January 2022 Newsletter: Altcoins Ring in the New Year at All-Time Highs – Which Assets Are Next in 2022?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 6th January 2022, 08:50 pm

What a year it was for alternative investors.

Silver took a loss following an erratic year marked by a Reddit-led pump on the news of a “short squeeze” in February. Its price fell from about $27 to $23.25 per ounce on the year.

Gold, on the other hand, was a beacon of stability. Amid wild economic conditions, the yellow metal held strong around $1,800 per ounce by year-end after opening the year at $1,890.

Bitcoin saw runaway growth as it crossed the $1 trillion market value barrier for the first time—but not without its share of peaks and valleys along the way. The world’s largest cryptocurrency opened the year at $33,000 per BTC and closed at about $47,000.

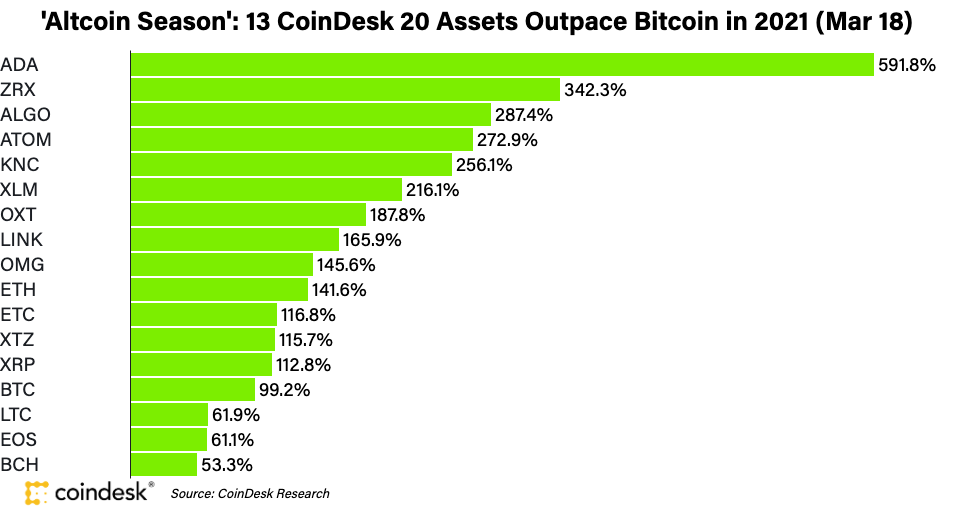

Altcoins (i.e., cryptocurrencies not named “Bitcoin”), however, grew by +1,300% in 2021. Ethereum (ETH) made enormous gains from $979 per token to $3,831 by year-end; similarly, Binance Coin (BNB) skyrocketed from about $41 to $530 per token in the same 12-month span.

To summarize, let’s look at the developments of the past year from a bird’s eye view:

- Silver prices fell (-14%)

- Gold prices remained stable (-4%)

- Bitcoin rallied to all-time highs (+43%)

- Altcoins skyrocketed (ETH +400%; BNB +1,290%)

Source: VaroRegistry

In 2021, there were certainly winners and losers. While the market may appear to be all over the place right now, the year ahead will also have its share of winning assets that outperform the rest. Which assets these may be are still uncertain.

There are, however, a few things we do know.

The Fed is set to buy about $60 billion in bonds per month and hike federal interest rates as many as three times in 2022. As interest rates rise and the economy cools down in order to stymie inflation, we could see the stock market, the real estate market, and the U.S. dollar undergo a sustained period of decline.

In the event that the above comes to fruition, investors would be wise to diversify their portfolios with a variety of assets. Wealth concentrated in stocks, cash, and physical properties may lose much of its value in a market crash—and possibly delay your retirement by years in the process.

Today, we have silver selling at a discount, gold holding strong, a red-hot altcoin market, and a steady Bitcoin market driven by widespread institutional adoption. If you were looking for an entry point in the alternatives market, now might be the time.

Investors serious about preserving (and building) their retirement wealth in 2022 would do well to shore up their self-directed IRA. SDIRAs allow you to invest in a host of assets unavailable through conventional brokerages, such as Bitcoin, altcoins, gold, and silver. Together, these alternative assets can provide exposure to stores of value uncorrelated to the stock market. This way, your portfolio might be able to better withstand whatever 2022 throws at it.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,361.71

Gold: $3,361.71

Silver: $38.45

Silver: $38.45

Platinum: $1,341.60

Platinum: $1,341.60

Palladium: $1,133.51

Palladium: $1,133.51

Bitcoin: $120,682.02

Bitcoin: $120,682.02

Ethereum: $4,687.39

Ethereum: $4,687.39