Nationwide Survey: 42.9% of American Adults Have Less Than $25k Saved for Retirement

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 15th November 2021, 08:52 am

Table of Contents

Key Takeaways:

- 18.5% of respondents nationwide report having $1 million or more saved for retirement

- 42.9% of Americans have $25,000 or less in a retirement savings account

- The results are skewed by gender, with 48.9% of women reporting having saved $25k or less compared to 35.6% of men; men outnumber women nearly 2:1 among those who report having more than $1M saved

- Politically “red” states generally have less saved than “blue” states

- The states with the highest population percentage with less than $25k saved are Oklahoma (59.2%), Indiana (53.4%), and Alabama (52.1%)

- The states with the highest population percentage with more than $1 million saved are California (21%), Connecticut (19.7%), and Michigan (18%)

- The results are not greatly skewed by age; 36.2% of those aged 45 and older have less than $25k saved for retirement

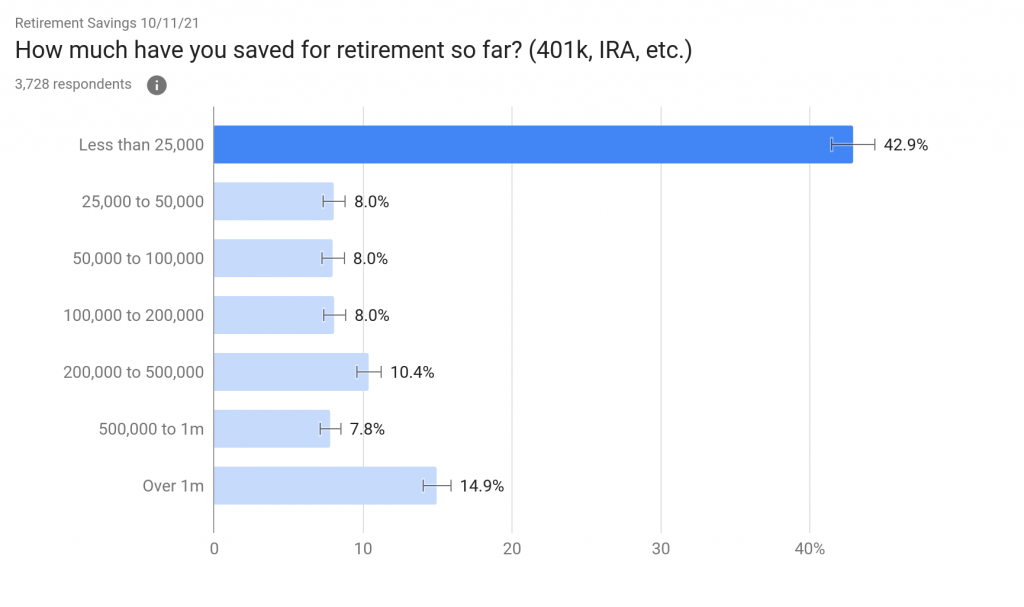

Figure 1. Source: Google Surveys

Many Americans are unprepared for retirement. According to a nationwide survey published by Gold IRA Guide on November 10th, 2021, an incredible 42.9% of Americans aged 18 and over have less than $25 thousand saved for after their working life.

The survey data confirms earlier opinion polling by the Federal Reserve which found that over one-third of U.S. adults believe their retirement savings aren’t on track.

Until now, however, the extent of America's pandemic-era retirement saving problem had yet to be uncovered. In this article, we’ll unpack the data from this landmark survey and discuss its implications for the average American investor.

November 2021 Survey: 42.9% of Americans Have Less Than $25k in Retirement Accounts

Gold IRA Guide recently published the results of a nationwide poll that found that 42.9% of U.S. adults claim to have less than $25,000 in a registered retirement savings account. The question was posited as follows:

“How much have you saved for retirement so far? (401k, IRA, etc.)”

The survey recruited 5,000 respondents (3,728 after weighting adjustments) residing in the United States aged 18 and older. The respondents’ data was collected between October 12 and November 6, 2021, via Google Surveys using a nationally-representative sample.

The results displayed above (Fig. 1) demonstrate that a strong plurality of U.S. adults have less than $25k saved for retirement, and roughly half (50.9%) have less than $50k. Further, a total of 58.9% claim to have less than $100k saved, and 66.9% report having less than $200k in a retirement account.

In short, a majority of Americans have less than $50,000 saved for retirement. This should come as a concern, given that retirement experts estimate that Americans need approximately $1 million or 12 times your pre-retirement salary in order to comfortably retire.

In total, 1,981 respondents claimed to have less than $25k saved. This number is greater than the sum of all respondents in the highest four response categories (i.e., those with $100k or more saved), which numbered 1,659. Therefore, there are more Americans with $25k or less saved for retirement than there are with $100k or more.

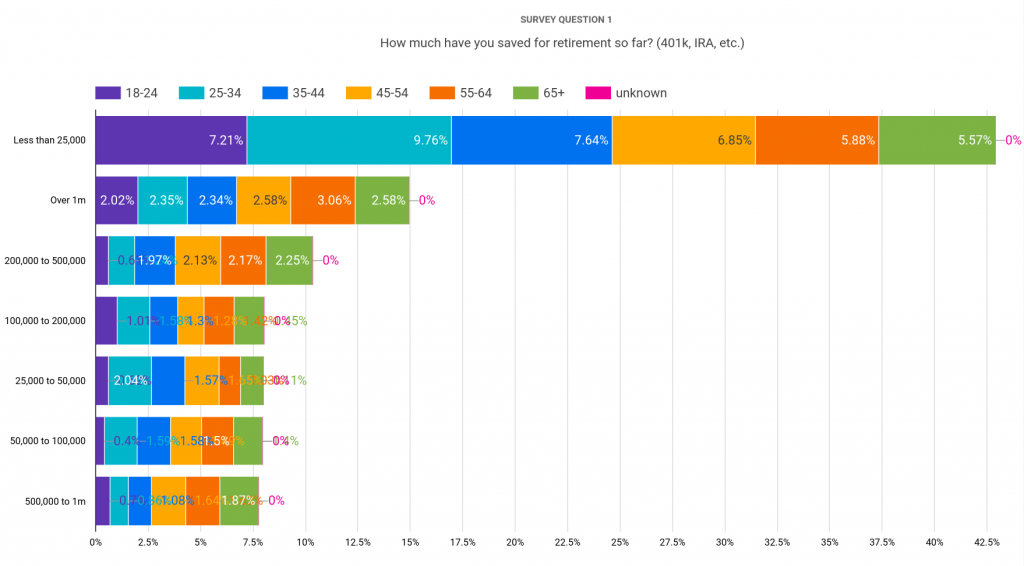

Retirement Savings by Age Group

The graph below (Fig. 2) depicts the survey results broken down by age group. Interestingly, the “under $25k” response group is not as skewed by age as we initially expected. Although it's unsurprising that younger respondents (i.e., under age 35) were more likely to report being within this response group,

For instance, 7.21% of respondents self-reported as having less than $25k saved and being between the ages of 18 and 25. Surprisingly, a very close percentage of respondents (6.85%) report having saved the same amount of money but being between the ages of 45 and 54. Those in the oldest age bracket (65+) made up the smallest share of those in the $25k and under response group (5.57%).

As a rule, older respondents tended to report having more money saved for retirement than younger respondents. There were more respondents aged 65 and older who reported having over $1 million saved (1.87%) than there were in both the 18 to 25 and 26 to 35 age categories combined (1.56%).

Figure 2. Source: Google Surveys

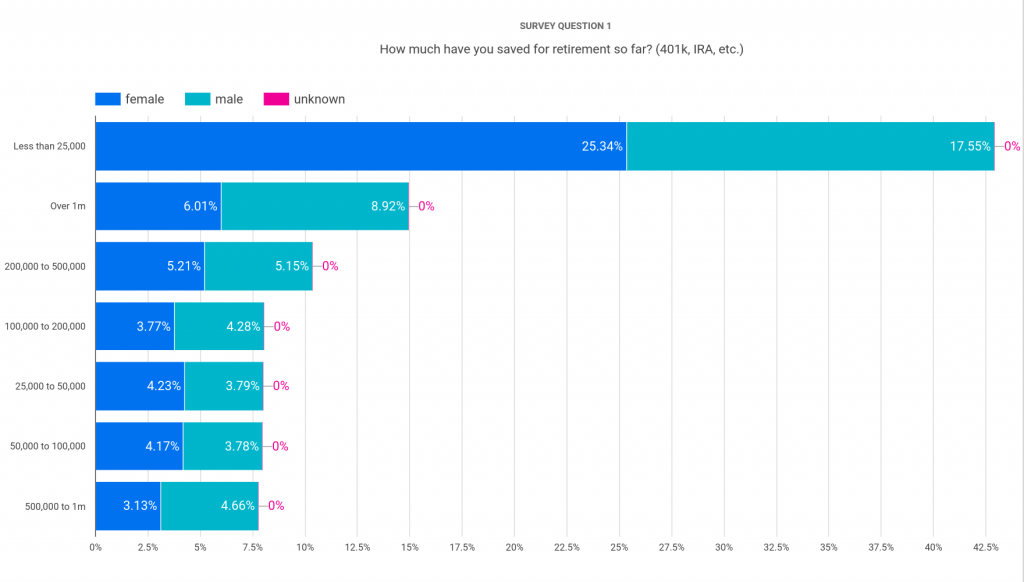

Retirement Savings by Gender

Gender-based retirement savings differences are highly prevalent in the extremes on both sides of the scale.

For example, women outnumber men in the less-than-$25k response category by 44.5%. Among those with the most saved for retirement (<$1M), men overshadow women nearly 2-to-1 (+48%), and the same is true for the $500k to $1M category (+49% more men than women).

In the middle categories, however, there's a fair degree of gender parity. Men and women report having retirement savings in the $50k to $500k at relatively equal rates. The widest differential among these categories is the $100-200k group, with men outnumbering women by only +13%. The narrowest gender differential is the $50-100k group, where women outnumber men by +10%.

Figure 3. Source: Google Surveys

Retirement Savings by State and Geographical Region

There are large disparities in retirement savings by state and region, which tend to follow socio-political divisions. Below, we've highlighted the upper and lowermost response categories according to geographical region and state.

<$25k Saved by Region

- West: 40.9%

- South: 45.8%

- Northeast: 40.6%

- Midwest: 42%

>$1M Saved by Region

- West: 18.3%

- South: 13.5%

- Northeast: 14.5%

- Midwest: 14.1%

States With Highest Percentage Reporting <$25k Saved

- Oklahoma (59.2%)

- Indiana (52.4%)

- Alabama (52.1%)

States With Highest Percentage Reporting >$1M Saved

- California (21%)

- Connecticut (19.7%)

- Michigan (18%)

Survey Methodology

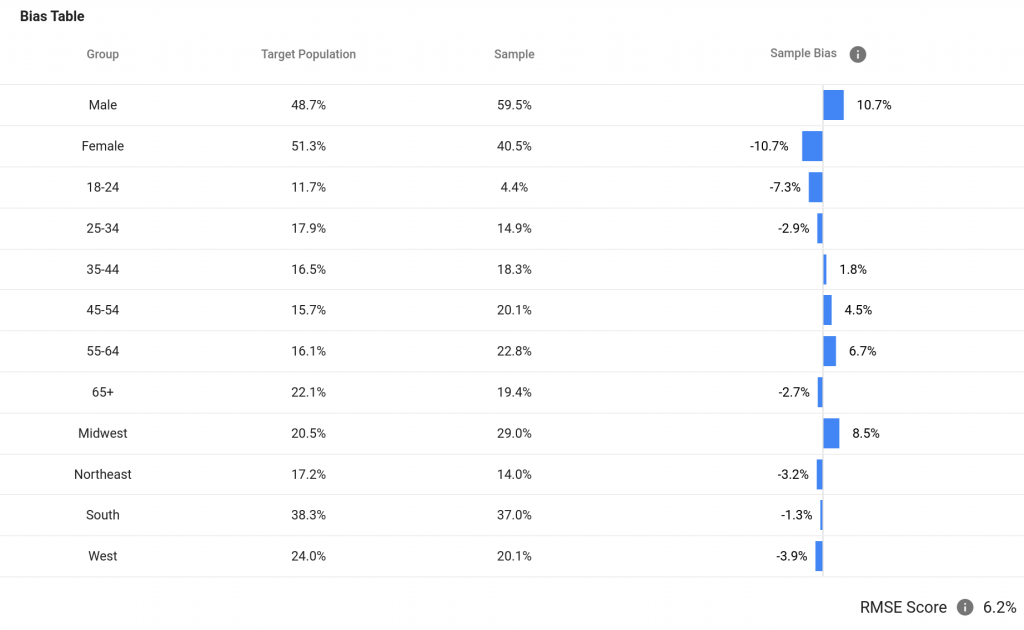

The survey was conducted via Google Surveys over a 25-day period between October 12 and November 6, 2021, with a sample size of 5,000 adults. To improve national representation, Google Surveys automatically eliminated some 1,272 responses for a total of 3,728.

Respondents included residents of every U.S. state, including Alaska and Hawaii. States that did not receive enough responses to generate statistically significant results were automatically omitted from consideration by Google Surveys.

Study Details and RMSE Score

- Audience: Users of the Google Surveys Publisher Network

- Method: Representative

- Age: 18+

- Gender: All genders

- Location: United States

- Language: English

- Frequency: Once

Root mean square error (RMSE) is a weighted average of the difference between the predicted population sample (CPS) and the actual sample (Google). The lower the RMSE score, the smaller the total sample bias.

Discussion and Conclusions

These findings shed light on a number of stark realities regarding the U.S. retirement savings environment. In particular, they indicate that many Americans are unprepared or behind track on their retirement savings. This is especially concerning given that experts suggest saving around $1M (or 12 times your pre-retirement salary) before retiring.

These findings defy earlier research published in July 2021 that found that the average retirement savings was $65,000. Our survey contradicts this claim, suggesting that a majority of Americans (50.9%) have less than $50k saved for their retirement.

Regarding gender, men tend to be far more prepared for retirement than women. However, these findings may be skewed by stay-at-home wives and mothers who primarily perform unpaid work within the household, thereby having less income and savings to report. These results also cast a light on income inequality between men and women, as the national female-to-male earnings ratio is 81.9% according to the U.S. Census Bureau.

Surprisingly, our conclusions hold true for every age category. While those aged 18-25 were the most likely to report having less than $25k saved, this response category made up a plurality of all age categories—in other words, “less than $25k” was the most popular response no matter one's age, even among those 65 and older.

Regional and state-by-state disparities highlight the economic differences evident within the United States. Policymakers could use this data to inform public policy approaches to financial literacy or to assist in the formation of social programs aimed at assisting with retirement savings.

Retire Responsibly: Invest With a Self-Directed IRA

Although many Americans are far behind on their retirement savings plans, you don't have to include yourself among them.

To get a competitive edge, invest with a tax-advantaged individual retirement account (IRA) through a self-directed service provider. This way, you can take control of your investment strategy and invest in a wide variety of assets unavailable to traditional brokerage accounts.

Get started today by browsing our exclusive list of the best self-directed IRA companies on the market. With their assistance, you can invest in all assets, from stocks and bonds to precious metals, cryptocurrencies, and real estate—all on a tax-free or tax-deferred basis.

Full Survey Report

For a more in-depth look at the data, view the full survey report on Google Data Studio.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,328.02

Gold: $3,328.02

Silver: $37.77

Silver: $37.77

Platinum: $1,404.65

Platinum: $1,404.65

Palladium: $1,226.98

Palladium: $1,226.98

Bitcoin: $117,368.41

Bitcoin: $117,368.41

Ethereum: $3,090.52

Ethereum: $3,090.52