The Debt Ceiling Crisis: What it Means for Gold Investors

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 9th February 2024, 05:13 pm

On June 5, 2023, the U.S. Congress is due to pass key legislation to raise or suspend the federal government’s ability to borrow money.

If the deadline passes without a resolution, one of two things will happen: a federal government shutdown will ensue, or a legal and economic crisis will be triggered when the President bypasses Congress to unilaterally raise the government’s spending limit.

In either case, investors should be concerned. For June 5 to pass without a resolution would likely set off a series of destabilizing events in financial markets, one that would hit Wall Street hard and evaporate some $10 trillion in household wealth.

Given today’s divided Congress—split between highly disciplined Democratic and Republican parties—there’s no guarantee that a deal will be struck by the deadline.

As gold investors and retirement investors, it’s important to learn how this event might negatively impact our financial situation in the coming weeks and to prepare for it accordingly.

Table of Contents

What is the U.S. Debt Ceiling?

The debt limit (or “debt ceiling”) is the maximum amount of money that the U.S. Treasury can generate via debt security offerings to service the government’s spending obligations, such as servicing Social Security checks. The Treasury is not authorized to borrow beyond this amount. The exact sum is predetermined by Congress and ratified by the President.

For those on Social Security, debt ceiling changes are, therefore, of particular concern.

While normally considered a routine procedure, the process of raising the debt limit is sometimes subject to politicization, as it is currently. The political nature of government spending can lead to a gridlock situation where neither party can agree to raise the debt limit.

Unable to borrow or raise funds, the U.S. would risk defaulting on its debt. This would, in Treasury Secretary Janet Yellen’s words, “cause irreparable harm to the U.S. economy…and global financial security.”

In April 2023, the Republican-controlled House passed a bill (entitled the Limit, Save, and Grow Act) that extends the debt ceiling until March 31, 2024. Tethered to the debt ceiling increase are deep spending cuts that would save U.S. taxpayers an estimated $3.6 trillion. To date, the bill has not been supported by the Democrat-controlled Senate or the White House.

“Failure to meet the government’s obligations would cause irreparable harm to the U.S. economy, the livelihoods of all Americans, and global financial stability.”

Janet Yellen

Bipartisan negotiations were paused on May 19 as progress had stalled between Democratic and Republican lawmakers.

Debt Ceiling 2023: How We Got Here

Under previous administrations, the debt ceiling has been amended on a consistent annual or biannual basis.

In fact, the debt ceiling has been raised or suspended seven times since the Donald Trump administration began in 2017, and dozens of times under prior administrations. These debt ceiling raises augmented the federal government’s ability to borrow to the following levels:

- March 15, 2017: 19.85 trillion

- September 30, 2017: Suspended

- March 1, 2019: 22.03 trillion

- August 2, 2019: Suspended

- July 31, 2021: 28.5 trillion

- October 14, 2021: 28.9 trillion

- December 16, 2021: 31.4 trillion

Notably, the previous debt ceiling amendments were passed by Congresses less divided along partisan lines. In today’s intensely polarized legislative environment, with power divided between both parties, Congress’ ability to reach a bipartisan agreement is limited relative to previous administrations that saw less partisan division.

The Cost of the Debt Ceiling Crisis

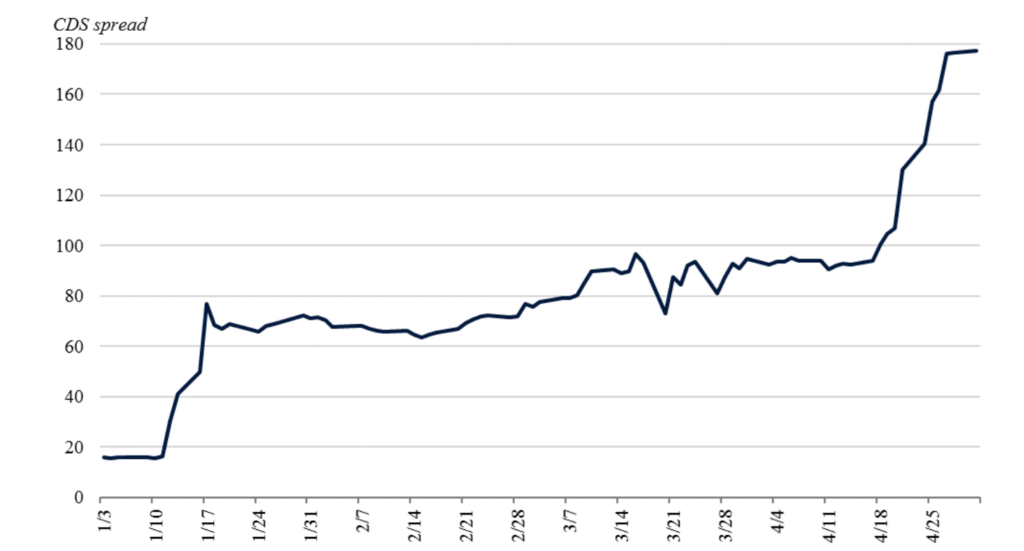

The cost of insuring U.S. debt has risen starkly in recent months due to increased fears of a federal government default. Credit default swap (CDS) spreads are now at an all-time high—these represent the insurance premiums paid to insure debt held by the federal government. The cost of CDS spreads began increasing dramatically in April.

As we inch closer to the debt ceiling deadline, CDS spread costs are likely to continue increasing until a deal is reached or June 5 elapses. These are general indicators of market stress which, if left unchecked, can lead to equity market volatility as well as credit financing disruptions that can hinder the productive capacity of the economy.

Image 1: One-year U.S. government bond insurance premiums (Source: White House)

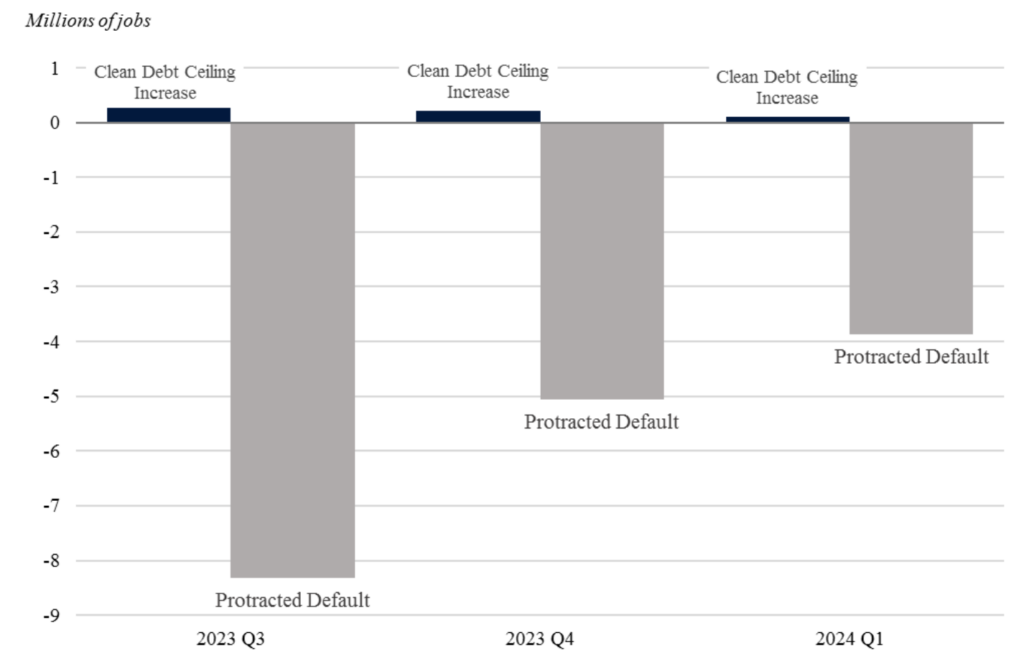

A long-term default would give rise to even greater costs to the U.S. economy. A recent simulation of a long-term default (Image 2) depicts a large-scale job loss and recession-like labor market activity. The simulation found that, in Q3 2023 alone, the U.S. equities market would lose up to 45 percent of its value—leading to devastating consequences for retirement investors and those with short-term investment horizons.

While retirement accounts will certainly take a hit, deeper and more entrenched economy-wide effects are also likely to occur. For example, consumer and business confidence are estimated to diminish, resulting in a widespread pullback in investment assets and overall consumption levels.

Unlike previous bouts of heavy job losses (e.g., COVID recession, 2007-2009 financial crisis), a protracted default would render the federal government unable to borrow additional funds to support families and the businesses that employ them.

Image 2: Job gains/losses under default or clean debt ceiling increase scenarios, Q3 2023 to Q1 2024 (Source: White House)

Implications for Gold Investors

The debt ceiling crisis is of particular importance for gold investors. In the unlikely, yet plausible, scenario in which a deal isn’t struck by the June 5 deadline, economy-wide ripple effects are likely to initiate—consequences that the U.S. government would be completely unequipped to address via traditional bailout packages.

Capital flight from riskier or more speculative assets, including broad segments of the U.S. equities market, would likely take place. During times of instability and uncertainty, less speculative assets tend to outperform more volatile ones.

For example, physical gold bullion reached an all-time high of $2,075 per ounce in August 2020 at the height of the COVID-19 pandemic, a time when the stock market suffered extreme volatility. Since then, the price of gold has held steady around the $2,000 mark while riskier assets such as cryptocurrencies have performed erratically. For instance, the price of Bitcoin fell 57% virtually overnight during the initial coronavirus crash in March 2020 before reaching all-time highs in November of the following year.

If the worst comes to worst during the debt ceiling standoff, it stands to reason that similar market effects could be seen in the gold, stock, and cryptocurrency markets. This is because both situations bear key resemblances, such as:

- Widespread fear, uncertainty, and doubt (“FUD”)

- Unprecedented status (i.e., debt ceiling never elapsed in history)

- Global contagion effects in emerging markets

- Public sector shutdown (i.e., Social Security checks, Medicare reimbursements unpaid)

For this reason, it may be a good idea to keep an eye on both the cryptocurrency and precious metals markets in the days ahead. In the unlikely event that a deal isn’t reached by next Monday, we could see markets resemble March 2020 (i.e., bullish gold).

The 14th Amendment and Ambiguity on Default

In the event that Congress cannot pass a spending bill by June 5, the President may choose to unilaterally raise the debt ceiling by invoking the Fourteenth Amendment of the U.S. Constitution. The Fourteenth Amendment reads:

“The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.”

The 14th Amendment was passed as part of a series of post-Civil War amendments that attempted to resolve some of the legal problems left over by the war. The objective was to unambiguously affirm that the U.S. government was not responsible for the debt incurred by the Confederate government.

However, there are important implications and open questions that have yet to be answered. The 14th Amendment could mean that any spending legally approved by Congress must be honored by the government. In essence, it could mean the law creating the debt ceiling is unconstitutional. Because the law has never been challenged by the Supreme Court of the United States, this remains an open legal question.

You can think of the debt ceiling as the federal government’s credit limit. The 14th Amendment can raise or nullify this limit—however, such a constitutional test has never been attempted in the nation’s history. Legal scholars are divided on how the court would or should rule.

The 14th Amendment adds another layer of complexity to the issue and lends even more uncertainty to an already concerningly precarious situation.

Debt Default on the Horizon?

The looming threat of debt default will likely push negotiations forward right up until the June 5 deadline, the point when Secretary Yellen claims the U.S. Treasury will run out of funding. Should we make it that far without a deal, the economic consequences would likely be both devastating and irreversible until the state’s borrowing capacity is restored.

There are several plausible scenarios that could emerge in the weeks ahead, including:

- A debt default by the U.S. government (less likely)

- A constitutional crisis triggered by the executive branch’s unilateral debt ceiling resolution (moderately likely)

- A compromise deal between House Republicans and the Biden administration that results in deep discretionary spending cuts that could disrupt consumer confidence and add volatility to speculative asset markets (more likely)

Savvy, risk-conscious investors may want to prepare their portfolios for any of the potential outcomes listed above.

To do so, consider diversifying your investment portfolio with a broad range of hard assets that are uncorrelated with the U.S. and global equities markets. Under these circumstances, even some traditional safe-haven assets—such as bonds and Treasury bills—would assume a much higher degree of risk than usual.

Instead, gold and other precious metals may provide greater protection against economy-wide systemic risks. To hedge against the risk of any upcoming market shock, consider adding physical gold bullion, silver, or platinum to your retirement accounts. You can get started today by consulting one of America’s top-ranked gold IRA investment companies.

(Disclaimer: This article is not financial advice. Do your due diligence. Always consult with your financial advisor before making any investment decision, and never invest more than you can afford to lose.)

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.30

Gold: $3,355.30

Silver: $37.89

Silver: $37.89

Platinum: $1,333.91

Platinum: $1,333.91

Palladium: $1,157.09

Palladium: $1,157.09

Bitcoin: $118,533.38

Bitcoin: $118,533.38

Ethereum: $4,283.95

Ethereum: $4,283.95