How to Buy Silver and Gold: The Basics of Investing in Gold, Silver, and Beyond

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 22nd January 2024, 11:40 pm

Retirement planning is a crucial aspect of securing financial stability for the future. On average, 42 percent of Americans do not feel prepared for their retirement. Among the thin majority who are prepared, however, a sizable portion is diversifying their portfolios with alternative asset classes that hedge against market instability, inflation, and economic recessions.

As investors seek to diversify their retirement portfolios, one option that has gained considerable attention is investing in precious metals within an Individual Retirement Account (IRA).

Before learning how to buy silver and gold through an IRA, it’s important to do your due diligence to understand the benefits and risks of this investment option. If you do decide to invest in gold, silver, or other precious metals in an IRA (or outside of one), we will provide a short list of top-rated American precious metals providers.

Table of Contents

- Understanding Precious Metals in an IRA

- Why Invest in Gold Through an IRA?

- Benefits of Investing in Precious Metals within an IRA

- Getting Started: Steps to Invest in Precious Metals within an IRA

- Our Top 3 Precious Metals IRA Companies

- Noble Gold

- Augusta Precious Metals

- Advantage Gold

- Invest in Precious Metals With Confidence

Understanding Precious Metals in an IRA

Precious metals, such as gold, silver, platinum, and palladium, have long been valued for their rarity, beauty, and use in various industries. These metals have also been recognized as a store of value throughout history, making them an attractive investment option for those looking to safeguard their wealth.

Many American retirement investors choose to include precious metals in an IRA account in order to capture the tax advantages that these accounts provide. There are two types of IRAs available to Americans:

- Roth IRA: Tax-free growth, tax-free withdrawals upon retirement. Account consists of after-tax contributions.

- Traditional IRA: Tax-deferred growth, taxed withdrawals upon retirement. Account consists of pre-tax contributions.

Precious metals are eligible for inclusion in both account types. However, consult with a financial professional to decide which type is best for your financial situation. Note that penalty-free withdrawals can only be made from these accounts after the age of 59.5.

Not all gold and silver assets are eligible for inclusion in an IRA. Make sure you familiarize yourself with the full list of precious metals bullion and coinage that can be included in an IRA before getting started. Most of the bestselling precious metals investment items are currently available for IRA and 401(k) inclusion, such as:

- American Gold Eagle Coins

- American Gold Buffalo Coins

- Silver Morgan Dollars

- Canadian Silver Maple Leaf

- Australian Silver Lunar

- Austrian Gold Philharmonic Coin

It’s important to note that gold and silver investing within an IRA isn’t for everyone. Only long-term buy-and-hold investors should consider this option, as 10% early withdrawal penalties exist for those who take a distribution from their IRA before the age of 59.5.

For those who decide to invest in gold, silver, palladium, or platinum within an IRA, you must comply with IRS guidelines on storage requirements—notably, that all assets must be held in approved vault facilities by IRS-compliant third-party custodians.

Those who wish to invest in precious metals outside of an IRA can do so while storing their assets at home.

Why Invest in Gold Through an IRA?

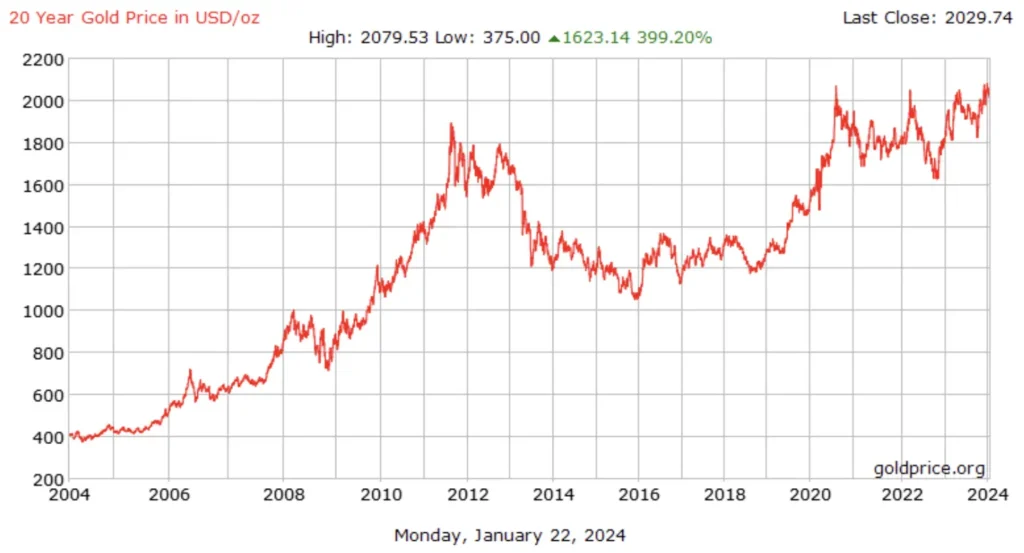

Many investors choose to invest in gold via an IRA to preserve the upside capital appreciation potential of their assets without being burdened by a large tax liability at the time of withdrawal. As displayed below, the price of gold has performed quite well over the past decade.

When viewed on an even greater time scale, the performance of the yellow metal is even more impressive. Over the past 20 years from the time of writing—from January 2004 until 2024—gold prices have risen +399%. By comparison, over the same period of time, the value of the S&P 500 stock market index rose by about +350%. While neither is too shabby, gold has outperformed the U.S. stock market over the past two decades, despite being pigeonholed as a risk management tool rather than an appreciating asset of its own.

Given the price potential of gold, it makes sense why some investors choose to hold gold within an IRA. The capital gains on the gold assets would be subject to taxation upon withdrawal unless the assets were held within a Roth IRA.

Fortunately, gold and other precious metals can easily be added to one's Roth or Traditional IRA by contacting a reputable precious metals IRA company or custodian.

Benefits of Investing in Precious Metals within an IRA

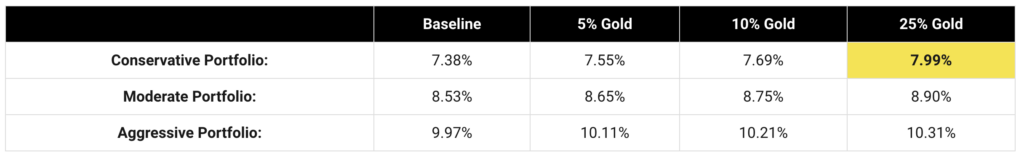

1. Diversification: Including precious metals in your IRA allows you to diversify your retirement portfolio beyond traditional stocks and bonds. Precious metals often exhibit low or negative correlations with other asset classes, providing a potential hedge against market volatility.

According to a gold allocation study that sourced real-world investment data from 1972 until 2015, portfolios that included gold outperformed those that did not. As seen below, aggressive portfolios (i.e., stock-heavy) and conservative portfolios (i.e., cash equivalent-heavy) both saw greater annual average growth rates in step with the amount of gold they added.

2. Wealth Preservation: Precious metals have demonstrated the ability to preserve wealth during times of economic uncertainty, inflation, and currency devaluation. They can serve as a reliable store of value over the long term.

3. Tax Advantages: Investing in precious metals within an IRA offers tax benefits. By using a self-directed IRA, investors can defer taxes on their gains until retirement or choose a Roth IRA to potentially enjoy tax-free distributions in retirement.

Getting Started: Steps to Invest in Precious Metals within an IRA

1. Select a Self-Directed IRA Custodian: Choose a reputable self-directed IRA custodian who allows investments in precious metals. Some well-known custodians in the industry include companies like Equity Trust, New Direction IRA, and Goldco.

2. Open and Fund Your IRA Account: Once you've chosen a custodian, follow the account opening process and fund your IRA. This typically involves rolling over funds from an existing retirement account or making contributions directly to the new IRA.

3. Choose the Type of Precious Metals: Determine which precious metals you wish to include in your IRA. Gold and silver are the most commonly chosen metals, but platinum and palladium are also viable options. Consider factors such as historical performance, market liquidity, and risk tolerance when making your selection.

4. Locate a Reputable Precious Metals Dealer: Work with a trusted precious metals dealer who specializes in IRA-approved metals. Ensure the dealer has a solid reputation, transparent pricing, and reliable customer service.

5. Purchase and Store Precious Metals: With the help of your chosen dealer, make the purchase of your selected precious metals. The dealer will ship the metals directly to a secure storage facility approved by your custodian. It is crucial to comply with IRS regulations regarding the storage of precious metals in an IRA.

6. Monitor and Rebalance: Regularly monitor the performance of your precious metals investments and rebalance your portfolio if necessary. Stay informed about market trends and consult with financial professionals to make informed decisions.

Our Top 3 Precious Metals IRA Companies

Knowing how to buy silver and gold starts by working with trustworthy vendors. Unfortunately, fraudulent precious metals dealers exist, and they are known to target industry newcomers who don’t know what to look out for.

The companies listed below are reputed within the industry due to their longevity, verified third-party reviews, and security track record.

Noble Gold

- Founded in 2017

- Based in Pasadena, California

- $100 annual fees; $150 storage fee

- Texas Depository and IDS storage facilities

- Low account minimum ($2,000)

- Lowest fees in the industry

Noble Gold is a reputable precious metals dealer and IRA custodian that specializes in helping individuals diversify their retirement portfolios through investments in gold, silver, platinum, and palladium. With a strong emphasis on customer service and transparency, Noble Gold has earned a solid reputation in the industry.

They offer a range of IRA options, including self-directed and traditional IRAs, to suit different investor preferences. Their team of experts provides personalized guidance to clients, assisting them in selecting the right precious metals products and facilitating the purchase and storage process. With a commitment to excellence and a focus on client satisfaction, Noble Gold is a trusted choice for individuals looking to incorporate precious metals into their retirement investments.

Augusta Precious Metals

- Founded in 2012

- Based in Casper, Wyoming

- Variable annual fees

- Partner with Delaware Depository

- Offer ZERO fees for 10 years

- Money magazine’s “Best Overall” gold IRA company

- High account minimum ($50,000)

Augusta Precious Metals is a well-established and reputable company that specializes in helping individuals diversify and protect their retirement savings through precious metals investments. With a strong emphasis on customer satisfaction and integrity, Augusta Precious Metals has built a solid reputation in the industry. They offer a range of IRA options, including self-directed and traditional IRAs, and provide personalized guidance to clients throughout the investment process.

Augusta Precious Metals prides itself on transparency and strives to educate investors about the benefits and risks of precious metals. Their team of experts assists clients in selecting the right metals for their portfolios and ensures a seamless purchasing and storage experience. With a commitment to delivering exceptional service and empowering investors to make informed decisions, Augusta Precious Metals is a trusted partner for those seeking to incorporate precious metals into their retirement plans.

Advantage Gold

- Founded in 2014

- Based in Los Angeles, California

- 1st year fees waived for new sign-ups

- $1,000 in free silver for qualified purchases

- DDSC preferred storage vault

- Storage locations in Delaware, Nevada, Utah, and Texas

Advantage Gold is a precious metals company that specializes in helping individuals protect and enhance their retirement portfolios through strategic investments in gold and other precious metals. With a strong emphasis on customer satisfaction and personalized service, Advantage Gold has established itself as a leading provider in the industry.

They offer a range of retirement account options, including self-directed IRAs, and guide clients through the entire process, from account setup to the selection and acquisition of precious metals. Advantage Gold's team of experts provides valuable market insights and assists clients in making informed decisions based on their individual goals and risk tolerance.

With a commitment to transparency, competitive pricing, and secure storage options, Advantage Gold is a reliable choice for individuals seeking to diversify their retirement investments with the stability and potential growth offered by precious metals.

Invest in Precious Metals With Confidence

Investing in precious metals, within or without an IRA, provides investors with an opportunity to diversify their portfolios and protect their wealth. Precious metals offer unique benefits such as wealth preservation, diversification, and potential tax advantages.

By following the steps outlined in this guide, investors can begin their journey toward incorporating precious metals into their investment strategy. Remember to conduct thorough research, seek professional advice, and work with reputable custodians and dealers—such as those listed above—to ensure a smooth and successful investment experience.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $5,245.88

Gold: $5,245.88

Silver: $93.09

Silver: $93.09

Platinum: $2,351.42

Platinum: $2,351.42

Palladium: $1,781.25

Palladium: $1,781.25

Bitcoin: $65,519.53

Bitcoin: $65,519.53

Ethereum: $1,924.13

Ethereum: $1,924.13