September 2022 Newsletter: Bear Market Across the Board Following Mid-August Rallies; Instability to Come?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 8th September 2022, 01:48 am

Amid topsy-turvy jobs reports, unpredictable inflation numbers, and off-and-on recession fears, the markets have waxed and waned with investor sentiment. Let’s take a look back at how the financial markets performed over the last 30 days, do our best to make sense of it, and see how, as alternative investors, we can shore up our portfolios against increasing interest rate risk.

- S&P 500: (-5.5%)

- Gold: (-3.9%)

- Silver: (-11.0%)

- Platinum: (-7.9%)

- Palladium: (-0.1%)

- Bitcoin: (-11.5%)

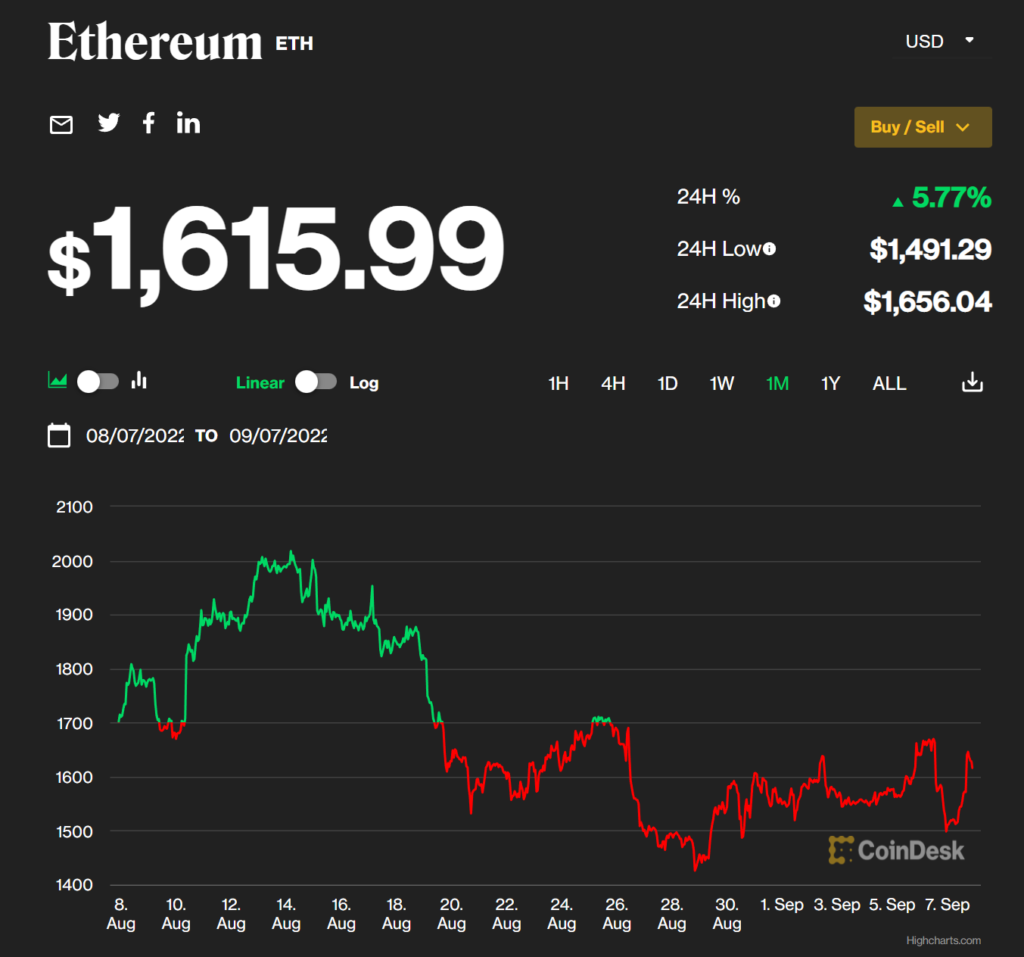

- Ethereum: (-5.9%)

Despite mid-August highs in many asset classes, the month closed with all markets in the red. The silver lining, however, is that especially resilient assets, such as gold and palladium, held their value better than all other major asset classes listed above.

It's not all bad, however. Assets such as Ethereum, for example, say major intra-month price swings including a gain of nearly 25% between August 1st and 15th. While this bodes well for day traders looking to capitalize on day-to-day price movements, the effects have hit buy-and-hold investors particularly hard.

Source: Coindesk

The underlying fundamentals of the economy, though, remain optimistic. If August's inflation data and jobs report mirrors July's, it may suggest that the worst of the inflationary period is over and that we may stave off a looming recession. Should we enter back into a bull market, we're likely to see currently discounted alternative assets—such as precious metals and cryptocurrencies—return to multi-year high territory.

Fickle Markets in August: Stability on the Horizon?

Given that the August CPI report did better than expectations (“only” 8.5% rather than 8.7%), markets experienced a bit of euphoria in the latter half of the month.

However, the Fed’s Jackson Hole symposium announcement on August 26 indicated that inflation, and the rising interest rate environment, is here to stay for the foreseeable future. This caused markets to drop significantly as investors sought more rate-resilient assets.

To make matters worse, 315,000 payrolls were added nationwide in August—slower jobs growth than many analysts expected.

The good news is that history books have proven that, to date, what comes down must come up. Although assets are at multi-year lows, the next bull market is poised to rocket them back up to prices that'll make you wish you had stocked up now.

Interested in getting in on the action and diversifying with assets that are resilient to interest rate volatility? Check out our exclusive reviews of the top-ranked self-directed IRA companies in America. There you’ll find a list of trusted providers who can help you invest in evergreen assets that can flourish in any interest rate environment—such as silver, gold, and copper—all within a tax-advantaged investment account.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,329.45

Gold: $3,329.45

Silver: $36.82

Silver: $36.82

Platinum: $1,388.07

Platinum: $1,388.07

Palladium: $1,153.30

Palladium: $1,153.30

Bitcoin: $109,622.77

Bitcoin: $109,622.77

Ethereum: $2,590.46

Ethereum: $2,590.46