When Is The Best Time to Invest In Gold?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 16th September 2021, 06:36 pm

Although gold has strong growth potential—after all, the commodity saw gains of +28% in 2020—the yellow metal is rarely sought after for this reason. For centuries, investors have coveted gold mainly for its properties as an inflation hedge and a portfolio stabilizer.

Research has found that the spot price of gold moves independently of the stock market. During times of economic turbulence, gold bullion tends to fare well compared to the S&P 500 Index or the Dow Jones. In 2009, during the depths of the Great Recession, the Producer Price Index (PPI) for gold rose +12.8% when the stock market was in shambles.

Recent economic events have led many investors to question whether now is the right time to invest in gold. But is now really the best time to invest in gold? Let's see what the data has to say about timing the gold market, and whether we're seeing an entry point today.

Table of Contents

The Best Time to Invest in Gold: A Look At History

There are several sustained periods in recent history where the price of gold saw significant growth, including these five notable cases:

- Black Monday (1987): Gold up +4.2% on October 19, 1987.

- Iraq-Kuwait War (1990): Gold up +11.1% between August 1 and 14, 1990.

- Dot Com Crash (2000-02): Gold up +18% between October 2000 and 2002.

- Financial Crisis (2007-10): Gold up +78.9% between October 2007 and 2010.

- Coronavirus Crash (2020-): Gold up +7.6% between Dec. 2019 and March 2020

The common denominator among the above growth periods is that they all coincided (and not incidentally) with recessions or stock market downturns. When investors have little confidence in the stability or upside potential of the stock market, they tend to seek stability in uncorrelated assets such as gold, silver, and cryptocurrencies.

Although there are exceptions to every rule, the historical trend for gold and other commodities is that they rise in demand when the stock and real estate markets are underperforming. This is because investors seek out gold as a form of “portfolio insurance” to hedge against the risk of market failure in traditional financial markets.

Fed Policies in 2021-2022: A Golden Opportunity?

Following the onset of the COVID-19 pandemic, the Federal Reserve initiated another round of quantitative easing (QE) in March 2020. This involved cutting federal interest rates to virtually zero while simultaneously freeing up $700 billion of liquidity into circulation.

The total budgetary resources committed to mitigating the economic impact of COVID-19 in the United States total $4.5 trillion—yes, trillion—as of May 2021.

At the moment, the inflation rate in the U.S., as measured by the consumer price index (CPI), is sitting at a 13-year high (4.2%). Small wonder, considering the rate at which liquidity has been pumped into the financial system. Although the Fed has committed to keeping rates low for the time being, it's only a matter of time until the next hike in order to keep rising inflation at bay.

The current spot price of gold is down significantly from its all-time high on August 7, 2020, when the yellow metal hit $2,067.15 per troy ounce. If you’re wondering when to buy gold, there appears to be a window of opportunity given the surrounding macroeconomic environment—if future trends continue, we're likely to see positive price action soon for gold.

When Is The Best Time To Buy Gold During The Year?

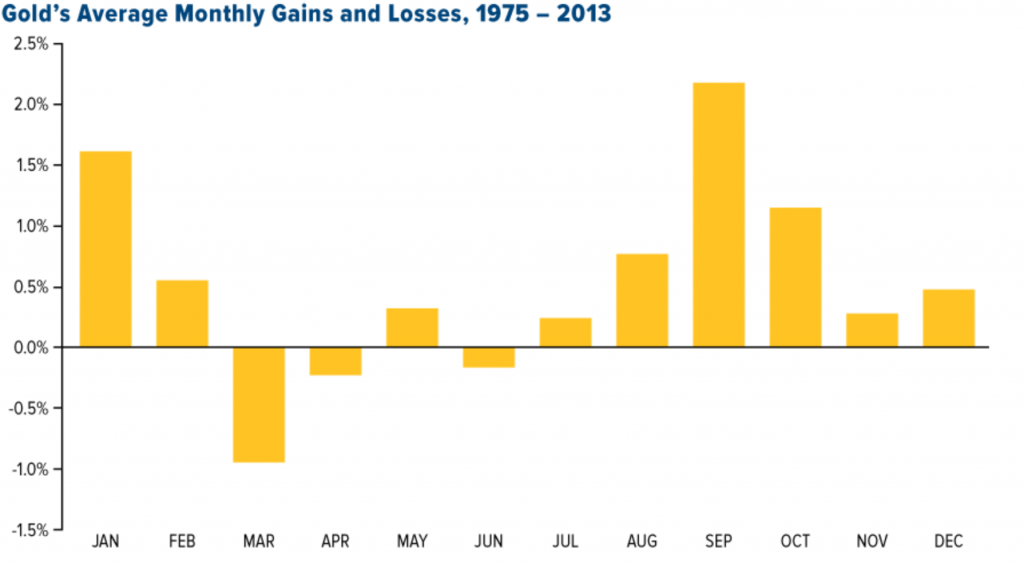

Historically, the best months to invest in gold have been during the second quarter of the year. The average monthly net price movement by month indicates that gold prices are typically at their lowest between March and June relative to the rest of the year.

As indicated in the graph below, research from London Bullion Market (LMBA) compiled between 1975 and 2013 finds that Q2 gold prices tend to be ideal entry points for buyers. By contrast, the worst time of year to buy gold is in September and January, when prices tend to be at their highest point (2.25% and 1.5% average gains, respectively).

Source: Mining.com

Therefore, historical trends indicate that now until June 30 appears to be the ideal entry point for investors looking to buy physical gold.

However, knowing when to invest in gold also comes down to reading macroeconomic indicators. For example, if the Fed announces their intent to raise interest rates (and therefore exert contractionary effects on the stock market), then many investors would interpret this as a bullish signal for gold.

A Word On Timing The Market

Remember, past market performance is no guarantee of future results. Simply because markets have behaved a certain way in years past does not mean that history will repeat. For this reason, many successful investors caution against trying to time the market.

Instead, consider incorporating a dollar-cost averaging (DAA) strategy for adding gold to your investment portfolio. In the long run, acquiring an asset incrementally over time (i.e., making regular purchases every month or quarter) helps minimize the negative impacts of volatility in the market and avoid buying at disadvantageous times.

Is It The Best Time To Invest In Gold?

Short of having a crystal ball, every economic indicator points to good days ahead for gold and precious metals. Fortunately, you don't need to be clairvoyant to see the writing on the wall. With the Fed's immense QE campaign, rampant fiscal spending, and a potentially looming inflation crisis, now is the time to load up on the yellow metal.

Gold bullion is one of the only time-tested solutions for combating inflation and recessionary action in the stock market. To prepare your retirement portfolio for the next economic downturn, and to hedge against monetary risk, consider dedicating a small portion of your net worth to gold and precious metals.

If you're interested in diversifying your portfolio with physical gold bullion, download our free gold IRA guide. In it, you'll find everything you need to know about adding gold to your retirement account while avoiding the most common (and costly) mistakes for beginners.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,408.31

Gold: $3,408.31

Silver: $38.91

Silver: $38.91

Platinum: $1,356.66

Platinum: $1,356.66

Palladium: $1,114.94

Palladium: $1,114.94

Bitcoin: $112,480.93

Bitcoin: $112,480.93

Ethereum: $4,502.64

Ethereum: $4,502.64