Palladium Coins and Bars: A Primer for New Investors (2024)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 23rd January 2024, 03:32 pm

Investing in precious metals has been a tried-and-true method of wealth preservation for centuries. While gold and silver might be the first metals to come to mind, there's another silver-hued contender that's gaining popularity: palladium. The global market for this silver-colored precious metal is approximately $16.5 billion USD as of 2022.

Palladium coins and bullion bars are becoming a favorite among discerning investors and with good reason. Let's dive into the lustrous world of palladium, specifically as it pertains to retirement investors looking to diversify their portfolios.

Table of Contents

A Glimpse into Palladium for Investors

Palladium, with the atomic number 46 on the periodic table, is a rare and lustrous silvery-white metal. It was discovered in 1803 by William Hyde Wollaston, who named it after the asteroid Pallas. It belongs to the platinum group metals, which includes platinum, rhodium, ruthenium, osmium, and iridium.

Key uses of palladium span across various industries. It's vital in the automotive industry for catalytic converters, which reduce harmful emissions. Palladium is also used in electronics, dentistry, and jewelry. Its unique properties—like its ability to absorb 900 times its own volume in hydrogen—make it invaluable in certain industrial applications.

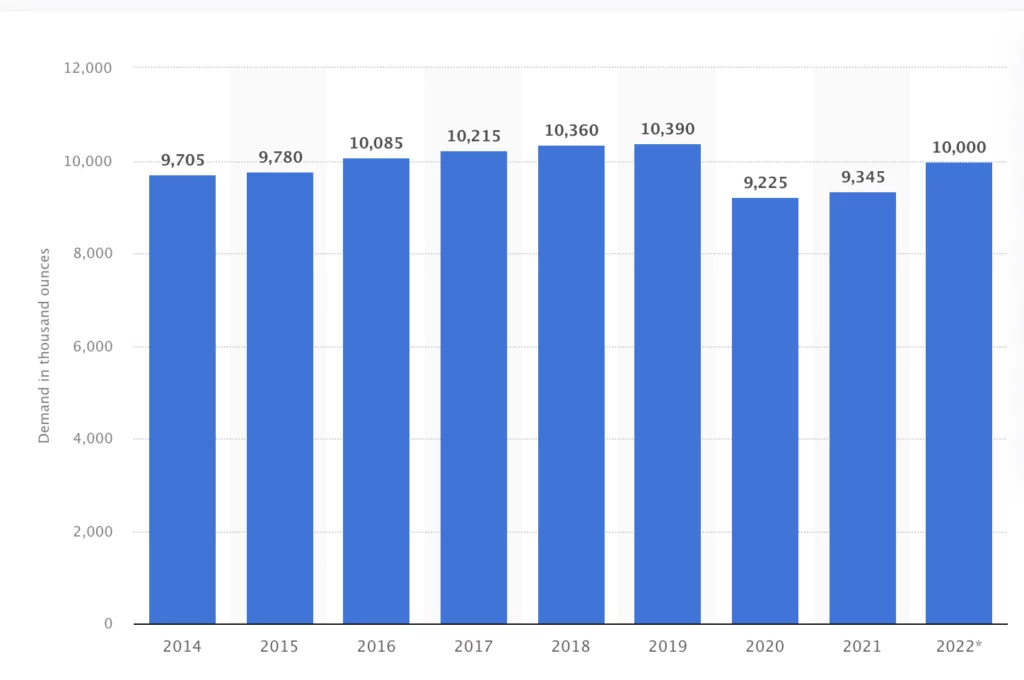

Figure 1: Global palladium demand from 2014-2022 (Source: Statista)

Above, Figure 1 demonstrates the consistently rising global demand for palladium over the eight years preceding 2022. The notable exception is during 2020 to 2022, when pandemic-related measures resulted in a slowdown in auto sector demand.

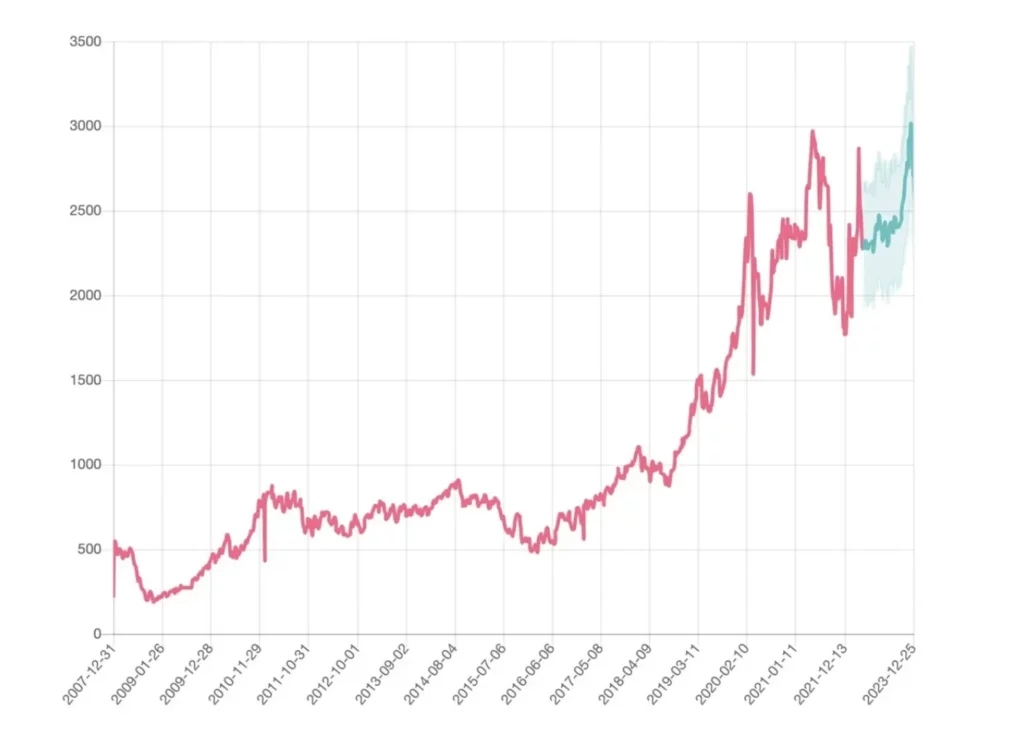

In 2024, the global market for palladium is expected by some to hit a supply surplus of 300,000 troy ounces. By some estimations, as depicted in Figure 2 below, palladium demand is also expected to concurrently surpass all-time highs set in 2019.

Figure 2: Palladium demand for Q4 2023 (Source: Libertex)

Palladium as an Investment 101

So, why are investors so smitten by palladium? Let’s take a look at some of the most important elements of palladium investing:

1. Supply and Demand Dynamics: The primary demand for palladium comes from the automotive industry. With stricter emission regulations globally, the demand for palladium is robust. Coupled with supply constraints, the price of palladium has seen significant surges in recent years.

2. Diversification: Palladium offers diversification for those who already invest in other precious metals. Its price doesn't always move in tandem with gold or silver, making it an attractive option for portfolio diversification.

3. Physical Ownership: Like gold and silver, investors can own palladium in physical form—coins and bullion bars. This tangible asset can be stored, moved, and even used as collateral if needed.

In 2023, palladium investment demand will have increased by 25,000 troy ounces following a decline in the previous year due to Chinese manufacturing shutdowns. In the months ahead, supply and demand forces corrected to an equilibrium point due to pandemic-related investor selling.

Indeed, palladium is a unique metal whose chemical and physical properties make it widely sought after for manufacturing purposes. Its extremely ductile nature allows for the metal to be easily worked and, additionally, it is largely untarnished by regular atmospheric pressures. These attributes are particularly in demand by automotive manufacturers for their use in catalytic reactions.

Investments in palladium are seen as a diversification method that, in some cases, can manage risk in one’s portfolio. Investing in physical assets such as palladium coins and bars provides tangible proof of one’s ownership of the asset, and can minimize counterparty risks.

Popular Palladium Coins and Bullion Bars

For those interested in dipping their toes (or diving headfirst) into palladium investment, here are some of the most popular options:

Of course! Here's a more detailed breakdown of four popular palladium coins and four palladium bullion bars, presented with bullet points for easier reference.

Palladium Coins

Most palladium investors and collectors opt for palladium coins rather than bullion. This is because they are immediately recognizable and easier to trade. Generally, coins benefit from greater liquidity, although they often carry higher premiums.

1. Palladium Canadian Maple Leaf

Issued by the Royal Canadian Mint, this coin features Queen Elizabeth II on its obverse and the iconic Canadian maple leaf on its reverse. It's one of the most recognized palladium coins globally and boasts a purity of .9995 palladium.

– Issuer: Royal Canadian Mint

– Design: Queen Elizabeth II on the obverse, iconic Canadian maple leaf on the reverse.

– Purity: .9995 palladium

2. Palladium Ballerina (Russia)

This beautiful coin, issued by Russia, showcases an elegant ballerina on its obverse. It's a nod to Russia's deep cultural connection to ballet. The coin is made of .999 fine palladium.

– Issuer: Russian Mint

– Design: Features an elegant ballerina, signifying Russia's rich ballet history.

– Purity: .999 fine palladium

3. American Palladium Eagle

The U.S. Mint introduced this coin in 2017. It features a high-relief likeness of “Winged Liberty” from the “Mercury Dime” obverse and an eagle on its reverse. With a purity of .9995 palladium, it's a favorite among American investors.

– Issuer: U.S. Mint

– Design: High-relief “Winged Liberty” from the “Mercury Dime” on the obverse and an eagle on the reverse.

– Purity: .9995 palladium

4. Palladium Britannia (UK)

Issued by the Royal Mint, the Palladium Britannia is structurally similar to the famous gold and silver versions of the Britannia. This item carries an Article Number of 5052 and has a gross weight of 31.1 grams. Palladium collectors tend to prize the Britannia given that its lesser-known than its gold and silver counterparts.

– Issuer: The Royal Mint

– Design: Features the iconic Britannia figure, symbolizing Britain’s strength and integrity.

– Purity: .9995 palladium

Palladium Bullion Bars

For those looking to invest in larger quantities, bullion bars may be a better way to go. Renowned mints and refiners like PAMP Suisse, Credit Suisse, and Valcambi produce palladium bars ranging from 1 gram to 10 ounces. These bars are typically .9995 pure palladium.

1. PAMP Suisse Palladium Bar

– Refiner: PAMP Suisse

– Size Options: Available in multiple sizes, from 1 gram to 10 ounces.

– Purity: .9995 palladium

– Design: Features the famous Lady Fortuna, the Roman goddess of fortune and luck.

2. Credit Suisse Palladium Bar

– Refiner: Credit Suisse

– Size Options: Typically available in 1 ounce and 10 ounces.

– Purity: .9995 palladium

– Design: Simple and elegant, often with the Credit Suisse logo and weight indications.

3. Valcambi Palladium Bar

– Refiner: Valcambi Suisse

– Size Options: Range from 1 gram to 1 kilogram.

– Purity: .9995 palladium

– Design: Distinctive with the Valcambi logo, weight, and purity indications.

4. Engelhard Palladium Bar

– Refiner: Engelhard

– Size Options: Most commonly found in 1 ounce and 10 ounces.

– Purity: .9995 palladium

– Design: Minimalistic, often bearing the Engelhard logo and purity specifications.

Remember, the physical appearance and design of the bars and coins listed above can vary over time or with special editions. Always ensure you're purchasing from reputable sources to guarantee authenticity.

How to Invest in Palladium Coins and Bars

For many, investing in palladium coins and bars is as simple as visiting your local precious metals dealer or pawn shop and asking to view their palladium inventory. However, the downside to this approach is twofold:

- Pawn shops often do not sufficiently stock palladium and platinum-group metals

- Local vendors usually cannot accommodate IRA investing

Fortunately, alternative options exist for investors who want to purchase investment-grade palladium—especially if they want to hold their assets within tax-advantaged accounts.

Self-directed IRAs (SDIRAs) allow investors to add their palladium assets to their retirement accounts so that the assets can appreciate in value on a tax-free or tax-deferred basis.

Since SDIRAs are not available from regular brokerages, investors must contact a dedicated precious metals IRA provider to access accounts of this type.

Top-Rated Precious Metals IRA Companies

Below are some of the industry’s best-rated precious metals IRA providers. These companies offer specialized IRA solutions, present a compelling option for investors seeking to diversify their retirement portfolios beyond traditional stocks, bonds, and mutual funds.

These IRAs allow individuals to hold physical precious metals, such as gold, silver, platinum, and palladium, as part of their tax-advantaged retirement savings. Investors are drawn to them not only for the tangible nature of the assets but also for the potential hedge against inflation, currency fluctuations, and economic downturns that precious metals historically offer.

The allure of tangibility, combined with the metals' enduring value across civilizations and economic conditions, makes precious metals IRA companies an attractive proposition for those aiming for a well-rounded and resilient investment strategy.

1. Noble Gold

Noble Gold is arguably the best source for precious metals investing within a self-directed IRA. Founded in 2017, this firm has among the lowest fees ($100 annually, plus $250 for annual storage) while partnering with the industry-leading Equity Trust Company for custodial services. This California-based company has Gold IRA Guide’s maximum global rating of 5 stars.

Global Rating: ⭐⭐⭐⭐⭐ (5/5 Stars)

Quick Facts:

- Lowest fees in the industry

- Minimum account value of just $2,000

- “No-quibble” buyback policy

- Founded by industry veteran Collin Plume

3. Augusta Precious Metals

Augusta Precious Metals is regarded as one of America’s premier sources for precious metals SDIRAs. Boasting a huge selection, star-studded endorsements, and no high-pressure sales tactics, Augusta is one of the most reputable firms in the industry.

Global Rating: ⭐⭐⭐⭐⭐ (5/5 Stars)

Quick Facts:

- Named Money magazine’s “Best Overall” Precious Metals IRA company

- Endorsed by Hall of Fame quarterback Joe Montana

- Zero fees for up to 10 years

- Terrific customer ratings across the board

3. SilverGoldBull

The Canadian-American gold and precious metals supplier, SilverGoldBull, partners with a variety of custodians, including Equity Trust Company, to provide affordable gold, silver, and platinum-group metals to North American clientele. Storage services are provided by Brink’s Global Service.

Global Rating: ⭐⭐⭐⭐⭐ (4.7/5 Stars)

Quick Facts:

- Nearly 300,000 verified 5-star reviews

- Has physical retail locations in both U.S. and Canada

- Excellent catalog of precious metals

- Partner with various third-party custodians

For a full list of the best precious metals and palladium IRA companies in America, check out our gold IRA reviews page.

Final Thoughts: Are Palladium Coins and Bars Worth It?

Palladium's lustrous allure isn't just skin deep. Its unique industrial applications, coupled with its investment potential, make it a shining star in the precious metals market.

Whether you're a seasoned investor or just beginning your journey, palladium coins and bullion bars could be a worthwhile addition to your portfolio. For more information about palladium SDIRAs and investing in palladium coins or bars within a tax-advantaged account, read our full list of the best precious metals IRA providers.

Remember, as with any investment, do your due diligence, consult with licensed professionals, and always buy from reputable dealers.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,307.17

Gold: $3,307.17

Silver: $36.09

Silver: $36.09

Platinum: $1,351.02

Platinum: $1,351.02

Palladium: $1,110.25

Palladium: $1,110.25

Bitcoin: $107,626.91

Bitcoin: $107,626.91

Ethereum: $2,483.54

Ethereum: $2,483.54