PocketSmith Review

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 25th March 2023, 12:14 am

- Phone : +64 98891088

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

No one can compete with PocketSmith's completely unique model of account and financial forecasts that can be made to run out from 10 to 30 years into the future. Their budgeting and calendar functions are fun and innovative as well. The value for money issue is the only one you have to decide for yourself personally.

Pros:

- Setting up your PocketSmith account requires completing five steps in a matter of less than a minute.

- You do not have to give out your confidential information when you sign up.

- Easily change up your plan by canceling, downgrading, or upgrading your service tier whenever you want.

- PocketSmith runs a YouTube channel that maintains tutorials with instructions on every element of the platform.

- Terrific customer service that actually responds to and makes website improvements based on customer feedback.

Cons:

- For anyone with numerous accounts, you will find you must pay to upgrade to a Super or Premium tiered account to receive financial forecasts for each of them.

- You can only track two accounts with the app's free version.

- Even though PocketSmith strives to be easy to use, the functions and services of the platform are involved enough to require some time and effort to understand them all.

If you are like us, you have often wished that you could find a crystal ball which would forecast your financial future in a single glance. We have found a personal financial management app that claims to do just that, and its name is PocketSmith. Pocketsmith uses all of your financial information that you feed into it, including checking and savings accounts, credit cards, investments, spending patterns, and student loans in order to predict just how much money you will have at various points in the future based on your actual and scenario budgets.

PocketSmith Intro and Background

Some fans out there claim that the best thing about PocketSmith is where it is from— New Zealand. Founded by the New Zealand trio James Wigglesworth, Jason Leong, and Francois Bondiguel, this personal financial management app proves to be unique by allowing you to set up your budget for any length of time, at any time of the month, week, or day that you want. We love this flexibility which stands in stark contrast to typical static monthly budgets that simply have to start on the first day of every month. PocketSmith's versatility is so great that you can even create single day, week, or month-long budgets that can extend into the future if you like. That is what you call flexible.

The budgeting is so workable that you can add in both recurring costs such as utilities, car payments, and mortgage/rent and one-off expenses such as taxes due for the year or quarter. You can also put in recurring or one- time income such as freelance work. You may also keep tabs on your outflows using either standard pre-set categories or you may set up your own.

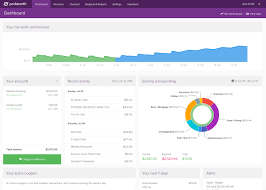

The interface also analyzes and beautifully renders your spending habits. It compares and contrasts your budgeted costs against real-world ones so that you can figure where you are off track. The pie chart it includes is so easy to read and makes the whole experience much more user-friendly.

PocketSmith Tools and Features

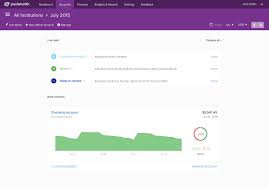

- Calendar – This Google look-alike calendar is a revolution in portraying your future finances. Not only does it display your present account balance, but it also shows you future balance forecasts. It synchronizes with your various accounts and your budget categories to do this amazing task. This feature is what makes PocketSmith unique versus other personal financial management products.

- Compatibility with Mint – PocketSmith is globally available, probably because its founders are based in New Zealand and appreciate the true international nature of the world far better than typical Americans. It is completely compatible with Mint, allowing you to easily import your accounts and information from that platform.

- Dashboard – Makes it easy for you to see both your spending patterns and income side by side. With a few button clicks you are able to view your prior spending history going back as much as six months on the free version.

- Budget – Budgeting is one of the fantastic functionalities of PocketSmith. You may create daily, weekly, monthly, or longer time-frame budgets and start them on any day of the week or month that you so desire. You can also come up with scenarios to play around with your finances to see how it impacts your savings, net worth, and money for retirement.

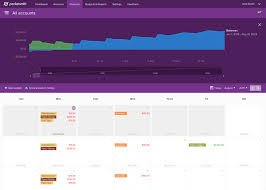

- Net Worth – This handy feature helps you to easily see how much you owe and what you possess. It has input categories for loans, autos, mortgages, and property, among other categories.

- Expenses and Income – We love their excellent reports that display the amounts you have both earned and spent within a given time range.

- Cashflow Statement – We are suitably impressed with how PocketSmith does all the heavy lifting for you with this reporting feature that is completely automatic and updates all by itself, too. In a month by month view, you are able to examine your historical cash flow statements as well.

PocketSmith Interface Screenshots

PocketSmith Fees

PocketSmith has three tiers of service and accompanying pricing. The free version is more limited but still includes 12 budget and spending categories, 2 different calendars, financial forecasts for six months out, three months worth of transactions analyzed, and two credit cards or bank accounts input. You do not get any bank feeds with this level of service, and must download from your bank and then upload to PocketSmith all of your bank statements and transactions manually.

Premium tier provides live bank feeds and limitless budget and spending categories. With 20 different calendars and financial forecasts running a fairly impressive 10 years ahead, you can also have as many as ten credit card or bank accounts synchronized and receive up to 5 years of transaction analysis. This service costs you $9.95 per month or only $7.49 per month if you pay annually in advance, which translates to about $90 per year upfront.

We are in awe of this third super tier that delivers some impressive financial feats of forecasting wizardry. You receive the live bank feeds, limitless calendars, limitless budget and spending categories, and an incredible 30 years advance financial forecasting for your bank balances, net worth, and retirement savings. You also get limitless credit cards and bank accounts synchronization and 10 years of transaction analysis and reporting. This service runs $19.95 per month or $14.16 per month paid annually in advance, which amounts to a fairly steep $170 per year upfront. We realize that the New Zealand trio of founders need to feed their families too, but this is a significant annual investment for most people, unless you are passionate about the interesting features and functionality of this somewhat unique personal financial management platform.

PocketSmith Safety and Security

It may be that the Kiwis of New Zealand have less fraud back home or are simply a more trusting people, but we felt like PocketSmith has a fairly limited suite of security features. The biggest safety check they have going is optional two-factor authentication. This means that you can require they send you a unique code to your mobile phone that you must then use to log in along with your standard username and selected password.

An interesting feature that they offer is called advisor access. PocketSmith will allow you to select a different PocketSmith account holder to manage and have access to your personal account. This could be useful if you have a friend, advisor, or family member who wants to help you with your finances.

Final Words on PocketSmith

The final verdict we give on PocketSmith is that it is both fascinating and helpful as a uniquely functional budgeting tool and financial calendar. This calendar is really the standout feature, as it permits you to simply and graphically follow your various accounts including student loans, credit cards, checking, and savings. The best deal on their subscription services is undoubtedly the $9.95 per month one that you can have for $7.49 per month by pre-paying for a year in advance. This is especially worthwhile if you need microscopic level views and future forecasts on a number of your accounts. In this case, the platform is worth your hard-earned money. If you are able to get by utilizing one of the less enjoyable but free service rival apps, then you can instead pocket the $90 per year and put it toward your retirement savings.

- Phone : +64 98891088

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

No one can compete with PocketSmith's completely unique model of account and financial forecasts that can be made to run out from 10 to 30 years into the future. Their budgeting and calendar functions are fun and innovative as well. The value for money issue is the only one you have to decide for yourself personally.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $5,178.85

Gold: $5,178.85

Silver: $88.20

Silver: $88.20

Platinum: $2,150.48

Platinum: $2,150.48

Palladium: $1,749.48

Palladium: $1,749.48

Bitcoin: $62,980.98

Bitcoin: $62,980.98

Ethereum: $1,822.96

Ethereum: $1,822.96