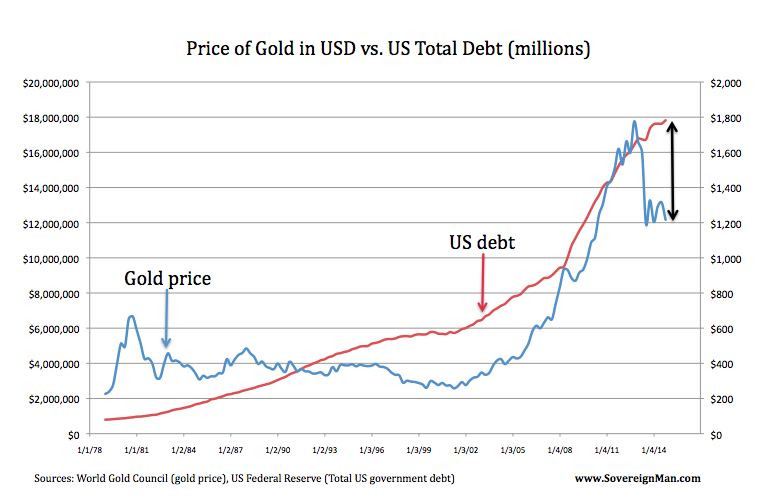

Faber also appears to be right about the value of gold. Over the past 40 years (since the end of the Gold Standard), gold has a very strongly correlated relationship with total US Debt levels (see chart).

As you can see, gold has never been so undervalued relative to US debt.

Even if gold doesn’t immediately bridge the gap in that you see in that chart, there is no reason to believe that the United States is going to stop piling on more debt and printing more money. It’s why the dollar is in trouble, and why gold is a more sound asset that fiat currency.

Gold has tracked the Federal Reserve’s 10-year interest rate with a very strong correlation, but now the metal appears to be undervalued in a very similar way to how it was undervalued in late 2009 – early 2010, when the price of gold appreciated from less than $1,100 / oz. in Q3 2009 to $1,500 / oz. by the start of 2011.

Not only are gold prices presently undervalued against real interest rates, but real interest rates are near historic lows. When real rates finally begin their climb, don’t be shocked when the value of gold explodes.

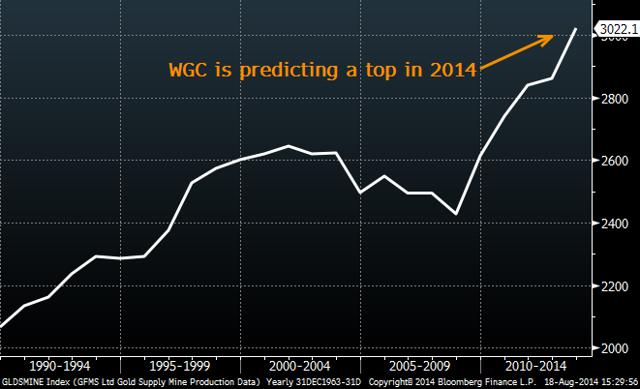

Gold Production Should Slow

Gold production carries on at a steady pace, its supply capped by a finite amount of ore and geographic, technical, and regulatory hurdles. In fact, the average length of time required to build a functioning gold mine has doubled (20 years from 10) over the past decade. The World Gold Council predicted that mining would peak in 2014, before production and development begins sliding in 2015.

A reduction in supply should only exaggerate the expected future value of gold.

Gold Demand Should Increase

There is little reason to believe that global demand for gold (and other precious metals) is going to slow anytime soon. China and India, two of the most gold-hungry populations in the world, have enormous and burgeoning middle classes. The Euro Zone and the United States are both in rough economic shape, meaning that, unless the global economy has a miraculous cure around the corner, gold will continue to present an attractive long-term hedging option.

Stick With Gold Bullion

One of the side effects of gold’s timidity this year has been that mining companies, which expanded on the assumption of 2011-level prices, have struggled to the point where they are now undervalued and drawing a lot of interest from private equity investors. This is one of the reason that certain (but not all) mining stocks have gained at a more impressive clip than gold over the past several months. Like all gold equities, however, these stocks are prone to huge boom-bust shocks.

When gold begins realizing its value in the near future, you’ll probably hear a lot of noise about mining indexes and fully funded companies, but we still prefer the actual investment metal as a buy-and-hold proposition for long term stability and inflation hedge.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81