How to Buy Bitcoin in IRA

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 10th February 2023, 09:10 pm

How to Buy Bitcoin in IRA

Bitcoin first appeared on the scene around 12 years ago and has moved into the mainstream after various scandals from its early years. The virtual currency has had a helter-skelter ride to widespread popularity. As events unfolded, some gave its price headwind while others battered its evaluation through the floor.

Over the years, hackers have stolen billions of dollars in various exchange thefts causing prospective Bitcoin buyers to flee. Then came renewed confidence as the memory of these thefts faded and security protocols improved. Various endorsements and the participation of funds in bitcoin have recently added fuel to the cryptocurrency’s demand.

We are going to have a look at how to create a Bitcoin IRA, the issues involved when investing in bitcoin through your retirement account, as well as some commonly asked questions about bitcoin IRAs.

Can I Buy Bitcoin in My IRA?

In 2014 the IRS issued notice 2014-21 stating they would treat cryptocurrencies as property for tax purposes. This notice gave way to including Bitcoin in IRAs. The IRS has never actually made an endorsement on the includability of Bitcoins in IRAs.

However, they have never said they are forbidden either. Today, many Americans hold bitcoin in their IRAs without penalty, and there are dedicated investment firms that specialize in investing in bitcoin through an IRA.

You cannot add Bitcoin to any IRA, however. Even though most account custodians accept alternative assets, you will need to find an IRA custodian that will allow you to hold Bitcoin, and usually, that won't be directly.

Indirect Ownership

Most IRA custodians will not allow you to buy Bitcoin directly through your IRA account. You will need to set up a Limited Liability Company within a Self-Directed IRA. Any IRA custodian that offers checkbook LLCs should allow investors to hold Bitcoin.

Within this structure, you will be able to buy and sell Bitcoins without any intervention from the custodian. You should also have ownership of your wallets and keys. For more security, you need to store wallets offline to avoid possible theft from hackers. Not all custodians specialize in setting up Bitcoin accounts.

There are several companies that can help in the process of setting up a Bitcoin IRA. Our top-rated companies overall include BitcoinIRA and IRA Financial Group.

BitcoinIRA is an Alternative IRA Service, they connect clients to qualified custodians and streamline the process of setting up a Bitcoin IRA.

All digital assets are stored with BitGo Trust, the world’s largest processor of Bitcoin transactions with a 20% global share. All investments are stored offline which means hackers will not be able to steal your Bitcoins.

IRA Financial Group offers checkbook LLCs and sets up Self-Directed IRAs for you to hold Bitcoin. They charge a flat fee for the service and connect your holdings to the Gemini platform. The process is 100% online, although your account is set up through Capital One, you will never have to go to a bank in person.

You may fund your Bitcoin via wire transfer, or by rolling over your IRA or 401K. The regulations for these IRAs are the same as regular IRAs. You will not be able to access your cash until the age of 59.5. Early withdrawals will create a penalty.

Investing in a Bitcoin Fund

Another option is to invest in a fund that only holds Bitcoin. For example, the world’s largest Bitcoin fund, Grayscale Bitcoin Trust (GBTC:OTCQX) with $29.5 billion of assets under management. The fund tracks the price of Bitcoin through ownership of the digital asset.

This fund is an approved investment vehicle and is offered by most IRA custodians. You can make subscriptions through Pacific Premier Trust, Millennium Trust, The Entrust Group as well as others. Due to the high risk and sophistication, you will have to be an accredited investor.

There are other not-so-attractive features, however. It comes with a high minimum investment of $50,000 and a 2% management fee for the sponsor. The sponsor fee goes on top of regular bitcoin IRA fees.

Redemptions of shares are not authorized, if you wanted to cash in your shares to receive the corresponding Bitcoin, you can't. There is also a 6-month holding period before you can sell the shares in the secondary market.

Compliance

Care needs to be taken when investing in Bitcoin through your IRA. Various nuances may affect the tax status of your virtual coins. Account custodians may also not be aware of, or capable of, evaluating correctly your assets. They also may not be aware of the rules concerning their management.

IRAs have a special tax status that is inherent to the account, whether Roth or standard. To keep the tax advantages, you must avoid prohibited transactions. As you make all your decisions within a Self-Directed IRA, you must make sure you do not disqualify your assets from their tax protection.

Prohibited Transactions

There are various prohibited transactions that are meant to avoid account owners obtaining double benefits. That is, obtaining benefits from the assets in the account in ways that extend beyond the benefits inherent to owning an IRA.

An obvious example would be using the funds in your IRA as collateral to receive a loan. In this case, you are receiving the tax benefits of the IRA and at the same time the benefits of using the funds as collateral.

The prohibited transaction list gets a bit more complicated with Bitcoin. Under these rules, if you already own Bitcoin outside of the IRA you cannot make a simple transfer from your external wallet to the wallet in your IRA.

This exclusion is due to the fact that the IRA and its owner are considered two separate entities. According to this definition, each entity must act separately. If you do already have Bitcoin and you wish to transfer them to your IRA, you only have one option.

You would have to sell the Bitcoins in your external wallet and receive the funds in US dollars. The next step, contribute to your Bitcoin IRA and then buy the coins in the name of your LLC.

Is it Smart to Buy Bitcoin?

This is a crucial question and one that is not easy to answer. Bitcoin has been around for a relatively short time. Other assets such as stocks, real estate, or gold have been around for centuries. Their seniority means we can look back and see how they have acted in the past. Looking back helps us understand what behavior these assets might have going forward.

Cryptocurrencies are steadily making their way into the world of alternative investments. As acceptance of Bitcoin continues to grow so does its reliability as an asset that can diversify your risk. Time is still needed to test the resilience of the digital coin’s price.

One factor helping cryptocurrencies gain mainstream recognition is the growing number of crypto-only funds and hedge funds. Research by PWC and Elwood Asset Management showed there were 150 active crypto hedge funds in the first quarter of 2020.

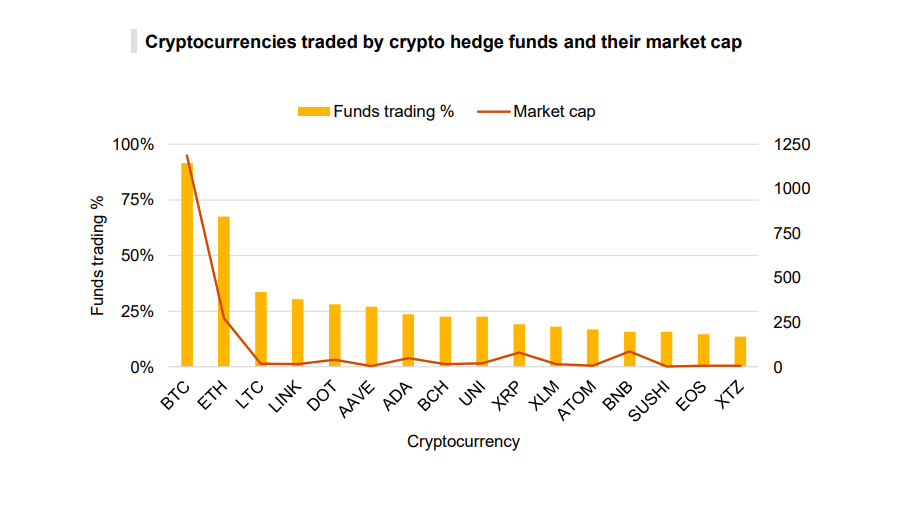

From the PWC Crypto Hedge Fund report of 2021, we see that global assets under management increased from $2 billion in 2020 to nearly $3.8 billion in 2021. With 92% of these funds trading in Bitcoin. The chart below shows the 15 most traded cryptocurrencies by hedge funds.

Source PWC Global Crypto Hedge Fund Report

Data from Statista shows that in the first quarter of 2021 assets under management of crypto funds reached a peak of $59.6 billion for the first time. An increase that more than doubles its $20 billion AUM of 2020.

Historical analysis isn't so relevant with cryptocurrencies, as they haven't been around that long. So, we are left with what we can determine their future demand to be, from news events and the fundamentals of the virtual currency. The fundamentals of Bitcoin are the factors that determine its desirability.

What Makes Bitcoin Desirable

Bitcoin has a finite supply; the limit of coins that can be created is hard capped at 21 million. So far, just under 19 million have been mined, approximately 90%. If demand keeps increasing for this digital asset and supply is limited its price could perform positively.

Blockchain is the technology that keeps records of coins produced and all transactions. This technology generates an incorruptible ledger of all records. For now, the ledger is unhackable and gives levels of security to financial transactions and registers not reached before.

The use of digital currencies eliminates the need for a middleman. In this case, the middleman is the banking system. Bitcoin is a decentralized peer-to-peer financial system. Decentralization allows individuals to make transactions and safely store their wealth without the use of third parties.

An interwoven network of individuals each with their personal computer allows for a system that will unlikely be breakable ever. There is no single server or address with a set of servers that could be taken down. The multitude of contributors to the system creates a high level of security for the hardware it uses.

Bottom Line

If you are going to invest in Bitcoin for the long-term, then doing so through an IRA has its benefits despite its complications. You will be able to get tax advantages, whether you choose a Roth IRA or prefer to delay your taxes until you take distributions.

Once you have decided which type of investment vehicle you wish to set up you can ask your broker or bank what services they have. Or you may use the online services of the platforms mentioned above. Check out this guide for more information on IRA account types.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,418.37

Gold: $3,418.37

Silver: $39.05

Silver: $39.05

Platinum: $1,363.16

Platinum: $1,363.16

Palladium: $1,117.71

Palladium: $1,117.71

Bitcoin: $112,480.93

Bitcoin: $112,480.93

Ethereum: $4,502.64

Ethereum: $4,502.64