How Cryptocurrencies Can Become Your Retirement Fund

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 16th September 2021, 07:07 pm

Research has shown that diversified retirement funds are less risky than those concentrated in just stocks and bonds. Diversified portfolios offer greater stability, security, and long-term growth. To truly diversify, however, requires investing in more than just traditional assets.

You can’t own a portfolio containing 500 different stocks and pass it off as “diversified”—rather, true risk differentiation is achieved only by asset class and risk factor diversification. In other words, investing in assets exposed to different kinds of risk. Small wonder, then, why cryptocurrencies have caught the attention of so many retirement funds and investors looking to manage downside risk and maximize potential return.

Cryptocurrencies such as Bitcoin and Ethereum are brand new asset classes that are wholly distinct from the stock and bond markets. As such, they can provide the diversification benefits necessary for a safe and secure retirement fund. But they also come with their share of risks. In this article, we’ll take a look at the advantages and drawbacks of using crypto IRAs as part of your retirement strategy.

Table of Contents

Crypto 101: Massive Upside, Limited Downside

Like all investment vehicles, cryptocurrencies are certainly not without their share of risks. However, cryptocurrencies are a classic example of an asymmetrical asset. On one hand, their potential for growth is virtually unlimited, since their prices aren’t based on the financial fundamentals that determine stock prices. Rather, they’re an entirely new kind of asset whose prices are driven by their technological potential in a decentralized global economy.

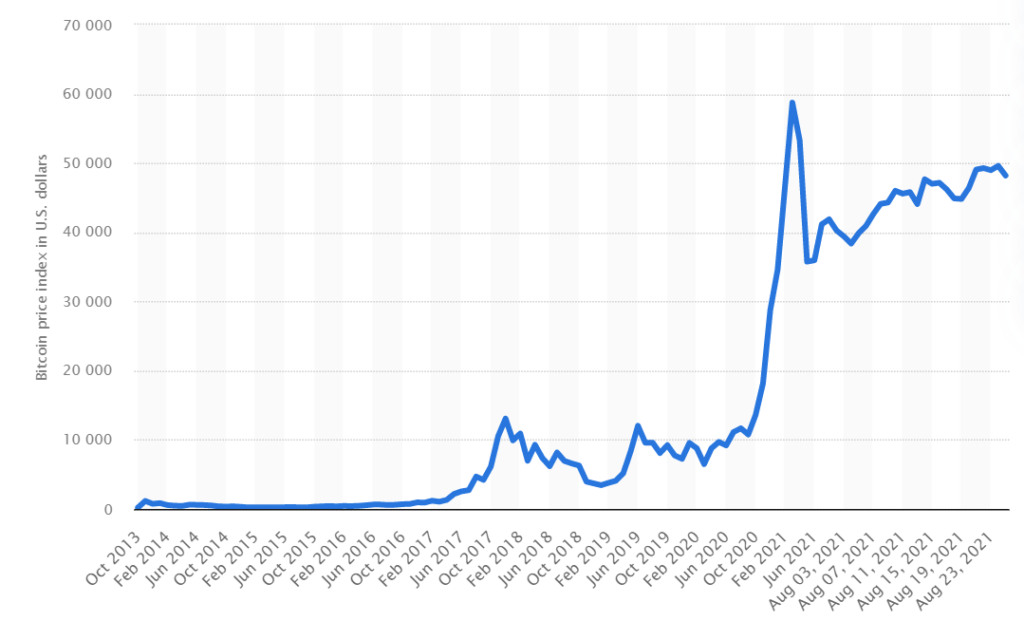

Essentially, the sky’s the limit for cryptocurrency prices. On the other hand, there’s very little risk of Bitcoin ever going to zero. Since its inception in 2008, Bitcoin has always held value and served as a valid medium of exchange. In fact, its price has skyrocketed, going from about $600 per token in mid-2016 to over $50,000 only five years later (Fig.1).

Therefore, the volatility risk of Bitcoin—which, for the record, certainly exists—is offset by its potential upside. Savvy investors might want to bet on Bitcoin if they deem that its potential for growth exceeds its potential for losses.

Figure 1. Source: Statista

How To Get Started With Crypto in Your Retirement Fund

Brokerage account providers, such as Fidelity and Vanguard, are slowly warming up to the idea of allowing cryptocurrency ETFs and alternative retirement investments in one’s IRA. However, at present, they’re still off-limits for the vast majority of retirement investors who invest through brokerage firms.

Only self-directed IRA investors have the freedom and independence to invest in cryptocurrencies through their IRA. Therefore, to get started, you must open a self-directed IRA through a new account custodian. If you need a place to start, I highly recommend browsing our reviews of the top self-directed Bitcoin IRA providers.

The set-up process is simple, fast, and straightforward. Simply contact a company representative and they will walk you through the process. Then, it's merely a matter of choosing how to fund your account: a direct bank deposit, an IRA/401(k) transfer, or an IRA rollover.

For more information about initiating rollovers, check out our guide to gold IRA rollovers, which follow the same rules as cryptocurrency IRA rollovers.

Should You Open A Cryptocurrency Roth IRA?

Roth IRAs allow investors to save for retirement on a tax-free basis. That is, they consist of after-tax dollars, and are therefore not taxed a second time upon withdrawal.

Generally, a cryptocurrency Roth IRA is advisable for younger investors who haven’t yet reached their earning potential and expect to be in a higher tax bracket during retirement. By contrast, those who expect to be in a lower tax bracket during their retirement should opt for a traditional IRA composed of pre-tax dollars.

The Roth and traditional IRA represent the two main retirement fund options for investors looking to diversify with cryptocurrencies. As a broad rule, those within 10 years of retirement are likely to benefit more from a traditional IRA, whereas the Roth IRA is preferable for those who are further from their target retirement date.

Your personal financial circumstance should be evaluated before choosing a retirement account type for your cryptocurrency holdings. Speak with a qualified financial advisor, or an account representative of a Bitcoin IRA company, to find the best option for you.

Using Bitcoin as a Diversification Tool

Remember that Bitcoin, as well as other cryptocurrencies, are best used as a tool for diversifying. The dangers of portfolio concentration are as true for stocks as they are for Bitcoin. If you over-invest in Bitcoin, you’re exposing yourself to similar risks that you would if you’re over-invested in stocks.

Many of the most successful investors in the world caution against overexposing one’s portfolio to alternative investments. For example, multimillionaire investor Kevin O’Leary insists on keeping his crypto holdings limited to around 5% of his personal wealth. This may be an advisable allocation for a risk-conscious investor.

For some, O’Leary’s allocation might be too ambitious. For instance, Ric Edelman of Edelman Financial Engines suggests a portfolio allocation of 1% to Bitcoin. In other words, a $5,000 investment in a $500,000 retirement portfolio. This way, investors can be exposed to the upside benefits of the asset without assuming too much risk.

Do Cryptocurrencies Belong In Your Retirement Fund?

Prudent investors should consider adding mature cryptocurrencies like Bitcoin, Ethereum, and Litecoin to their IRA or 401(k). Doing so would add a level of security to their savings that would otherwise be unattainable to stock, bond, and mutual fund investors.

Since cryptocurrencies are subject to long-term capital gains taxes, it’s crucial that you invest within a tax-advantaged retirement vehicle. Otherwise, you might lose out on thousands of dollars in profits at the point of withdrawal. In most cases, a Roth or traditional self-directed IRA is your best retirement account option for minimizing your tax liability when investing in crypto.

To boost your retirement potential, start investing in cryptocurrencies today. Your first step is to choose one of the trusted cryptocurrency IRA companies that, once contacted, can assist you with opening and funding a cryptocurrency retirement fund.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24