We Asked ChatGPT to Make a “Recession Proof” Portfolio, Here’s What It Told Us To Do

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 3rd April 2023, 01:29 pm

The word “recession proof” gets thrown around from time to time in the investing world. In essence, it describes a risk management strategy for limiting the exposure of one’s investments to the effects of the boom and bust market cycle.

Recession-proofing your IRA or 401(k), in other words, means you’re likely to safeguard more of your wealth during economic downturns but accrue less of it during bull markets. It’s a fundamentally conservative approach to investing popular among older investors closer to their retirement age.

The tricky thing is that there’s no consensus strategy for how to go about recession-proofing. A cursory Google search on the subject pulled up a bunch of think pieces, each of which suggested a different formula.

That got me thinking—what would ChatGPT have to say about this?

So, I ran another search through OpenAI’s GPT-4 engine and, well, the results were a bit surprising to say the least. While the debate is by no means settled, it’s pretty notable to see that ChatGPT suggests taking a much large stake in gold than even the staunchest real-life gold bugs.

ChatGPT’s “Recession-Proof” Portfolio (Option A)

Below, I’ve pasted the exchange I had with ChatGPT.

At first, I asked it to provide an example of a well-diversified recession-proof investment portfolio. I defined “recession-proof” as having the qualities of a portfolio that is economically resistant to boom and bust cycles. I also asked it to provide allocation percentages.

Then, ChatGPT responded by offering the following:

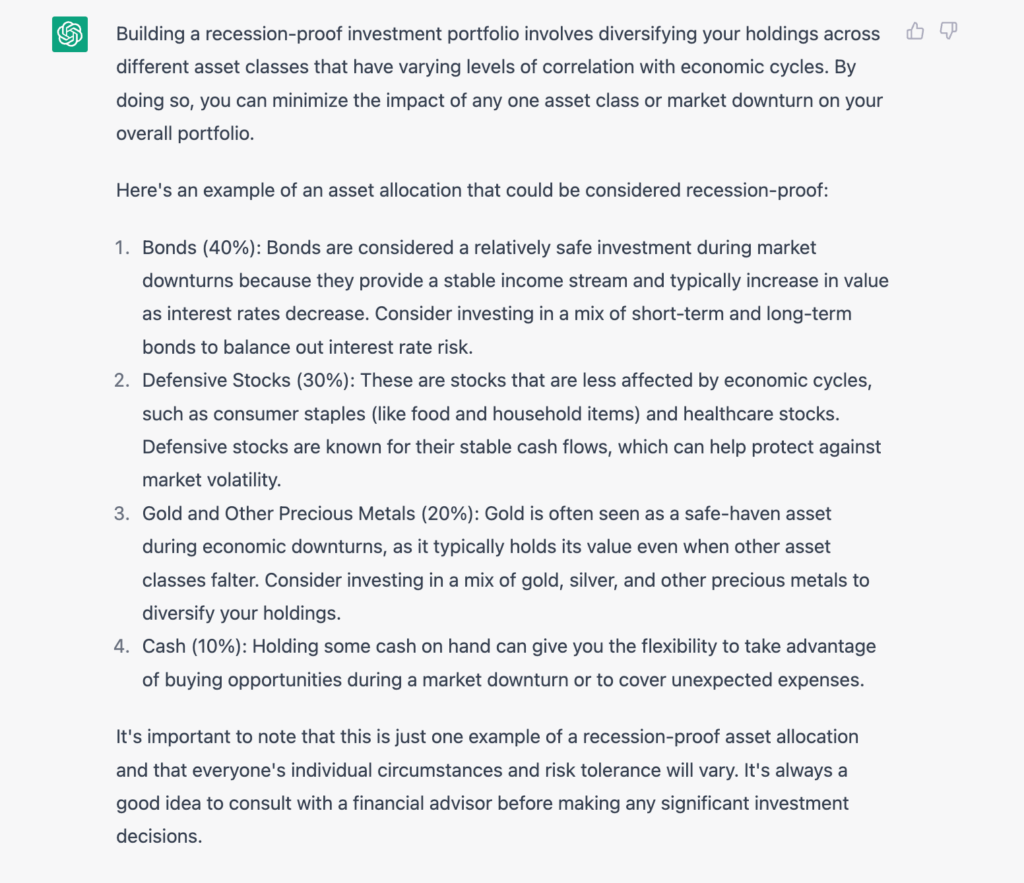

Notice anything interesting about this response? In summary, it suggested the following allocations and weighting across the portfolio:

- Bonds (40%)

- Defensive stocks (30%)

- Gold and other precious metals (20%)

- Cash (10%)

While the assets listed above are fairly standard course as far as hedging instruments are concerned, I was surprised to see ChatGPT recommend a 20% allocation in gold. Even staunch gold bugs like Ray Dalio recommend 5-10% of one’s wealth held in gold.

It seems like ChatGPT is more bullish on gold than even those who’ve made careers selling it!

Wanting to better understand ChatGPT’s perspective, I asked it how its model portfolio would have compared to the S&P 500 during the global financial crisis.

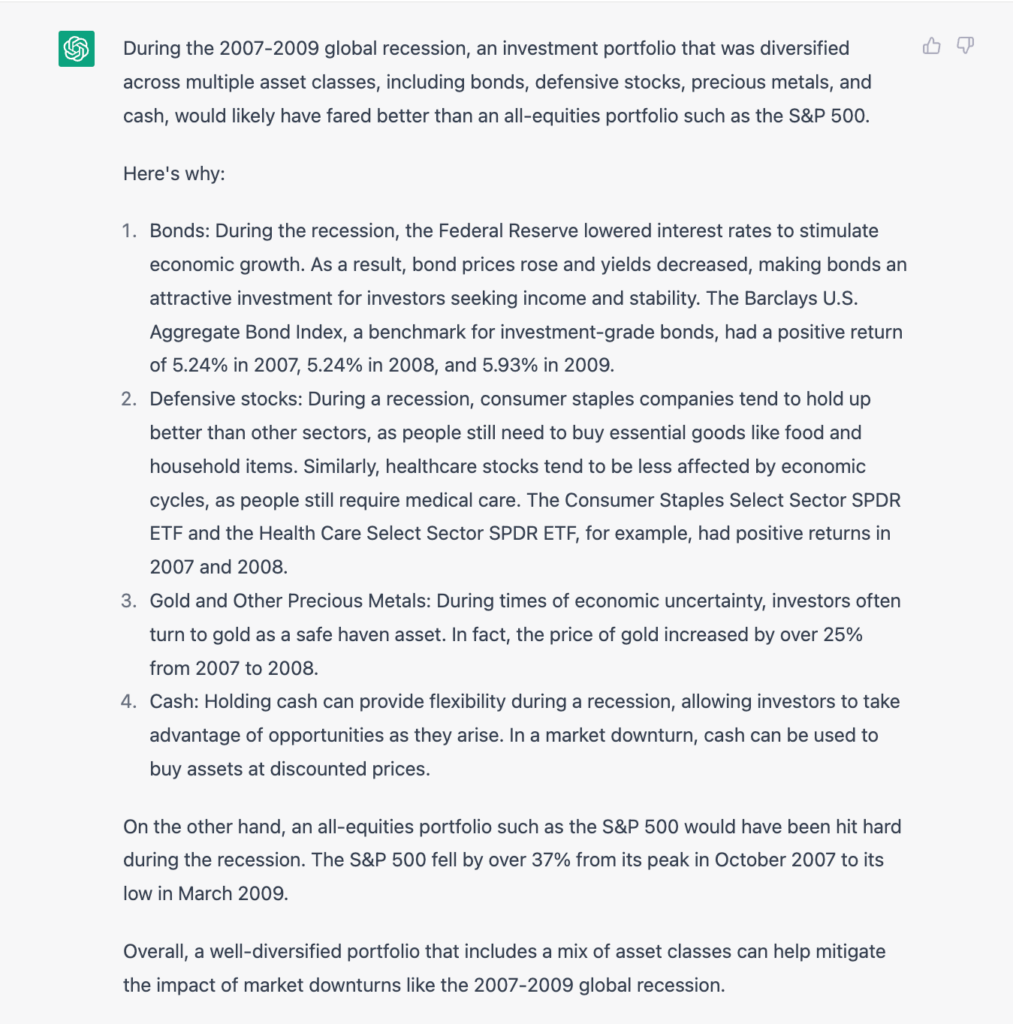

ChatGPT concludes that their model recession-proof portfolio would have performed well during the 2007-2009 financial crisis. Specifically, it notes that the price of gold increased by over 25% during the height of the recession during a time in which the benchmark U.S. equities index, the S&P 500, fell by 37%.

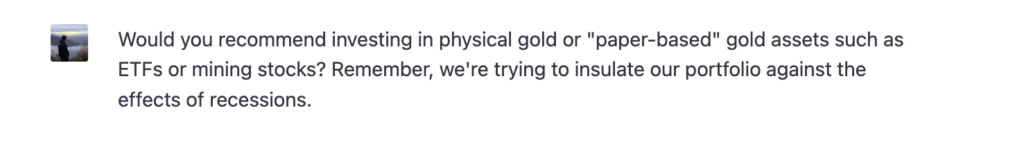

Next, I inquired about the specific type of gold they recommend investing in. As there are many types of gold investments (e.g., ETFs, mining stocks, bullion, coins), I wanted to clarify which asset types ChatGPT would invest in if its goal is to risk-minimize recessionary effects.

Then, ChatGPT took a disappointing turn, veering into ambiguity when I wanted a more precise answer based on its own risk assessments of each asset type. Instead, it weighed the pros and cons of both and suggested that savvy investors are likely best off by balancing investments in both physical and non-physical gold.

I was slightly disappointed with ChatGPT’s response at this point because it seemed to abandon its former objectivity. Rather than weigh the benefits of physical gold against its drawbacks, it only listed its disadvantages; all the while, ignoring the known benefits of physical gold investing such as avoiding counterparty risks.

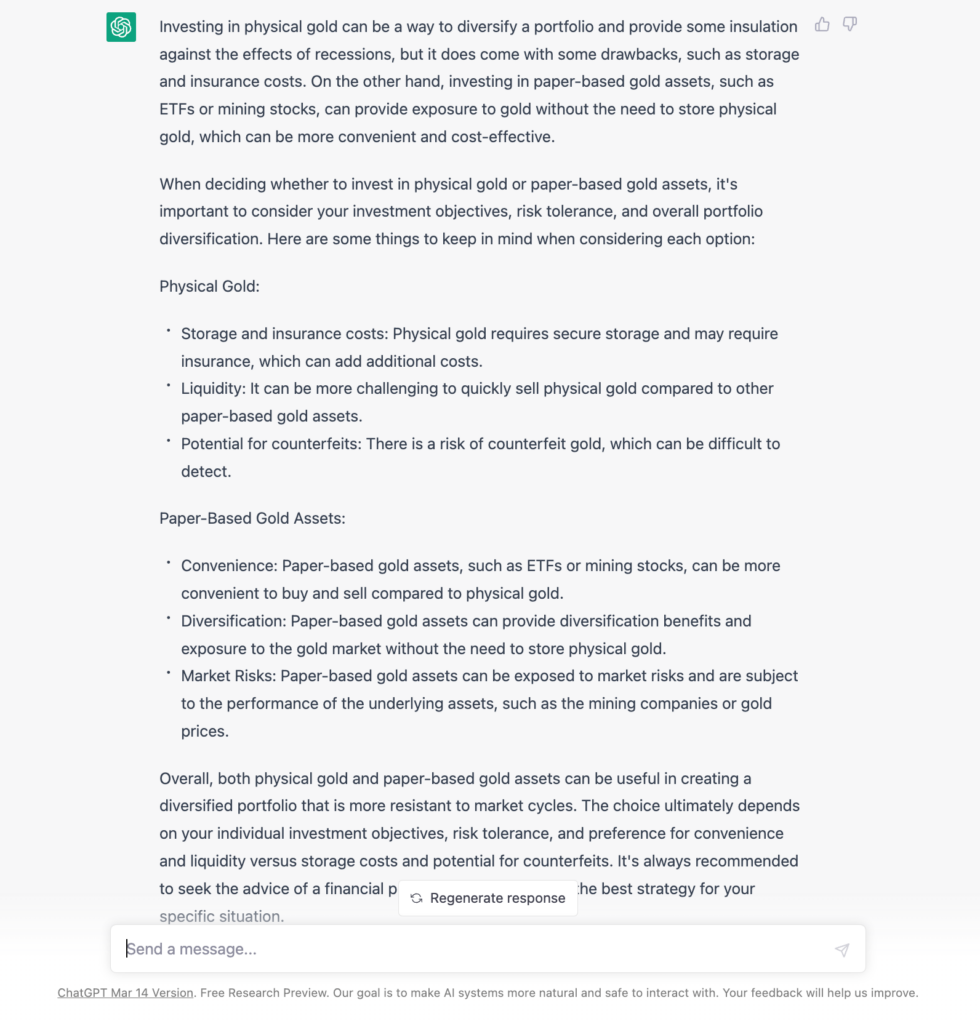

Unsatisfied with ChatGPT’s answer, I pried a bit deeper and asked it a second time what it would invest in, personally, given its stated objectives.

While many pundits swear by the unique benefits of physical gold, ChatGPT is a little more bullish on paper-based gold due to its liquidity benefits and cost-effectiveness. In any case, ChatGPT maintains that both asset formats have their own benefits, and which kind one invests in should depend on one’s individual financial circumstance.

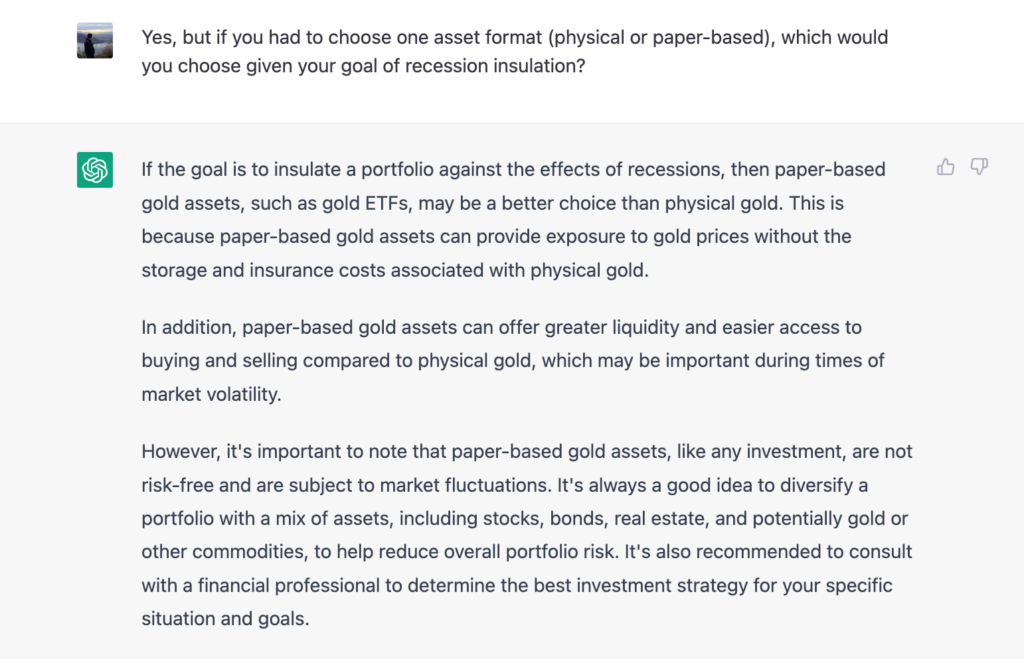

Last, I made a desperate plea to acquire a new robotic financial advisor—I mean, what’s the worst that can happen?

Unfortunately, ChatGPT rejected my offer for it to be my personal financial advisor. It seems as though ChatGPT agrees with the (human) financial advisors we polled about whether artificial intelligence can replace licensed investment professionals.

In Summary: Is ChatGPT The World’s Biggest Gold Bug?

OpenAI’s ChatGPT is clearly a major proponent of gold as a recession hedge, and even advocates a massive 20 percent allocation in the yellow metal. Even gold’s biggest acolytes, such as Euro Pacific Capital CEO Peter Schiff, only recommends a 5 to 10 percent allocation split between both gold and silver assets.

There’s definitely a case to be made that ChatGPT is even more bullish than the likes of Alan Greenspan and Ray Dalio!

While gold and silver investing may not be the ideal solution for every investor, there’s no denying that hard commodities such as these can help manage market risks in one’s portfolio. And not only does an AI program agree, but it suggests dedicating a sizeable percentage of one’s holdings to gold.

If you want to follow ChatGPT’s advice for recession-proofing your retirement portfolio, consider contacting any of our top-ranked gold IRA companies today. Opening a self-directed IRA also gives you the opportunity to invest in other recession-resistant assets, such as real estate and annuities.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24

The post is a good news that more and more investors want to put their money in the cannabis industry. It´s really important.