U.S. Inflation is at 6.2%, a Generational High: How Can You Protect Your Wealth?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 11th November 2021, 04:41 pm

On November 10th, market-watchers recoiled as the U.S. Bureau of Labor Statistics announced that October’s inflation rate has hit a multi-generational high. The Consumer Price Index (CPI), our best record of inflation, reached 6.2% for the first time since November 1990.

While the numbers are alarming, they aren’t surprising.

Since the global outbreak of the COVID-19 pandemic in March 2020, the U.S. federal government has spent $4.7 trillion in total budgetary resources to respond to the public health crisis. This says nothing of state and local-level relief efforts, nevermind the additional trillions in liquidity injected into circulation by the Federal Reserve in the form of quantitative easing.

We’ve always known that the federal government's strategy of throwing trillions of dollars at the pandemic would have consequences. Now we're facing them.

While there is little we as investors can do to reverse the damage to the economy, the important thing is that we protect our individual savings from the effects of inflation. Below, I've shared a general investing strategy designed to safeguard your wealth in an inflationary economy.

Table of Contents

What Is Inflation?

Inflation refers to the increase in prices for goods and services over time; it is the opposite of deflation, which denotes a decrease in consumer prices. In an inflationary economy, your currency is worth less with the passage of time, whereas it becomes worth more in a deflationary one.

There's nothing inherently bad about inflation. A low, stable rate of inflation (the Federal Reserve maintains a 2% target inflation rate) helps incentivize consumption and increases consumer spending—in short, inflation keeps money flowing through an economy.

Think about it: if the value of the dollar rises with time (in the case of deflation), you have an incentive not to spend it. Next year, you would be able to purchase more with the same dollar. In the case of inflation, the consumer is encouraged to spend their money under the assumption that it will be worth less the following year.

Inflation that exceeds a central bank’s target inflation rate is, however, bad for consumers and the economy at large. At 6.2% CPI, today's inflation rate can be characterized as excessively high; it's over three times the Fed's target rate. Under these conditions, wages and salaries cannot keep up with the increase in the prices of goods and services, and the result is that the cost of living becomes less affordable.

What Causes Inflation?

When too much money is available for too few goods or services, inflation ensues. As consumers “bid up” the prices of goods, the purchasing power of their dollars declines in lockstep.

Sometimes inflation occurs as a natural byproduct of economic growth. Periods of economic growth are characterized by the following features:

- Low unemployment

- High wages

- Industry operating at full capacity

Together, these qualities result in individuals earning more money than products are being made. This gap between the acquisition of money and the production of goods can lead to price increases that engender inflation.

Government authorities can also cause inflation inorganically. If a sovereign government decides to print more money, or release more money into public circulation, the general money supply will increase and thereby diminish the value of the preexisting currency.

A Lesson on the Velocity of Money

A key component of price inflation is the velocity of money, which is the speed at which money is exchanged from one party to the next in an economy. It's measured as the ratio of nominal GDP to the measure of the economy's total money supply (denoted as “M1” or “M2”).

The velocity of money is one variable that determines inflation. When money moves more frequently between economic entities, inflation tends to rise as the two metrics are correlated (+0.3).

In 2021, the velocity money has remained relatively low and stable. Throughout the pandemic, money has moved more slowly than it has in decades (M1 Q3 2021: 1.179). Interestingly, inflation has steadily grown to 30-year highs despite the velocity of money being low.

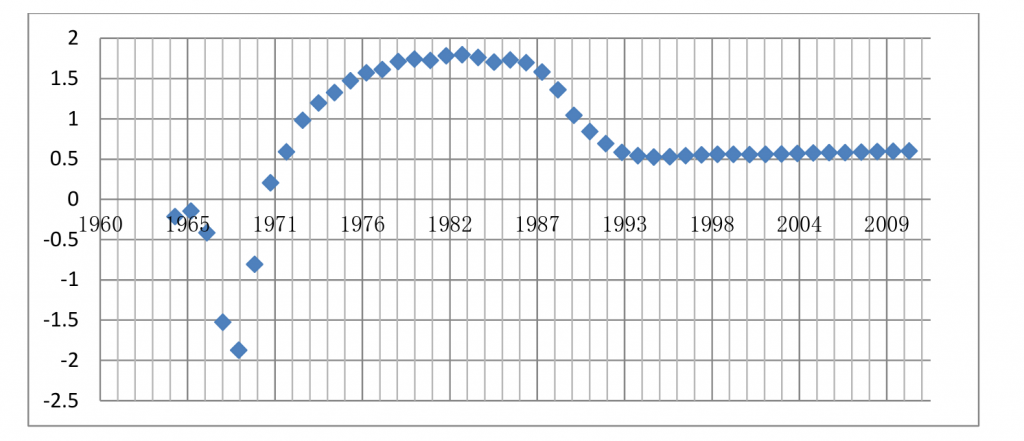

Figure 1. Source: Dr. Tong Cao et al.

The chart above (Fig. 1) shows the positive correlation between the CPI and the M1 money stock. Given that the CPI tends to increase when the money supply increases, it could be the case that inflation will rise even higher when post-pandemic spending frequency accelerates.

In other words, inflation could get worse before it gets better. As we resume our pre-pandemic spending habits, the velocity of money may increase and spark an even more inflationary environment.

The Role of the Federal Reserve

Central banks, such as the Federal Reserve, control inflation through monetary policy. If the economy is a river, you can think of the Federal Reserve as a dam. Central banks can print money to increase its supply, or inject liquidity into circulation by lowering interest rates on short-term loans offered to banks, akin to a dam releasing water from a reservoir when natural flows are inadequate.

The pandemic has seen the Federal Reserve maintain an all-time low federal funds rate of 0.25%. A low interest rate environment supports inflation by incentivizing borrowing (by making borrowing nearly free) and debt-financed spending.

Governments and central banks attempt to control inflation through the adjustment of interest rates. High interest rates make it more expensive to borrow money and therefore encourage spendthriftiness; this, rate hikes are utilized to cool-off an economy and reduce inflation.

To mitigate the damage of excessive inflation, the Fed will likely increase interest rates in the months ahead. Fed Chairman Jerome Powell recently declared that interest rates aren't going to rise in the immediate term, but officials expect a rate hike by at least 2023. In other words, we could be facing over a year of inflationary conditions because central bankers intervene.

Investing During Inflation: Assets for Inflation-Resistant Investing

Inflation is likely here for the long haul. As an investor, there are steps you can take to reposition your portfolio for wealth preservation during inflationary periods. Check out these three important inflation-resistant assets that you can invest in to ward off the negative effects of inflation.

1. Gold and Silver

As scarce assets, precious metals cannot be printed, reproduced, or created by decree. They are rare and industrial useful materials that, owing to their unique chemical properties, have myriad applications in manufacturing as well as in the making of jewelry and artinsal goods.

Both silver and gold have long been used as a hedge against inflation. For generations, precious metals have been sought after as a counterweight against stock market volatility and inflation. Recent economic modeling from Queen's University Belfast has confirmed that there's a significant time-varying relationship between the money supply and the price of gold.

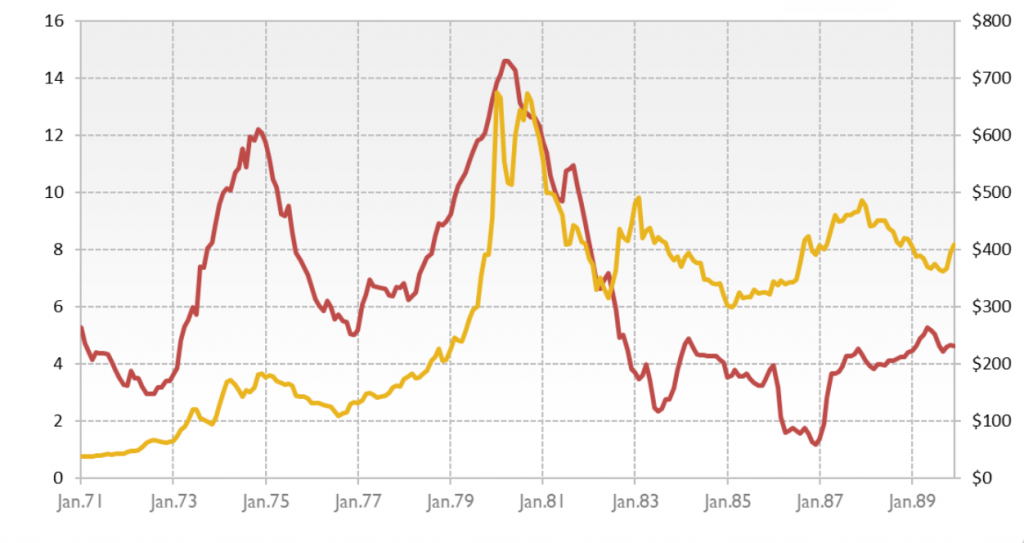

For instance, the 1970s era of “stagflation” saw the spot price of gold skyrocket from $100 per troy ounce to $650 in 1980. At the same time, the U.S. dollar plummeted in value and the U.S. economy saw an average inflation rate of nearly 7% over the course of the decade.

The chart below (Fig. 2) represents the gold spot price (yellow line, right axis) against the CPI (red line, left axis) spanning the two decades between 1970 and 1990. After 1979, the price of gold underwent a sustained cool-off period as interest rates rose and the M1/M2 diminished under the monetary policy agenda of Federal Reserve Chair Paul Volcker.

Figure 2. Source: Sunshine Profits

2. Cryptocurrencies

Although presenting greater downside risk than precious metals, cryptocurrencies are a worthwhile supplement to any portfolio looking to isolate itself from inflation. As a scarce asset—after all, token production is mathematically limited by the blockchain—cryptocurrencies are more resistant to price manipulation than fiat currencies that can be printed on-demand.

The world's leading cryptocurrencies by market cap, such as Bitcoin and Ether, are digital stores of value that rival gold. Like gold, they have inherent value in that they can instantly facilitate cross-border payments and send remittances in a peer-to-peer, trustless system.

Cryptocurrencies are still in their infancy as an asset class. As such, they hold greater upside potential for gains as well as downside risk. In fact, the year-to-date performance of Bitcoin is +124% as of November 11, 2021. On the whole, assets such as Bitcoin may thrive during inflationary periods. However, as a new financial instrument, this assertion remains speculative and theoretical in nature compared to the price predictions of established assets such as gold.

3. Real Estate & REITS

It's always a good idea to dedicate a portion of your net worth to hard assets to combat the effects of inflation. For the wealthy, real estate and rental properties have traditionally served this role. For the rest of us, the capital requirements of commercial or residential real estate investing is simply off limits.

Luckily, real estate investment trusts (REITs) provide an affordable solution for those who lack the means to purchase rental properties outright. These actively-managed funds specialize in income-producing investments in the real estate sector. They issue stock in the form of publicly-traded securities, similar to an ETF or mutual fund.

At 10.5% AAR, REITS provide excellent long-term returns that outperform the S&P 500 over time. They also have little, if any, correlation to the broader business cycle or the strength of the U.S. dollar. Given that REITS perform largely independent of extraneous economic conditions, they’re an excellent inflation-era hold and one of the best means of strategic capital preservation.

Prepare for Inflation Today: Diversify Your Retirement Portfolio

We’re staring down the biggest inflation surge in 30 years. Worse yet, there’s no guarantee that it will be transitory, despite what economists and central bankers say to the media.

Today every dollar in your pocket is worth 6.2% less than it was a year ago in terms of purchasing power. Unless you got a raise above that mark, you took a pay cut this year.

The good news is that you can stop the bleeding. In today's inflationary economy, you can diversify with alternative assets such as precious metals, cryptocurrencies, and real estate. These assets provide protection against a weakening U.S. dollar.

You can invest in alternative assets in a retirement savings account to save on taxes. To get started, check out our list of the top precious metals IRA companies or, alternatively, open a self-directed IRA today for an even wider array of assets to choose from.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,408.31

Gold: $3,408.31

Silver: $38.91

Silver: $38.91

Platinum: $1,356.66

Platinum: $1,356.66

Palladium: $1,114.94

Palladium: $1,114.94

Bitcoin: $112,480.93

Bitcoin: $112,480.93

Ethereum: $4,502.64

Ethereum: $4,502.64