Keogh Plan: How Does it Work & Who Qualifies?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

The Keogh Plan is a retirement plan which was established in 1962 for the self-employed. The plan takes its name from the New York representative who proposed the act to Congress. This plan is similar to your 401k or IRA retirement accounts, but differs in important ways.

Is a Keogh a qualified plan? The terminology “qualified plan” is how the IRS refers to this retirement plan that is governed by section 401(a) of the tax code. These plans are also known as HR10 or simply qualified plans. Let’s take a look at how this plan works and who is eligible.

Table of Contents

Keogh Plan Rules

In 1982 Keogh plan was greatly reshaped under the 1982 tax code changes. The plan underwent further changes in 2001 under a piece of legislation called the Economic Growth and Tax Relief Reconciliation Act.

- Your contributions qualify for tax deductions up to the annual limit

- Money contributed to your Keogh plan grows on a tax-deferred basis until you cash in

- You can make voluntary withdrawals from the age of 59.5. You can make early withdrawals under the exemption of hardships rules otherwise, you pay a 10% penalty.

- You are obligated to take minimum distributions from age 72

- Distributions will be taxed at your going income tax rate

- You can roll over your Keogh plan into a Roth or Traditional IRA. You may owe taxes on a Roth roll over.

Keogh plans allow you to make tax-deferred contributions to your retirement account for yourself or your employees. You will also benefit from tax-deferred growth, as you will only pay taxes on investment income when you take distributions. These plans also have higher contribution limits than an IRA as we are about to see.

Keogh Plan Types

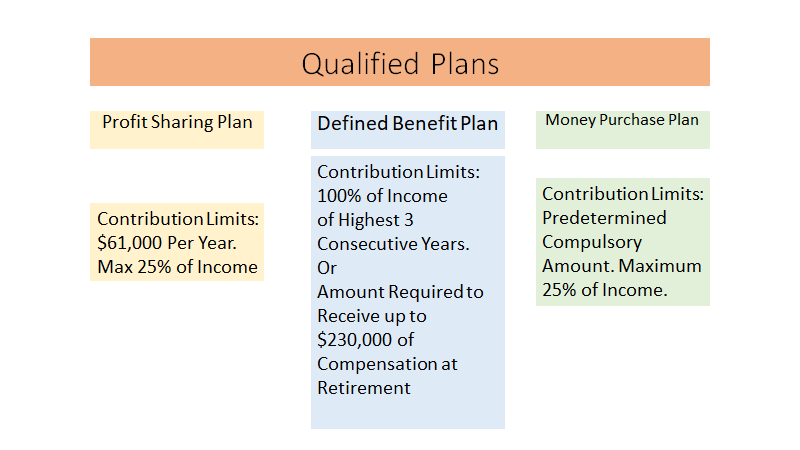

You can open 3 types of Keogh plan each with particular limits and considerations.

- Profit Sharing Plan

- Defined Benefit Plan

- Money Purchase Plan

Profit Sharing Plan

Defined contribution plans allow you to choose the amount of cash you will contribute to your retirement plan each year. The limit for 2022 is $61,000 or a maximum of 25% of income. While for 2021 the limit was $58,000. Presumably, these increases will continue to be applied.

Defining your contributions allows you to adjust the contributions you make to your plan. You may have other priorities in some years and want to contribute less, while in other years you may want to save more.

Defined Benefit Plan

Defined benefit plans allow you to make contributions to your retirement plan that allow you to receive a compensation of up to $230,000 or 100% of the highest 3 consecutive years of income. Payments must be made quarterly, and you may be charged interest if payments are delayed.

The contributions for this type of plan are complicated to calculate. You will need to speak to a financial planner to correctly calculate your contributions for the desired distributions when you retire.

Money Purchase Plan

With Money Purchase Plans you set the percentage of income per year you will contribute to your plan, maximum 25%. The percentage is set in the founding documents, and you will be subject to a penalty if you do not pay the established amount into the plan.

Who Qualifies for a Keogh Plan?

Unless you are self-employed or a small business owner you won’t be able to open a Keogh Plan. You are eligible to open a Keogh plan if you are one of the following:

- A sole proprietor who files Schedule C

- A small business owner

- Self-employed

- An active partner of an unincorporated business who works for the company

- An employee of a company but with a second self-employed job

You are not eligible to set up a Keogh plan if you are one of the following:

- Retired and not receiving compensation from a business

- A volunteer where the business offers the plan

- An employee of an incorporated business with no other source of income

Main Differences with Other Retirement Plans

There are some similarities between Keogh plans and other retirement plans. For example, all benefit from a special taxation status, either by deferring taxation or allowing you to take distributions tax-free.

Keogh plans have a much higher annual limit for tax-deductible contributions than most other plans including 401(k) plans. The IRS has recently increased the annual limit on contributions to 401(k) plans to $20,500 for 2022.

Paperwork is more intensive with Keogh plans, and you can expect higher administrative costs on these plans when compared to other types. You will also be subject to fees associated with the initial set-up of the Keogh plan. Fees for the creation of these plans can run into the 1000s, and you will also have annual fees to service your plan.

Documentation

To set up a Keogh plan you must implement a written document. The written document must fulfill the requirements of the IRS Publication 560. The IRS will also require you to file an IRS Form 5500 annually.

The above documentation requirements are a considerable handful for most people, especially when we are busy working all day. Fortunately, many brokerages and banks offer prototype plans and can help you meet all the requirements.

Pros & Cons of a Keogh Plan

Pros

- High deductible contribution limits

- Multiple structures to define contributions and distributions

- Tax-deferred status

Cons

- high administrative burden

- Expensive start up cost

- High ongoing costs

Possibly the greatest advantage of a Keogh plan is the higher tax-deductible contribution limit. To take advantage of these plans you probably want to be very close to maxing out those limits given the high costs of running these plans.

These plans also have various structures to define contributions. Including contributions as a percentage of income, or to achieve a defined distribution at retirement. These structures offer a higher level of sophistication than most of the more common plans.

The downside for Keogh plans is the higher than usual administrative burden, and with it, all the costs associated. The IRS requires you to file various documents, apart from the specific startup document, you also need to file a yearly form as mentioned above.

Who we Recommend a Keogh Plan For

Keogh plans are more sophisticated than a standard retirement plan such a 401(k). They also come with high overheads and servicing costs. A Keogh plan is probably more suitable for high income professionals and business owners.

For self-employed professionals a sample list of who we might recommend a Keogh plan include:

- Doctors

- Lawyers

- Financial Professionals

- Self-employed Individuals

Conclusion

If you are a small business owner or self-employed, a Keogh plan offers you the opportunity to set aside a much larger amount of cash than other plans. If you are a high-income earner you may want to consider this option. It will help you get closer to maintaining the level of income to more closely match your lifestyle in retirement.

As a self-employed person, you also have another option on the table such as a Solo 401(k). This plan type has more limitations and is not as sophisticated or as expensive as a Keogh plan. You can learn more about what investments you can make, and how to make the most of a Keogh plan in this article.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,338.16

Gold: $3,338.16

Silver: $36.06

Silver: $36.06

Platinum: $1,357.42

Platinum: $1,357.42

Palladium: $1,110.47

Palladium: $1,110.47

Bitcoin: $105,607.89

Bitcoin: $105,607.89

Ethereum: $2,404.72

Ethereum: $2,404.72