What Happens to Your 401(k) When You Quit?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 21st December 2022, 02:11 pm

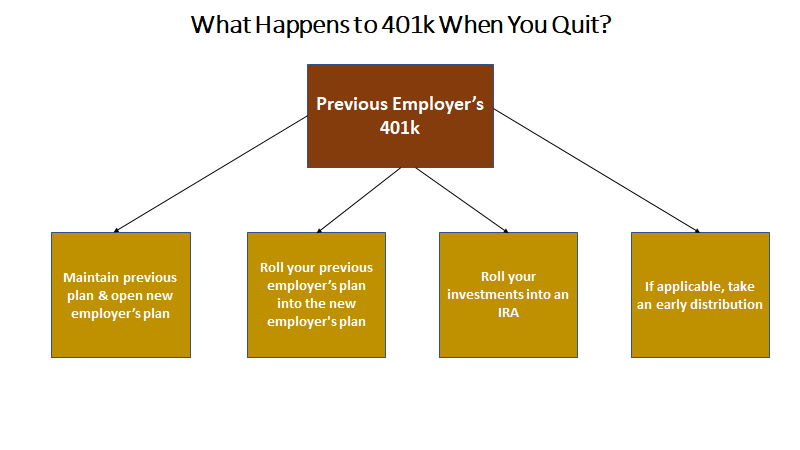

When you quit your job you have various options available for your 401(k). These plans are very common, so the question What happens to 401(k) when you quit? impacts a lot of people. In this article, we’ll go through the 4 options you have and their implications.

Table of Contents

401k Options When You Quit Your Job

These are the four options you can consider for your 401k when you leave your employer. Each person’s situation is very different, so we recommend you speak to your financial planner before making a final decision.

- Leave your money in the current 401(k)

- Roll your investments into your new employer’s 401(k)

- Roll the 401k account into an Individual Retirement Account (IRA)

- Take a cash distribution – limits apply

Keeping Your Previous Employer’s Plan

When you leave an employer with a 401(k) you may be allowed to keep the plan as it is. The choice usually depends on whether there is enough money in the 401k. For most plans, it’s $5,000. If you do have enough money this may be an easy option to choose.

In this case, you won’t be required to do any extra paperwork. You can keep your cash in the investments within the plan. However, you won’t be allowed to add any further contributions to this plan.

Rolling Investments into Your New Employers 401(k)

If you are starting a job with a new employer you may have the option of opening a new 401(k). You may roll over the investments of your previous employer's plan into your new 401(k). A lot probably depends on how happy you are with the previous plan's choice of investments and fees.

Or you may simply want to keep all of your 401(k) investments in one place. As you won’t be able to make any new contributions to your previous employer’s plan some people prefer not having to worry about a second 401(k) and most likely with a different administrator.

Most employers will want you to serve a minimum number of days before being eligible for a matched contribution 401(k). Once your new plan is open you can check that you are allowed to perform rollover.

The best way to do this is to ask the administrator of your old 401(k) to transfer the funds directly into your new plan. This type of transfer is known as a direct transfer, from the custodian of your old plan to the custodian of your new plan.

It also helps you avoid any possible penalties from the IRS, which might consider it an early distribution otherwise. Another way of rolling over your 401(k) is the indirect transfer. In this case, you receive a check directly from your previous employer's 401(k).

The procedure is a bit trickier as you have 60 days to deposit the funds in full into your new plan. Otherwise, the IRS will consider you to have taken an early distribution. If you are under the age of 59 ½ usually you must pay a 10 percent penalty on top of any taxes.

Another drawback of this method is that your previous employer will be obligated to hold back 20 percent of federal income tax and any state taxes.

Rolling Over to an IRA

IRAs come in two types: traditional or Roth. With a traditional account, you contribute before-tax dollars. With a Roth account, your contributions are after-tax. This also allows you to make early withdrawals without any penalty.

Even if you are starting a new job with another employer offering a 401(k) plan, you may want to take advantage of the extra freedom of asset classes involved with IRAs. By rolling over to an IRA you can invest in a much wider variety of assets.

These IRAs are known as self-directed IRAs, and they allow you to hold real estate, single stocks, precious metals, and cryptocurrencies. Specialized companies offer their services for specific asset classes such as gold and cryptocurrency.

If you don't already own an IRA this may be an opportunity to open one. IRAs have much lower contribution limits than 401(k). So, opening an IRA with the funds from a rolled-over 401(k) may help build up enough capital to give you more choice in diversifying your assets.

Cashing Out Your 401(k)

You can also choose to take a cash distribution from your 401(k) account, but this is generally not a good idea. If you are under age 59 1/2, you will generally have to pay a 10% penalty on the distribution, in addition to regular income taxes. Taking a cash distribution can also deplete your savings and reduce your ability to save for retirement.

If you have a Roth 401(k) and have held that account for at least 5 years you can take early distributions without paying income tax on the principal amount. Taxes will be applied to the earnings accrued in the plan. However, if you are under the age of 59 ½ you must still pay the 10 percent penalty.

Conclusion

What happens to your 401(k) when you quit, therefore, depends on several factors, including the terms of your employer's plan, the type of account you have, and your age. If you are under the age of 59 and a half, you may face penalties for withdrawing funds from your 401(k) account before retirement.

However, you do have options for rolling over your 401(k) balance into a new employer's plan or an individual retirement account (IRA). It's important to carefully consider your options and seek the advice of a financial professional before making any decisions about your 401(k) account. Regardless of your age or the type of account you have, it's always a good idea to plan ahead and make sure you are saving enough for retirement.

Bottom Line

Retirement plans are always a good idea and since you can keep 401(k)s and IRAs at the same time it may be a good idea to expand your retirement savings. Adding gold and precious metals to your savings through a tax-advantaged account can protect you from downside swings in the stock market and inflation.

If you are thinking of opening up a gold IRA you can contact the specialist company in the sector, Silver Gold Bull, you can also read our full review on them here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,329.45

Gold: $3,329.45

Silver: $36.82

Silver: $36.82

Platinum: $1,388.07

Platinum: $1,388.07

Palladium: $1,153.30

Palladium: $1,153.30

Bitcoin: $109,622.77

Bitcoin: $109,622.77

Ethereum: $2,590.46

Ethereum: $2,590.46