JPMorgan Predicts U.S. Economy Will Shrink by 40 Percent for Second Quarter

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th December 2020, 06:21 am

This past week, devastating predictions on the depth of the economic collapse in the United States emerged. JPMorgan economists had previously predicted that the economic carnage would result in a 25 percent decline in GDP for the second quarter of 2020. That was last week. This week they have gathered more data and revised down their forecast to a staggering drop of 40 percent for Q2.

JPMorgan Also Predicts Unemployment Will Reach 20 Percent for This Quarter

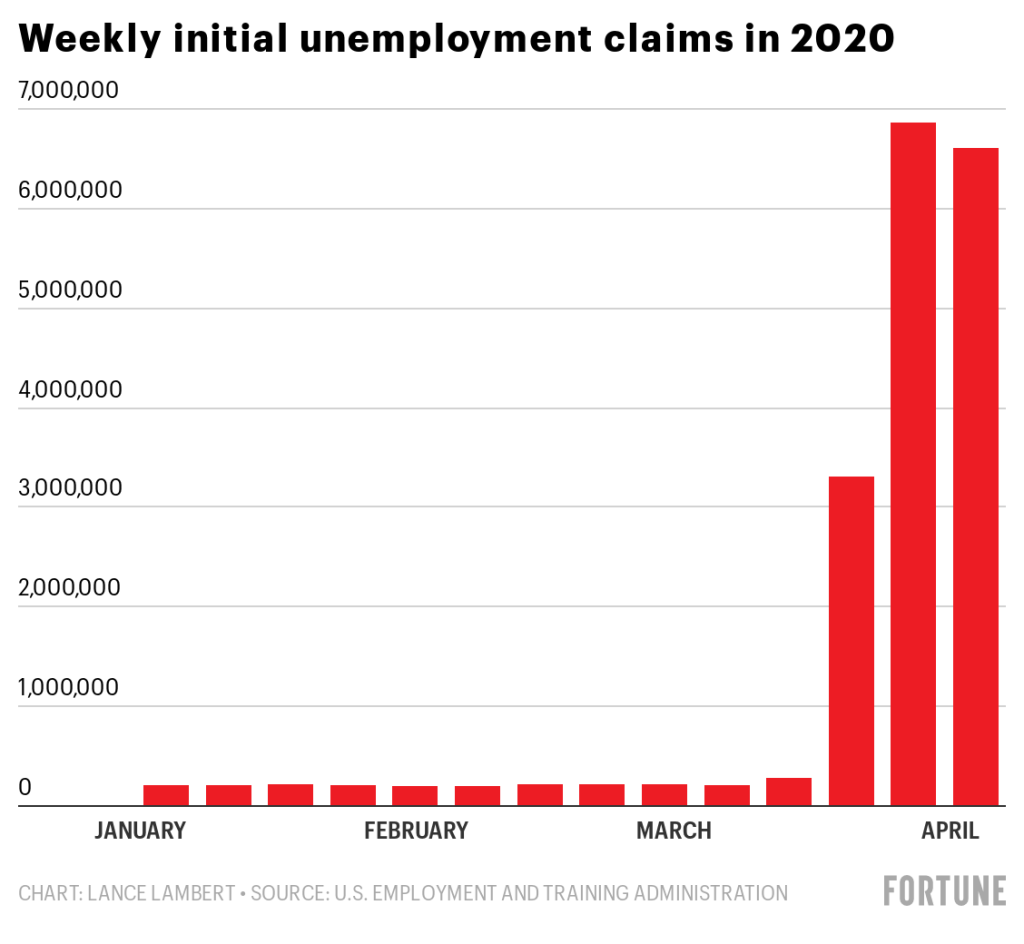

Their grim assessment is equally bad where employment figures are concerned. JPMorgan economists project that the April unemployment figure will roar higher to an eye-watering 20 percent with a total of 25 million jobs destroyed in the one month. Underlying their figures are the stark Labor Department statistics showing that 16.8 million Americans have filed for unemployment benefits in only the past three consecutive weeks as the chart below shows:

If there is a silver lining to their prognosis, it is that they expect some form of a second half recovery. This is of course predicated on the pandemic disruptions dissipating by June. JPMorgan's economists stated in their recent research note on the subject that:

“Over the last few weeks forecasters have been operating in a fog. More recently, however, we are starting to get some shreds of data on the magnitude of the economic crisis. With these data in hand we think the April jobs report could indicate about 25 million jobs lost since the March survey week, and an unemployment rate around 20 percent.”

The investment banking firm's revision to the dire economic data came as they took in the sharper than anticipated run up in the weekly jobless figures that have reached an unprecedented nearly 17 million in only three weeks time.

Federal Reserve Proving Powerless to Prevent the Economic Fallout

Over the past few weeks, the Federal Reserve has demonstrated its willingness and ability to attempt to get out in front of the pandemic shutdown crisis. They have unveiled yet another round of dramatic emergency actions geared towards maintaining the flow of credit in markets even as an economic shutdown is underway. Economist Steve Blitz of TS Lombard commented on the situation in the U.S. in a recent exchange where he said that:

“This is not about boosting animal spirits, the animals are still caged.”

The Fed's unprecedented actions have comprised a first time adventure into buying the markets of corporate bonds to purchase and hold up the market. Yet as Blitz reminded:

This will do “nothing to change what's going on on the ground. It admittedly keeps a recession from turning into the 1930s, but how many [corporate bonds] are you going to buy if their underlying business is disappearing?”

Federal Reserve Chairman Jay Powell can sense the fear pervading the national atmosphere. He stated over a Thursday speech via videoconference that the Fed possesses:

“Lending powers, not spending powers. The Fed is not authorized to grant money to particular beneficiaries. The Fed can only make secured loans to solvent entities with the expectation that the loans will be fully repaid.”

Corporate Earnings Predicted to Fall From 20 to 30 Percent In Second Quarter

Now the time has arrived to pay the proverbial piper for shutting down nearly the entire economy. Strategists have been making wildly ranging educated guesses at what the various corporate earnings will be in 2020, yet many of them concur that it will range from a staggering decline of from 20 to 30 percent. Goldman Sachs predicts an average corporate earnings of down 33 percent.

They are not alone in this grim assessment either. Credit Suisse estimates it will be down 29 percent. Citigroup looks for a decline in corporate earnings of 24 percent. Morgan Stanley is the most optimistic of the major investment banking analysts, calling for a drop in the from low teens to 20 percent.

What Will the Economy Recover To When the Coronavirus Pandemic Ends?

Economist Peter Schiff of Euro Pacific Management group explained in a recent podcast that there will not be a much-touted recovery back to where things were with the economy after the pandemic ends. Instead, the most that we can hope for is to recover from a potential depression into the recession that was looming large in any case. Consider that the labor market just experienced its first contraction for more than a decade.

The U.S. economy suffered the disappearance of 701,000 jobs for March. Keep in mind that this was before the lockdown really took effect. The unemployment rate vaulted up to 4.4 percent in consequence. All of this happened when the job loss totals for the month were nearly as high as in the peak of the Global Financial Crisis at 800,000 back in May of 2009.

The bad news is that the weekly unemployment applications in the past two weeks have demonstrated that the 700,000 figure was only the tip of the proverbial iceberg in a truly breathtaking market collapse. More than 10 million Americans have since filed for unemployment in only two weeks. It means that the prior month's total of over 700,000 claims will look simply amazing compared to the final April totals. This is why Peter states that it ought to be obvious when the dust finally settles that there is no getting back to a normal:

“This is not going to be a quick recovery. People keep talking about this, that it's going to be this quick recovery. We can't have a quick recovery. And when we recover, what are we going to recover to? [The global pandemic] pricked that bubble. So, we're not going to go back. The best that we can hope for is that we recover from a depression into a recession. That's about the best we're going to get. We're going to go back into the recession that we were going to have anyway.”

What the Black Swan of the coronavirus outbreak has simply done was to advance the speed of the economic meltdown that was already in the works. Many businesses and small companies will now fail that were going to fail eventually, according to Schiff. Many jobs that were going to disappear anyway simply will be gone sooner. All that the coronavirus really did was to pour gasoline on a raging economic meltdown fire that was already in progress.

American Consumers Will Ultimately Pay the Price for the Money Printing

Predictably, the government is busily attempting to spend its way out of this crisis. They have allocated literally trillions of dollars between business rescues and forgivable loans, corporate and municipal bond purchases, and free money to help the average American on the street called “economic impact payments.” This spending has to come from somewhere, either taxation or money printing. The government is quickly printing trillions of dollars in a bid to finance the massive urgent new spending.

Schiff explains that even though this is not an overt form of taxation, it is still ultimately the average American who will pay for the spending (even if the government is just conjuring the money seemingly out of thin air):

“The public still pays. It pays through inflation. It's through a diminishment of their purchasing power. There is no free lunch. Who is paying for this lunch? The American public.”

Unfortunately for everyone, the economic projections for the second quarter of this year from JPMorgan, Credit Suisse, and Citigroup investment banking economists are all absolutely terrifying. It explains why gold makes sense in an IRA. The price of gold has run up massively in percentage terms in response even as the stock markets have crashed and burned on the wildest volatility roller coaster ride in well over half a century.

IRA-approved gold is a natural safe haven defense for both your investment and retirement portfolios. You can learn more by reading all about the Top Five Gold Coins for Investors and the Top Gold IRA Companies with which to consider doing business.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,623.09

Gold: $2,623.09

Silver: $29.51

Silver: $29.51

Platinum: $929.27

Platinum: $929.27

Palladium: $917.22

Palladium: $917.22

Bitcoin: $98,210.06

Bitcoin: $98,210.06

Ethereum: $3,442.95

Ethereum: $3,442.95