Tips for Investing in the Right Precious Metal at the Right Time

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 22nd January 2024, 11:41 pm

Although precious metals such as gold, silver, and platinum are often thought of as low-maintenance assets, there are still three key questions that need to be addressed before you get started. First: which metal do I need most? Second: which type of account should I invest through? And finally: when should I enter the market?

If you're one of the 89.2% of Americans who don’t already own precious metals investments, the good news is that it's easy to get started. It's simply a matter of choosing your metals, your account, and your entry point. In this guide, I'll go over these three crucial questions, with particular emphasis on how to invest in precious metal at the right time.

Table of Contents

What Are Precious Metal Investments?

A precious metal investment refers to scarce, naturally sourced metal bullions that have industrial applications and are purchased with the expectation of generating a profit. Often, though not always, these types of investment take the form of one of the following:

- Gold

- Silver

- Platinum

- Palladium

- Rhodium

However, precious metals investments are not necessarily limited to physical assets. Some investors who prefer greater liquidity—the ability to quickly liquidate the assets for cash, which comes at the expense of volatility—opt for investing in “paper precious metals” such as mining stocks or exchange-traded funds (ETFs).

For security reasons, however, holding physical precious metals is often more beneficial than investing in paper gold or silver. Unlike stocks and ETFs, physical metals do not pose counterparty risk. In other words, metal bullion cannot declare bankruptcy or default on their contractual obligations, whereas publicly traded gold companies can.

Also, for many investors, physical metals offer peace of mind. In the event of a market-wide collapse, physical metals can be used as a tool for barter and economic exchange. By contrast, paper or electronic gold or silver can be confiscated, seized, or stolen with greater ease, while also generally experiencing more erratic and unpredictable price movement.

Can You Time the Precious Metals Market?

Generally, time in the market is more effective than trying to time the market. If everyone knew how to reliably predict market cycles and future price movements, there wouldn't be a need for multi-billion dollar hedge funds because every retail investor would be able to game the system to their advantage.

With that being said, there are still general rules of thumb that can help people invest in precious metals at the right time. For instance, historical evidence points to there being an optimal window of time for buying gold.

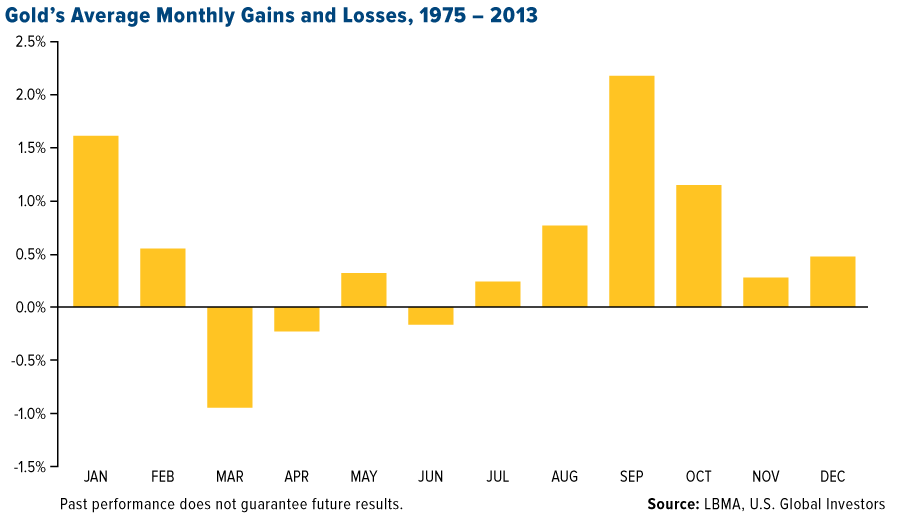

Source: Mining.com

The chart above indicates the average monthly price movement in percentage form for each month of the year between 1975 and 2013. Based on these data, we can infer that April until June is the best time for buying gold at the best price in any given year.

Considering that gold prices have historically risen the most in September, as compared to all other months, it's a good idea to have your position settled by July. This way, you can capture the upward price movement during both August and September.

No matter the type of metal in which you decide to invest, it should always be the objective of the acquiring party to buy when everybody else is selling. Of course, there is always a reason circumscribed by supply and demand for the sell-off, but long-term buyers should acquire the asset anyway with the understanding that the price will inevitably rise again.

Timing the Silver Market

According to this month-by-month report, the best time to invest in silver during the year is January or June. Historical precedent indicates that silver prices tend to be at their lowest during these months, followed by a sharp price increase through the rest of the month. For silver, the worst time to invest is September as this month generally sees the largest upward price movement on average.

Timing the Platinum-Group Metal (PGM) Market

Platinum-group metals—which include palladium, rhodium, and pure platinum bullion—generally do not have significant investment demand. However, it is still possible to acquire these assets and turn a profit on their investment, considering that nearly all PGMs have significant industrial demand, especially within the auto sector.

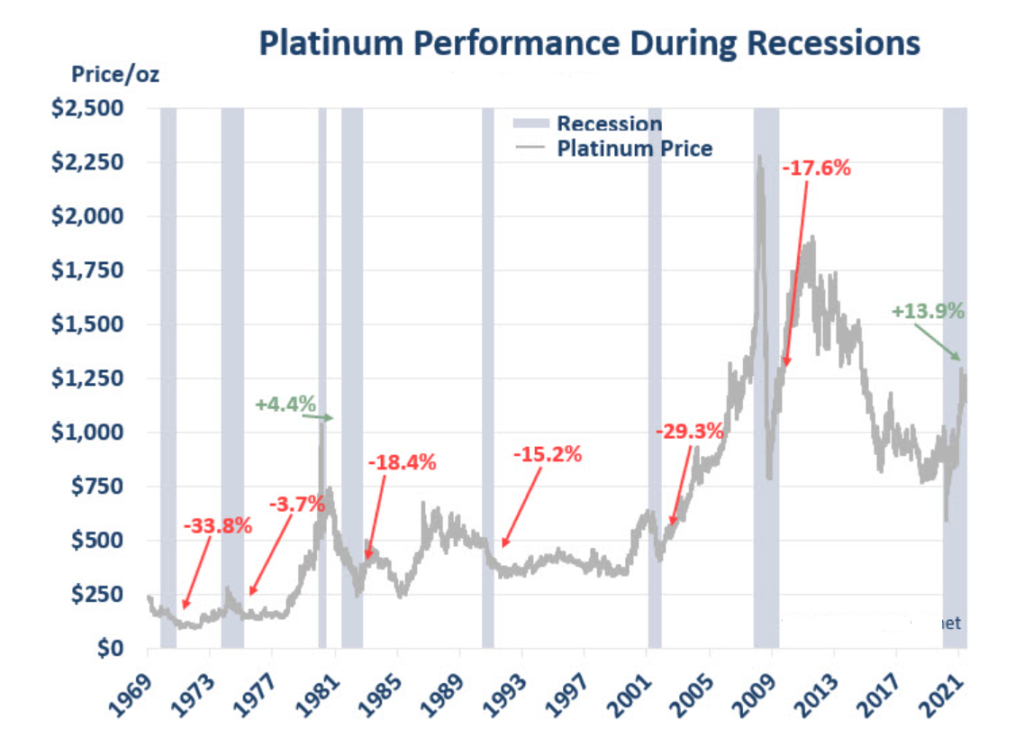

Unfortunately, there is no reliable intra-year data available for optimizing platinum market entry points. However, the chart below depicts the historic performance of PGMs. Metals of this type have typically performed their best during recessions, especially during the COVID-19 crash (+13.9%) and the stock market crash of 1981 (+4.4%).

Source: Goldsilver.com

We’re often asked, “What is the best metal to invest in during recessions?” Although we strongly believe that all precious metals are worthwhile portfolio diversifiers during recessions and bear markets, the data supports the idea that PGMs are exceptionally strong performers during recessions.

Based on the above data, we can infer that recessions and down-cycles in the market are the best times to invest in alternative precious metals such as platinum and palladium. It should be noted, however, that past performance is not a reliable indicator of future success, and that these trends may not persist in the long term.

Is Now the Time to Invest in Silver?

There's a strong argument that now is an excellent time to get in on silver. This is because the U.S. federal government—including the White House administration and both chambers of Congress—are pushing forward a $1.2 trillion infrastructure spending bill.

If the bill passes into law, which is highly probable in today’s political climate, the price of silver is set to skyrocket. Thanks to massive public investments in electric vehicles (EVs) and photovoltaic (PV) cells used in solar panels, silver, which is used extensively in the production of both, will see a significant boost in industrial demand.

The bill, as written, would revolutionize the U.S. solar energy grid and would funnel billions into electric car rebates, subsidies, and charging stations. The key elements of the infrastructure spending bill include the following:

- A 10-year extension of an investment tax credit to subsidize PV production

- Multi-billion dollar investments in renewable energy research through the National Science Foundation

- $100B+ in public investments in EV production and infrastructural support

- $41.9 in federal grant funding for EV charging infrastructure

Both PVs and EVs rely on silver metal for conductivity purposes. If the U.S. federal government is set to make sweeping investments in both technologies, we should therefore see a commensurate increase in demand for silver. Savvy investors would do well to see this as a potentially lucrative buying opportunity in the market.

Benefits of Investing in Precious Metals

There are countless financial benefits to investing in precious metals. Especially if you invest in gold through an IRA or 401(k), you can let your metal bullion appreciate in value over time without paying capital gains taxes. However, the benefits of precious metals investing are not limited to only that. They also include:

- Protection from hackers, digital seizure, or forced handovers

- Privacy benefits and anonymity

- Stability during market crashes and recessions

- A strategic hedge against inflation

- Portfolio diversification to reduce exposure to equity market risk

- Can be used as a form of money and a medium of exchange

Another of the key benefits of investing in precious metals for beginners is that they offer a potential lifetime’s worth of “portfolio insurance”. Young investors, or those who are new to retirement investing, should generally play it safe when investing in financial markets. The illiquidity and stability of commodities markets make precious metals an appropriate substitute for stocks.

Finally, precious metals have a low barrier to entry. If you want a simple investing experience, all you have to do is select a trusted precious metals IRA company to get started purchasing precious metals in a tax-sheltered retirement account—no brokerage required!

What’s the Best Precious Metal for Investing?

Simply put, there’s no ideal investment-grade precious metal that’s better than any other. Although our readers often ask us, “What’s the best precious metal for investing?” there is rarely a clear-cut answer.

Naturally, any answer would depend on what your investment goals are. For instance, silver might be the best option for investors who want to maximize their short-run earnings. Gold may be preferable for investors who want to stabilize their portfolios throughout their lifetime and reduce their exposure to volatility. Finally, PGMs may be ideal for those who want to hedge against recessions.

Many of the most successful investors invest across all precious metals. Indeed, dedicating a small portion (i.e., 5-20%) of your investments in a diverse range of precious metals can help safeguard your wealth from adverse market events. Plus, precious metals investing can grow your wealth as the demand for investment-grade metals continues to grow.

When (and How) to Invest in Precious Metals

Although there’s no magic crystal ball that can predict the future of the precious metals market, there are some useful precedents that can inform your investing decisions. For instance, the best time to invest in gold, historically, is between April and June, whereas for silver it’s either early January or June.

Platinum-group metals, on the other hand, are strong performers during recessions. Therefore, historical precedent suggests that taking a long position in PGMs such as palladium or rhodium is a winning move at the very start of a recessionary period.

Regarding silver, we’re currently seeing a critical entry point thanks to large-scale upcoming federal infrastructure spending. Public investments in EVs and solar energy should cause a significant uptick in silver demand and, by extension, the price of silver, in the years ahead.

Ready to get started? If you’re looking to invest in precious metal at the right time, there’s no better time to act than now. To get that crucial first step, explore our top-rated silver and gold IRA companies that can walk you through the investment process from start to finish.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,336.55

Gold: $3,336.55

Silver: $37.80

Silver: $37.80

Platinum: $1,337.40

Platinum: $1,337.40

Palladium: $1,124.21

Palladium: $1,124.21

Bitcoin: $117,645.06

Bitcoin: $117,645.06

Ethereum: $4,436.18

Ethereum: $4,436.18