Profit Sharing Plan: What Is it and How Does it Work?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Profit Sharing plans are employer-sponsored defined contribution plans, along the lines of a 401(k). However, with a profit sharing plan, only the employer can make contributions to the plan, and employees cannot make contributions.

This type of plan allows employees to share in the company’s success and is also an attractive perk when it comes to hiring new staff. We’ll take a look at what a Profit Sharing Plan is and how it compares to other retirement plans such as the 401(k).

Table of Contents

What is a Profit Sharing Plan?

A Profit-Sharing Plan allows companies to share part of the profits with their employees. The program offers a lot of flexibility as employers can decide which years they will make contributions to the plan.

As the amount of contributions can be determined from year-to-year, companies can adjust the contributions to the plan depending on their cash flow needs and the size of the profits. If the company has a bad year in generating revenue it can also decide to make no contributions at all.

Companies can decide to make contributions based on quarterly or yearly profits. The freedom of maneuver allows them to decide what percentage of profits they will contribute to employees at their complete discretion.

Even if a business is profitable in any given year the discretion allowed under the plan means the company is not under any obligation to make contributions for that period. The company may also set up a Profit Sharing Plan if it is not currently profitable.

The federal government, and most states, will not tax any contributions made within the limits. All contributions made within the set limits are tax-deferred, allowing the money held within the plan to grow tax-free until retirement.

Who Can Participate?

In general, Profit Sharing Plans include all rank-and-file employees, managers, and owners of the business. However, the company may exclude some employees under a few circumstances outlined below:

- Employees younger than age 21

- Those with less than 1 year of service (2 years for some plans)

- Already covered by a collective bargaining agreement

- Retirement benefits were subject to good faith bargaining

- Certain nonresident aliens

If you are an eligible employee for the plan, the company must provide information about the features of the plan, your benefits, and your rights. The company must provide all eligible participants with a Summary Plan Description. This document informs participants and beneficiaries about the plan and how it operates.

Nondiscrimination Rules

Under the rules of nondiscrimination concurrent to a Profit Sharing Plan, employers must ensure contributions made to rank-and-file employees are proportional to contributions made for managers and owners.

Plans may undergo annual testing to determine that contributions made to employees are proportional to the contributions made to managers and owners. Proportionality of contributions across all staff is a requirement for the plan to maintain its tax-deferred status.

Contribution Limits

Contribution limits are determined by the lesser of 100% of remuneration or $58,000 for 2021 and $61,000 for 2022. As with most retirement plans, the yearly contribution limit is adjusted yearly to compensate for inflation.

However, there is no Roth option under a Profit Sharing Plan. These limits do not affect your contribution limits on your IRA or 401(k) as you may still set up retirement plans where you can make your contributions.

How Does My Employer Calculate My Profit Share?

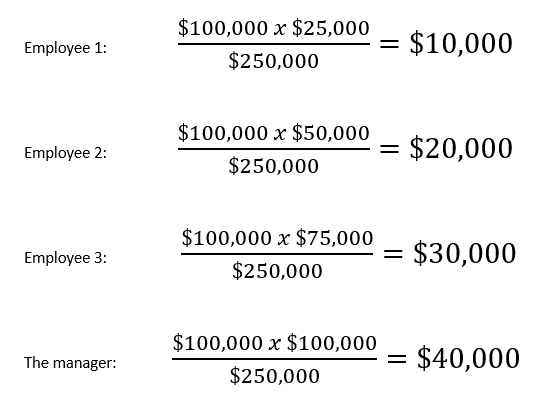

The most commonly used method to determine how much of the profits a company will contribute to each Profit Sharing Plan is the comp-to-comp approach. With this method of calculation, the company contributes to each participant an amount of the profits that is proportional to the employees’ salaries.

Let’s look at a numerical case. For example, the company decides that for the past tax year it will contribute 10% of profits to its employees. The company has 3 employees and 1 manager and generates a profit of $1,000,000.

The total amount the company will contribute to all plans is 10% of $1 million, or $100,000. This then needs to be distributed among all eligible participants proportionately. Under the method mentioned above, the profit share will be multiplied by each participant's salary and then divided by the total of all salaries.

To create easy calculations for our example, let’s say the staff at the company have the following salaries:

- Employee 1 earns $25,000

- Employee 2 earns $50,000

- Employee 3 earns $75,000

- The manager earns $100,000

The company will contribute to each participant following the calculations made below:

What Investments Can I Make With a Profit Sharing Plan?

You can invest in a variety of assets under a Profit Sharing Plan, although there are some limitations. And you may not have direction over which investments you can make with the contributions made to your plan on your behalf.

Typically Profit Sharing Plans can invest in the following broad asset categories:

- Individual stocks

- Corporate and government bonds

- Options

- Mutual funds

- Exchange Traded Funds (ETFs)

Unfortunately, you cannot invest in precious metals through a Profit Sharing Plan. In fact, any type of real asset is strictly prohibited within a Profit Sharing Plan. This means you won’t be able to invest in cryptocurrencies either.

You may invest in paper gold; these are securities of precious metals mining firms or funds that invest in precious metals. Examples include Barrick Gold (GOLD: NYSE) and Coeur Mining Inc. (CDE: NYSE), or iShares Gold Trust (IAU: NYSEArca), and SPDR Gold Shares (GLD: NYSEArca).

Rollover Option

Another option you have once the money in your plan is fully vested is to roll over your contributions to an IRA or a 401(k). Rolling over your contributions of a Profit Sharing Plan to a Self-Directed IRA will allow you to gain access to investments in real assets.

Can I Cash Out My Profit Sharing Plan?

This depends on a few factors. If you are over the age of 59 ½ you may take distributions from the plan without any penalty. Distributions from a Profit Sharing Plan under the age of 59 ½ may incur a 10% penalty.

You must check the vesting schedule of the plan. Some employers make fully vested contributions. This means the money in the plan belongs to you immediately. So, if you were to leave the company at any time you will be able to take that cash with you.

Some employers adopt a vesting schedule which means that you will forfeit the money if you change jobs before the vesting period is complete. For example, a Profit Sharing Plan with a 2 year vesting period means you will forfeit any money that has not been in the plan for longer than 2 years when you leave.

To explain further, say you received $5,000 in your first year under the company’s Profit Sharing Plan. The next year you received $10,000; however, the plan has a 2-year vesting period. If you leave 2 years after receiving the first contribution of $5,000 you can take it with you. But you will forfeit the $10,000 of contributions.

Can an Employer Keep Your Profit Sharing Plan?

This question is often asked as the employer is the one who makes the contributions to your plan as an incentive over your salary. So, the fact of the matter is that your employer can keep part or all of your Profit Sharing Plan contributions if you leave and your cash is not fully vested.

As mentioned earlier, some plans include a vesting schedule, which is often between 3 and 5 years. Usually, these schedules give you 100% ownership of the contribution once the vesting period is over. However, some vesting schedules allow for your contribution to become fully vested gradually.

That is, as the years go by a higher percentage of your contributions become vested. For example, after 1 year you may have 25% of your contributions fully vested, after 2 years 50%, and so on. In which case, if you leave before the final vesting period you will only lose the proportion of the contributions that are not fully vested.

Profit Sharing Plan Compared to a 401(k)

The main difference between Profit Sharing Plans and 401(k) is that contributions are made from your salary and not by the company. These contributions are a regular percentage of your income, although some employers also match employee contributions up to a certain amount.

You also have full ownership of the cash that goes into your retirement plan, whereas some Profit Sharing Plans may use a vesting schedule which delays full ownership of your funds. 401(k)s also usually allow for more flexibility when it comes to choosing which investments you want to make.

Contribution limits for Profit Sharing Plans are much higher than those for 401(k)s. For 2022, 401(k) contributions are limited at $20,500 plus $6,500 catch-up if you are over the age of 50. The good news is that you are not limited to having one type of plan only. Employers can provide both types of plans to all workers simultaneously.

Wrapping Up

Profit Sharing Plans allow employers a way to motivate their employees and managers. It is also useful in attracting new hires, and the vesting schedule can also help in keeping employees for longer.

However, if you are thinking of holding precious metals in your retirement plan, as you just read it's not possible through your Profit Sharing Plan. You have many options to consider if you want to add gold or other precious metals to your retirement portfolio. You can learn more about how to invest in gold for retirement with our downloadable free guide.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.85

Gold: $3,355.85

Silver: $38.41

Silver: $38.41

Platinum: $1,434.24

Platinum: $1,434.24

Palladium: $1,243.37

Palladium: $1,243.37

Bitcoin: $117,749.21

Bitcoin: $117,749.21

Ethereum: $2,952.91

Ethereum: $2,952.91