Retiring With 1 Million Dollars: A Roadmap Investment Strategy for 7-Figure Wealth

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 28th August 2022, 09:27 am

1 million dollars might sound like an amount of money you may never be able to reach. However, by investing consistently and with discipline, you can find yourself with this type of fortune or more as the years go by.

Never think it’s too early, or too late, to start investing. Keeping as high a percentage of your yearly income as capital to make investments can go a long way. Think, for example, that you could save 10% of your income to allocate to investments every month or year. And you shouldn’t be in a position where you would miss 10% of your income.

Let’s say you save $10,000 of yearly income to make investments. Remember that money left in a bank account will not grow as rapidly as money invested in assets. With an average growth rate of 10%, your investments would turn into just over 1 million dollars in 25 years.

That’s on a compounded growth basis and without adjusting for inflation. But you can see that with some application and research in making the right investments you can gather a very interesting pension nest or retirement savings.

Table of Contents

Consider Your Needs

Before committing your cash to any investments always consider how much risk you are willing to take. And whether you may need access to the cash in a timely way. Many people buy real estate, but if you put all your cash into a condo, it can take months to sell if you need the cash.

So, can you wait for those months to go by? Or would you be forced to sell at a discount, and maybe take a hit on your investment? If you are one hundred percent certain you will not need any of the cash you put away for investments, then liquidity is not a concern.

However, prudence and thinking of the unforeseeable means that you should always have a high percentage of your investments in assets that are very liquid. In either case, having a diversified portfolio that reduces your overall risk will almost inevitably include some liquid assets.

Eliminate Debt

Financing your debts can be a big drag on your investment goals. Of the investments we are about to consider, it is very unlikely that any of them will consistently pay out returns similar to the interest you pay on a personal loan or credit card.

Credit card debt is the first thing you need to clear up, many carry interest in the 20 percent region. But even personal loans are a big drag, with many of these loans priced at around 15 percent. Then you may have a mortgage, and here things are a bit more complicated.

Mortgage loans carry a relatively low-interest charge as you are putting up the equity of your house in case of failure. So, it may be a good choice to keep your mortgage with a low-interest rate payment when compared to the returns you may receive from your investments.

1 Million Dollar Goal: Invest For the Long-Term

Investing with the goal of reaching 1 million dollars is a long-term affair. When you make investments with this goal in mind it’s not an overnight miracle. Neither are we talking about actively managing your investments. And even less are we talking about trading.

Both activities carry even more risk than simple buy-and-hold strategies. Trading involves leverage to achieve substantial returns in short time spaces. With leverage comes extra risk, and trading is ultimately about timing the markets. Something most of us don’t have the time or the experience to successfully achieve attractive returns.

In simple terms, think of your investments as longstanding reserves. When you are invested in the long-term you can withstand market volatility. Where price decreases may offer an opportunity to invest in the asset at a cheaper price.

Alternative Investments

Stocks and bonds are the investor's choice for their high level of liquidity and easiness to understand what these assets represent. However, alternative assets are a fundamental choice when constructing a long-term portfolio.

The returns of most alternative assets have a low correlation to the returns of traditional assets such as stock and bonds. This feature means that you will not always see returns of alternative and traditional assets move in unison. This can create protection in times of financial market crises as alternative returns may not necessarily suffer the same fate as stocks and bonds.

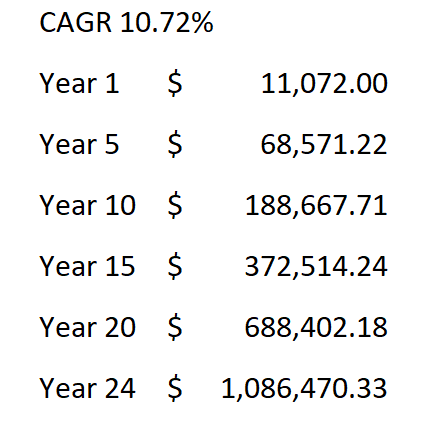

We know from past performance that the broad stock market has had an average return over the past 30 years of 10.72 percent. Using a financial calculator, we can see that the above example would now take just over 23 years to reach 1 million dollars with a compounded growth rate of 10.72 percent. The table below shows the progression of the value of your investments as your growth is compounded.

So, if we are looking at investments to make in alternative assets to construct a widely diversified portfolio, we also know what returns we should look for. Or in other words, we want to consider alternative assets that have average returns similar to or higher than those of the broad stock market.

Real Estate

Physical real estate is a tricky business to enter but can produce returns that have a low correlation to stocks and bonds. The greatest risk factor with real estate is liquidity. It’s fairly easy to identify and buy a property. But when it comes to selling, things can take much longer.

Investing in physical property as opposed to REITs means that you are sure of not seeing yourself in an immediate need for the cash you locked into that investment. REITs are liquid and quoted on public exchanges for price transparency.

They offer exposure to property returns, yet they are much more liquid. However, they also have a high correlation to stocks. So, you may find that in a general stock market rout these stocks also suffer.

Physical properties allow for much more stable income streams, and you will rarely see your property devalued in half. Having said that, getting on the property ladder may take longer than investing in REITs.

Gold

Gold is one of the alternative assets that investors use to protect their portfolios from shocks in the prices of traditional assets. Gold is known to have various characteristics that include protection from inflation and diversification of returns.

Gold has a very low correlation to the stock and bond market. Meaning that even if the stock market has a bad year your gold investment may not follow the same course. On the other hand, gold does not pay any dividends, therefore there are no income streams. Although many blue-chip corporations don’t pay dividends either.

That’s the price for holding an asset that can protect you from a market rout. It’s a bit like paying a premium for your insurance policy. Nevertheless, gold has had some healthy returns over the past 22 years.

Source MacroTrends

Source MacroTrends

As we can see from the chart above, comparing gold returns to those of the Dow Jones Index, gold has outperformed stocks in a big way. Not only that, but the gray areas of the chart delimiting the previous recessions, show how gold also held much better during these periods.

Cryptocurrencies

Cryptocurrencies are a very new asset class. Compare it to gold which has been around for millennia. But even to stocks and bonds that have been around for centuries. But in my opinion, that doesn't disqualify it at all.

Rather, I would look at the utility of such assets. And I would also look at who is getting involved. Many bankers have made a complete 180-degree turn when it comes to crypto. Jamie Dimon, CEO of JP Morgan, once had a very skeptical view of cryptos. But has recently been making bullish comments about Bitcoin.

Various funds invest in blockchain technology and crypto assets, think of Grayscale. In Canada Fidelity has already set up a Bitcoin ETF. And more and more pundits are getting involved with positive forecasts for crypto.

In our opinion with a long-term investment horizon decentralized finance has a lot to offer. And the main cryptocurrencies like Ethereum and Bitcoin should consolidate into reliable assets.

Portfolio Allocation

Let’s have a look at what a portfolio might look like for someone investing to reach that 1-million-dollar goal. We always recommend speaking to your financial advisor before making any hard commitments.

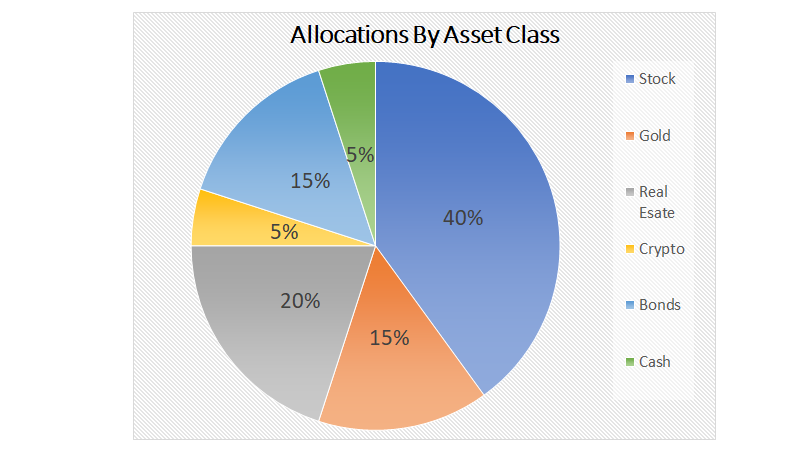

If you are investing for the long-term you may allow yourself a high level of risk tolerance. This comes from the fact that if there is a selloff you are more likely to weather the storm as you have time to wait and see your investments turn positive again.

In other words, you should have a high-risk profile for the type of portfolio we are about to envisage. This factor would allow you to allocate 80 percent of your capital to risky assets, 15 percent to bonds, and a cash reserve of 5 percent.

In case you are wondering, the 5 percent cash reserve is for situations unknown, or for an investment that may prop up punctually. In which case, you would need to have some cash at hand perhaps.

The allocation pie chart is an example of what an investor may construct for their portfolio. However, it gives a general idea that stocks may not be the only risky asset worth investing in. I added some crypto as I personally believe these digital currencies and the blockchain they are based on have applications and are making an impact.

However, they are also very risky, and I believe any sound investor should take a stake in this new asset class with caution. We have already seen how Bitcoin has gone from over $65,000 to at one point, to then touch $17,500 recently. That's a helter-skelter ride, so hold your hat if you get on.

Flexibility

Bear in mind that you should have some flexibility in your asset allocation as time goes by. The above example would probably fit best a younger person, as the overall exposure to risky assets is quite high. The closer you get to retirement the less risky assets you should own.

Having said that, there is only one risky asset we recommend maintaining the same percentage. And that is gold. So, getting closer to retirement you might want to readjust your allocations. We recommend reducing other risky assets but increasing gold and bonds.

We say that based on the protective qualities of gold and that it is and always has been a store of value under any conditions.

Bottom Line

Investing for the long-term means you should take advantage of retirement savings accounts. With these types of accounts, you can maximize your investment growth in a tax-free environment. So, it's always wise to max out your 401k, or IRA, etc. to get the most bang for your buck.

If you are going to invest in crypto or gold, you will need the expert services of IRA companies that offer their specialized services. We have gone through a great many of them to come up with two lists. You can read our reviews on the top gold IRA companies here. And our reviews on the top crypto IRA companies here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24