BitIRA Review (2025 Update): Are They Still Among the Best Crypto IRAs in America?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 8th February 2025, 12:03 am

- Phone : 800-299-1567

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

BitIRA was founded in 2017 by Birch Gold Group to allow investors to hold various cryptocurrencies in an IRA designed specifically to meet the needs of digital asset investing. The company recently added Chainlink (LINK) to its catalog of crypto tokens, bringing the total of digital coins available to nine. Although a relative newcomer to the digital IRA industry, they have set about delivering top-tier security with offline storage and full end-to-end insurance. They also pride themselves in education, one of their company's missions is to educate investors about the benefits of investing in cryptocurrencies. However, they are somewhat limited in their selection of cryptos and aren't always fully transparent about pricing.

Pros:

- Enhanced reporting and account holdings overview that makes tracking all operations and transactions easy

- Best in the industry cold storage and full protection with insurance of your digital coins

- Wide choice of digital assets with a list of the nine top cryptocurrencies in the market

- Perfect physical and cybersecurity track record

- Exclusive partnership with Genesis to facilitate trades and an interest-earning crypto loan program

Cons:

- Lack of transparency of all costs implied in transactions, maintenance, and setup

- Smaller choice of cryptocurrencies (9) compared to other digital IRA companies

- Higher than average minimum deposit ($5,000)

BitIRA is a sister company of Birch Gold Group. It was established to give retirement investors a choice of cryptocurrencies that would allow for broader economy-wide diversification. Along with top-tier security through cold storage and comprehensive insurance policies, BitIRA puts together a compelling product for retirement investors looking for crypto exposure. The selection of nine digital coins encompasses around 65% of the total market capitalization of cryptocurrencies.

BitIRA is one of the original companies offering crypto IRAs. Other companies such as BitcoinIRA and Noble Bitcoin also offer quality services. To help you decide if BitIRA is right for you, we have reviewed their cryptocurrency service below.

Table of Contents

- Company Background & Philosophy

- BitIRA Reviews, User Ratings, and Complaints

- Genesis: BitIRA's Exclusive Crypto Trading Partner

- BitIRA Storage Security & Insurance

- BitIRA Management Team

- Free Investor Guide: All the Information You Need About BitIRA

- Allocation Calculator

- BitIRA Account Sign-up & Opening Process

- BitIRA Fees and Account Minimums

- BitIRA Products

- My BitIRA Platform

- BitIRA Company Contact Information

- Do We Recommend BitIRA?

Company Background & Philosophy

Birch Gold Group, a gold IRA company, established BitIRA with the idea of educating Americans about their retirement investing options outside of mainstream conventional assets. Many people are caught up in exclusively bonds and stocks, yet many alternative assets offer diversification through returns that are not correlated to traditional assets. Cryptocurrencies are one such alternative being used increasingly for diversification and risk management purposes.

BitIRA management set about offering two prominent benefits: security and diversification. Birch Gold, their parent company, has been in the gold and silver bullion business for over 100 years. They bring extensive knowledge of the requirements investors have when saving for retirement.

BitIRA understands that security is of utmost concern for investors of cryptocurrencies. They claim that their security level of cold storage together with insurance policies make their service the most secure in the industry. Cold storage security means that all wallets are stored offline in fully securitized facilities that cannot be accessed by hackers.

They also believe in diversification, some crypto providers in the IRA space only offer Bitcoin. Although Bitcoin is the digital coin with the largest market capitalization at around $744 billion, holding all your crypto investment in one coin may not be as effective as holding various coins simultaneously.

The company prides itself on having a solid reputation for customer service excellence. This is proven by their top ratings from the nation's most important business and consumer protection organizations; Better Business Bureau and Business Consumer Alliance.

BitIRA has made core strategic partnerships with two highly regarded custodians: Equity Trust Company and Preferred Trust Company. All transactions are conducted via the Genesis platform, which also facilitates an interest-earning program for loaned assets, which is regulated by the SEC and FINRA, as is BitIRA.

BitIRA Reviews, User Ratings, and Complaints

BitIRA gets top marks for ratings from the Business Consumer Alliance (BCA) and the Better Business Bureau (BBB): AAA from BCA, and A+ from BBB. These are the highest possible grades from both consumer protection organizations. Matched together with positive reviews from clients, 4.95 over 5 from 20 reviews on BBB, and zero complaints at the BCA.

- BCA Rating: ⭐⭐⭐⭐⭐ (“AAA” and 5 Star Rating based on 1 Customer Review)

- BCA Complaints: 0 Complaints (Details)

- BBB Rating: ⭐⭐⭐⭐⭐ (“A+” and 2 Star Rating based on 1 Customer Review)

- BirdEye Reviews: 4.9/5 Stars (68 Customer Reviews)

- Facebook: 3,500+ “Likes” (Details)

Genesis: BitIRA's Exclusive Crypto Trading Partner

BitIRA has partnered with Genesis, one of the largest crypto trading platforms worldwide. Genesis caters to individual investors as well as institutional investors such as funds and market makers. They currently have dealing relationships with counterparties in over 50 countries.

The company started operations in 2013 and is regulated by the SEC and FINRA. Regulation by top-tier financial authorities guarantees high standards of transparency, accountability, and security of funds.

Genesis also offers a lending program, whereby you can lend your digital assets to them and earn interest payments for the duration of the loan. It was not possible to establish from the information on BitIRA’s website if this is possible while the cryptocurrencies are held within the IRA.

BitIRA Storage Security & Insurance

BitIRA has done something that no other IRA company has done so far. Apart from keeping your cryptocurrencies in cold storage, they also offer full insurance. Security is a big concern for most investors in digital assets. We have all heard of various investors losing all their coins when cybercriminals hacked their accounts.

With BitIRA your crypto coins are kept in cold storage. This means they are no longer available through the Internet. They simply cannot be hacked because they cannot even be found.

All transactions are validated and recorded by BitIRA, once the transaction is cleared the digital coins are sent to cold storage.

The storage servers are kept in grade-5 nuclear bunkers, which not even Jason Bourne could get into. Specialist personnel monitor and guard the wallets 24/7, 365 days a year. Should something go wrong, BitIRA has insurance policies in place that cover End-to-End risk for up to $100 million. Balances held in cash are also insured up to a value of $3.75 million.

Simply put, the insurance policy covers you throughout the whole process from transit to storage. More specifically you’re covered against the following:

- Hacking or theft

- Embezzlement

- Physical loss

- Damage

- Destruction

Some crypto IRA companies offer insurance during the purchasing phase; however, none offer insurance once the digital coins are in storage.

BitIRA also tackles the problem many investors see with the security maintenance of wallets. The risk with wallets is that if you lose your keys, you are also going to lose your digital coins. This danger is averted as BitIRA will store your keys for you. This may be an aspect some investors of crypto coins may find contrary to the independence of decentralized assets.

BitIRA Management Team

Unfortunately, publicly available information about the management team at BitIRA is not easily accessible. We have found some of the main players in their management team, but we were not able to determine the CEO or other top ranks of the company.

Theresa Fette (Board Member)

Fette recently joined BitIRA as a full-time board member, in June 2021. She brings several years of experience as a CEO. She is currently CEO and co-founder of Digital Trust, this company offers self-directed IRAs with a specialization in digital assets. In the past, she has also been the CEO of Fintruth, a FinTech company for the financial sector, from 2018 to 2021.

Since 2018, Fette is also a board member and co-founder of LED Connection, Las Vegas, the company offers LED lighting solutions for commercial and residential properties. Previously she was the CEO of Provident Trust Group, from December 2007 to October 2018. This company serves clients throughout the US and has 30,000 customers with $5 billion of assets in custody.

Andy Klein (Director of Strategic Planning)

Andy Klein graduated from the University of Pennsylvania in 2003, a renowned Ivy League institution. He joined Birch Gold in 2011 and currently serves as their Marketing Director. Previously, Klein was Director of Marketing for US Tax Shield in Los Angeles. Since BitIRA’s start in 2017, Klein has been their Director of Strategic Planning.

Jay Blaskey (Head of Sales)

Blaskey joined Birch Gold Group in 2012 as a sales consultant. He had previously worked for Pinnacle Gold as a sales consultant for 2 years. In 2014, he was promoted to head of retirement sales group operations at Birch Gold. The management at Birch chose Blaskey to be the head of sales when the company set up BitIRA in 2017.

Free Investor Guide: All the Information You Need About BitIRA

You can only hold cryptocurrencies, and other alternative assets such as precious metals, in a Self-Directed IRA. The setup and compliance of this type of IRA offer its rewards and its challenges.

BitIRA has everything in place to take you through all the steps needed to arrange your Self-Directed IRA and keep you up to track with all compliance issues. In exchange for your personal data, including your phone number, you can download your BitIRA free investor guide here.

Allocation Calculator

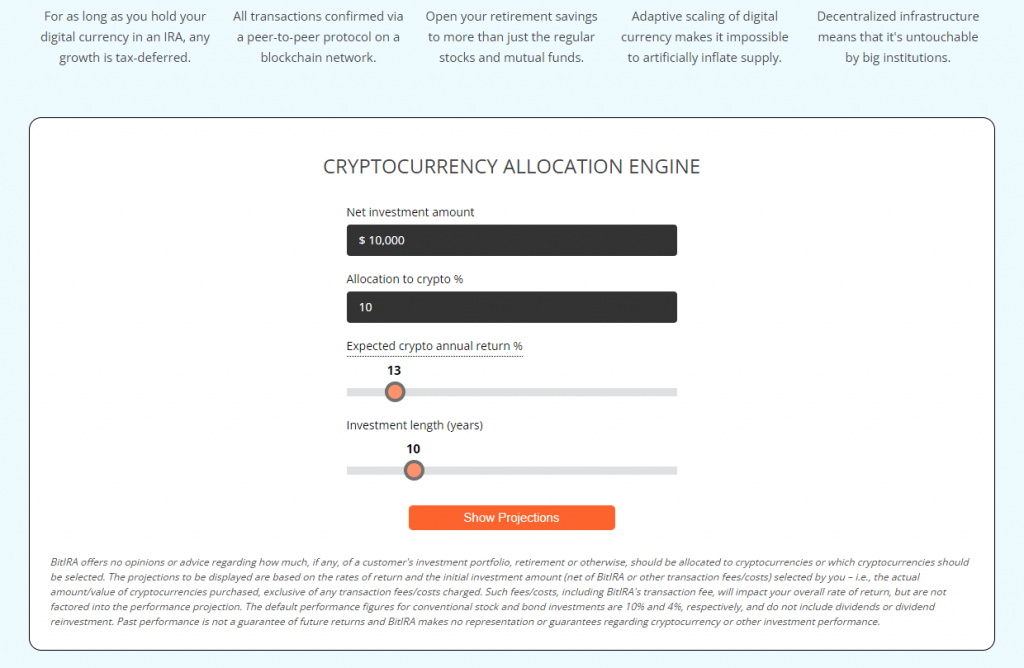

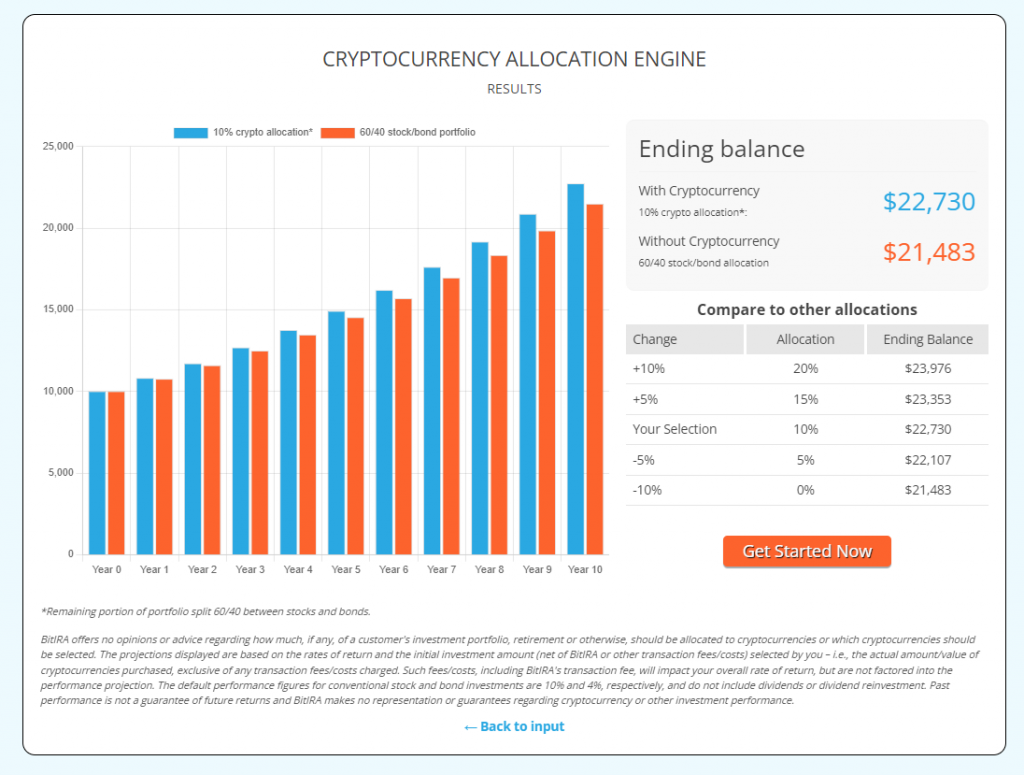

This tool calculates how your investments would perform with an allocation to cryptocurrencies. In the example below we input a starting investment of $10,000 with a 10% allocation to cryptocurrencies.

Source: BitIRA

The table below shows the output data presented by BitIRA with a 60/40 allocation to stocks and bonds for 90% of the initial investment. You can choose the performance of your allocation to cryptocurrencies in the slide bar on the input screen. In this case, it was 13% growth, while stocks and bonds are attributed a fixed growth of 10% and 4% respectively.

Source: BitIRA

BitIRA Account Sign-up & Opening Process

BitIRA has a professional team that will guide you through the whole process of setting up your new digital IRA. You can fund your Self-Directed IRA with cash or you can roll over just about any retirement plan. For new contributions to an IRA, the SEC has set the contribution limit until 2025 at $7,000 or $8,000 if you are over 50.

Retirement accounts you can roll over into your Self-Directed Digital IRA include Traditional and Roth IRAs, 401(k)s, 403(b)s, and TSPs. You may also continue to hold other assets in your BitIRA account such as ETFs, stocks, or bonds. You may also sell these assets to purchase your cryptocurrencies. As long as any gains received from the liquidation of assets remain inside the IRA taxes are deferred.

Due to legal requirements, the current minimum initial investment is $20,000 with BitIRA. You can open two types of IRA with BitIRA at the moment, Traditional and Roth:

- Traditional IRA: This account allows you to make tax-deferred contributions up to the yearly limit. You will pay taxes when you take distributions at the retirement age. Early distributions may be subject to a penalty.

- Roth IRA: Roth IRAs allow you to pay your taxes when you make the contribution. You will not pay taxes when you take distribution upon retirement. This strategy is useful if you believe your tax bracket will be higher when you retire.

3 Step Roll Over

Step-1: To fund your new Self-Directed IRA you will need a qualified custodian. BitIRA specialists will help you complete as much of the paper as you need. Once the paperwork is in place you can then proceed to the transfer of your savings from your 401(k), IRA, or other eligible savings account.

Step-2: BitIRA works with your custodian and their exchange partner Genesis to set up and fund your account. You will receive the credentials needed to buy and sell digital currencies as you deem fit. According to BitIRA:

Because Genesis oversees one of the largest global networks of trading partners in the cryptocurrency market, you can buy and sell Bitcoin with the confidence of stable prices and extremely fast transactions.

Step-3: Your digital assets are then sent to cold storage. Your coins are held in wallets stored offline in a high-security environment, and guarded day and night.

BitIRA Fees and Account Minimums

As of March 11, 2022, BitIRA decided to stop charging a monthly fee for its services. All accounts that use Equity Trust Company will no longer pay the $29.99 monthly fee. That adds up to $359.88 of extra income per year for your IRA.

| Set-up fee | $50 |

| Wire fee | $30 |

| Annual depository fee | $400 |

| Initial purchase transaction fee | $300 + $100 for subsequent |

| Minimum initial deposit | $5,000 |

| Sell transaction fee | $100 |

| Account management | $300-$1,000 |

BitIRA Products

BitIRA has tapped into the 2 largest cryptocurrencies to offer their customers digital investment opportunities. BitIRA has completed the list with digital coins that are compliant with regulatory authorities, have a large market capitalization, and have a solid structure and application.

There are eighteen digital assets currently on offer at BitIRA:

- Bitcoin

- Bitcoin Cash

- Chainlink

- Ethereum

- Ethereum Classic

- Litecoin

- Zcash

- Stellar Lumens

- Aave

- The Graph

- Basic Attention Token

- Livepeer

- Uniswap

- Dcentraland

- Compound

- DAI

- Maker

- yearn.finance

As with all asset classes, it is good practice to diversify your investment and not risk having all your eggs in one basket. BitIRA offers the two largest cryptos by market capitalization and several other altcoins for investors seeking diversification.

My BitIRA Platform

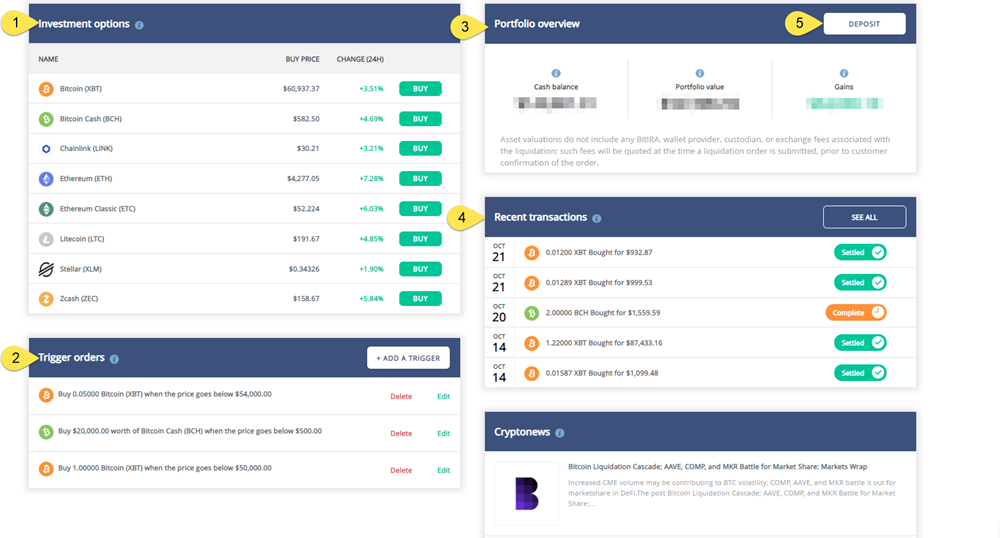

BitIRA has created an online dashboard with all the important information at the touch of your keyboard. The picture below is a screenshot of the My BitIRA platform where you can access all the information regarding balances, transactions, and historical performance, amongst others.

Source: BitIRA

Some of the tools and information you will find on your My BitIRA dashboard include:

- Investment options: All the cryptocurrencies on offer with real-time prices.

- Orders: You can set custom orders to buy and sell digital assets when specified targets are reached.

- Portfolio Overview: Snapshot of your cash balance, digital IRA value, and gains.

- Recent Transactions: Summary of your most recent trades and their status.

- Deposit: This allows you to add funds to your digital IRA.

- News: A tab with the latest insights into the crypto world to keep you updated and able to make informed decisions.

BitIRA Company Contact Information

- Address: Central Park Building, 3500 W. Olive Ave. Suite 730, Burbank, CA 91505

- Phone: 800-299-1567

- Email: info@bitira.com

- Monday – Friday from 8 am to 5 pm PST

Do We Recommend BitIRA?

Altogether, BitIRA offers a competitive package of services for investors looking to invest in digital assets. IRAs allow you to take advantage of tax-deferred growth, while BItIRA offers nine cryptocurrencies and state-of-the-art security.

Security is the main factor BitIRA promotes as they consider their level of security second to none.

If you value security over diversity, you may want to check out BitIRA's services. While they don't offer as many crypto assets as their competitors, they have top-notch security and a history of security excellence. However, they charge steeper fees than some of their competitors as well.

Although BitIRA offers an excellent cryptocurrency IRA investing service, you should do your homework before you make a final decision. We recommend contacting several similar self-directed IRA services to find a company that offers the perfect product for your needs. You can read more of our Bitcoin IRA company reviews here.

- Phone : 800-299-1567

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

BitIRA was founded in 2017 by Birch Gold Group to allow investors to hold various cryptocurrencies in an IRA designed specifically to meet the needs of digital asset investing. The company recently added Chainlink (LINK) to its catalog of crypto tokens, bringing the total of digital coins available to nine. Although a relative newcomer to the digital IRA industry, they have set about delivering top-tier security with offline storage and full end-to-end insurance. They also pride themselves in education, one of their company's missions is to educate investors about the benefits of investing in cryptocurrencies. However, they are somewhat limited in their selection of cryptos and aren't always fully transparent about pricing.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,329.37

Gold: $3,329.37

Silver: $36.85

Silver: $36.85

Platinum: $1,380.82

Platinum: $1,380.82

Palladium: $1,143.38

Palladium: $1,143.38

Bitcoin: $109,622.77

Bitcoin: $109,622.77

Ethereum: $2,590.46

Ethereum: $2,590.46