Return of Early 80’s Styled Inflation Possible

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 15th June 2021, 06:53 pm

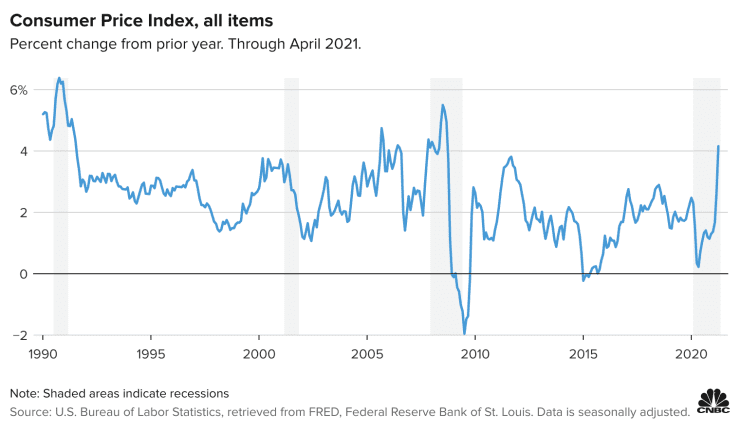

This past week saw the fastest level of inflation since 2008. The critical measure of headline consumer prices soared five percent versus May of last year. Meanwhile the core inflation rate's 3.8 percent increase, with food and energy prices not counted, turned out to be the biggest rise in almost three decades. Not since the OPEC Oil war of last year has so much been at stake for your wallet.

Consumer Prices Roar 5% Higher Than in May

On Thursday the Labor Department released its much anticipated inflation report. The data showed that consumer prices in May rose at their quickest rate in almost 13 years. The Labor Department revealed that inflation is building rapidly in the American economy at levels not seen in a long time.

This consumer price index is made up of a basket that includes energy, groceries, food, housing expenses, and sales over a range of goods. It was up five percent from the previous year versus the 4.7 percent that the surveyed economists had been anticipating. Such a significant gain amounted to the largest rise in the CPI dating back to August of 2008 when the increase came in at 5.3 percent. At that point the financial crisis pushed the American economy into the Great Recession of 2008-2009, the worst pullback dating back to the devastating Great Depression.

Federal Reserve Dismisses the Numbers

For now the Federal Reserve officials have blamed the hike in inflation on temporary factors that appear to be higher thanks to comparisons to the year prior period. At that time a large part of the economy was under severe restrictions because of the global pandemic. This has encouraged the U.S. central bank to dismiss the figures for the most part.

Because of this, the consensus of market participants is not expecting the Federal Reserve to make new policy measures at their Federal Open Market Committee meeting this week. Senior Economist Eric Wingorad of Alliance Bernstein shared his belief that:

“The strength in the top line indices was driven largely by categories that have been heavily disrupted by COVID and remain under pressure from supply chain disruptions. The more persistent categories of inflation — the ones that do a better job of capturing the sustainable trend — are significantly more subdued. That means that the details of today's print continue to support the idea that the spike in inflation is transitory, even if it is more intense than most forecasters (myself included) would originally have anticipated.”

Another metric called core inflation that removes volatile energy and food prices rose 3.8 percent as compared to the Dow Jones estimate for 3.5 percent. This represented the quickest rate on record dating back to May of 1992. For the month, the headline CPI figure jumped .8 percent with the core number up .7 percent. Both figures had been estimated to come in at .5 percent. Inflation has not significantly threatened the American economy since early in the decade of the 1980's, and these troubling numbers have drawn the focus of investors back to the topic of inflation for the first time in years.

Prices Surge As Economy Recovers from Pandemic

The report showed that prices had risen substantially over a wide range of segments of the economy as it rebounded from the crippling restrictions that government officials had mandated in months of the pandemic. The category of household furnishings and operations jumped 1.3 percent for the largest monthly gain going back to January of 1976. With more people flying, airline ticket prices increased by seven percent on a monthly basis and 24 percent versus a year ago.

Rentals of cars and trucks leapt higher by 12.1 percent versus April's 16.2 percent gain. The rental category is up 110 percent compared to a year ago. The costs of shelter category comprises around a third of the CPI index. It gained by .3 percent on the month and another 2.2 percent on a year to year basis comparison. A sub category index of the group that covers hotel/motel prices roared ten percent higher as compared to the year ago time frame. This chart below illustrates the rise in prices compared to other volatile periods that occurred over the last four decades:

Fed Policy May Not Be Sufficient to Contain Early 80's Styled Inflation

Some investors now are predicting that the return of inflation will be the most broad based it has been in several decades. Chief Investment Officer Peter Boockvar of the Bleakley Advisory Group warned on the Wednesday edition of the CNBC TV program Trading Nation that this issue is especially apparent now within the housing market, with:

“Monetary policy… is right now impotent in its ability to stimulate economic activity. We are at a point where very low interest rates are no longer stimulative to the housing market. On the purchase side, we know the dearth of inventories and sticker shock prices increases are slowing the pace of transactions.”

It is the housing market that shows the greatest sensitivity to these significant interest rate changes. Another area of concern according to economist and investor Boockvar is the refinancing rate. In the last two weeks the Mortgage Bankers Association report revealed that fewer Americans are choosing to refinance. The volume of total mortgage applications declined by 3.1 percent. Boockvar pointed out that:

“The levels of refis are at the lowest level since pre-Covid: February 2020. So, we're not getting that stimulative impact from very low rates anymore. The Fed knows how to tackle it [inflation]. It's just a question of whether they have the guts to do so.”

Economists and investors like Boockvar also have strong opinions on the timeframe for the end to quantitative easing. He is doubtful that the U.S. central bank will raise interest rates or halt its quantitative easing program earlier than what Wall Street anticipates thanks to the probable strong negative reaction of both the economy and the stock market. According to Boockvar, these inflationary pressures will cause the yield on the benchmark 10 Year Treasury Note to break out over two percent before the end of the year. He cautioned:

“That will create its own hurdles for the stock market. The stock market has rallied here of late, and it's back to highs because of the pullback in yields.”

By the end of this last Wednesday the yield on the 10 Year Treasury Note had reached 1.49 percent and dropped by over six percent versus the prior week.

Fed Still Planning Easing At Some Future Point

The Fed is still currently signaling that it will start a first phase of easing when it feels that both the labor market and the economy are sufficiently strong. Officials at the central bank have stated that they will accept inflation at an average range that hovers near their long held two percent target. A level greater than this would continue to push prices on many goods and commodities like IRA-approved gold and IRA-approved silver higher. This would lend support to the idea that gold makes sense in an IRA.

There is conjecture among economists and investors that the Fed will start to discuss the taper of its $120 billion per month stimulus at its Jackson Hole Economic Symposium meeting in late August. Fed observers anticipate that it will hold off a few months from this point to actually start reducing purchases in the month of December or even early in 2022. This scenario would see a prolonged time frame in which the Federal Reserve gradually decreased its bond purchases. At some point after this it would begin to increase interest rates. For now though the majority of market players do not anticipate the Federal Reserve actually hiking its interest rates ahead of year 2023.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,307.17

Gold: $3,307.17

Silver: $36.09

Silver: $36.09

Platinum: $1,351.02

Platinum: $1,351.02

Palladium: $1,110.25

Palladium: $1,110.25

Bitcoin: $107,626.91

Bitcoin: $107,626.91

Ethereum: $2,483.54

Ethereum: $2,483.54