November 2021 Newsletter: Inflation At Generational Highs, Crypto Soars to ATHs; Gold the Last Safe Haven?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 5th November 2021, 08:53 pm

If you ever needed evidence that gold is a legitimate disaster hedge, look no further than today’s Venezuela. A recent Bloomberg report found that Venezuelans, beset by hyperinflation, have resorted to breaking off flakes of gold to pay for food and essential services.

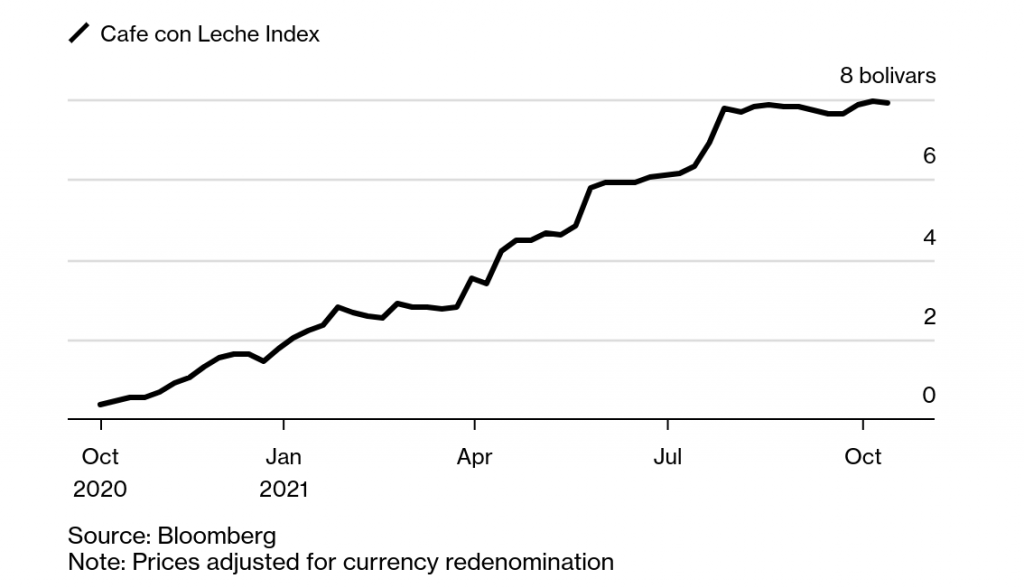

In Venezuela, the price of a cup of coffee has risen +1,737% over the past 12 months.

Although America’s inflation levels are a far cry from socialist Venezuela’s, there's no telling where the devaluation of the U.S. dollar will end. In any case, there's an important lesson we can take from Venezuela's monetary policy: when fiat money dies, gold is the curreny of last resort.

The U.S. consumer price index—our best measurement of inflation—hit a 13-year high in October when it reached 5.4%. Inflation has been steadily on the rise throughout the pandemic, the aftereffects of the Fed’s $4 trillion stimulus campaign.

Savvy investors would do well to load up on hard commodities such as gold, silver, and cryptocurrencies before the market catches on. When federal interest rates hike in 2023—or potentially even earlier—we could see runaway inflation combined with a generational stock market correction. Taken together, a perfect storm for a gold surge.

To make matters worse, we’re facing massive supply constraints on a global scale. Major retailers such as Home Depot, Target, and Walmart have even chartered their own cargo ships to transport goods to North American markets for the holiday season.

If the big box stores have to go to such extreme measures to get their products on store shelves, what will happen to local mom-and-pop retailers on Main Street? Unless we see drastic intervention to remedy supply chain issues, there could be disastrous consequences for our local economies and the U.S. job market as a whole.

None of this is good news. On the bright side, you can take action today to protect your wealth.

By all indications, we're at the stock market mountaintop, and at the brink of a structural crisis. If you're going to diversify your portfolio, it would be wise to do it now.

Historically, gold and silver perform well during economic crises—this is true, to a lesser extent, of cryptocurrencies as well.

Amid raging markets, gold had another good month in October. The yellow metal rose a safe and stable +1.5% to $1,796 per troy ounce. Meanwhile, Bitcoin surged over +40% to a new all-time high of $67,016 on October 20 on the heels of a major new Bitcoin ETF launch.

The days of ultra-low interest rates and multi-trillion-dollar bond purchases are coming to a close. When our economy changes, don't be stuck playing catch up. Instead, prepare in advance. Start your diversification journey by contacting a self-directed IRA provider today. With their assistance, you can set up and fund a retirement account with alternative assets—including gold, silver, and cryptocurrencies—within days.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,336.55

Gold: $3,336.55

Silver: $37.80

Silver: $37.80

Platinum: $1,337.40

Platinum: $1,337.40

Palladium: $1,124.21

Palladium: $1,124.21

Bitcoin: $117,645.06

Bitcoin: $117,645.06

Ethereum: $4,436.18

Ethereum: $4,436.18