Pension Funds and State Governments Alike Desperately Need Federal Bailouts

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Over the past several weeks, the news has emerged that state and local governments are so hard up financially that they have even sought help from the big state pension funds. Unfortunately for everyone, the pension funds are mostly hopelessly broke themselves. With many different state and municipal governments nearing the brink of financial default on their obligations, there is no one left to help bail them out but the federal government. The situation is so desperately bleak that the federal government is on the verge of printing and borrowing several trillion dollars more to save the local and state governments from collapse.

Pension Funds Are Hopelessly Broke Alongside Their State Governments

Pension funds used to offer financing in the form of bond purchases to state and local governments. Nowadays, they are starting to look for bailouts of their own failed pension schemes. Consider the Teachers' Retirement Systems of New York. This is the union which originally heroically saved New York City from imminent default back in 1975. Today it is technically insolvent itself. The most current financial report of this pension fund reveals that it is roughly 40 percent short of covering its own obligations.

These numbers are pretty consistent throughout the New York Police and Fire pensions also. Would that the state of New York were the only place in America having these problems. Illinois' State public pensions run an average of 60 percent under their necessary funding. The pension funding gap is 65 percent within the state of New Jersey.

There are only two states remaining within the U.S. that possess completely funded public pension systems per 2019. These are South Dakota and Wisconsin. The sad truth is that the overwhelming majority of the pensions funds in the 50 states have fallen into severe financial trouble so that they can not possibly bail anyone out today.

State Governments to Receive Federal Bailouts?

Sadly, the governments of the various states are in worse financial shape than their own pitiful pension systems. The state of Illinois has debt that ranks a single notch over junk level. The state legislature has recently appealed to Washington to give them an eye-watering $40 billion bailout. This state is far from alone either. New Jersey, California, and New York have also joined the queue to receive major federal government bailout funding.

With the economic collapse still ongoing, the local and state governments are almost definitely staring a severe budget crisis in the face with their critical tax receipts drying up while social service needs skyrocket. Senior Vice President Nicholas Johnson for State Fiscal Policy in the Center for Budget and Policy Priorities recently shared that:

“The emerging bipartisan agreement on the Senate's economic emergency legislation contains very significant new resources to help states address their massive immediate budget problems due to COVID-19, though it almost certainly doesn't go far enough.”

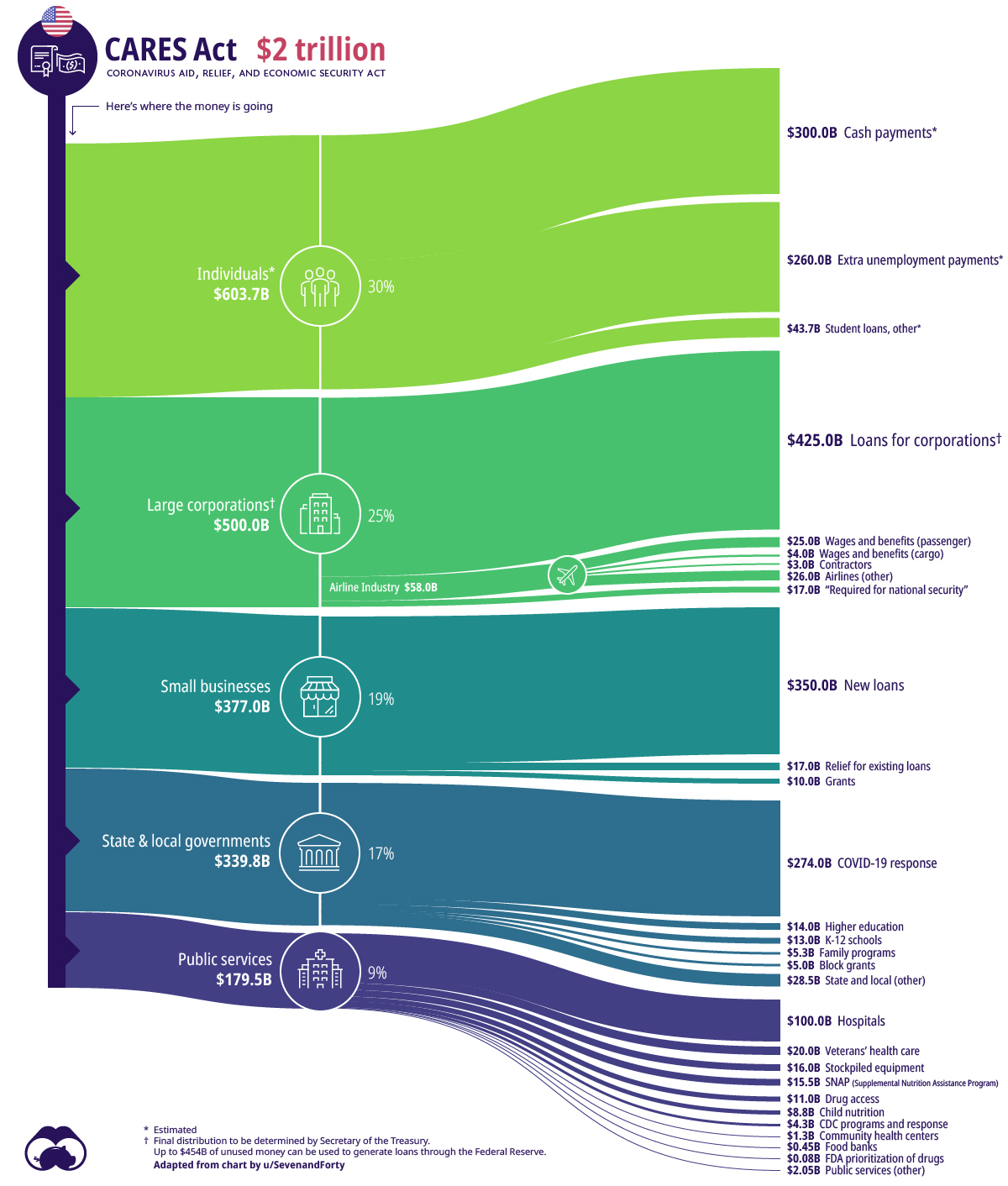

These strains are showing everywhere in the country now. In New York, Governor Andrew Cuomo has decried the CARES Act for not helping out his state enough as they are the epicenter for the coronavirus within the United States. He stated that the bill would provide New York state with under $4 billion, when they really need $15 billion to cover their revenue shortage which the shutdown has created. This chart below shows the breakdown of the funding from the $2 trillion CARES Act rescue:

Cuomo stated that:

“We have no state revenues to speak of. We are going to have to dramatically cut state spending. You can't spend what you don't have.”

Officials in San Francisco have estimated that the budget for the two year period for the city will increase from the prior $420 million to potentially $1.7 billion now. Still other local and state governments are already reducing spending or making plans to do so imminently. Nevada and Ohio are cases in point. The Governor Steve Sisolak of Nevada has declared a freeze on hiring. Ohio's Governor Mike DeWine is calling for fully 20 percent across the board cuts on state government as well as a freeze on hiring. New York City's Mayor Bill de Blasio is searching for a substantial $1 billion worth of savings to the city budget himself.

Surprisingly to economic observers, Congress is in fact working up a one trillion dollar bailout for the troubled state governments even now. On top of that, just last week the Federal Reserve declared that it will enter the bond markets to purchase an incredible $500 billion in bonds from the municipalities, counties, and states. Between them, these two bailouts total an amazing $1.5 trillion in funds for local and state governments (atop the other already many trillions that the United States' federal government has made so far).

Treasury Announces It Will Borrow $3 Trillion in Only This Quarter

Many are wondering where the money to pay for all of these lauded bailouts is coming from now. Treasury shed some light on the mystery when it announced this week that it will borrow an all-time high amount of $2.99 trillion for only this quarter of April through June. This is necessary to pay for the expenses associated with the many rescues that are ongoing in response to the shutdown from the pandemic.

This nearly $3 trillion amount will vastly exceed their prior record quarterly borrowing from the July to September quarter of 2008 when it addressed the Global Financial Crisis and Great Recession. To put this figure into perspective, the government borrowed a total of $1.28 trillion for the entire year 2019 from the bond markets.

Yet Treasury has defended this need because of all the money it is delivering to numerous supporting programs for businesses and workers via direct economic payouts and the Paycheck Protection Program, to name only a few of them. Besides this, the federal government has to borrow to fund its revenue shortfall resulting from the delay of the tax revenue collection brought on by deferring the filing deadline from April until June.

Creating Money From Nothing Does Not Lead to Prosperity

It is important for you to remember that these vast sums of money in the trillions being tossed around are coming from thin air. Unfortunately the central bankers and their politicians feel certain that they are able to print as much bailout money as is required without having to make any painful choices. It is not possible to print money or borrow your way prosperity though, as national case studies like Zimbabwe and Venezuela have clearly reinforced in our own current day.

Perhaps the virus actually will go away as if it had never occurred in the first place, things will somehow return to their prior bubble inflated levels, and the consequences of debasing the dollar will not materialize at all. Unfortunately for everyone in the U.S. and around the world, reality is that the virus pandemic will likely be with us for several years at least, cowardly leaders will continue to make economically ruinous decisions for their economies (so as not to realize their ultimate fear of losing reelections), and the money printing will simply continue until the national financial balance sheet buckles and collapses from it.

The news about failing state and local governments' finances and pension system shortfalls this week is another reason for why gold makes sense in an IRA. Now is a sensible time to consider IRA-approved precious metals for your investment and retirement portfolios. While you are reading about the Top Five Gold Coins for Investors, you might want to learn more about Top Gold IRA Companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,935.49

Gold: $2,935.49

Silver: $32.50

Silver: $32.50

Platinum: $980.75

Platinum: $980.75

Palladium: $973.89

Palladium: $973.89

Bitcoin: $96,581.55

Bitcoin: $96,581.55

Ethereum: $2,764.30

Ethereum: $2,764.30