Is Crypto Dead? In-Depth Analysis & Pundits’ Views

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 23rd September 2022, 07:15 am

The question “Is crypto dead?” keeps cropping up again and again. Investors and traders are both wondering how long the current crypto winter will last, and if digital currencies will ever fully recover into a new bull trend.

This isn’t the first time cryptocurrencies have taken a beating. Using Bitcoin as a benchmark, the cryptocurrency lost 83% in a sell-off from December 2017 to January 2019. The digital coin went from a high of $19,891 to a low of $3.337 over that time.

By June 2019 it had recovered to $13,868 after which it lost 72% as it traveled south to $3,858 by March 2020. And of course, after that came the 2-year bull market that took the leading cryptocurrency to its all-time high at $69,000 in November 2021.

At the time of writing, Bitcoin has lost 73% from its all-time high. But has this sell-off reached its bottom, or are there further depths to reach? Before we continue, we need to make a couple of considerations. One is Bitcoin's drop relative to the significance of sharp losses in other assets. And the other is to address the correlation with stocks.

Table of Contents

Bear Markets

So, is crypto dead after the third decline of over 70%? First, one has to create a parallel with other assets, even if they are not digital. For example, gold fell from $1,920 per ounce in September 2011 to $1,046 by November 2015.

That drop equals a loss of 45 percent, but gold has a much wider acceptance institutionally as well as among private investors. Not to mention the ever-increasing industrial use. And we could also look at crude oil.

WTI crude oil prices have seen drops in the past of 77 and 69 percent. In the 1990s and 1980s respectively. Yet no one would have thought back then that crude oil was over, or dead. Neither did any investors believe that gold was heading for zero.

The reason for that is the underlying fundamentals of both assets. The fundamental factors that give crude oil and gold their value were and still are in place. What changes are supply, demand, and risk perception?

So, the price of these assets changes, but there is no doubt about their utility. This is similar to cryptocurrency, in that there is an inherent utility for an asset that cannot be controlled by a centralized institution.

Each cryptocurrency is different, and some have more demand than others based on their perceived utility. Or in other words, on the validity of their project. In any case, cryptocurrency has a function among investors, and acceptance and awareness are growing.

Stock Market Correlation

More recently, we have seen how stock market prices and Cryptocurrencies tend to move in the same direction in unison. The sell-off in cryptocurrency started before the stock market bear entered the scene.

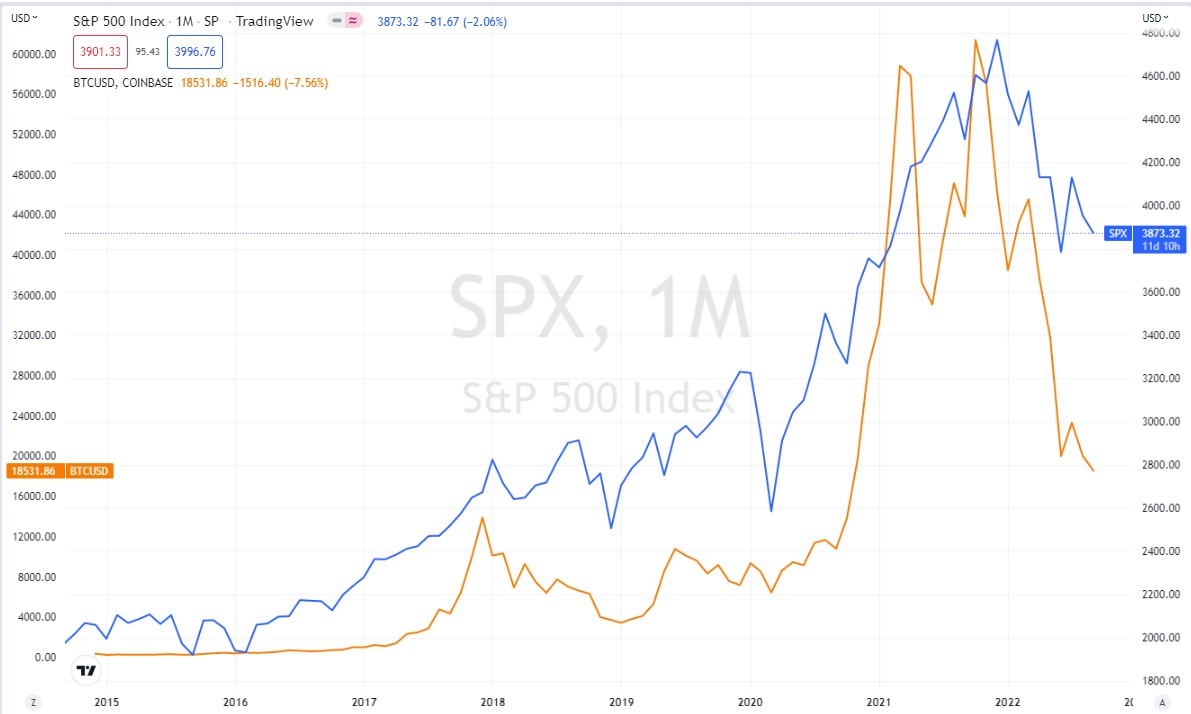

Using Bitcoin and the S&P 500 as benchmarks for crypto and stocks, we can see from the chart below how the crypto sell-off started in October 2021. While the stock market started its fall in December 2021.

Source: TradingView

However, we can also see clearly from the chart, how crypto and stocks have been moving in line with each other from as early as 2017. So, it does not come as a surprise that the recent sell-off is also happening at the same time.

The main difference is the degree of volatility. Volatility can be caused by a variety of factors, but the main ones are liquidity and market capitalization. Liquidity is generated when many participants hold a large inventory of an asset and there are many buyers and sellers.

Liquidity seems well covered especially for Bitcoin and Ethereum the two largest digital assets. But what about the market cap? The total market capitalization of public US stocks on March 31, 2022, was just over $48 trillion. While the market capitalization of crypto on the same day was just over $2 trillion.

The difference in market cap is clearly revealing, and explains, I believe, why crypto is so volatile when compared to stocks.

Fear & Greed

Fear and greed have always been known in the world of investing as the two killer emotions. We all know that we should absolutely stay away from them. Yet probably due to the repetitiveness of human nature, the markets seem not to take example of this wisdom.

So, what does this have to do with the correlation between stocks and crypto? Well, because both stocks and cryptocurrency are risky assets, and fear and greed drive risk-taking decisions. In other words, when the stock market is seen as a bad bet and everyone is selling, the risk-off sentiment spreads to other risky assets. In this case, cryptocurrency.

Crypto Fundamentals

We are going to look at some fundamentals of Bitcoin and Ether as they are the two largest coins by market cap. Also, Bitcoin has the first mover advantage and Ethereum is possibly the project with the most widespread use case.

Bitcoin

- A hard cap on supply – limited to 21 million coins

- Decentralized peer-to-peer network

- Cannot be counterfeited

- Bitcoin can’t be copied

- Unhackable blockchain

- Cheap international transactions

Ether

- Decentralized peer-to-peer network

- Transfer from Proof-of-Work to Proof-of-Stake

- Unhackable blockchain

- Ether can’t be copied

- Coins can be used in cheap money transfers

- Ethereum blockchain supports other decentralized apps

These are the fundamental factors that give cryptos their value. There may be others depending on which cryptocurrency you are analyzing. However, it seems clear that factors like decentralization and the lack of manipulation can have a key influence on the demand for crypto.

Finance Pundits & Their Views: Is Crypto Dead?

Various pundits from the finance space have made a series of opinions over the months about crypto. So, before we decide the answer to the question is crypto dead? Let’s also have a look at what some of the most notorious players have said recently.

JP Morgan

In the past, JP Morgan has been very bullish on crypto in general and on Bitcoin in particular. However, more recently some analysts at the Wall Street bank have made extremely bearish statements.

In August 2022, David Kelly, chief global strategist at JP Morgan Asset Management, said that investors should dump cryptocurrencies. Citing the hawkish stance from Federal Reserve Chairman Jerome Powel at the last Jackson Whole meeting.

Rising interest rates have concerned stock market investors and consequentially crypto investors as well. Another note from JP Morgan analyst Nikolaos Panigirtzoglou, said that the cost of mining Bitcoin had fallen to around $13,000 per coin. Many in the crypto space see the cost of mining as a lower boundary for Bitcoin price.

At the end of August 2022, Umar Farooq, CEO of Onyx by JP Morgan said that although he believed many of the cryptocurrencies around will eventually disappear, apart from the main twelve or so. He sees that the technology behind crypto and the tokens themselves will find a rising number of use cases.

Ray Dalio – Bridgewater Associates Founder

Ray Dalio is known for being a bullish pundit when it comes to cryptocurrency. No doubt if you ask him is crypto dead? He would respond negatively. Recently in an interview with CNBC, he stated that he felt cryptocurrencies were great and that Bitcoin in relation to other digital assets should be considered as digital gold.

Fidelity Investments

In May 2022, Fidelity Launched another Bitcoin ETF this time in Australia. That comes after the asset manager successfully launched a Bitcoin ETF in Canada. And currently, Fidelity is still trying to get approval from US authorities to launch a Bitcoin ETF.

Grayscale Trust

Fidelity is not alone in its quest for authorization of a Bitcoin ETF. Grayscale Trust, which currently manages $12.5 billion, is taking the SEC to court for refusing their request to convert the trust into an ETF.

Bottom Line

There are still many skeptics of cryptocurrency, and it usually arises from a lack of knowledge and understanding. So, when you ask the question, “Is crypto dead?” The answer you get will greatly depend on whether you ask someone with a real understanding of crypto.

What does seem clear to us is that there is a real need for decentralized assets and the ability to steer away from institutional overreach. Not all cryptos are the same, so it is important to thoroughly understand what you are investing in before making any commitments.

Many companies offer their specialized services to help achieve your investment needs in the crypto space, all within a tax-advantaged environment.But which ones are really worth the money? To help you out, we've selected the best in the market. You can read our reviews on the top five crypto IRA companies here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24